Với doanh nghiệp bán lẻ, chuỗi cửa hàng, nhà hàng hay thương mại điện tử, thao tác invoice retail customers không còn chỉ là thủ tục hành chính — nó là điểm chạm quan trọng giữa trải nghiệm khách hàng, quy trình kế toán, kiểm soát nội bộ. Việc triển khai một quy trình xuất hóa đơn nhanh, hợp pháp, đồng bộ với hệ thống bán hàng đang trở thành tiêu chí đánh giá năng lực vận hành số của doanh nghiệp.

Bài viết này phân tích rõ khái niệm, khung pháp lý, những lưu ý nghiệp vụ liên quan đến xuất hóa đơn khách lẻ, nhằm giúp nhà quản trị, kế toán trưởng, đội triển khai CNTT có căn cứ để thiết kế hoặc lựa chọn giải pháp hóa đơn điện tử phù hợp.

1. Điều kiện, loại hóa đơn xuất hóa đơn khách lẻ

Trước khi xuất hóa đơn cho khách lẻ, doanh nghiệp hoặc cá nhân cần xác định rõ mình thuộc đối tượng nào, từ đó lựa chọn đúng loại hóa đơn, tuân thủ quy định của cơ quan thuế.

Doanh nghiệp hoặc hộ kinh doanh đã đăng ký

Nếu bạn là doanh nghiệp hoặc hộ kinh doanh đã đăng ký kinh doanh, việc xuất hóa đơn cho khách lẻ phải tuân thủ quy định bắt buộc về hóa đơn điện tử của Tổng cục Thuế.

- How to perform:

- Sử dụng phần mềm hóa đơn điện tử đã đăng ký với cơ quan thuế để lập, phát hành hóa đơn.

- Hóa đơn cần đảm bảo đầy đủ thông tin bắt buộc: tên người bán, tên hàng hóa/dịch vụ, số lượng, đơn giá, thuế suất, tổng tiền, ngày lập, mã hóa đơn, …

- Dữ liệu hóa đơn sẽ được tự động gửi về cơ quan thuế, đảm bảo tuân thủ pháp lý, tiện cho việc tra cứu, lưu trữ.

- Benefits:

- Đảm bảo tuân thủ pháp luật, giảm rủi ro phạt hành chính.

- Tiết kiệm thời gian, chi phí so với hóa đơn giấy.

- Dễ dàng đồng bộ với hệ thống kế toán, quản lý doanh thu.

Read more:

- Guide invoice simple electronic theo đúng thời điểm và nội dung hợp lệ

- Invoice under the contract đúng thời điểm theo quy định pháp luật

- Xuất hóa đơn điều chỉnh giảm đúng trường hợp theo quy định thuế GTGT

Cá nhân bán hàng không thường xuyên

Nếu bạn là cá nhân bán hàng không kinh doanh thường xuyên, nhưng phát sinh giao dịch bán hàng hoặc cung cấp dịch vụ, bạn có thể đề nghị cơ quan thuế cấp hóa đơn lẻ (hóa đơn giấy lẻ có mã của cơ quan thuế) cho từng lần phát sinh.

- Đặc điểm của hóa đơn lẻ:

- Dùng cho mỗi lần bán hàng riêng lẻ, không áp dụng cho doanh nghiệp đã đăng ký kinh doanh bắt buộc.

- Có mã của cơ quan thuế để đảm bảo tính pháp lý.

- Phù hợp cho các giao dịch phát sinh nhỏ lẻ, bán trực tiếp cho khách hàng cá nhân.

- Note:

- Cá nhân cần lưu giữ hóa đơn lẻ để phục vụ kê khai hoặc kiểm tra thuế nếu cơ quan thuế yêu cầu.

- Hóa đơn lẻ không thể sử dụng để kê khai khấu trừ thuế GTGT.

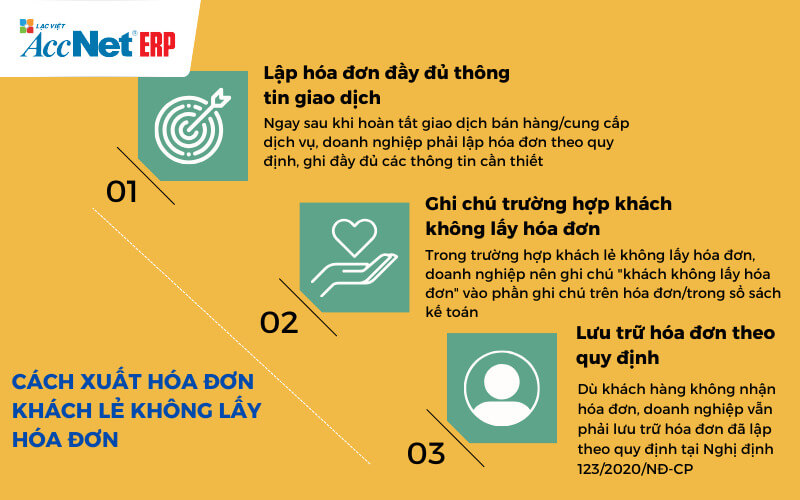

2. Các bước thực hiện xuất hóa đơn khách lẻ

Doanh nghiệp hoặc cá nhân khi xuất hóa đơn khách lẻ cần nắm rõ quy trình thực hiện để đảm bảo tuân thủ pháp luật, hạn chế sai sót, tối ưu thời gian. Quy trình được chia theo từng đối tượng:

DOWNLOAD FILE SAMPLE INVOICE RETAIL CUSTOMERS AT THIS

Đối với Doanh nghiệp/Hộ kinh doanh sử dụng hóa đơn điện tử

Đây là quy trình phổ biến nhất hiện nay cho các doanh nghiệp đã đăng ký kinh doanh, sử dụng phần mềm hóa đơn điện tử:

- Đăng nhập phần mềm hóa đơn điện tử

- Sử dụng phần mềm đã đăng ký với cơ quan thuế như: AccNet eInvoice, VNPT Invoice, Viettel S-Invoice, MISA Amis Invoice…

- Kiểm tra kết nối mạng, quyền truy cập, đảm bảo phần mềm đã được cập nhật phiên bản mới nhất.

- Tạo thông tin khách hàng

- Với khách lẻ, không bắt buộc nhập mã số thuế.

- Thông tin tối thiểu gồm:

- Tên khách hàng (có thể ghi “Khách lẻ” hoặc tên cụ thể nếu có);

- Địa chỉ (không bắt buộc chi tiết cho giao dịch bán lẻ).

- Nếu khách hàng đã mua trước đó, phần mềm có thể tự động gợi ý dữ liệu để giảm thao tác.

- Lập nội dung hóa đơn

- Nhập đầy đủ thông tin về hàng hóa/dịch vụ:

- Name product/service

- Unit

- Number

- Unit price

- The money

- Thuế suất VAT (nếu có)

- Đảm bảo số liệu chính xác để tránh sai sót, nhất là khi xuất hóa đơn nhiều lần trong ngày.

- Nhập đầy đủ thông tin về hàng hóa/dịch vụ:

- Ký số hóa đơn (ký điện tử)

- Sử dụng chữ ký số (USB Token hoặc HSM) để ký xác thực hóa đơn, đảm bảo tính pháp lý.

- Một số phần mềm sẽ tự động nhắc ký khi hoàn tất nhập liệu.

- Gửi hóa đơn lên cơ quan thuế

- Sau khi ký số, phần mềm sẽ tự động gửi dữ liệu hóa đơn lên Tổng cục Thuế để lấy mã xác thực.

- Hóa đơn chỉ có hiệu lực pháp lý khi có mã xác thực từ cơ quan thuế.

- Cấp phát hóa đơn cho khách hàng

- Gửi hóa đơn điện tử cho khách qua: email, tin nhắn, hoặc các ứng dụng như Zalo/ZaloPay.

- Nếu khách yêu cầu, doanh nghiệp có thể in bản sao hóa đơn giấy từ file điện tử.

Lưu ý: Việc sử dụng phần mềm hóa đơn điện tử giúp doanh nghiệp giảm rủi ro sai sót, tiết kiệm thời gian, đồng thời dễ dàng đồng bộ với hệ thống kế toán, báo cáo thuế.

Read more:

- Cá nhân xuất hóa đơn cho doanh nghiệp cần đáp ứng điều kiện gì?

- Hướng dẫn hộ kinh doanh lập và phát hành hóa đơn điện tử đúng quy định

- Instructions VAT invoice can be issued for individual theo quy định hiện hành

Đối với cá nhân bán hàng lẻ (đề nghị cấp hóa đơn giấy lẻ)

Quy trình này áp dụng cho các cá nhân không kinh doanh thường xuyên nhưng có giao dịch cần xuất hóa đơn (ví dụ: bán tài sản cá nhân, lô hàng nhỏ phát sinh không thường xuyên):

- Chuẩn bị hồ sơ đề nghị cấp hóa đơn lẻ

- Đơn đề nghị cấp hóa đơn lẻ theo mẫu của cơ quan thuế.

- Giấy tờ tùy thân: CMND/CCCD hoặc hộ chiếu.

- Giấy tờ chứng minh giao dịch: hợp đồng mua bán, biên lai, phiếu thu hoặc chứng từ liên quan.

- Submission

- Nộp trực tiếp tại Chi cục Thuế nơi phát sinh giao dịch kinh doanh hoặc nơi cư trú của cá nhân.

- Cán bộ thuế sẽ kiểm tra hồ sơ, xác nhận tính hợp lệ, hướng dẫn thực hiện bước tiếp theo.

- Nhận, nộp thuế

- Cơ quan thuế sẽ xác định số thuế phải nộp (nếu có).

- Sau đó cấp cho bạn cuốn hóa đơn lẻ hoặc từng tờ hóa đơn có mã của cơ quan thuế.

- Lập hóa đơn cho khách

- Cá nhân tự ghi nội dung hóa đơn theo hướng dẫn của cơ quan thuế ngay tại cơ quan, hoặc mang hóa đơn về viết tại nhà.

- Hóa đơn lẻ cần ghi đầy đủ thông tin tối thiểu: tên người bán, tên hàng hóa/dịch vụ, số lượng, đơn giá, thành tiền, ngày lập hóa đơn.

Lưu ý: Hóa đơn giấy lẻ có hiệu lực pháp lý khi có mã của cơ quan thuế. Cá nhân cần lưu giữ cẩn thận để phục vụ kê khai hoặc kiểm tra nếu được yêu cầu.

3. Quy định cơ bản của cơ quan thuế khi xuất hóa đơn cho khách lẻ

Các nguyên tắc chính doanh nghiệp cần tuân thủ khi xuất hóa đơn khách lẻ:

- Mọi phát sinh bán hàng hóa, cung cấp dịch vụ đều phải lập hóa đơn theo quy định; không phụ thuộc khách có yêu cầu hay không.

- Trên hóa đơn điện tử cho khách lẻ, các trường quan trọng gồm: mã, số hóa đơn, ngày lập, tên người bán, hàng hóa/dịch vụ, đơn giá, số lượng, thuế suất, tổng tiền. Thông tin người mua có thể để trống hoặc ghi “Khách lẻ” nếu khách không cung cấp.

- Khi khách yêu cầu hóa đơn ghi thông tin doanh nghiệp (có MST), doanh nghiệp phải lập lại hóa đơn theo thông tin chính xác hoặc lập hóa đơn điều chỉnh/hủy theo trình tự pháp luật quy định.

Doanh nghiệp lưu ý: một số lỗi thường thấy dẫn đến xử phạt là không lập hóa đơn, lập hóa đơn sai thuế suất, hoặc lập hóa đơn nhưng không gửi/khai báo đúng quy trình điện tử với cơ quan thuế. Vì vậy, hệ thống xuất hóa đơn cần có logic kiểm tra trước khi phát hành.

Learn more:

- Instructions invoice gifts for employees regulations

- Advance have to invoice no? Giải đáp chi tiết cho doanh nghiệp

- Xuất hóa đơn đỏ tối thiểu bao nhiêu tiền? Hướng dẫn chi tiết

Khi nào doanh nghiệp phải/không phải lập hóa đơn cho khách lẻ?

Nguyên tắc tổng quát: nếu có phát sinh doanh thu bán hàng hóa/dịch vụ thì phải lập hóa đơn. Tuy nhiên, về thực tế vận hành:

- Bán lẻ tại quầy: lập hóa đơn ngay hoặc tập hợp hóa đơn ghi sổ theo quy định nội bộ (tùy chính sách, quy mô).

- Bán hàng online: nếu khách cung cấp email/SĐT, doanh nghiệp nên gửi hóa đơn điện tử ngay sau thanh toán để minh bạch, tạo dấu vết giao dịch.

- Trường hợp giao dịch rất nhỏ (ví dụ bán lẻ giá trị thấp), doanh nghiệp vẫn phải có chứng từ tương ứng theo quy định; cách thể hiện có thể là hóa đơn theo mẫu dành cho bán lẻ.

Doanh nghiệp khi thiết kế quy trình cần cân nhắc cân bằng giữa trải nghiệm khách hàng (không gây phiền hà), yêu cầu tuân thủ.

4. Những vấn đề doanh nghiệp thường gặp khi xuất hóa đơn khách lẻ

Sai thông tin người mua – khi nào được để trống?

Theo khảo sát ngành bán lẻ Việt Nam 2024, khoảng 68% giao dịch khách lẻ không cung cấp đầy đủ thông tin. Trong trường hợp này:

- Tên khách có thể ghi “Khách lẻ”;

- Địa chỉ/MST để trống nếu không yêu cầu;

- Hệ thống hóa đơn điện tử cần ghi chú, đảm bảo các trường bắt buộc khác đầy đủ.

Hiểu rõ quy định này giúp doanh nghiệp tránh lỗi lập hóa đơn sai thông tin, giảm nguy cơ bị xử phạt hành chính.

Xuất hóa đơn chậm hoặc không kịp thời

Doanh nghiệp không xuất hóa đơn đúng thời hạn sẽ gặp rủi ro:

- Phạt hành chính: từ 2–10 triệu đồng theo Nghị định 125.

- Nguyên nhân phổ biến: thao tác thủ công, không kết nối POS với phần mềm hóa đơn, kiểm duyệt nội bộ chậm.

Đặc biệt với các doanh nghiệp bán lẻ có lượng giao dịch lớn, việc chậm xuất hóa đơn không chỉ gây phạt mà còn ảnh hưởng đến trải nghiệm khách hàng.

Áp lực ghi nhận doanh thu theo thời điểm

Với doanh nghiệp bán hàng số lượng lớn, việc ghi nhận doanh thu chính xác là thách thức:

- Xuất hóa đơn thủ công dễ sai dòng, sai thuế suất;

- Khi doanh nghiệp quản lý đa kênh (offline + online), nếu dữ liệu không đồng bộ, báo cáo doanh thu sẽ bị lệch.

Hệ thống điện tử với tự động tạo bút toán giúp giảm sai sót, đảm bảo khớp số liệu kế toán.

Lỗi đồng bộ giữa hệ thống bán hàng, hệ thống hóa đơn

Theo báo cáo Deloitte 2024, 35% doanh nghiệp bán lẻ đa kênh gặp lỗi đồng bộ hóa đơn, kho:

- Sai mã hàng, sai VAT, chênh lệch tồn kho;

- Khó theo dõi doanh thu theo cửa hàng/chi nhánh;

- Tăng nguy cơ phạt thuế, sai báo cáo kế toán.

Việc tối ưu quy trình vận hành số, kết nối POS – ERP – phần mềm hóa đơn điện tử là yếu tố quyết định để hạn chế rủi ro trên.

5. Giới thiệu giải pháp AccNet eInvoice – Tối ưu xuất hóa đơn khách lẻ

Các tính năng nổi bật

- Xuất hóa đơn tức thì: kết nối POS, website, app;

- Tự động hóa thông tin khách lẻ: hệ thống điền mặc định hoặc gợi ý dữ liệu cũ;

- Gửi hóa đơn hàng loạt: qua SMS, Email;

- AI kiểm tra lỗi: cảnh báo sai thuế suất, đơn giá, trùng hóa đơn;

- Đồng bộ với kế toán – ERP – báo cáo thuế: dữ liệu luôn chính xác, minh bạch.

Lợi ích khi doanh nghiệp triển khai

- Tiết kiệm thời gian: giảm 70% thời gian xuất hóa đơn khách lẻ;

- Kiểm soát doanh thu hiệu quả: theo ca, cửa hàng, chi nhánh;

- Tuân thủ pháp lý 100%: đáp ứng yêu cầu cơ quan thuế;

- Tối ưu vận hành số: tích hợp liền mạch bán hàng – hóa đơn – kế toán.

AccNet eInvoice giúp doanh nghiệp bán lẻ, chuỗi cửa hàng, F&B vận hành tự động hóa quy trình xuất hóa đơn khách lẻ, giảm rủi ro sai sót, nâng cao hiệu quả kinh doanh.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

The invoice retail customers không chỉ là nghĩa vụ pháp lý mà còn là chìa khóa để nâng cao hiệu quả quản trị doanh nghiệp. Doanh nghiệp hiện nay nếu vẫn dùng phương pháp thủ công sẽ gặp rủi ro sai sót, mất thời gian, khó kiểm soát doanh thu. Chuyển sang hóa đơn điện tử, kết hợp tự động hóa, AI, doanh nghiệp vừa đảm bảo tuân thủ pháp luật, vừa cải thiện trải nghiệm khách hàng, đặc biệt trong môi trường bán lẻ đa kênh. Triển khai giải pháp như AccNet eInvoice là bước đi thông minh giúp doanh nghiệp tối ưu quy trình, giảm rủi ro, tăng hiệu suất vận hành số, sẵn sàng đáp ứng nhu cầu kinh doanh hiện đại.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: