Wave of artificial intelligence (AI) is gradually crept into the system, accounting software, opens a new generation: accounting software integration AI – smart assistant helps business analysis, financial depth, accurate decisions, enhance operator efficiency.

According to the survey of Gartner (2024)more than 62% of medium and large business in Asia has or is planning applications, accounting software with integrated AI in the next 12 months. This trend suggests that businesses not only need a software to “recorded data”, which need a tool which has ability to understand, analyze data, to financial forecasts, optimize cash flow, risk warning soon.

In this article, AccNet will help you to understand the concept of accounting software with integrated AI, the benefits, especially the TOP 10 integrated software best AI today, in which there are solutions featured with AI assistant financial statements in depth.

1. Concept & benefits of accounting software integrated AI

Accounting software integration WHO is what?

Accounting software integration WHO is the accounting system has applications in artificial intelligence (AI) in the process of accounting – finance in order to automate advanced analysis of financial data with depth.

Different accounting software traditional (only storage, calculated based on the input data), the software has integrated AI can:

- Learn from data to improve accuracy over time.

- Trend analysis of financial (cash flow, revenues, expenses).

- Automatically recognize deviations in accounting reports.

- Warning of financial risks before business discovery engine.

For example easy to understand: Instead of having to wait until the end of the month to check the reported public debt, a accounting software integration WHO will constantly monitor cash flow, warning, right when the bad debt exceeded safety, helping business handled promptly. In addition, AI can also automate the proposed scheme treats such as: should relax the debt, reduce spending, or transfer the flow of money from account A to account B.

The outstanding benefits business get

Support financial decisions timely, accurate

- WHO not only synthetic data, but also analyze, compare, predict trends, help leadership make decisions faster, more accurately. For example: WHO can alert “marketing costs are exceeding 18% of the budget month”, from which proposed to cut items not effective.

Minimize errors, fraud, accounting

- WHO learn from history, service to automatically detect abnormalities, such as bills, sperm, testimony from the account, or fluctuations in any reasonable between the states.

Increase the speed of financial statements

- With the software integrates AI, businesses can:

- Reporting interest – hole in real time.

- Cash flow forecast for the next quarter.

- Detailed analysis by department or cost type.

- Instead of taking weeks to synthetic data, managers only take a few minutes to grasp the whole picture business finance.

Optimal accounting personnel

- WHO handles most of the work calculation, synthesis, data analysis, help accounting team focused on the strategy as a control, assessment, financial advice.

Easy integration with other systems

- Most of the accounting software integration WHO are now compatible with ERP, CRM, e-bills, bank number, to help accounting data to be synchronized continuously.

Increase transparency, compliance with the law

- Software can ANYONE help auto tracking deadline for submission of tax reports, alerts, delays, or errors. In addition, WHO also hosted stain complete the entire process, support the audit work, inspector.

Note for business: When choosing accounting software with integrated AI, it is important not just “SOMEONE” but also to consider SOMEONE capable of supporting financial statements to the extent any, are in accordance with accounting standards in Vietnam or not.

Read more:

2. Top 6 accounting software integration best AI 2025

In hundreds of accounting software today, only a handful of truly integrated AI-depth for financial reporting. Here are 10 names that are appreciated globally, based on the possibility of AI support:

- Data analysis, finance multi-dimensional

- Automatic establishment, forecast report

- Warning risk, support financial decisions

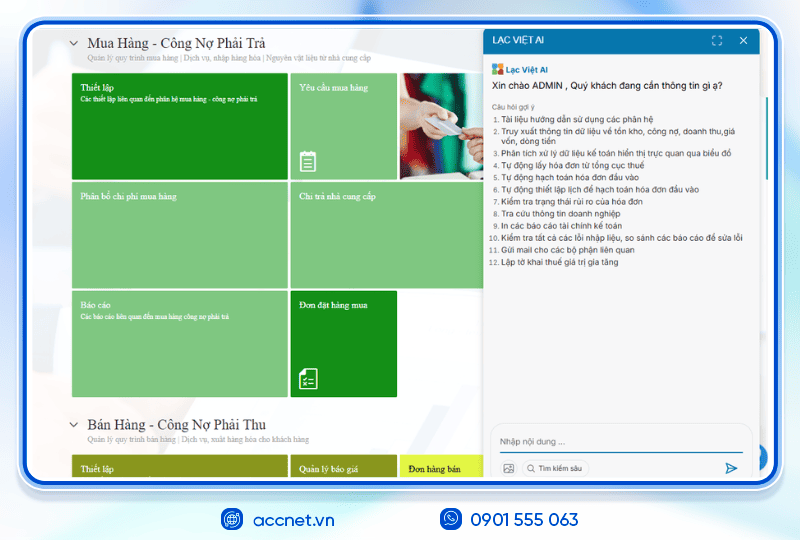

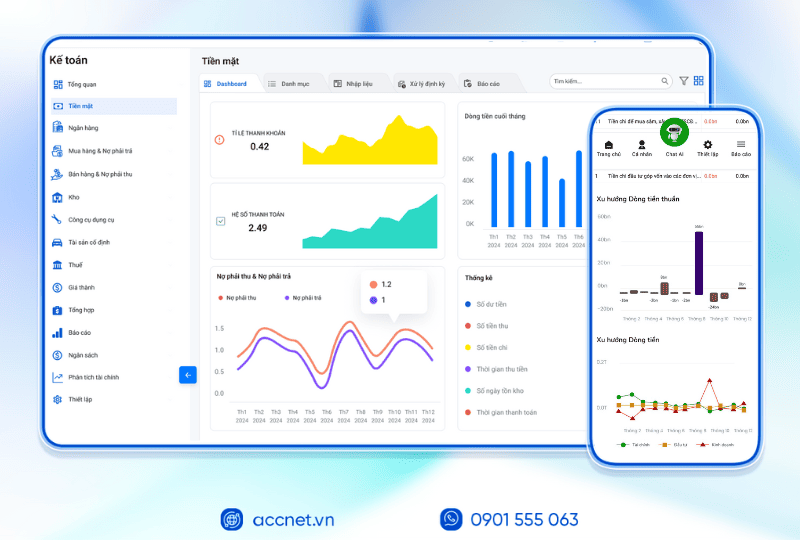

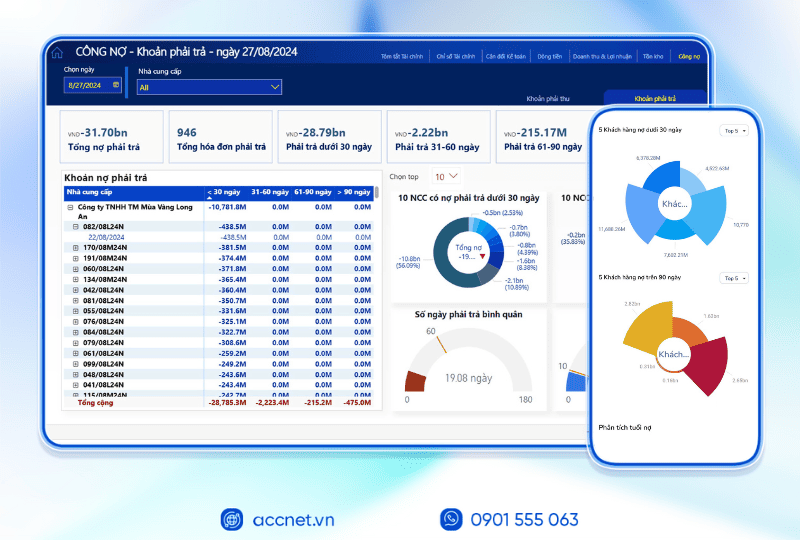

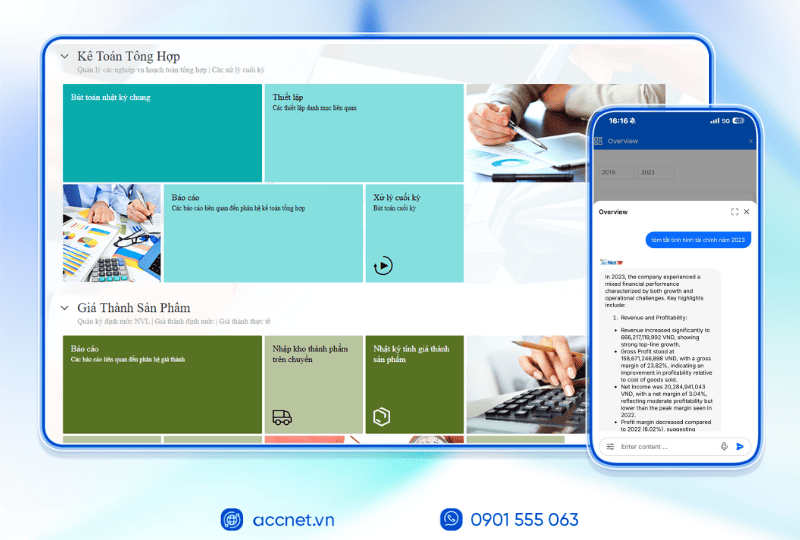

AccNet ERP – financial Assistant smart for business

AccNet ERP is not merely accounting software, which is an ERP solution comprehensive, integrated AI – designed exclusively for Vietnamese businesses are switching numbers. Highlights of AccNet ERP today is the assistant financial statements WHO helps leaders, chief accountant take financial decisions quickly and accurately based on real data.

Solution overview AccNet ERP

- Developed by Lac Viet – brand accounting software has nearly 30 years in Vietnam.

- Designed exclusively for local markets, ensuring compliance with accounting standards in Vietnam (VAS).

- Fit medium and large businesses, especially businesses that requires the administration complex (production, trade chain, logistics...).

- Scalable, flexible, can be integrated modules: accounting, hr, sales, warehouse, manufacturing, property, contracts...

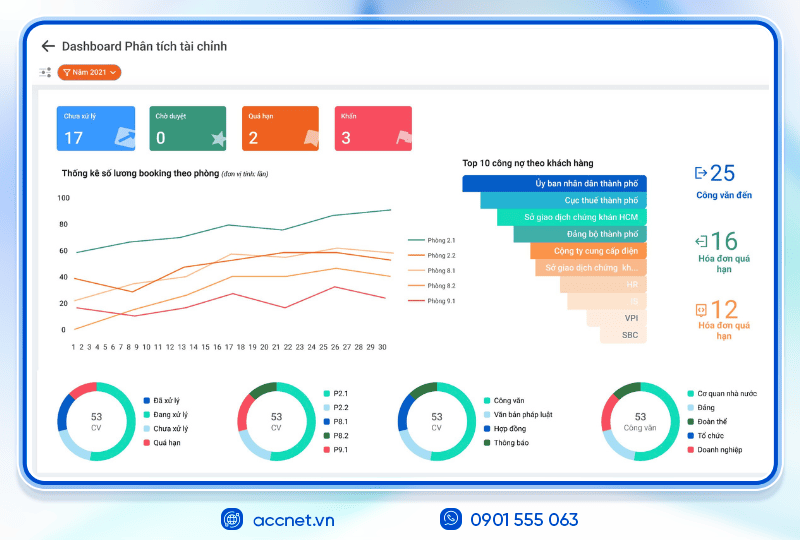

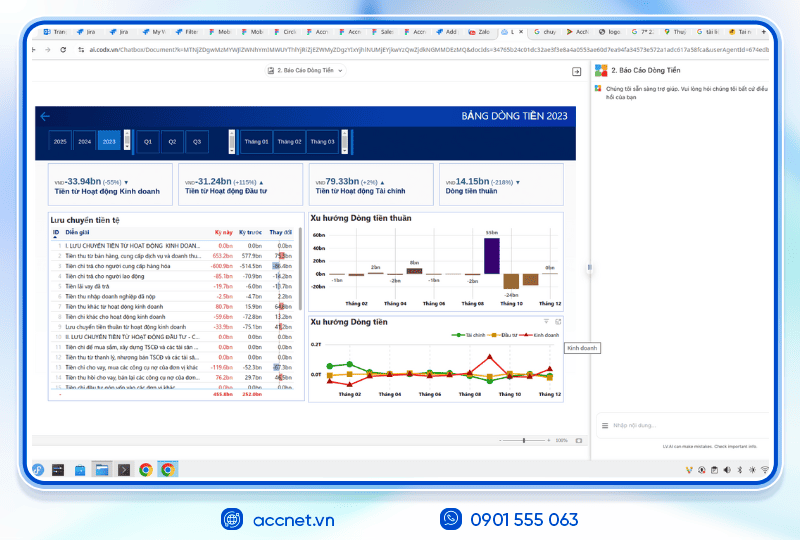

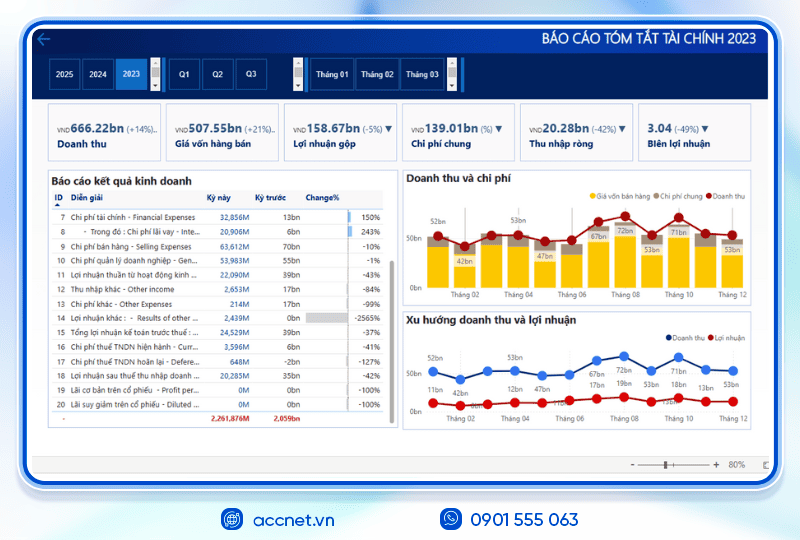

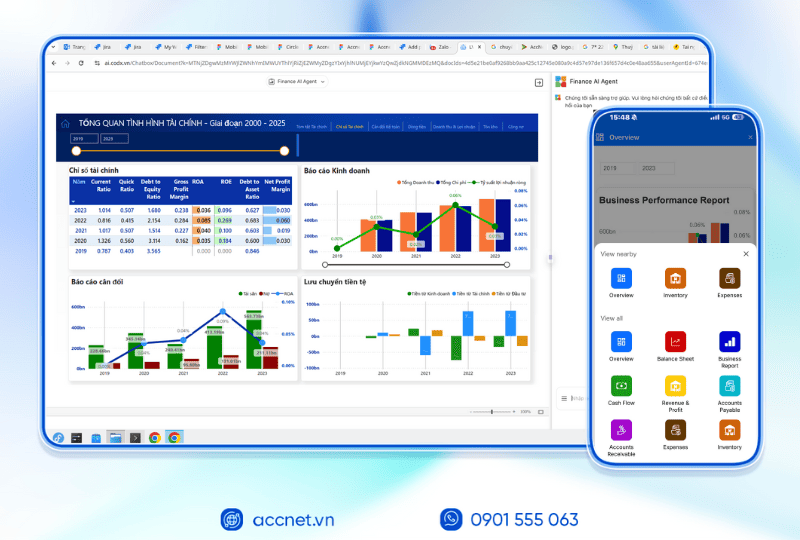

AI assistant financial statements – the breakthrough point of AccNet ERP

This function is particularly striking, help AccNet ERP completely different than the accounting software tradition.

Financial analysis automatic contextual

- AI assistant automatically analyze profit and loss statement, balance sheet, cash flow, not only give data but also explain fluctuations contextual reality.

- For example, When net profit fell, WHO will state the specific cause such as increasing the price of capital, cost of sales, unusual, or revenue drop due to large customers stop buying.

Hint executive action based on data

- The system not only displays the result, but also give recommended operating as: should cut down on any costs, focus groups, customers, strengthen the recovery of the debt...

- The recommendations are based on machine learning models from data combined business data industry (benchmarking internal, external).

Customizable dashboard according to user role

- CEO, CFO or accountant can see the report is personalized, showing the angle suited to the role.

- Assistant WHO supports queries using natural language (E.G., “quarter revenue 2 reduce how much % compared with quarter 1?”), help leaders do not need to read the report manually.

Learn constantly, adapt to business

- WHO trained constantly accordance with the act of use, data of the business.

- The report gradually tweaked contextual operators, ensuring increasingly smart, practical observation.

The outstanding benefits of AccNet ERP with AI financial

| Features | Benefits |

| WHO analysis of financial volatility | Reduce the time to read the report, quickly detect risks |

| Hint financial executives | Help the leader board decisions have base data support |

| Report multi – dimensional, highly customizable | Reduction depends on the personnel report, easy to use for the CEO |

| Alert auto finance | To detect the deviation unusual, early warning negative money flow |

| Friendly interface, easy to use | Easy to apply, no need data experts to operate |

Any business should use AccNet ERP?

- Business scale from medium to large, active in the field of manufacturing, retail chains, trade, logistics...

- Businesses need finance management depth, a decision fast, can't wait for the report engine.

- Businesses are converting some want financial assistant companion in every investment decision, cost, financing.

Statistics – AccNet ERP helps to increase operator efficiency

A study of internal Communication on 50 enterprises deploy AccNet ERP in 2024 shows:

- 80% of businesses save 30% of the time financial reporting every month.

- 62% of businesses reduced operating costs, financial – accounting in the first 6 months of deployment.

- 85% of CEOS identified financial decisions of their more accurate thanks to the AI assistant.

Demo free experience, support package execution

AccNet ERP is supported demo practice by industry, to business can test AI assistant finance before commissioning. In addition, the deployment team provides:

- Guide 1-1.

- Customized consulting in financial modeling business.

- Deploy each stage to ensure receptive.

AccNet ERP is not simply an accounting software integrated AI – which is a system assistant, comprehensive financial help business control, optimal financial forecast in real-time. With a solid foundation, team support, and the ability to analyze financial intelligence, AccNet ERP is the top choice for enterprises want to upgrade capability financial management by power ONE.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

MISA AMIS accounting

MISA AMIS is one of the accounting software most popular in Vietnam, especially in the business sector, SME. In the recent version (2023-2025), MISA has integrated more AI, big data (Big Data) to automate the process of establishment – analysis – forecast financial help accountants, administrators make decisions quickly.

Possibility of AI financial assistant

- Automatic analysis of financial ratios: profitability, revenues, expenses, margins,... is represented into tables – chart easy to understand, help administrators understand the financial situation without having to check each report.

- Warning of financial risks: AI analysis, cash flow, accounts receivable, to pay for early warning of risk of deficiency of cash flow or debt overdue.

- Hints handle discrepancies, errors: When there is an abnormality (for example: the cost – invoice), the system will automatically highlight, hint adjusted.

Strengths:

- Easy to use interface, familiar with Vietnamese accounting.

- ONE practical application, in accordance with the small and medium enterprises.

- Built on the platform administrator MISA AMIS, link multiple modules.

FAST Accounting Online

FAST is a supplier of accounting software have lived, serving both medium and large business. Recently, FAST has developed more features financial analysis by AI in FAST Accounting Online.

Possibility of AI financial assistant

- Financial forecast based on historical data: AI learning from figures 1-3 years ago of the business, from it to make predictions about cash flow, revenue – costs in the period to come.

- Auto report according to the scenario management: in Addition to financial reporting standards, the system further hints of management reports such as reports, expense details according to the departments, the report compares the effectiveness, project...

- Analysis of financial volatility anomaly: When profits or costs, sudden movements, WHO will analyze the causes, warning to the administrator.

Strengths:

- Suitable business there have been many financial data in the past.

- Cloud system, easy to integrate other modules.

- Meet the needs of business is growing fast, the need to forecast.

Bravo 8 ERP

Bravo featured in the segment of large enterprises and corporations. Bravo 8 is the version ERP latest has integrated AI, BI (Business Intelligence) helps personalize, financial analysis, data visualizations, support leadership decision-making in real time.

Possibility of AI financial assistant

- Financial analysis according to the model dashboard intelligence: AI aggregated data from accounting, inventory, sales, purchase,... of the dashboard, intuitive leadership a comprehensive look at the business situation.

- Automatically detect unusual take strategic warning: when, For example, gross profit margin decreased 5% continuously for 3 months, WHO will alert the proposed criteria need to review (the price of capital, discount,...).

- AI machine learning (machine learning): Hint items spending need to optimize, or to predict the financial situation in the future based on learning models from data, internal business.

Strengths:

- Customization possibilities, suitable large corporations, multi-branch.

- Report of financial analysis in depth, multi-dimensional (in units of product, time,...).

- Strong integration of the entire ERP system, not just the accounting.

Odoo Accounting

Odoo Accounting is a part of the ecosystem Odoo ERP – open source platform globally famous. With millions of businesses across more than 120 countries use Odoo stand out thanks to the flexibility, scalability, especially the ability to integrate powerful AI in the accounting process, in which the most prominent is the assistant features smart financial support analytical reports, decisions.

WHO in Odoo Accounting support to business?

Odoo use technology, Machine Learning (ML), artificial intelligence (AI) to analyze and give suggestions to the user on the financial statements:

- Auto suggestion categorized accounting: When entering data or receive data from the electronic invoice, the system automatically recognizes content, hints the account fit, help reduce errors and save time.

- Cash flow analysis according to historical trends, forecast future: ONE in Odoo can learn from the cash flow of the past to make forecasts short term – medium term according to the optimistic scenario, on average, negative.

- Financial alerts in real time: Business, be alert when indicators such as irregular expenses, revenues decreased continuously, bad debts... exceeds the permitted threshold. WHO put out the reason analysis to help users easily traceability.

- Dashboard financial intelligence (Financial Dashboards): interface visually displays the KPI financial, WHO suggested actions based on real data such as “operating Costs are exceeded by 20% compared to the plan – proposed review contract NCC A or test order code XYZ.”

Advantages of Odoo Accounting with SOMEONE financial statements:

| AI feature highlights | Specific benefits |

| Machine learning automatically recognizes transactions | Shorten the process, data entry, reduce errors fixed account |

| Forecast cash flow, financial according to the scenario | Help business owners prepare budgets, investment scenario flexibility |

| Assistant intelligent alerts | Early detection of financial risks, protect the business from the crisis, cash flow |

| Interface, dashboard, financial analysis, real-time | Update on business instant decisions quickly and accurately |

| Expand easily – integrated module Odoo other | Synchronized accounting with sales, inventory, CRM, HR... help seamless data |

Suitable with any business?

- Medium and large business has a team of strong IT, has the ability to customize the system or cooperate with partners to deploy.

- Businesses need to extend the ERP system sync more array functions.

- Business directory or multi-national, thanks to support many standard accounting language.

Cons to consider

- The deployment of Odoo team requests technical or implementation partner, experienced, especially with AI.

- Some features AI enhanced only on Odoo Enterprise (paid).

Read more:

Effect Accounting

Effect Accounting is the product of the joint STOCK company, software development, EFFECT, one of the pioneers in the field of accounting software in Vietnam from the beginning of the year 2000. Software highlights thanks to the ability of highly customizable according to each industry and business model.

Salient features of accounting

- System standard account in accordance with the provisions of the Ministry of Finance, easy-to-customize.

- Managing invoices, vouchers, VAT, CIT, PIT.

- System report full financial: balance Sheet reports the results of operations, business, cash flows, notes to financial statements...

- Support handle the amount of stock from large, suitable for both medium and large business.

- Data link software with electronic invoicing, banking, ERP system...

The ability to integrate AI in financial statements

Effect does not develop, WHO styled the tea that focus on integration of AI analysis, alerts in financial statements. Some highlights include:

- Analysis of false data automatically: WHO collated between the reports, alerts when there is a difference irrational, between the cost – revenue – profit.

- Proposed adjustments and final states: Especially useful for business no accounting chief good.

- Hint financial trends based on data from the past: serving the board of directors in the decision to invest, expand, loans.

- System dashboard visual financial Assistant WHO create the chart, compare a. – years – similar branches for users to easily follow.

Advantages for enterprises

- Interface Vietnam net, easy to use with the internal accounting.

- Have our team of expert support, deep, regular updates according to the specified accounting – tax latest.

- Version cloud, on-premise flexible according to the model operated business.

- Deep customization according to specific industries: construction, trade, manufacturing, services.

Reviews from the market

- Be trusted, especially businesses that have high requirements on internal control, transparency report.

- Many accountants minister appreciated the hint feature adjustments and AI, the ability to export financial reports quickly correct form audit requirements.

3. Criteria to choose accounting software that integrates the best AI for business

Choosing the right accounting software not only helps businesses manage financial performance, but also create competitive advantage in the long term, especially when that software is integrated AI-assisted analysis of financial statements. Here are 6 core criteria that businesses need to consider carefully before making decisions.

Features financial analysis, intelligent, intuitive

Integrated software WHO need to have the ability to:

- Automatic synthesis, data processing, finance and accounting in real time.

- Turn raw data into charts, reports, visual helps leaders easily grasp the situation, revenue, cost, profit.

- Analyze financial trends (trend), giving early warning for abnormal fluctuations.

Hint reviews:

- Accounting software integration WHO has the dashboard for finance?

- Function drill-down (go deep) each financial indicators not?

- Have the ability to predict financial volatility based on historical data?

Learn more:

The ability to machine learning (Machine Learning) to support forecast

WHO does not just report but also forecast the financial future based on patterns from past data.

- Predict cash flow coming.

- Estimated recurring cost, revenue next month.

- Hint to balance the budget if the cost exceeds the threshold.

This is step strategy to help businesses not only reactive but also proactive executive.

The ability to customize, expand according to specific industry

Every industry needs accounting, financial reporting different:

- Manufacturing enterprises need to allocate prices, track the level of raw material.

- Commercial enterprise management priority debts and discount.

- Service businesses need to track revenue under the contract, according to time.

A accounting software smart to allow customized report according to specific industry, and provides tools to analyze in depth as:

- Profitability analysis by branch, industry, product lines.

- Options KPI financial according to the needs of the CEO or CFO.

Automation of accounting process, reducing the risk of errors

WHO can support automatic:

- Recognition, sorting evidence from the input.

- The account automatically according to the context.

- For control public debt, to check the validity of the bill.

- Hint adjusting entry when it detects the difference extraordinary.

Automate as much business as save time, reduce errors, limited risk inspection later.

The ability to integrate data system multi-source

A accounting software integration WHO have connections open (Open API) to:

- Connect to software sales, CRM, warehouse management, bank number.

- Sync data from the electronic invoice, contract, electronics, software, personnel.

- Synthesis report from the other system into a financial platform sole.

This helps to ensure data throughout – transparency – consistency, is a platform for ANYONE to operate efficiently.

Friendly interface, easy to use, has virtual assistant finance

Integrated software WHO should have:

- Simple interface, easy to manipulate for accountant.

- Setting options dashboard for each role (CEO, CFO, Head).

- Virtual assistant (AI Assistant) can hint pen math, explained index, or support decision making by answering questions using natural language.

For example, You can ask: “profit at month 6 increase or decrease compared to January 5? Why?” – WHO can provide both data and analyze the causes.

Refer to:

The application accounting software integration AI no longer is the trend that has become essential requirements. The superior benefits from automation, data analysis, to financial forecasts, to help businesses operate more streamlined, transparent, more competitive, more efficient.

However, choosing the right software is always a problem to consider thoroughly – from the actual needs, capacities, operating internal to the ability to expand later. Determining the right criteria, the solution chosen SOMEONE strong in analysis, financial statements, will be leverage to help administrators make decisions based on data, not feelings.

If the business you're in the transition period of, don't just look at the features “flashy” let's start from the inner need – choose the right accounting solution integrates AI as an integral part in the development strategy long-term.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: