From date 1/7/2022, according to the Decree 123/2020/ND-CP, circular 78/2021/TT-BTC, all the business, organization for economic household – personal business compelled to adopt electronic invoicing have the code of the tax authority. In the context of transformation of the ongoing comprehensive, the electronic invoice is no longer choose, which has become an integral part of the process accounting – tax of modern business.

However, in fact, many businesses – especially new units established or are switching from a system of traditional accounting – still perplexed in the invoice electronically, from the choice of invoice template, fill information regulations, to number, to transmit data to the tax authorities.

So, this article AccNet will play the role as a handbook guide invoice simple electronic detailed, easy to understand, standard, helping business:

- Understand business process, accounting – tax related to electronic invoicing

- Avoid the mistakes common can cause penalties

- Confidently deploy solutions accounting – bills sync, save time – cost

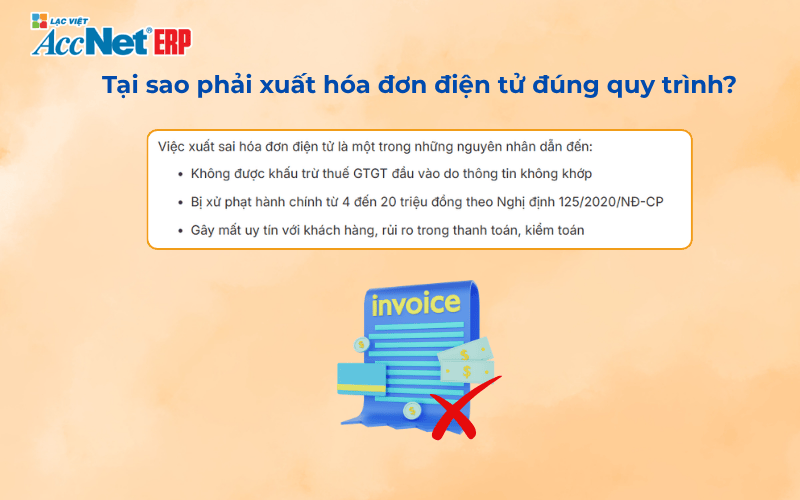

1. Why not electronic invoice the correct process?

The wrong bill electronic is one of the causes that led to:

- Non-deductible input VAT, so the information doesn't match

- Administrative fine from 4 to 20 million according to the Decree 125/2020/ND-CP

- Cause loss of credibility with customers, risks in payment and audit

Some common errors include:

- Invoices not the right time of the transaction

- Enter the wrong tax code, the wrong tax rate

- Electronic signing is not valid, or not send the invoice data to the tax authorities

2. Conditions for businesses to be invoiced electronic

Businesses need to prepare anything before making an electronic invoice?

To be able to legally export bill electronic business should meet 3 conditions following specifications:

Sign up using electronic invoices with tax authorities

- Thực hiện qua hệ thống eTax: https://thuedientu.gdt.gov.vn

- Submit the form 01/ĐKT-HĐĐTwait for feedback approval

With digital signature valid

- To sign up each electronic invoice

- There must be, in effect, be the tax authorities accept

Use software electronic invoice standard

- Have the ability to connect data with the system of the General department of Taxation via API

- Make – up – send invoices valid according to the XML format specified

Suggestions: Should choose software integrated accounting – bills as AccNet eInvoice to sync data, up operation manually, increase the accuracy.

Rules on establishment, signed, send, storage of electronic invoices

Business needs in full compliance with the following principles:

- Invoicing at the right time arises the obligation sales – service provider

- Sign electronically immediately after establishment, do not sign the back or wrong date

- Send an invoice for the purchase, the tax system (via software or email)

- Store invoice data in a minimum of 10 years, ensuring access when needed

Under circular 78, electronic bills only be considered effective when signed numbers are valid, successfully transmitted to the CQT in real-time.

Read more:

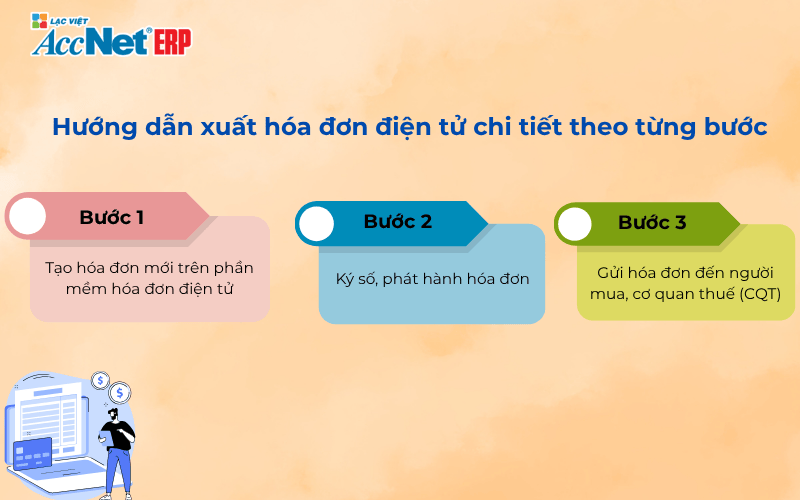

3. Guide bill electronic detailed step by step

The guide how to export electronic invoice right process not only helps businesses comply with the law, but also ensure the data accounting – tax is synchronized, catering to declare tax, VAT, financial reporting, auditing, inspection, after this. Here is a guide bill electronic step by step details:

Step 1: Create new invoice on software electronic invoice

- Login software electronic invoice has been Total Tax department accepted (for example: AccNet eInvoice).

- Select the type of invoice matching transactions:

- VAT invoices

- Bill of sale

- Export invoices

- Bill adjustment/replacement

- Fill in the required fields:

- Buyer information: company name, tax code, address and email invoice

- Information goods/services: name, unit, quantity, unit price, amount, VAT,

- Date of invoice: must match with the date of the transaction or delivery

- Model number – sign bill: right according to the type of bill has book released

Note: Avoid typing name of goods by way abridged, abbreviated misleading. For example: do not write "DV maintenance" which should be "maintenance service system internal network months 03/2025".

Step 2: Register number, invoice issuance

- Double-check the entire information on the bill before you sign.

- Attach the digital signature of business on the invoice:

- Ensure the digital signature is in effect, are connected with software.

- Select “invoice issuance” on the system.

In the system of a number of modern software such as AccNet eInvoiceafter invoicing, the software automatically:

- Register number

- Submitted to the department of Taxation

- Send email with link lookup for buyers

Step 3: Send the invoice to the buyer the tax authorities (CQT)

- Bill after being signed number will be automatically transmitted to the General department of Taxation according to the XML format.

- Business need to send the invoice can now PDF (or link lookup) to the buyer via:

- Zalo Business API

- Port lookup bills own the business

Sending invoices right process according to the guide, cumshot, electronic invoice to help businesses avoid arrears or non-tax-deductible in the accounting period.

4. Some important notes when making guide invoice simple electronic

Below are the accounting issues often encountered in practice when applied to electronic invoice, comes how to avoid them to ensure each invoice issued are valid, legitimate, proper use:

Check the tax code, buyer information carefully before cumshot

- The wrong tax code → bills are not accepted to declare input tax.

- Company name, teen, marker, write wrong character can also cause refused to deduct VAT.

Suggestions: Use lookup functions, tax code automatically integrated in the software to minimize input errors.

Do not edit the invoice after you've signed, released

- An electronic invoice signed numbers, released as the document is not editable.

- If errors are detected, the accountant must:

- Invoice correction if wrong about the amount of the tariffs.

- Invoicing replace if false, the entire content (wrong tax code, and send someone to buy...).

The correction of the PDF does not have legal value – will be sanctioned according to the Decree 125.

To set, released bills on time

- The moment the invoice is right when:

- Delivery done

- Complete service

- Receive payment (for prepaid services)

- Don't be billed back date or record date set does not coincide with the time of the transaction.

This is a common error when implementing guides, electronic invoice to the tax arrears, sanctions against administrative violations, excluded from cost is tax.

Read more:

5. Suggestions software support bill electronic effect

The choice of software, invoice maker electronic key role in the process of implementing accounting invoice for business. A good software would not only help the invoice fast – correct – valid, but also ensures seamless connection with the accounting system, the General department of Taxation (CQT).

Criteria for selecting software electronic invoice for business

The Total Tax administration certified API connection

- Meet the standard XML data

- Automatic transmission electronic invoice to the CQT true real-time

Integration with accounting software business

- Sync data from accounting to bill

- Limit the input multiple times → reduce errors, save manpower

User – friendly interface- quick – multimodal bill

- Send invoice via email, link, lookup QR Code

- Are authorized users according to the role of accounting – director

Meet professional tuning – replace – cancel invoice flexible

- The system supports full operation handling errors

- Storage bill a minimum of 10 years in accordance

Hint software specialized: AccNet eInvoice

AccNet eInvoice is software electronic invoice of The company shares Information, Lac Viet development – unit credibility over 29 years in the field of accounting software business.

Reasons AccNet eInvoice consistent with ongoing business accounting – bills:

- Integrated with accounting software AccNet → accounting just recognized professional software invoicing fit

- Connect directly with Total Tax administration → automatic transmission correct invoice format – the right time

- Supports – register – submit – archive invoice the entire process → No need to switch platforms, don't worry about missing features

- Simple operation – optimized for both internal accounting and office tax agent → Reduce the time manipulation to 60%, reduce the error entered the wrong 80%

- Reasonable cost, does not arise, upgrade, maintenance → Special fit with business SME, new business establishment

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

6. The common errors when applying an electronic invoice

Here are some common errors when making guides electronic invoice that businesses should take note to avoid being sanctioned or lose the right to deduct tax:

Sorry wrong tax code, company name, or goods

Causes:

- Accounting data entry manually, do not check from the system CQT

- Customer data old, not updated to change legal name

How to handle:

- Invoicing replaced or adjusted depending on the level flaws

- Send the written explanation if irregularities were reported tax

Learn more: Xử lý nghiệp vụ hóa đơn cho đơn hàng phát sinh trên sàn số

Error register at the wrong time – bill released late

Causes:

- Business transaction but not timely

- System software does not sync time or digital signature error

How to handle:

- Check the signatures of time on the bill

- If necessary, invoicing adjust the time according to the instructions of the circular 78

Sent wrong email or wrong method to buyers

Causes:

- Entered the wrong email in the invoicing process

- Do not send invoices with link lookup or attachments

How to handle:

- Send back the essence is through the right email

- If detected late, repeat bill, replace (if necessary edit the content)

Way guide invoice simple electronic the right process, standards, legal regulations are vital in operating accounting – tax of modern enterprise. Not only ensure compliance with the law, the invoice accurately also helps businesses:

- Deduction of input tax due date

- Avoid administrative sanctions

- Increase professionalism and reputation in dealing with partner

To get this done in an active way – sync – accurate business should choose software electronic invoice specialized, deeply integrated with the accounting system as AccNet eInvoice. Experience free demo software electronic invoice AccNet eInvoice – standard connector, the General department of Taxation

- Integrated with the accounting system AccNet

- Over 20,000 businesses in Vietnam trusted

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: