Bill electronic input is “chain” of utmost importance, attached directly to eligible costs, tax obligations, the financial transparency of the business. But in fact, many businesses are still faced with the potential risks when handling electronic invoice input: bills invalid, there is no authentication code, saved in the wrong format, non-deductible VAT...

Why these errors still occur even when businesses have switched to electronic invoice? The answer largely lies in the lack of a process manage electronic invoice input basically, the software supports effective. The article below will help you:

- Understand the concept, role

- Master the steps in the standard process

- Avoid the mistakes common that many businesses have

- Orientation business choosing the right software solution.

1. Why the management of electronic receipts input should be invested?

Below is the enterprise risk to see if invoice management input control deficiencies:

| Risks | Consequence |

| Hosted in the wrong format (PDF, snapshot, not XML) | Bills not valid when the tax settlement |

| Do not check the digital signature, authentication code | Non-deductible VAT |

| Accounting sai states | Deflection financial statements, the influence profit |

| 't sync with orders | Increase the possibility of internal fraud, lost money whitewash |

According to statistics from the General administration of the Tax year 2023, there to 7,500 bill electronic input denied deduction due to lack of authentication code or without digital signature.

2. Manage electronic invoice input, what is?

The concept according to accounting – legal

Manage electronic invoice input is the entire activities related to the:

- Receive electronic invoices from suppliers;

- Check the validity of legal (tax code, digital signature, authentication code...);

- Collated with the contract, order, coupon, login, payment, etc.;

- Accounted for in the accounting system;

- The right storage format – time – limit- current regulations.

This is an important profession in the cycle of accounting – financial, direct influence:

- The validity of the cost;

- The ability to deduct input tax;

- The transparency of the financial system;

- Capacity auditor – inspector of the business.

The ai in the enterprise responsible for managing invoice input?

- Accounting purchase: receive invoice from supplier, collation order – value

- General accounting: the test for accounting allocated to the correct account states

- Department store – legal – internal control: responsible for research, audit periodically

- Approvers: legal responsibility upon declaration, tax settlement

Read more:

- Software invoice management input automatic, accurate

- The new location in the policy bill electronic current

- Price software electronic invoice latest updates 2025

3. Process management bill electronic input standard for business

To manage electronic invoice input effectively accordance with the law, enterprises need to build a process internal control items, with clear roles – clear manipulation – get tool. Here are 4 steps critical in the management process standard.

Step 1. Receive invoices from suppliers

Typically, the provider will send the bill electronic input via:

- Email attachments in XML/PDF

- Foundation bill electronic mediators (registered with the General department of Taxation)

- Send link lookup online

The business need to do immediately after receive:

- Xác minh mã tra cứu trên hệ thống Tổng cục Thuế (tra cứu qua https://hoadondientu.gdt.gov.vn)

- Check the digital signature of the seller: signature must be valid, not expired

- Check the information on the invoice: invoice number, release date, tax code, amount, tariffs, VAT...

Step 2. Collate information order – invoice – voucher related

After checking the legality, need to proceed to collate content bill with the stock from internal:

- Orders/purchase

- Receipt/handover

- Payment receipt or payment order

“Principle 3 side order”: order – Invoice – voucher details must match in content quantity, unit price, tax rate. A minor deviations may cause the bill is considered invalid in the tax declaration or cause delay in the settlement of the cost.

Step 3. Recorded in accounting software

After confirming a valid invoice should be:

- Recorded in the ledger the correct account (for example: TK 331 – pay the seller, TK 156 – cargo, TK 642 – cost management...)

- Properly accounted states: the same month/quarter incurred to avoid deflection financial statements

- Get ready to put on the table and declare VAT input (if available)

Bill electronic input wrong states accounted for, the wrong object or not enough conditions will lead to the type of expense or tax deduction.

Step 4. Storage bill electronic input regulations

According to the Law on accounting, 2015, electronic invoicing should be:

- Hosted under the original formatting XML

- Can attach digital signature valid

- Stored for at least 10 years

- Have the ability to research, collation, recovery when necessary inspection and audit

Many businesses today still save PDF file or a photo, there is no digital signature → do not qualify as tax settlement.

4. Common mistakes when managing HĐĐT input

The flaws in the process of receiving, invoice processing, electronic input can cause serious consequences: from not tax-deductible, to be fined for accounting wrong. Here are the most common errors that many businesses make when managing electronic invoices input:

Hosted false format – the lack of digital signatures

Save invoice as PDF or image, there is no XML file, digitally signed original. When audit or inspection, invoice not enough legal value → excluded from the cost reasonable or not is tax refund.

Do not check the authentication code, seller information

No verification, tax code, address, contents, invoices → easy to stick counterfeit bills, bills off. Declaration false, lose the ability to deduct the tax, even arrears of tax, penalty.

Accounting wrong accounts, wrong states

Accounting recorded cost of a wrong or mistaken object of accounting. Financial statements misleading, difficult settlement, affecting profitability.

Read more:

5. Software solutions support management bill electronic input efficiency

The management of electronic receipts input will be difficult to achieve effective legal maximum if the business only handle manually. In the digital age, using specialized software not only help businesses comply with regulations, but also optimal operation, control risk, save time.

Selection criteria management software, invoice input

A suitable software should meet the following criteria:

- The Total Tax administration certification valid connection

- Automatically check the legality of the bill: the tax code, digital signature, authentication code

- Allows mounting bills with evidence from internal as import receipt, voucher, contract

- Integrated accounting – tax reporting – store vouchers

- Proper storage of XML format, are digital signatures, root service, inspection – auditing

- Have permission system, log access, ensure transparency, internal control

Benefits of process automation invoice processing input

The digitization, automation brings many practical benefits:

| Benefits | The effect is achieved |

| Save time check | Up to 70% of the time compared to manual processing |

| Risk reduction bill erroneous or false | System automatic alerts |

| Speed accounting & reporting | Sync with accounting software |

| Service inspection easy | Have full processing history, digital signature, authentication code |

| Reduce the pressure to the accounting department | Automated processes – simple operation |

Learn more: Quy trình phát hành hóa đơn số khi bán hàng qua sàn TMĐT

Suggestions suitable software: Integrated, comprehensive, optimized for enterprise

The ideal solution for businesses today is to use the software:

- Have the ability to manage bills, input, output synchronized

- Integrated accounting – bills – internal administration

- Friendly interface, easy to use, support full accounting process, Vietnam

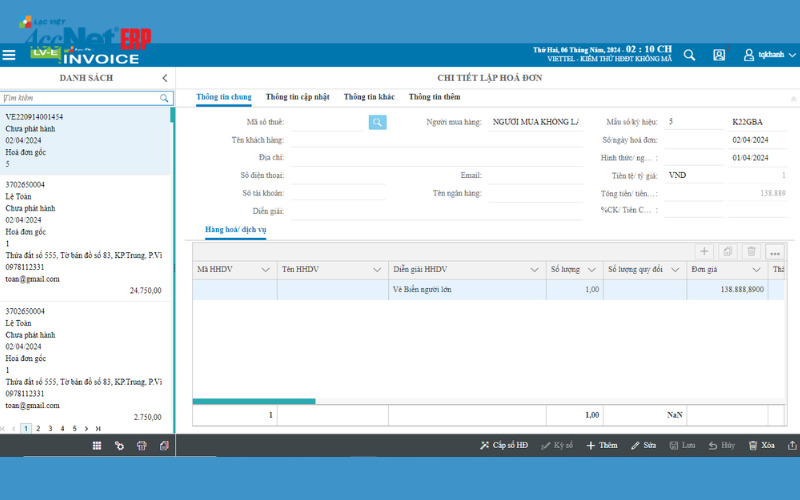

AccNet eInvoice is one of the software management bill electronic input typical meet the above criteria:

- Integrated check, collate, accounting, store receipts input

- Direct connection with the accounting system AccNet, ERP, internal

- Automatic classification of invoices, check the digital signature, authentication code from General department of Taxation

- Mounting evidence from internal support fast access when you need audit

Here is the solution to be many medium and large enterprises in Vietnam options for building accounting systems – professional invoices, valid and effective.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Manage electronic receipts input no longer is the "save XML file for enough", which is a professional accounting important directly related to:

- The validity of the cost

- The right to deduct VAT

- The transparency of the financial system business

To make the right business need:

- Construction process strictly controlled from receipt, check for reference to storage

- Accounting training, related department to understand business & legal

- Use specialized software to help automate and limit errors, ensure compliance

Tips from experts: Don't wait until an inspector or access the new control invoice input. Businesses should actively digitization process management today, choose software solutions, reliable to protect your privacy, reputation long-term. Experience demo right software to manage electronic invoice input efficiency!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

Headquarters: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Hotline: 0901 555 063

Email: accnet@lacviet.com.vn

Website: https://accnet.vn/

Theme: