Việc lập các khoản dự phòng là một trong những công việc tất yếu của doanh nghiệp nói chung, kế toán nói riêng. Vậy provision for diminution in value of inventory là gì? Những quy định, đối tượng nào sẽ cần lập dự phòng? Hãy cùng AccNet làm rõ vấn đề trên qua các nội dung bài viết sau

1. Provision for diminution in value what is inventory?

Dự phòng giảm giá hàng tồn kho được hiểu là một khoản dự phòng khi có sự suy giảm của giá trị thuần. Là giá trị thấp hơn so với giá trị mà đã ghi sổ của hàng tồn kho.

Việc lập dự phòng này chỉ được thực hiện khi doanh nghiệp có những bằng chứng chứng minh sự suy giảm của giá trị thuần có thể thực hiện được, giá trị thuần có thể thực hiện được của hàng tồn kho (A) được tính theo công thức:

A = Giá bán ước tính của hàng tồn kho trong kỳ - Chi phí ước tính để hoán thành việc sản xuất, bán hàng

2. Quy định trích lập dự phòng giảm giá hàng tồn kho

As specified in điều 4 của thông tư 48/2019/TT-BTC thì một số quy định về trích lập dự phòng được nêu như sau:

2.1 Quy định về đối tượng cần thực hiện

Objects need to set will include: raw materials, tools, merchandise, goods sent for sale, buy're on the go, goods warehouse, finished goods, which the original price in the ledger higher net worth can perform ( called inventory) ensure conditions:

- Full bill, vouchers legally in accordance with the regulations of the ministry of finance or other evidence prove to be the cost of inventory.

- Inventory high-level ownership of the enterprise at the time of year FINANCIAL statements.

Read more:

2.2 Quy định mức trích lập dự phòng giảm giá hàng tồn kho

Recipe to be the setting is applied according to:

The provision for diminution in value of inventory = inventory-fact at the time of reporting x original Price of inventory accounting - net worth can be done of inventory

In which:

- Giá gốc hàng tồn được xác định theo quy định của Chuẩn mực kế toán số 02 hàng tồn kho được ban hành kèm theo Quyết định số 149/2001/QĐ-BTC, văn bản sửa đổi, bổ sung hoặc thay thế kèm theo nếu có.

- Giá trị thuần có thể thực hiện được của hàng tồn kho là giá bán ước tính của hàng tồn kho trong kỳ tại thời điểm lập BCTC năm trừ cho chi phí ước tính để hoàn thành sản phẩm, tiêu thụ chúng.

2.3 Quy định về thời điểm thực hiện nghiệp vụ

Right at the time of year FINANCIAL statements. Based on the base material that the business collects prove the original price of inventory, higher net worth may carry out the inventory.

Căn cứ theo các quy định tại các khoản 1, khoản 2 của điều 4 thông tư 48/2019/TT-BTC doanh nghiệp thực hiện trích lập dự phòng giảm giá hàng tồn kho:

a) If reserves must set up corresponding with the balance of reserves for depreciation, inventory in report year ago be recorded in the books of the company. The enterprise shall not be made the recording lowers inventory.

b) If reserves must be set greater than the balance of reserves for depreciation, inventory in report year ago be recorded in the books of the company. The enterprise was excerpted add the difference in cost of sales in that time.

c) Nếu khoản dự phòng phải lập thấp hơn với số dư của khoản dự phòng khấu hao hàng tồn kho trong báo cáo năm trước được ghi vào sổ sách của công ty. Thì doanh nghiệp được hoàn lại phần chênh lệch, ghi giảm giá vốn hàng bán trong kỳ.

d) Mức dự phòng khấu hao hàng tồn kho được tính cho từng mặt hàng tồn kho. Được giảm giá, tổng hợp thành bảng kê chi tiết. Đây là căn cứ để hạch toán ghi vào giá vốn hàng bán. (Giá vốn của tất cả các sản phẩm, hàng hóa đã bán trong kỳ).

Learn more:

2.4. Quy định về nguyên tắc thực hiện dự phòng giảm giá hàng tồn kho

Nguyên tắc để thực hiện dự phòng giảm giá hàng tồn kho:

a) Doanh nghiệp trích lập dự phòng khấu hao cho hàng tồn kho; phải có bằng chứng đáng tin cậy chứng minh về sự suy giảm giá trị thuần có thể thực hiện được với giá gốc của hàng tồn kho. Khoản dự phòng là số tiền dự kiến được tính trước vào chi phí sản xuất, giao dịch phần giá trị giảm xuống dưới giá trị được ghi lại của sổ kế toán hàng tồn kho. Để bù đắp cho những tổn thất thực tế do sản phẩm, vật tư, hàng hóa tồn kho được giảm.

b) Dự phòng khấu hao cho hàng tồn kho được thực hiện khi lập báo cáo tài chính. Lập dự phòng phải đúng quy định. Theo các chuẩn mực kế toán hàng tồn kho, các quy định của chế độ tài chính hiện hành.

c) The formation of reserve depreciation inventory must be based on raw materials, goods. Backup recording window for the service is going to be calculated according to the separate prices for each service type.

d) Giá trị thuần có thể thực hiện được của hàng tồn kho là giá bán ước tính của hàng hóa. Hàng tồn kho giai đoạn sản xuất kinh doanh thông thường trừ đi chi phí ước tính cho đến khi hoàn thành (-) Thành phẩm, chi phí ước tính cần thiết để bán chúng.

đ) Khi lập báo cáo tài chính năm với số lượng, nguyên giá, giá trị thuần có thể thực hiện được của vật liệu, hàng hóa, dịch vụ thuộc bất kỳ loại nào đang được triển khai trích lập:

- Khi dự phòng ghi giảm hàng tồn kho cần phải lập vào cuối kỳ kế toán lớn hơn khoản dự phòng được ghi trên sổ sách thì khoản chênh lệch được ghi tăng dự phòng, tăng giá vốn hàng bán.

- Nếu khoản dự phòng giảm giá hàng tồn kho phải được hình thành vào cuối kỳ kế toán này nhỏ hơn dự phòng giảm trừ hàng tồn kho được ghi trên sổ sách thì số chênh lệch các khoản chênh lệch nhỏ hơn được hoàn nhập, ghi giảm dự trữ, giảm chi phí sản xuất.

3. Hạch toán dự phòng giảm giá hàng tồn kho

Hạch toán dự phòng giảm giá hàng tồn kho trong các trường học sau đây:

a) Khi lập BCTC nếu số dự phòng kỳ này cao hơn số đã trích lập từ các kỳ trước thì kế toán phải trích lập bổ sinh phần chênh lệch, hạch toán:

- Debt TK 632 - cost of goods sold

- Have TK 229 - prevention of property loss (2294)

b) Khi lập BCTC nếu số dự phòng kỳ này nhỏ hơn số đã trích lập từ các kỳ trước, thì kế toán phải trích lập bổ sinh phần chênh lệch, hạch toán:

- Debt TK 229 - prevention of property loss (2294)

- Have TK 632 - cost of goods sold

Read more:

c) Handling the reserves for supplies, goods, expiry date, loss of quality of goods damaged, no longer used, the accountant performs accounting:

- Debt TK 229 - preventive property loss

- Debt TK 632 - cost of goods sold

- Have the TK 152, 153, 155, 156.

d) Xử lý giảm giá hàng tồn kho trước khi chuyển đổi hình thức doanh nghiệp từ 100% vốn nhà nước sang thành công ty cổ phần. Các khoản dự phòng giảm sau khi bù đắp tổn thất, hạch toán tăng vốn nhà nước như sau:

- Debt TK 229 - prevention of property loss (2294)

- Have TK 411 - Capital investment of the owner.

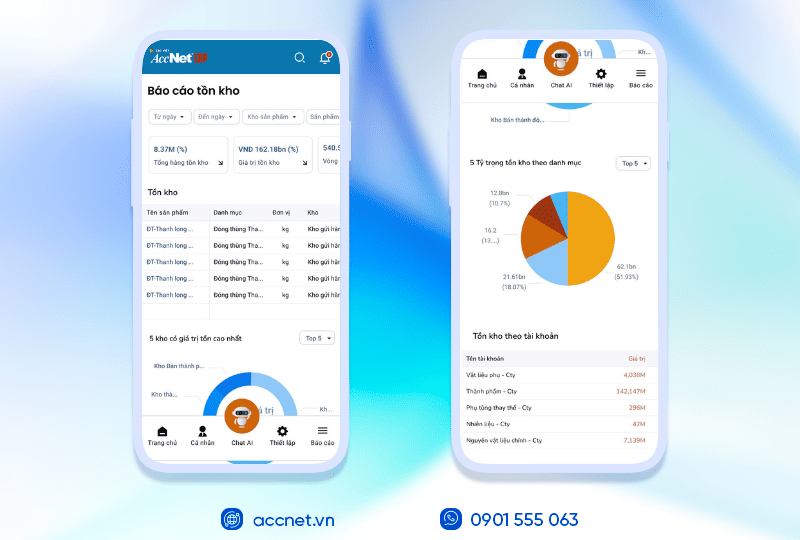

4. Công cụ trích lập dự phòng giảm giá hàng tồn kho nhanh chóng chính xác - AccNet ERP

Trên thực tế thì mức dự phòng hàng tồn kho được hỗ trợ từ chính sách nhà nước thường nhỏ hơn so với tổn thất thực tế của doanh nghiệp. Do đó, doanh nghiệp cần chủ động lập kế hoạch, có những công cụ giải pháp quản lý hàng tồn kho cho hiệu quả. Với xu thế chuyển đổi sổ như hiện nay việc sử dụng phần mềm AccNet ERP sẽ là một giải pháp tổng thể cho doanh nghiệp. Với những tính năng, công nghệ hiện đại quản lý kho đã không còn là nỗi băn khoăn của doanh nghiệp.

PHẦN MỀM QUẢN LÝ KHO ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” Không chỉ là một phần mềm nhập – xuất thông thường, AccNet ERP chính là nền tảng quản lý kho thông minh, tích hợp thiết bị, kết nối dữ liệu, cảnh báo tức thời, giúp doanh nghiệp: AccNet ERP mở ra một bước tiến mới trong quản lý kho khi tích hợp trợ lý tài chính AI, giúp doanh nghiệp vận hành chủ động và ra quyết định chính xác hơn. ✅ Quản lý kho chủ động – Không còn “tồn kho ảo, thất thoát khó kiểm soát” ✅ Hiệu quả rõ rệt khi ứng dụng quản lý kho tích hợp AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Tầm quan trọng của việc theo dõi hàng tồn kho giảm trong kho

Hope the information about provision for diminution in value of inventory do AccNet cung cấp giúp các kế toán viên, doanh nghiệp hiểu đúng, thực hiện chính xác theo quy định. Xem thêm nhiều thông tin hữu ích khác về kế toán tại website của chúng tôi.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: