Hiện nay có hai cách nộp thuế TNCN qua mạng chính là cá nhân tự nộp thuế nếu có thu nhập từ nhiều nguồn hoặc tự quyết toán và doanh nghiệp nộp thuế thay cho nhân viên theo hình thức khấu trừ. Dưới đây là hướng dẫn chi tiết từng trường hợp từ AccNet.

1. Cá nhân tự nộp thuế TNCN qua mạng

Nếu bạn có thu nhập từ nhiều nguồn hoặc thuộc diện tự quyết toán thuế, bạn có thể nộp thuế trực tiếp qua:

- Cổng thông tin Thuế điện tử (eTax)

- Dịch vụ Internet Banking của ngân hàng

Cách 1: Nộp thuế TNCN qua Cổng thông tin Thuế điện tử

Bước 1: Truy cập hệ thống eTax cá nhân

- Vào thuedientu.gdt.gov.vn, chọn "Cá nhân".

- Đăng nhập bằng Mã số thuế + Mật khẩu.

Bước 2: Lập giấy nộp tiền

- Vào "Nộp thuế" → "Lập giấy nộp tiền".

- Chọn Cơ quan thuế quản lý (nơi bạn kê khai thuế).

Bước 3: Nhập thông tin nộp thuế

- Loại thuế: Thuế thu nhập cá nhân.

- Tiểu mục: 1001 (thu nhập từ tiền lương, tiền công).

- Số tiền cần nộp theo tờ khai quyết toán thuế.

Bước 4: Xác nhận, thanh toán

- Nhấn "Hoàn thành", kiểm tra thông tin.

- Chọn Ngân hàng thanh toán, nhập mã OTP để xác nhận giao dịch.

Bước 5: Kiểm tra biên lai

- Vào "Tra cứu" → "Giấy nộp tiền" để xem trạng thái.

Read more:

- Process settlement tax personal income cuối năm theo chuẩn mới

- Model spreadsheet personal income tax mới nhất theo biểu thuế lũy tiến từng phần

- Thuế thu nhập cá nhân 2025 cập nhật mức giảm trừ và thu nhập chịu thuế

Cách 2: Nộp thuế TNCN qua Internet Banking của ngân hàng

Một số ngân hàng liên kết với Tổng cục Thuế cho phép nộp thuế trực tuyến, như: Vietcombank, BIDV, Techcombank, VietinBank…

Bước 1: Đăng nhập Internet Banking

- Vào ứng dụng ngân hàng trên điện thoại hoặc website ngân hàng.

Bước 2: Chọn chức năng nộp thuế

- Tìm mục "Nộp thuế điện tử" hoặc "Nộp thuế TNCN".

Bước 3: Nhập thông tin nộp thuế

- Mã số thuế cá nhân.

- Tiểu mục 1001 (Thuế TNCN từ tiền lương).

- Số tiền thuế phải nộp theo tờ khai thuế.

- Cơ quan thuế quản lý theo nơi đăng ký quyết toán.

Bước 4: Xác nhận thanh toán

- Kiểm tra thông tin, nhập mã OTP để hoàn tất giao dịch.

- Lưu lại biên lai điện tử để đối chiếu khi cần.

2. Doanh nghiệp nộp thuế TNCN qua mạng thay cho nhân viên

Doanh nghiệp có trách nhiệm khấu trừ thuế TNCN của nhân viên hàng tháng hoặc hàng quý, sau đó nộp vào ngân sách nhà nước qua Cổng thông tin Thuế điện tử (eTax).

Bước 1: Truy cập Cổng thông tin Thuế điện tử

- Truy cập thuedientu.gdt.gov.vn

- Chọn "Doanh nghiệp", đăng nhập bằng mã số thuế, mật khẩu.

Bước 2: Lập giấy nộp tiền

- Vào "Nộp thuế" → "Lập giấy nộp tiền".

- Chọn Cơ quan thuế quản lý, Ngân hàng thanh toán.

Bước 3: Nhập thông tin nộp thuế

- Loại thuế: Thuế thu nhập cá nhân.

- Mã chương: 757 hoặc 754 (tùy thuộc vào loại hình doanh nghiệp).

- Tiểu mục: 1001 (Thuế TNCN từ tiền lương, tiền công).

- Số tiền thuế cần nộp theo bảng lương khấu trừ.

Bước 4: Ký điện tử, gửi giấy nộp thuế

- Ký số bằng Chữ ký số (USB Token).

- Nhấn "Hoàn thành", kiểm tra lại thông tin rồi gửi.

Bước 5: Kiểm tra kết quả nộp thuế

- Vào "Tra cứu" → "Giấy nộp tiền" để xem trạng thái giao dịch.

3. Kiểm tra biên lai, tra cứu nộp thuế

Sau khi nộp thuế TNCN qua mạng, bạn có thể tra cứu thông tin nộp thuế bằng các cách sau:

- Trên Cổng Thuế điện tử: Vào "Tra cứu" → "Giấy nộp tiền" để xem trạng thái giao dịch.

- Trên Internet Banking: Vào lịch sử giao dịch, tìm mục nộp thuế để tải biên lai.

- Liên hệ ngân hàng hoặc cơ quan thuế nếu có lỗi hoặc chưa nhận được xác nhận nộp thuế.

Important note:

- Cá nhân tự quyết toán: Chậm nhất 31/03 hàng năm.

- Doanh nghiệp khấu trừ thuế: Nộp theo tháng hoặc quý tùy quy mô.

- Theo Luật Quản lý Thuế 38/2019/QH14, nếu nộp thuế trễ, sẽ bị tính tiền phạt chậm nộp theo lãi suất.

- Dù nộp thuế qua eTax hay ngân hàng, luôn lưu lại biên lai điện tử để có thể đối chiếu với cơ quan thuế khi cần.

4. Tự động hóa nộp thuế TNCN với phần mềm AccNet ERP

Bài viết “Hướng dẫn cách nộp thuế TNCN qua mạng chi tiết” đã cho bạn biết từng bước để cá nhân hoặc doanh nghiệp thực hiện kê khai, lập giấy nộp thuế và tra cứu biên lai qua cổng thuế điện tử hoặc ngân hàng. Tuy nhiên, làm thủ công từng bước như thế dễ dẫn đến sai sót, thiếu đồng bộ giữa dữ liệu lương – thuế – kế toán.

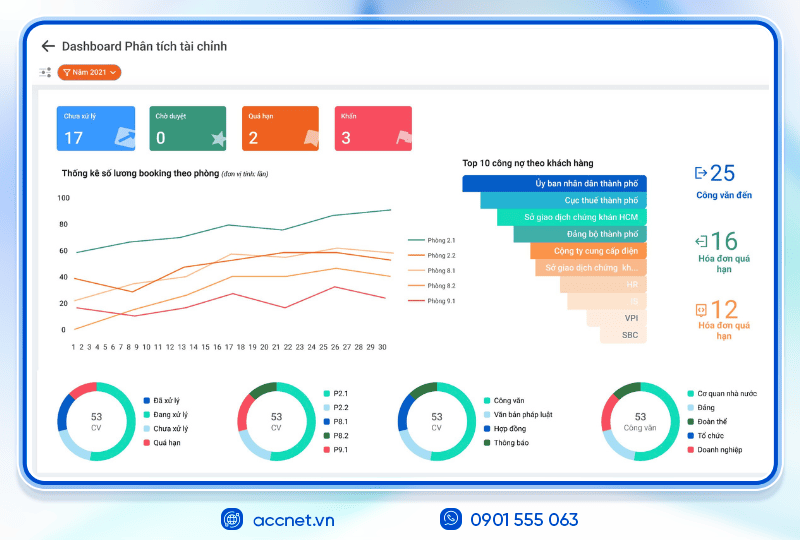

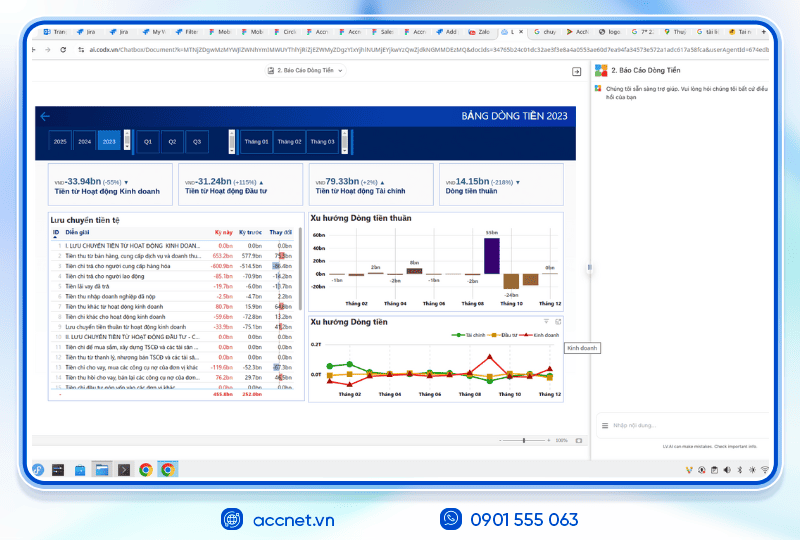

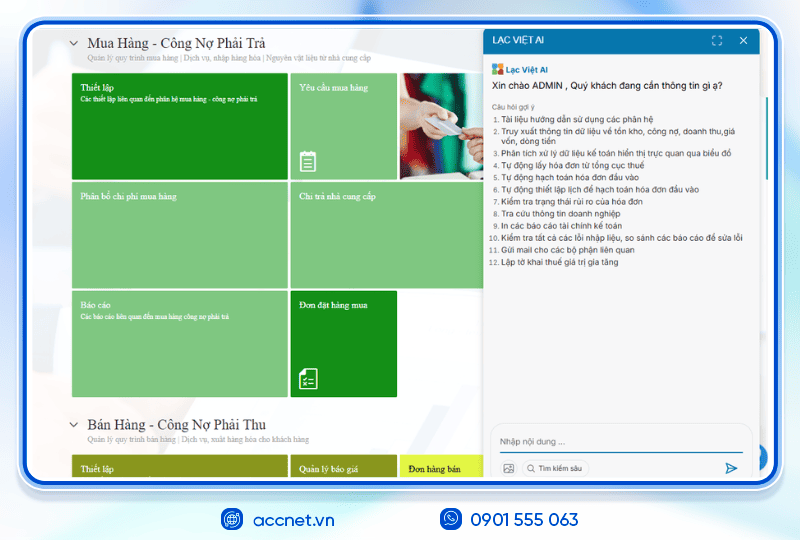

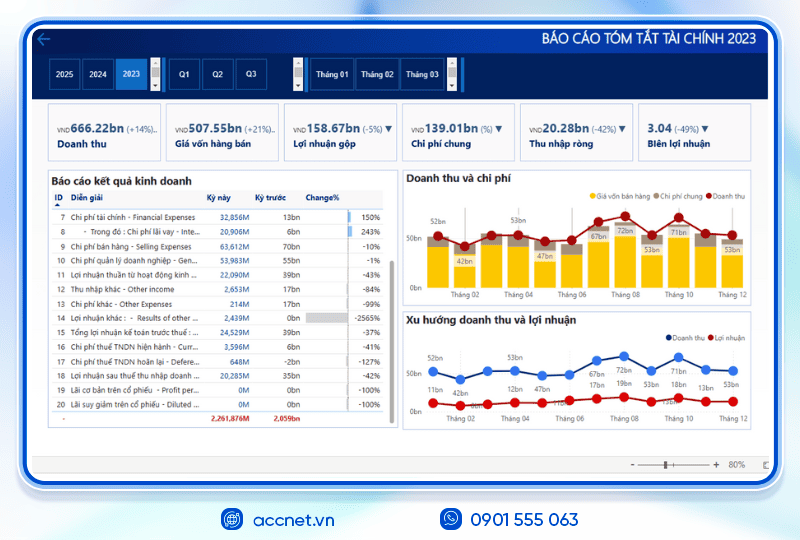

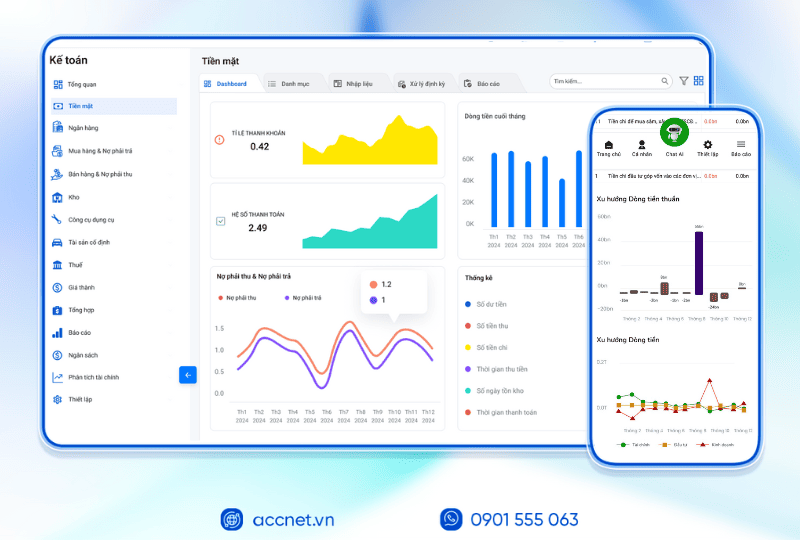

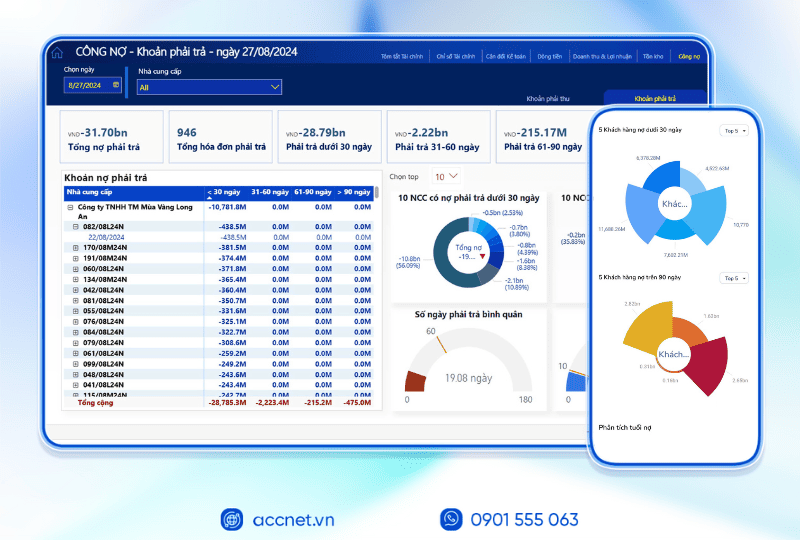

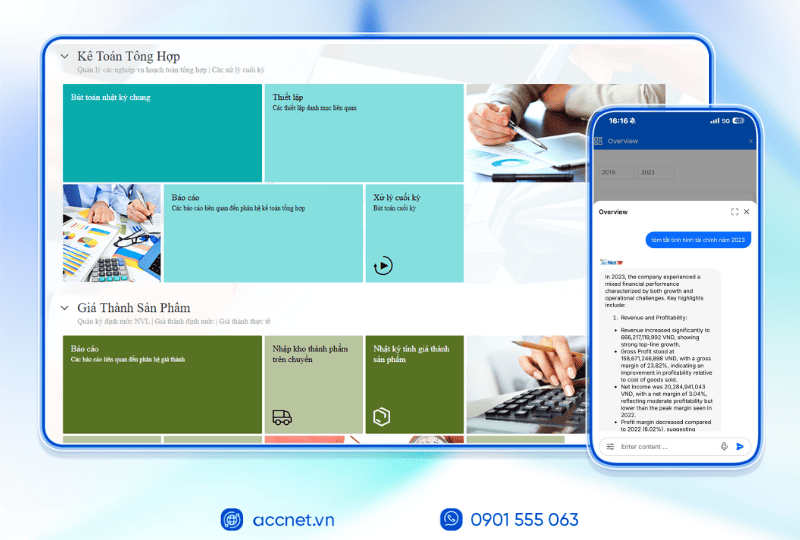

Đó chính là lúc AccNet ERP phát huy vai trò như một cầu nối tự động cho toàn bộ quy trình quản lý nhân sự, lương và thuế. Với module quản lý nhân sự & tính lương tích hợp, phần mềm giúp:

- Tự động tính khấu trừ thuế TNCN theo quy định: từ thu nhập chịu thuế, các khoản giảm trừ, đến tỷ lệ khấu trừ — hệ thống tính chính xác, phù hợp với từng nhân viên.

- Kết nối trực tiếp với module thuế / tài chính: khi phần mềm đã tính xong số thuế phải nộp, dữ liệu được đẩy sang module thuế để sinh tờ khai và giấy nộp thuế mà không cần nhập tay.

- Theo dõi trạng thái nộp thuế & cảnh báo lỗi: sau khi phát hành tờ khai, AccNet ERP có thể hỗ trợ kiểm tra biên lai, tra cứu chứng từ nộp thuế và cảnh báo khi có sai sót hoặc chưa hoàn thành nộp.

- Báo cáo tổng hợp – riêng lẻ: doanh nghiệp dễ xem báo cáo thuế TNCN theo nhân viên, theo kỳ, tổng hợp và so sánh giữa các giai đoạn.

Nhờ tích hợp chặt chẽ giữa module tính lương, thuế và tài chính, AccNet ERP không chỉ giúp giảm công việc nhập liệu thủ công mà còn tăng độ chính xác, đảm bảo tuân thủ luật thuế và gia tăng hiệu quả quản trị tài chính – nhân sự.

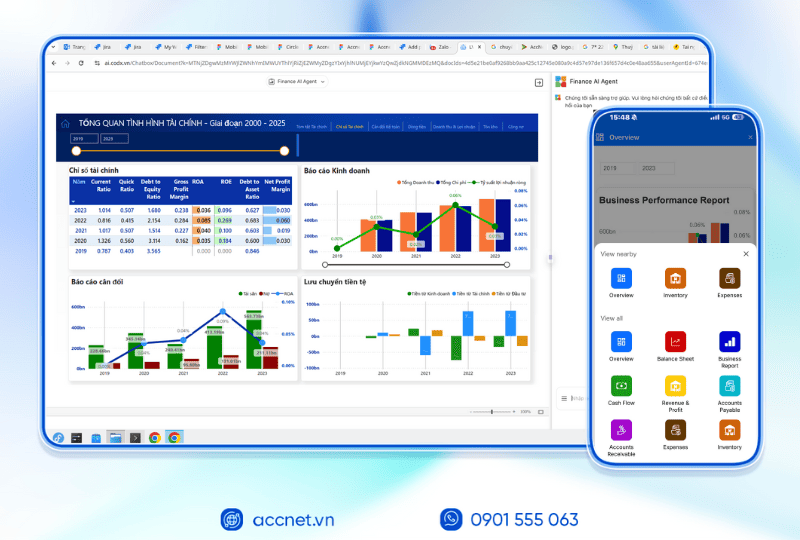

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Với một vài chia sẻ về cách nộp thuế TNCN qua mạng hy vọng sẽ mang đến những thông tin hữu ích cho bạn. Chúc bạn thực hiện thành công!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: