Hóa đơn điện tử đã trở thành chuẩn mực cho các doanh nghiệp hiện đại. Không chỉ giúp tiết kiệm thời gian, chi phí in ấn, mà còn đảm bảo tính minh bạch trong quản lý tài chính. Tuy nhiên, trong quá trình phát hành hóa đơn, không tránh khỏi những sai sót như thông tin người mua không chính xác, số lượng hóa đơn vượt quá đăng ký, hoặc nhầm lẫn về giá trị giao dịch.

Việc hủy hóa đơn điện tử đã phát hành là một bước quan trọng để doanh nghiệp khắc phục sai sót, đảm bảo đúng quy định pháp luật, tránh rủi ro trong kê khai thuế. Bài viết này sẽ cung cấp hướng dẫn chi tiết về thủ tục hủy hóa đơn điện tử đã phát hành, giúp doanh nghiệp nắm vững quy trình, áp dụng hiệu quả giải pháp hóa đơn điện tử trong quản trị vận hành số.

1. Thủ tục hủy hóa đơn điện tử đã phát hành là gì?

Theo quy định tại Thông tư 78/2021/TT-BTC, hủy hóa đơn điện tử là việc doanh nghiệp thực hiện xóa bỏ hóa đơn đã phát hành nhưng chưa hợp pháp hóa về mặt thuế, hoặc phát hiện sai sót cần điều chỉnh. Đây là thủ tục pháp lý nhằm bảo vệ quyền lợi của cả người bán lẫn người mua, đồng thời tránh các rủi ro liên quan đến kê khai thuế.

Khác với việc điều chỉnh hóa đơn hay xóa hóa đơn, hủy hóa đơn thực hiện khi hóa đơn chưa được kê khai thuế hoặc sai sót quá lớn, không thể sửa đổi. Doanh nghiệp cần lưu ý việc hủy hóa đơn phải được thực hiện đúng quy định, có lý do hợp lệ, được lưu trữ đầy đủ chứng từ kèm theo.

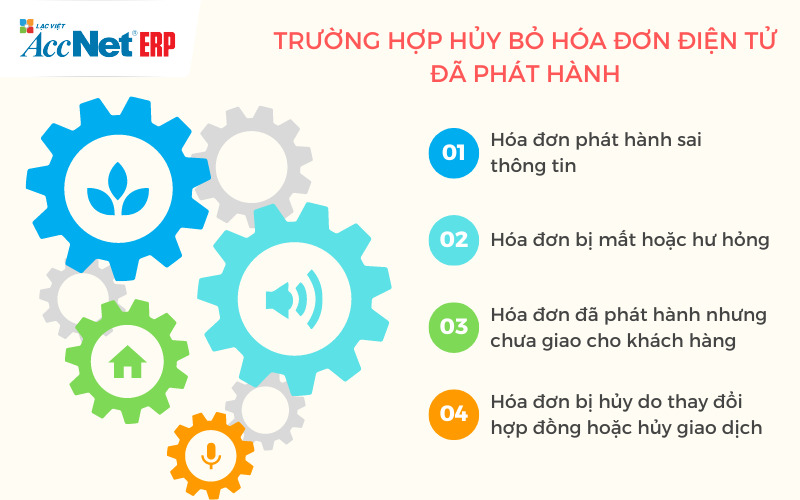

Các trường hợp phổ biến khiến doanh nghiệp phải hủy hóa đơn điện tử bao gồm:

- Thông tin sai lệch: Tên, mã số thuế, địa chỉ hoặc giá trị giao dịch của người mua không chính xác.

- Nhầm đối tượng phát hành: Hóa đơn phát hành cho khách hàng không đúng đối tượng.

- Phát hành vượt số lượng đã đăng ký: Doanh nghiệp phát hành nhiều hóa đơn hơn số lượng đã đăng ký với cơ quan thuế.

- Sai sót về giá trị, thuế: Số tiền, thuế suất hoặc cách tính thuế không chính xác.

Theo khảo sát gần đây của Tổng cục Thuế, hơn 15% doanh nghiệp gặp phải các lỗi trên trong quá trình sử dụng hóa đơn điện tử, cho thấy nhu cầu nắm rõ quy trình hủy hóa đơn là cấp thiết để giảm thiểu rủi ro, tránh xử phạt hành chính.

Read more:

- Cách hủy hóa đơn điện tử according to the latest regulations

- Biên bản hủy hóa đơn điện tử mẫu và hướng dẫn lập chi tiết

- Sample memorandum of alternative electronic invoice chuẩn và hướng dẫn lập

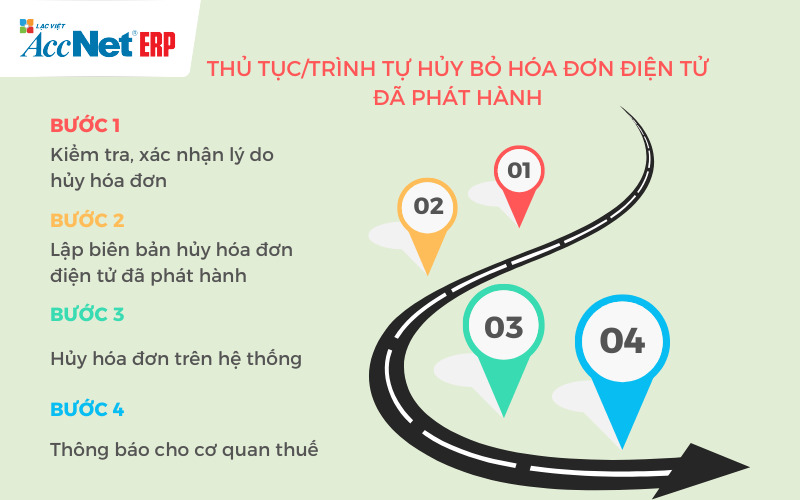

2. Thủ tục hủy hóa đơn điện tử đã phát hành – Trường hợp hóa đơn có sai sót, chưa gửi người mua

Theo Nghị định 123/2020/NĐ-CP, Thông tư 78/2021/TT-BTC, việc hủy hóa đơn điện tử đã phát hành phải thực hiện đúng quy định pháp luật để đảm bảo tính hợp pháp, tránh rủi ro xử phạt. Khi hóa đơn điện tử có sai sót nhưng chưa gửi đến người mua, doanh nghiệp có thể thực hiện quy trình hủy, thay thế hóa đơn mới theo các bước chi tiết sau:

Bước 1: Thông báo hóa đơn sai sót đến cơ quan thuế

- Người bán cần lập thông báo về hóa đơn điện tử có sai sót theo Mẫu số 04/SS-HĐĐT.

- Thông báo này được gửi qua Cổng thông tin điện tử của Tổng cục Thuế, nhằm ghi nhận việc hóa đơn này có lỗi trước khi tiến hành hủy.

- Mục đích: cơ quan thuế nắm được tình trạng hóa đơn, tránh phát sinh các rủi ro về kê khai thuế sau này.

Bước 2: Hủy hóa đơn sai sót trên phần mềm hóa đơn điện tử

- Sau khi thông báo đến cơ quan thuế, doanh nghiệp thực hiện hủy hóa đơn điện tử sai sót trên phần mềm hóa đơn của mình.

- Khi hóa đơn được hủy:

- Hóa đơn không còn giá trị sử dụng, không được phép kê khai thuế.

- Thông tin hóa đơn hủy sẽ được lưu trữ trong hệ thống phần mềm để phục vụ đối chiếu sau này.

- Lưu ý: doanh nghiệp cần kiểm tra trạng thái hóa đơn trước khi hủy để tránh hủy nhầm hóa đơn đã gửi cho cơ quan thuế hoặc người mua.

Read more:

- Memorandum to withdraw the bill chuẩn theo quy định hiện hành

- The custom electronic invoice chuẩn theo quy định

- Biên bản mất hóa đơn according to the latest regulations

Bước 3: Lập hóa đơn điện tử mới thay thế

- Sau khi hủy hóa đơn sai sót, doanh nghiệp lập hóa đơn điện tử mới để thay thế.

- Thao tác bao gồm:

- Nhập đầy đủ thông tin chính xác (tên, mã số thuế, giá trị giao dịch…).

- Ký số trên hóa đơn, gửi cơ quan thuế để cấp mã hóa đơn (đối với hóa đơn có mã).

- Mục đích: đảm bảo hóa đơn mới hợp pháp, đầy đủ thông tin, phù hợp với nghiệp vụ kế toán của doanh nghiệp.

Bước 4: Gửi hóa đơn mới đến người mua

- Sau khi hóa đơn mới được cấp mã bởi cơ quan thuế, doanh nghiệp thực hiện gửi hóa đơn điện tử mới cho người mua.

- Hóa đơn này thay thế hoàn toàn hóa đơn đã hủy, được sử dụng để:

- Kê khai thuế GTGT (nếu có).

- Làm cơ sở thanh toán, lưu trữ chứng từ kế toán hợp pháp.

3. Thủ tục hủy hóa đơn điện tử đã phát hành – Trường hợp hóa đơn có sai sót, đã gửi người mua

Khi hóa đơn điện tử đã được gửi cho người mua nhưng phát hiện sai sót, việc hủy hóa đơn đòi hỏi sự phối hợp giữa người bán, người mua, cơ quan thuế để đảm bảo tính pháp lý, tuân thủ quy định tại Nghị định 123/2020/NĐ-CP, Thông tư 78/2021/TT-BTC. Quy trình xử lý chi tiết bao gồm các bước sau:

Bước 1: Lập biên bản thỏa thuận với người mua

- Trước khi thực hiện hủy hóa đơn, người bán, người mua cần lập văn bản thỏa thuận về việc hủy hóa đơn điện tử sai sót.

- Biên bản có thể là:

- Biên bản thỏa thuận hủy hóa đơn; hoặc

- Văn bản thỏa thuận khác có đầy đủ chữ ký, xác nhận của cả hai bên.

- Mục đích: ghi nhận sự đồng thuận giữa các bên, làm căn cứ pháp lý khi hủy hóa đơn, phát hành hóa đơn mới.

Bước 2: Thông báo hóa đơn sai sót đến cơ quan thuế

- Người bán gửi thông báo về hóa đơn điện tử có sai sót theo Mẫu số 04/SS-HĐĐT đến cơ quan thuế.

- Thông báo này phải được thực hiện trước khi tiến hành hủy hóa đơn, nhằm đảm bảo cơ quan thuế nắm được tình trạng hóa đơn, xác nhận việc xử lý sai sót.

Bước 3: Hủy hóa đơn sai sót trên phần mềm hóa đơn điện tử

- Sau khi thông báo đến cơ quan thuế, người bán thực hiện hủy hóa đơn sai sót trên phần mềm hóa đơn điện tử.

- Khi hủy:

- Hóa đơn không còn giá trị sử dụng, không được kê khai thuế.

- Hệ thống phần mềm sẽ lưu trữ thông tin hóa đơn hủy để đối chiếu sau này.

- Lưu ý: kiểm tra kỹ hóa đơn trước khi hủy để tránh nhầm lẫn với các hóa đơn hợp lệ khác.

Bước 4: Lập hóa đơn điện tử mới thay thế

- Sau khi hủy hóa đơn sai sót, người bán lập hóa đơn điện tử mới với thông tin chính xác.

- Các bước bao gồm:

- Nhập đầy đủ thông tin đúng: tên, mã số thuế, giá trị giao dịch, thuế suất…

- Ký số hóa đơn, gửi cơ quan thuế cấp mã hóa đơn (đối với hóa đơn có mã).

- Hóa đơn mới này sẽ thay thế hoàn toàn hóa đơn đã hủy, đảm bảo hợp pháp về mặt pháp lý, kế toán.

Bước 5: Gửi hóa đơn mới cho người mua

- Sau khi hóa đơn mới được cấp mã (hoặc không có mã, tùy loại), người bán gửi hóa đơn điện tử mới đến người mua.

- Hóa đơn mới là cơ sở để:

- Kê khai thuế GTGT hợp lệ.

- Lưu trữ chứng từ kế toán đúng quy định.

- Thanh toán hoặc đối chiếu với hợp đồng đã ký kết giữa các bên.

4. Lưu ý quan trọng khi hủy hoặc xử lý hóa đơn điện tử sai sót

Khi thực hiện thủ tục hủy hóa đơn điện tử đã phát hành hoặc xử lý hóa đơn sai sót, doanh nghiệp cần nắm rõ một số lưu ý quan trọng để tránh vi phạm pháp luật, đảm bảo quy trình kế toán minh bạch.

Phân biệt giữa “Hủy”, “Xóa bỏ” hóa đơn

- Hủy hóa đơn: Áp dụng khi doanh nghiệp không còn sử dụng hóa đơn nữa, ví dụ: doanh nghiệp giải thể, sáp nhập hoặc chuyển đổi loại hình doanh nghiệp.

- Xóa bỏ/Điều chỉnh hóa đơn: Thường áp dụng khi hóa đơn đã phát hành có sai sót, như thông tin người mua, giá trị giao dịch hoặc thuế suất không đúng.

- Lưu ý: Quy trình nêu trên mà chúng ta đã triển khai là xử lý hóa đơn sai sót (xóa bỏ hoặc điều chỉnh), không phải hủy hóa đơn hoàn toàn.

Hiểu rõ sự khác biệt này giúp doanh nghiệp tránh nhầm lẫn pháp lý, đồng thời áp dụng đúng mẫu báo cáo, thủ tục với cơ quan thuế.

Mẫu báo cáo sử dụng

- Khi phát hiện hóa đơn sai sót, người bán phải gửi thông báo đến cơ quan thuế.

- Mẫu báo cáo: Sử dụng Mẫu số 04/SS-HĐĐT, theo quy định tại Thông tư 78/2021/TT-BTC.

- Thông báo này ghi nhận lý do sai sót, số hóa đơn cần xử lý, giúp cơ quan thuế nắm được tình trạng hóa đơn, tránh rủi ro kê khai sai.

Chế tài xử phạt

- Nếu doanh nghiệp không gửi thông báo hóa đơn sai sót đúng quy định, có thể bị xử phạt hành chính theo Nghị định 125/2020/NĐ-CP.

- Mức phạt phụ thuộc vào mức độ vi phạm, số lượng hóa đơn sai sót, thời gian chậm nộp thông báo.

- Ngoài ra, việc không thực hiện đúng quy trình còn có thể ảnh hưởng đến kê khai thuế GTGT, gây truy thu hoặc phát sinh phạt bổ sung.

Quy định mới từ 01/06/2025

- Doanh nghiệp cần lưu ý các thay đổi pháp lý mới theo Nghị định 70/2025/NĐ-CP, có thể bãi bỏ hoặc sửa đổi một số quy định hiện hành liên quan đến xử lý hóa đơn sai sót.

- Trước khi thực hiện hủy hoặc xóa bỏ hóa đơn, nên kiểm tra cập nhật văn bản pháp lý mới nhất để tuân thủ đúng quy định, tránh rủi ro pháp lý không đáng có.

5. Các chính sách pháp lý liên quan đến hủy hóa đơn điện tử

Căn cứ pháp lý hủy hóa đơn

Việc hủy hóa đơn điện tử đã phát hành được quy định rõ tại các văn bản pháp luật sau:

- Thông tư 78/2021/TT-BTC: hướng dẫn về phát hành, quản lý, hủy hóa đơn điện tử.

- Nghị định 123/2020/NĐ-CP: quy định xử lý vi phạm về hóa đơn, chứng từ.

- Các văn bản sửa đổi, bổ sung mới nhất liên quan đến quản lý hóa đơn điện tử.

Những căn cứ này giúp doanh nghiệp thực hiện thủ tục hủy hóa đơn đúng quy định, hạn chế rủi ro bị phạt hành chính.

Hậu quả khi thủ tục hủy hóa đơn điện tử đã phát hành không đúng quy định

Nếu doanh nghiệp hủy hóa đơn sai quy trình, có thể gặp phải:

- Xử phạt hành chính: theo Nghị định 125/2020/NĐ-CP, mức phạt có thể lên đến hàng triệu đồng tùy mức vi phạm.

- Ảnh hưởng đến kê khai thuế: sai sót trong hủy hóa đơn có thể dẫn đến kê khai thuế sai, bị truy thu hoặc phạt thêm.

- Rủi ro kiểm toán: hồ sơ không đầy đủ sẽ gặp khó khăn trong kiểm toán nội bộ hoặc bên ngoài.

Số liệu tham khảo: thống kê 2024–2025 cho thấy hơn 10% doanh nghiệp bị xử phạt do sai sót liên quan hủy hóa đơn điện tử, nhấn mạnh tầm quan trọng của việc tuân thủ thủ tục.

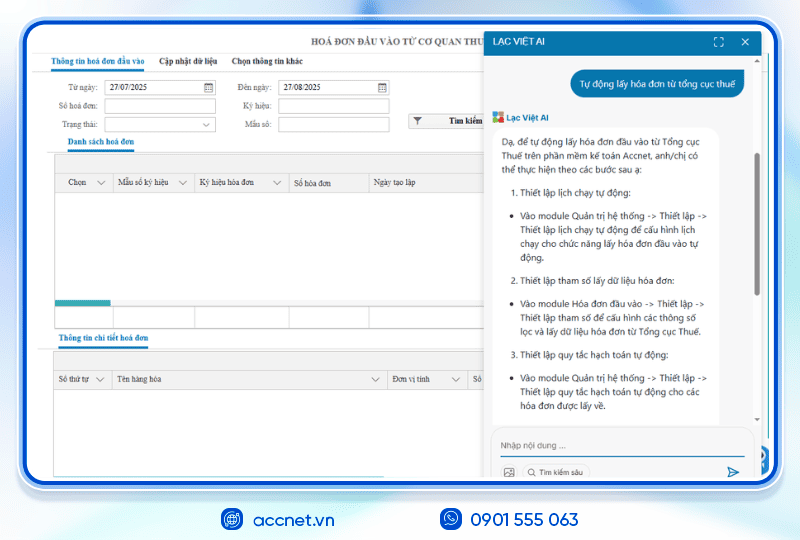

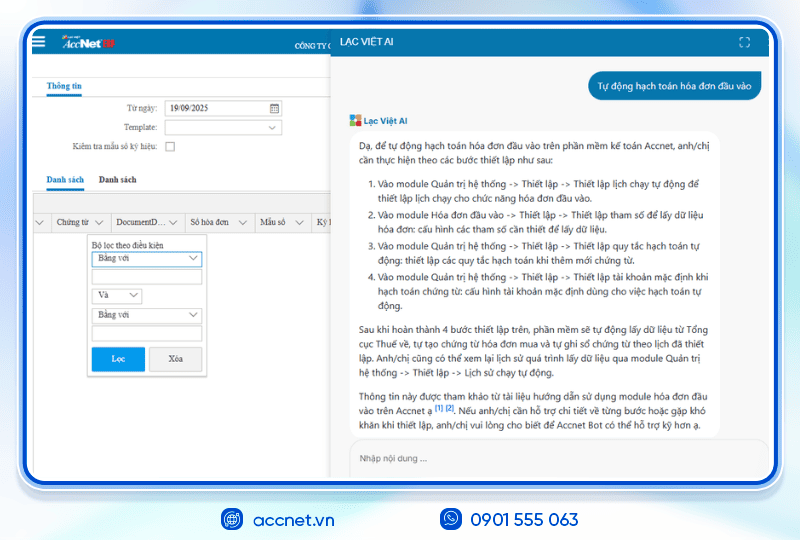

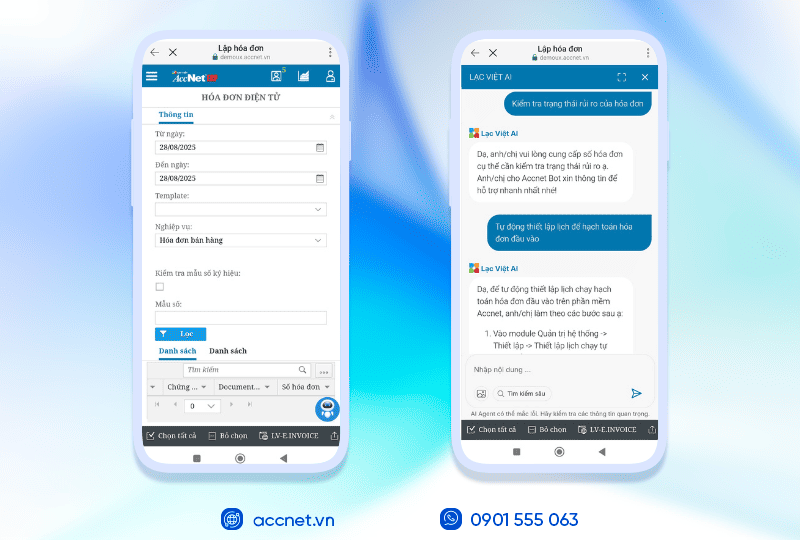

6. Giải pháp AccNet eInvoice – Quản lý, hủy hóa đơn điện tử an toàn

Đối với doanh nghiệp hiện đại, AccNet eInvoice là giải pháp tối ưu để quản lý toàn bộ vòng đời hóa đơn điện tử:

- Hủy hóa đơn điện tử tự động: thực hiện hủy hóa đơn chưa gửi hoặc đã gửi cơ quan thuế, lưu trữ chứng từ chuẩn pháp lý.

- Đối chiếu, kiểm tra thông tin: phần mềm tích hợp AI tự động đối chiếu dữ liệu hóa đơn, giảm rủi ro sai sót trước khi hủy.

- Báo cáo thông minh: thống kê hóa đơn hủy, tình trạng hủy, lý do hủy giúp doanh nghiệp theo dõi hiệu quả quy trình.

- Đồng bộ hóa dữ liệu với kế toán: đảm bảo mọi thay đổi, hủy hóa đơn được cập nhật trực tiếp vào sổ sách, báo cáo thuế.

Với AccNet eInvoice, doanh nghiệp không chỉ tiết kiệm thời gian, chi phí mà còn đảm bảo tuân thủ pháp luật, nâng cao hiệu quả vận hành số trong quản lý hóa đơn điện tử.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Thủ tục hủy hóa đơn điện tử đã phát hành là bước quan trọng trong quản trị tài chính, vận hành doanh nghiệp số. Hiểu rõ khái niệm, các trường hợp hủy, quy trình thực hiện, áp dụng đúng chính sách pháp lý sẽ giúp doanh nghiệp giảm thiểu rủi ro, tiết kiệm chi phí, đảm bảo tuân thủ pháp luật. Áp dụng giải pháp số hóa, phần mềm hóa đơn điện tử hiện đại sẽ giúp doanh nghiệp tự động hóa quy trình, lưu trữ chứng từ chuẩn pháp lý, nâng cao hiệu quả quản lý hóa đơn.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: