One of those processes that many businesses are still struggling are: how to convert electronic invoice luxury paper standard, valid. Material converts to of storage can be flaws legal? When switching on, who is responsible for authentication? You need software support or not? All these questions do not only appear in the new business development electronic invoice that exist in the business are upgrading your system, integrated software, accounting, or need backup stock from service work for inspection and audit. The article below will help you:

- Understand the concept, nature-way switch

- Master the case should switch

- Avoid the common mistakes

- Most important: choosing the right solution as AccNet eInvoice – accounting software invoice is fully integrated switch functionality, storage, lookup valid.

1. Why business need to switch electronic invoice?

Switch bill electronic't just a manipulation technique that is an important part in the process of management accounting and financial professional, especially in the following situations:

The actual deployment of electronic invoices in Vietnam

Until 2024, 100% corporate, business eligible have applied electronic invoices according to the regulations of the Ministry of Finance. However, when business:

- Need the invoice paper for bank loan

- Should the bill be signed to collate audit

- Want to archive documents for internal, then the switch electronic invoice to the paper is indispensable.

Benefits of the conversion regulations

- Clear legal: Meet the requirements of inspection, reduce the risk of administrative penalties

- Storage flexibility: easily check the bill important

- Convenient when used in parallel with ERP/accounting internal

- Valid to present with partners, banks, public authorities

Read more:

2. How to convert electronic invoice what is?

Conversion definitions electronic invoice

According to Clause 1, Article 10 circular 78/2021/TT-BTC, switch electronic invoice is: “the process of converting electronic invoice to invoice paper aims to serve for the storage of accounting vouchers or offers for Tuesday have needs.”

Important note:

- Bill switch does not replace bill electronic original

- Must meet 3 conditions valid: yes full signature of the representative signature confirmation, stating “conversion from electronic invoices”

The case should switch electronic invoice

Not always business must also switch electronic invoice. However, here are 4 common situations make way switch electronic invoice:

- Present the voucher with bank, public security audit: when the unit requires hard

- The internal storage format paper: especially with business process accounting parallel crafts

- Transfer system accounting software: from the old system to the new system, to synchronise data

- Change legal/tax code: need to re-confirm the validity of the bill

In all 4 cases above, if the use of software such as AccNet eInvoice, the conversion bill will simplify in just a few taps.

Distinguished: Switch electronic invoice and get invoice

This is a very easy to confuse:

| Criteria | Switch electronic invoice | Cancel electronic bill |

| Purpose | Variable electronic version of the paper to the storage or use of valid | Remove bills have errors, invalid |

| Effect | Version converts only used for reference, do not replace the original | Bill is destroyed take legal value |

| Process | Notice with CQT | To report cancel invoice |

So, if the business just want to save paper, the absolute cannot be cancelled invoice, which must proceed by transforming electronic invoice right process.

3. Detailed instructions how to convert electronic invoice standard [2025]

Switch electronic invoice not only is the printing alone. To invoice conversion valuable legal businesses that need to comply with the process under the provisions of circular 78/2021/TT-BTC, the Decree 123/2020/ND-CP. Here is a step by step guide:

Prerequisites before you perform the conversion

Businesses need to ensure the following conditions before making way switch electronic invoice:

- Have original bill electronic valid: is the legal code lookup, established regulations.

- Software supports conversion: ensure cumshot right format, the right content, features stamped “convert from electronic invoice”.

- Signature of legal representative or person is authorized: to confirm the validity of the conversion.

The steps taken to switch electronic invoice

Step 1: select the bills that need conversion

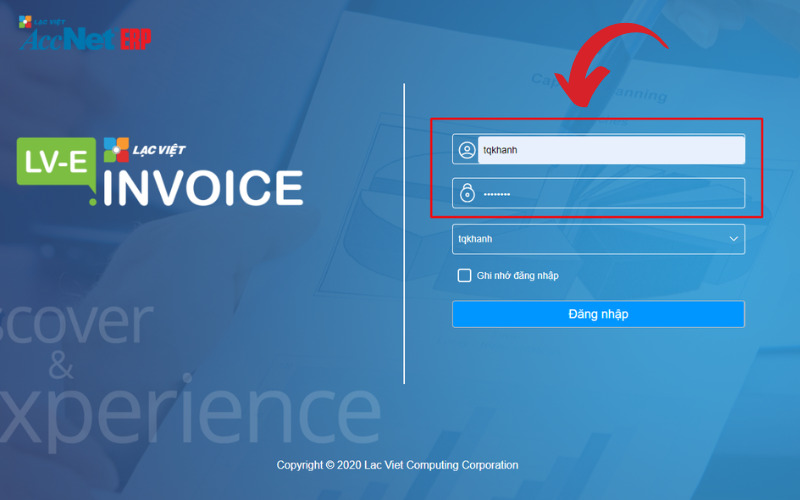

Visit the system software HĐĐT (for example AccNet eInvoice), search for bills that need to convert by:

- Tax code buyers

- Code invoice or invoice number

- Release date

Step 2: Print the invoice with the full information

The software will display the content correct invoice according to the original. Prints to display:

- Logo/QR code, if available

- Code lookup

- Date of signing, the digital signature of the seller

Step 3: Add the word “conversion from electronic invoices”

Under circular 78, the switch should be clearly indicated in the phrase "CONVERSION FROM ELECTRONIC INVOICE" at the position easy to see, often below title, bill or the last page.

Step 4: Sign the name of the representative business

Legal representative or chief accountant (or authorized users) sign up converter. The case of software, such as AccNet eInvoicecan sign electronically before printing, ensure the valid consistency.

Read more:

- Register electronic invoice first need to prepare what to not faulty?

- Storage solutions stock from the output to help business save cost

- Cách chuyển đổi dữ liệu hóa đơn truyền thống sang hóa đơn số

The note on the legality of the bill after the conversion

Here are 3 mandatory conditions to transition have legal value:

| Conditions | Content |

| 1. Fit original | Content prints to the right with the content on the bill electronic original |

| 2. Can confirm | Legal representative/chief accountant signed, stamped (if available) |

| 3. Clear notes | The words “conversion from electronic invoice” must appear on the paper |

If one of the three elements on the bill, the conversion will not be valid when comparing with authorities or present with your partner. This is the reason why businesses should use specialised software to help ensure adequate standards from the first step.

4. Businesses need to note what when choosing software supports converting electronic invoice?

One of the deciding factors to the performance, accuracy, legality in the conversion bill is software that businesses use. Below is the selection criteria important:

Meet legal standards

Software required:

- Have direct connection with the General department of Taxation

- Support establishment, release, transform your bills on standard Decree 123, circular 78

- Ensure data security, digital signature invalid, not be edited after release

The ability to integrate with accounting software, sales, warehouse,...

An ideal solution is software that can:

- Sync data from accounting software

- Automatically create invoices from sales slip, warehouse

- Integrated digital signature right on the system, no need operation manually

Suggestions suitable software: AccNet eInvoice – solution comprehensive bill for Vietnamese enterprises.

AccNet eInvoice not only support business released electronic invoice valid, but also:

- There are conversion functions integrated bill according to standard legal

- Support lookup bills by code number, date or customer information

- For permission to publish in bill switch with standard format, do not edit

- Secure storage system on the cloud, ensuring data is not lost

With thousands of Vietnamese enterprises are using, AccNet eInvoice is the ideal solution to help businesses just comply with the law while improving productivity accounting and finance.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

5. The common errors DN frequently when performing way switch electronic invoice

Whether to switch electronic invoicing is that the process is not too complex, but many businesses still suffering from a bug that the bill switch invalid or not accepted in the professional inspection and audit. Below are the common errors:

Do not specify the words “conversion from electronic invoices”

- Common errors: Business invoice printing out the paper without clearly this is a conversion from the electronic invoice.

- Fix: Must specify inscription “CONVERT FROM ELECTRONIC INVOICE” at the position easy to see, just below the title or the end of the bill.

Software such as AccNet eInvoice automatically add this line when done switch function, help businesses avoid omissions.

Learn more: Cách sắp xếp và lưu giữ hóa đơn điện tử nhận được theo chuẩn kế toán

Signature of the representative or person is authorized

- Common errors: A switch in place without a signature representative/chief accountant should be considered invalid.

- Fix: the competent Person must sign a the confirmation on the switch, may be signed manually or sign out before printing.

With AccNet eInvoicedigital signature is integrated, attached to the invoice immediately in the system, do not need to handle in addition to software.

In false information compared to the electronic version original

- Common errors: paper Invoice is in line shifts, teen, tax code, wrong date format,...

- Fix: Ensure the software switch are standard format according to the Decree 123, circular 78.

AccNet eInvoice commitment in the correct standard format, right layout templates, content joints 100% electronic original.

User software is not the Total Tax administration certification

- Common errors: Businesses using the software do not qualify, leaving the conversion is not valid.

- Fix: Choose software that has been the General department of Taxation announced valid, and integrated encryption – lookup.

AccNet eInvoice located in list software electronic invoice is approved, fully meet the standard current legislation.

Switch bill electronic is a professional indispensable in the process of management accounting in modern, especially when the business need:

- Present documents to banks, tax authorities, auditing

- Storage parallel hard to serve internal report

- Sync your data between software, accounting, sales, invoicing

However, if you do not understand the process or use the software non-standard, enterprise very easy to get wrong legal, rejected bills conversion or sanctioned by the bill invalid. Tips from expert business accounting:

- Always understand the legal rules about latest electronic invoice

- Equip accounting full knowledge about the conversion process

- Software selection credibility to automate and ensure the correct standard step by step

I hope this post has helped the business understand how to convert electronic invoice follow the right process, choose the software solution fit. If you are implementing the accounting system – electronic invoice, let AccNet eInvoice accompany you on the journey of digitizing business accounting. Experience consultant and free demo today!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

Headquarters: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Hotline: 0901 555 063

Email: accnet@lacviet.com.vn

Website: https://accnet.vn/

Theme: