Making decisions based on gut feeling or data lack of updates is becoming a major barrier for growth. Especially at the level of finance – where require high accuracy, the ability to in-depth analysis, managers can not only based on the Excel spreadsheet crafts, discrete, easy to errors. This is why the software supports reporting financial professional is gradually becoming essential tools in the accounting system – administrator of the modern enterprise. Not only helps in visualizing financial data, the software also opens new perspective on the operational efficiency, trends in cash flow indicators, early warning risk.

So software analysis, financial reporting what is? Why enterprises need to deploy soon? So where to start to choose a tool that fits? Let's find out in detail in this article.

1. Software analysis of financial statements, what is?

Definition

Software analysis, financial reporting is a tool to help businesses collect, synthesize, visualize, analyze the financial data in an automated, accurate, real-time. This software works based on the connection data from the accounting system or ERP (Enterprise Resource Planning), then convert them into the chart, the index or warning strategic leadership.

Other than the accounting software just focus on the recognition of professional reporting, as a rule, software, financial analysis capacity expansion decisions, help leaders to grasp the business situation holistically – both in the past, present, forecast the future.

Difference between software and accounting software, financial analysis

| Criteria | Accounting software | Software analysis, financial reporting |

| The main purpose | Noted professional reporting, tax, financial | Analysis and visualization of financial data to support decision-making |

| Users | Accountant | CFO, CEO, Head of Finance |

| Connection data | Each part, board | Synthetic form of Dashboard visualization |

| The ability to alert | Restrictions | Can alert according to the KPI trend |

Illustrative examples software financial analysis in practice

Imagine you are a director of finance. Instead of asking accounting extract report revenue by product, region, time... then sit synthetic hourly, software, analysis, financial statements will help you:

- Watch now revenue chart by week, month, quarter after only a few seconds;

- Click on each chart to drill-down to the invoice, or the original documents;

- Track future cash flows based on the public debt, plan cost;

- Receive alerts when the ratio of the cost exceeds the budget allows.

All is done in an intuitive interface, easy to use, can work both on your computer, phone.

Read more:

2. Top 10 software analysis financial statements are Vietnam business preferred

Here are 10 software solution is more Vietnam business news user, based on the criteria: the ability to analyze in-depth, integrated, flexible, easy-to-use, the common practice in the market.

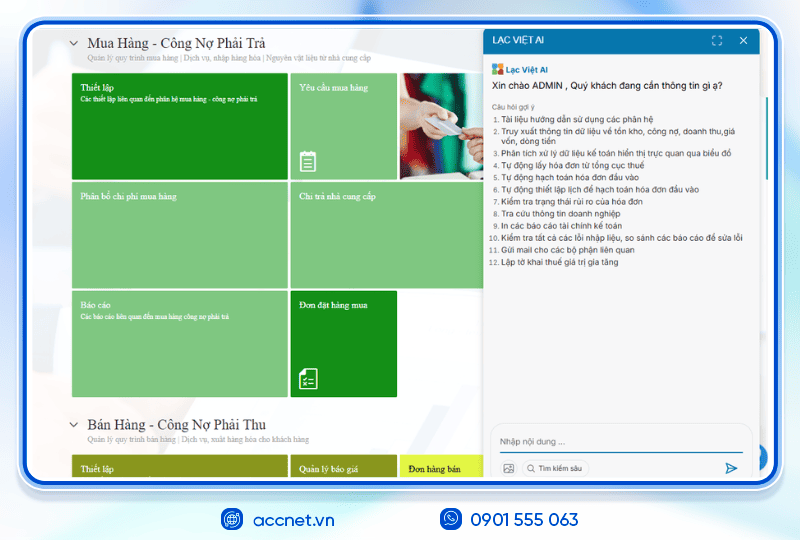

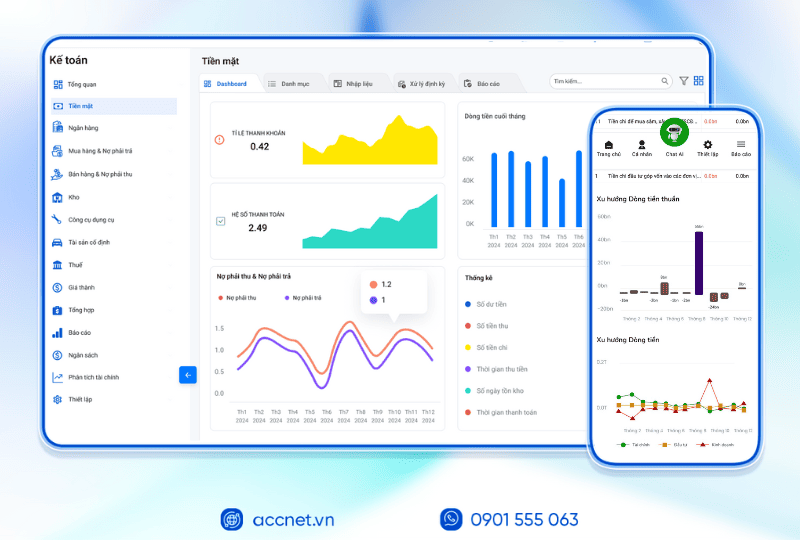

AccNet ERP (integrated AccNet BI Dashboards)

- Development unit: The company shares Information, Lac Viet

- Highlights:

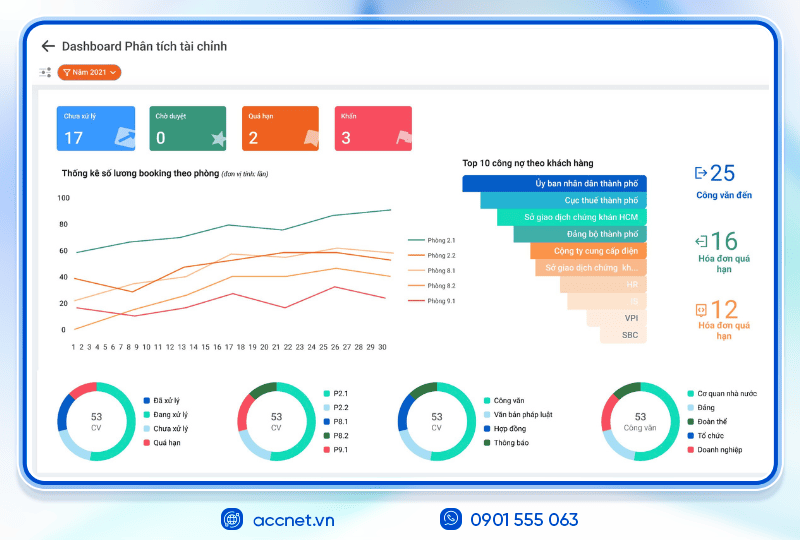

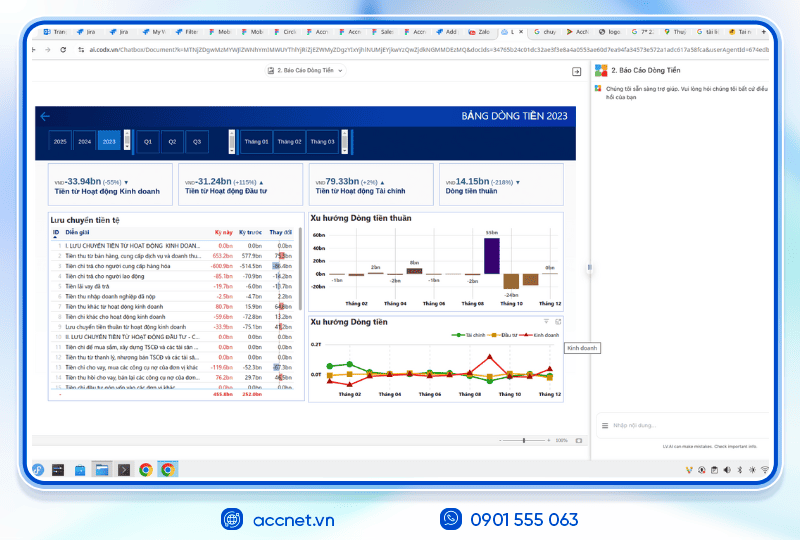

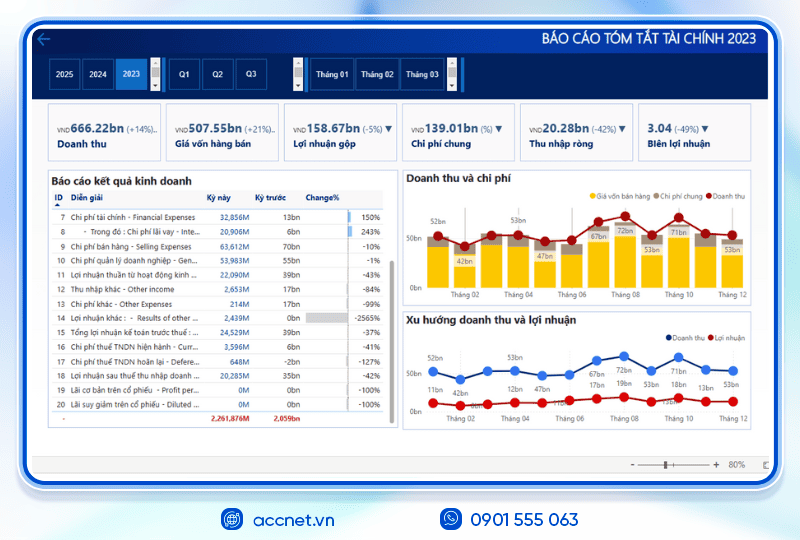

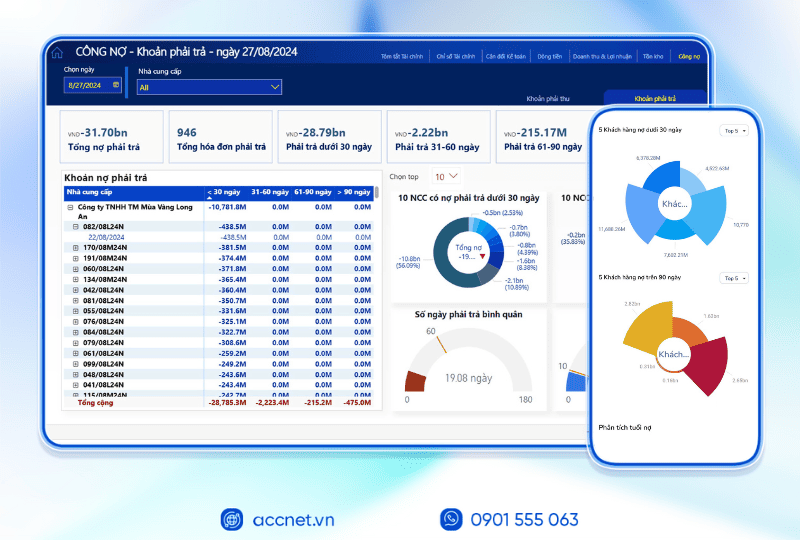

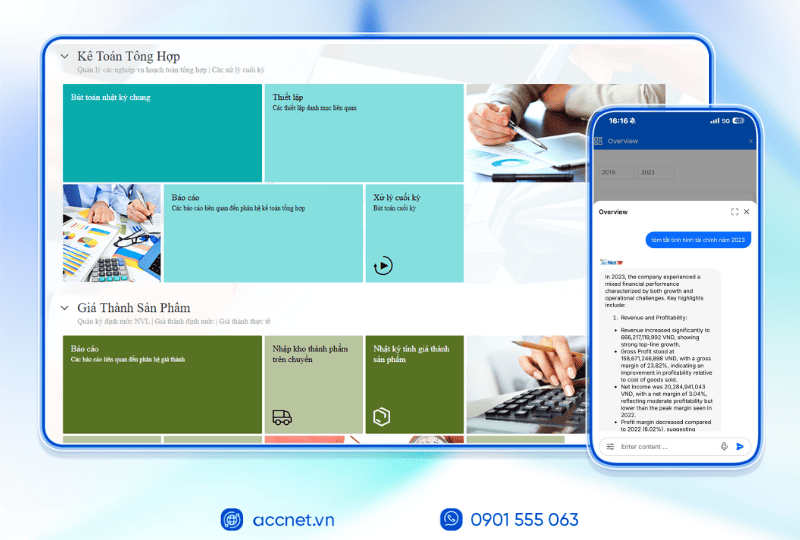

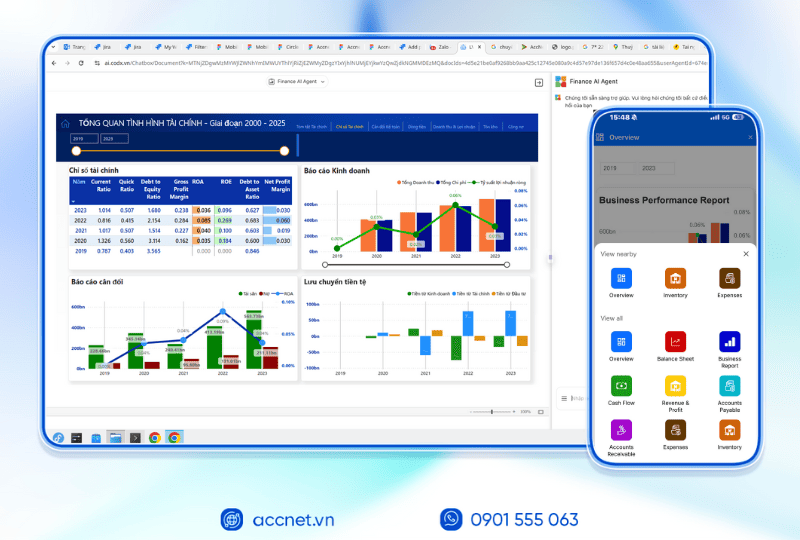

- The financial accounting direct integration with BI tools (Business Intelligence), to help visualise the entire report, profit/loss, cash flow, analysis, financial volatility over time.

- Automatic warning when the financial indicators exceeding the threshold of risk.

- Can drill-down from the overview report at each pen, bills, transaction-specific.

- Strengths:

- Simple interface, friendly accountants but still enough depth to the CEO or CFO analysis.

- Support standardized according to Circular 200/133.

- Fit medium and large business in the field of trade, production, service.

- Integrated highlights: Accounting module + BI, financial analysis + System process

- Review: Ideal choice for business is the conversion of comprehensive, want to just tightly controlled financial, moderately easy strategic decisions.

For businesses looking for a comprehensive solution, AccNet main ERP is the option worth considering. Not only management, accounting services business, AccNet ERP longer integrated system analysis financial statements depth (AccNet BI Dashboards), which allows:

- Track KPI financial in real time;

- Visualize all of the data from the books to payroll, public debt;

- Cash flow forecast, analyze trends in each of the departments, projects;

- Support strategic decisions quickly, the more accurate.

👉 Sign up to receive demo AccNet ERP for free to experience system analysis financial statements directly.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Fast Financial

- Development unit: Company FAST

- Highlights:

- Provide reporting system finance multi-dimensional according to Vietnam standard.

- Integrated management module value budgets, cash flow, liabilities, fixed assets.

- Systematic administration report dedicated for managers.

- Strengths:

- The ability to analyze in detail according to each cost centre, unit dependent.

- Strong financial analysis in the business-structured complex accounting.

- Review: The software supports financial reports professional Fast fit large businesses or corporations need to standardize the financial system in depth.

MISA AMIS accounting & Financial analysis

- Development unit: Company MISA

- Highlights:

- Intuitive interface, financial statements can build chart, instant analysis.

- Can compare the data between the states before, trend analysis, increased and decreased revenue, cost, profit.

- Have financial alerts, according to thresholds set by the user.

- Strengths:

- Fits small and medium business, startup.

- Easy to deploy, use quick thanks to ecosystem MISA.

- Review: Good option for businesses looking for a solution easy to use but still has the ability to analyze financial statements basic.

Bravo 8 ERP

- Development unit: Company Bravo

- Highlights:

- System of financial reporting is designed to be flexible, according to the model internal management of each business.

- Detailed analysis profitability by product, project, room board.

- Strengths:

- Be more business manufacturing, building use.

- Allow financial analysis according to the project lasts many of the accounting period.

- Review: In accordance with the business that requires the financial analysis associated with the project.

Sage Intacct (been localized by the partner)

- Unit root: United States – has been localized by a number of companies implementing ERP in Vietnam.

- Highlights:

- Financial reporting act (dynamic reporting), can assign indicators KPI in real time.

- Analysis financial forecasting, cash flow future.

- Strengths:

- System international standards, integration of AI.

- Match the business needs compare multiple legal entities, many countries.

- Review: For enterprises, which have foreign investment or orientation standardized financial according to global standards.

SAP S/4HANA (vietnamese goods by FPT IS, Citek,...)

- Unit deployment: The implementation partner of SAP in Vietnam such as FPT, Citek

- Highlights:

- System, financial analysis real-time (data instant updates).

- Reports can be customized deep in each logic business finance.

- Strengths:

- Integrated full ERP from accounting, manufacturing, logistics.

- For corporations, businesses very large scale.

- Review: Only suitable when businesses have the budget to deploy large, requires particularly high on the analysis of financial management.

Odoo Accounting & OCA Financial Reports

- Unit deployment: The company deployed Odoo Vietnam

- Highlights:

- Open source, customizable, powerful financial reports as you want.

- Module analysis of the multi-dimensional data (department, cost center, time).

- Strengths:

- Appropriate business need to control costs tightly, streamlined but still requires depth report.

- Review: Need IT or implementation partner has capacity for good customization to promote effective financial analysis.

Effect ERP

- Development unit: JSC software Effect

- Highlights:

- Are the financial statements prepared in Vietnam, reports financial management.

- Analysis is cost by each department, each job.

- Strengths:

- Focus on small and medium enterprises in the field of trade and services.

- Pretty full report, customized relatively flexible.

- Review: Economical choice for businesses are want to better control your privacy without the need for system/software support, financial reports, professional, too complicated.

AMnote (AsiaSoft)

- Development unit: Corporation AsiaSoft

- Highlights:

- Report analyzed in detail according to bookkeeping, tracking support, liabilities, cash flow, analysis, increase and decrease assets.

- Strengths:

- Simple, easy to use, support standardized financial accounting, internal.

- Review: Good for the small businesses need software easy to learn, rapid deployment.

Microsoft Power BI integration with Excel / ERP

- Not accounting software, but as analysis tools powerful is the business used in conjunction with accounting software.

- Highlights:

- Pull data from Excel, accounting software, ERP for analysis, visualization of financial data.

- Create dashboard in real-time.

- Strengths:

- Customizable strength, support, financial analysis according to every angle: profitability, cash flow, revenue by channel, customer.

- Review: Match the business had data system stability, it is necessary to add analytics tools to support strategic decisions.

Read more:

- Software support for business compliance with tax rules correctly

- Warehouse management software online support warehouse management remote convenience

- Process optimization, asset management, with business software

3. Reasons businesses should use software analysis, financial reporting

Solve the pain when analyzed by Excel crafts

Many businesses still depend on Excel in the synthesis, analysis of financial statements. However, this method revealed many limitations:

- Discrete data, not synchronized between the parts;

- Easy-to-happen errors and data entry mistakes recipe by manipulating the craft;

- Difficult to version control when there are multiple people editing;

- Take time synthesis, for lighting, affect the progress of the decision.

With software analysis, financial statements, the above problem is solved thanks to the direct connection with the accounting system, data processing, real-time automated reporting.

Increase the speed of analysis – Increase operator efficiency

According to the report of McKinsey (2023), the business applied data analysis in financial processes have the ability to make decisions faster than 5-fold increase of 60% operating efficiency compared with the traditional business. Thanks to the ability to:

- Visualize data using charts, dashboards;

- Updated in real-time;

- Allows drill-down (detailed analysis) to each entry;

The software analyzes financial statements to help leaders look clear, instant download financial situation to take timely decisions, limit risk.

Limited financial risk, support strategic decisions

Financial analysis is not only to “see the past”, but also help businesses forecast the future. The modern software allows:

- Warning when the cost exceeds the permitted threshold;

- Early detection of the trend decline in profits;

- Identify the factors that cause negative cash flow;

- Hint adjusting fiscal policies according to target.

From there, businesses can risk prevention early, instead of just “fire” when it was too late.

4. The important function of the software supports financial statements

Software to actually create value for the business, the function should respond is calculated automatically, intuitive, in-depth analysis. Below are the features key:

Automatically update accounting data, aggregated financial statements

- Connection data from the accounting software (such as AccNet ERP) without manipulating the craft;

- Data synchronization, general accounting, detail, liabilities, revenues, and expenses;

- Automatically generate reports periodic financial report: results of the business, balance sheet, cash flow...

To help businesses save time, reduce errors, ensure data is always accurate and timely.

Visualize data through charts dynamic Dashboards

- Display data in chart form columns, circles, lines, heat maps;

- Can optionally track the revenue, cost, gross, KPI financial... over time, departments, branches;

- Friendly interface, easy to use even for non-specialist finance.

Visualization helps leaders “look is out”, instead of having to read hundreds of lines of data.

Trend analysis, financial forecasting, cash flow

- Technology applications, AI or statistical models to detect trends, revenue, cost, profit;

- Cash flow forecast in – out, based on the public debt, plan shopping, investment;

- Hint adjusting the budget or the payment limit.

Help business proactive financial control, have not been touched by market fluctuations.

Learn more:

5. Choosing software analysis, financial reporting, suitable for business

The selection of software support, financial reports, professional, suitable not only based on the features, but also must consider the compatibility with the existing system, level of support, deployment, scalability later. Here are a number of core criteria:

- Integration with accounting software/ERP is available: The analysis software direct connection with the accounting system to update data automatically, instantaneously, reduce the operation input repeat.

- Easy to use, friendly interface: Ensure all accounting, finance, leadership can easily manipulate, access to information.

- Flexibly customized according to special business: Lets build KPI template report separately for each department or type of business.

- Has support from a reputable supplier: Enterprises should give priority to the selection software has a team of implementation consultants, after sales support, understand the business of accounting – finance in Vietnam.

- Reasonable cost, clear: The cost of not only the purchase price of the software, which also includes free deployment, maintenance, expansion later.

6. Practical benefits when deploying software analysis, financial reporting

Case Study: GHTK (Delivery Save) – Increase financial performance, thanks to data analysis

Context: GHTK is a business delivery, shipping and serving hundreds of thousands of orders per day. Previously, the finance department take 5-7 days to total case reports revenues, expenses, debts and from multiple branches, causing delay in operating.

Solution: in the Year 2023, GHTK software integration, financial analysis into the accounting system, internal operation.

Results:

- Duration of the financial statements shortened from 8 hours to 20 minutes

- CFO can track instant profit in each province, each partner

- Thanks to clear data, GHTK optimal operating budget, up 15% of operating costs

- Revenue in the third quarter of 2023, increasing by 12% thanks to the decision to invest in the right channel delivery key

Stats latest increase convince

According to a survey by PwC CFO Pulse Survey 2024:

- 74% CFO global said are increasing investment in financial analysis, automation;

- 68% of medium and large enterprises in Asia to use analysis software to plan your budget more flexible;

- Businesses have good analytical power has the ability to increase profits folding 1.5 times higher than businesses do not apply the data (according to Gartner).

7. Solution AccNet ERP integrated analysis of financial statements – Hints from experts

AccNet ERP not only is accounting software – management overall, but also built-in system analysis, financial reporting, intelligent (AccNet BI Dashboards) to help businesses get painting, comprehensive financial in real time.

Reasons businesses should choose AccNet ERP:

- Seamless integration with all other modules such as accounting, sales, purchasing, hr;

- Inventory dashboards diversity: profit according to the project, KPI according to departments, cost of operation, rotation debt...;

- Alert auto finance: Warning exceeding the budget, the debt to limit ratio, gross reduce irregularities;

- Support to configure according to the characteristics of each business: Production, trade, services, etc.

AccNet ERP particularly suited to medium and large businesses in Vietnam are in phase shift of the interface.

The ability to capture financial data accurate, timely not only help businesses control effective, but also opens up opportunities for sustainable growth. Deployment software analysis, financial reporting not just for the big corporations, which increasingly fit small and medium businesses, thanks to affordable, integrated, flexible, scalable. If your business is in the journey to improve operational efficiency, financial control, decision-making based on data, this is the right time to start.

👉 Subscribe to get the free demo solutions AccNet ERP to experience directly the ability to analyze financial intelligence today.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: