Have you ever heard or questions about accounted amount for late payment of tax not yet? And why your business must account for late payment of tax. Follow this article to clarify the issues and know how to perform in accordance with the regulations.

1. The case is considered slow to pay tax under the provisions

A number of cases to accounted amount for late payment of tax is regulated in Article 59 Law on Tax administration, 2019 is as follows:

- Taxpayers slow compared with the specified time limit, time limit of payment of tax, the period stated in the notice of the tax administration, the deadline in the decision of the tax assessment or decision making process of tax administration agencies.

- The taxpayer an additional tax increase the amount of tax payable or tax authorities, the competent authority test detected the lack of the amount of tax payable.

- The taxpayer an additional tax reduces the amount of tax has been fully paid or tax administration agencies, state agencies have the authority test detected the amount of tax is completely less than the amount of tax, was completed.

| >>> Read more articles on the same theme: |

2. The fines for late payment of tax

Before accounted amount for late payment of tax they need to understand the fine and the time charged for late payment of tax. According to Paragraph 2 of Article 59 of the Law on Tax administration 2019 regulations on the charge for late payment and the time charged for late payment of tax as follows:

"The rate charged for late payment and duration charge for late payment is defined as follows:

a) the Rate charged for late payment will be equal to 0,03%/day, calculated on the amount of tax paid

b) Time charge for late payment is calculated continuously since the day following the date incurred amount for late payment specified in clause 1 of this Article to the day preceding the date the amount of tax debt, money withdrawal tax refund, tax amount increased the amount of tax, fixed tax money slowly move has paid into the state budget.”

After understanding the case, the need to accounted amount for late payment of tax or penalty for late payment of tax. So, the amount of the penalty for the late payment of tax is how much, how to calculate how? Stay tuned right here, okay.

Read more:

2. Formula for calculating fines for late payment of tax

As prescribed in clause 3, Article 3, circular 130/2016/TT-BTC, the number of fines for late payment of tax is calculated according to the level of 0,03%/day, calculated on the amount of tax paid.

I.e.,

| The amount of the penalty money paid deferred tax | = | The amount of tax payment delay | x | 0,03% | x | The number of days late payment of tax |

For example: company X debt 70.000.000 VAT amount, there is the deadline for submission shall be the day 30/07/2020. Date 25/10/2020 accounting company X filed tax amount 70.000.000 to the state budget. The number of days delayed payment is calculated from the date 31/07/2020 to date 25/09/2020, then the amount of the penalty for late payment of tax as follows:

- Calculates the number of days delayed payment:

The number of days delayed payment = (30/07 to 31/07) + (01/08 to 31/08) + (01/09 to 25/09)

The number of days delayed payment = 1 + 31 + 25 = 57 (days)

- Calculate the number of fines for late payment:

The amount of the penalty for late payment of tax = 70.000.000 x 0.03% x 57 = 1,197,000 (gay)

3. Accounting slow money pay taxes like?

In the business process, for some reason, that's your business not paying taxes and the tax authority decisions penalty business late payment of tax. Please refer to the right way accounted amount for late payment of tax properly defined it.

3.1 accounting money for late payment of tax details

- When you receive a notification about the sanctions:

Debt TK 811: fines when filing tax deferred

Have TK 3339: fines when filing tax deferred

- When pay the fine:

Debt TK 3339: fines for late payment of tax

Have TK 111, 112: fines for late payment of tax

- End of the accounting period, made the transfer of money for late payment of tax:

Debt TK 911: Identify business results

Have TK 811: other Expenses

Read more:

3.2 accounting money, tax arrears more due to late payment of tax

- INCOME tax payable:

Debt TK 8211: the Cost of corporate INCOME tax current

Have TK 3334: CIT

- Pay into the state Budget:

Debt TK 3334: Amount of corporate INCOME tax payable

Have TK 111, 112: Amount of corporate INCOME tax payable

- VAT payable in addition:

Debt TK 811: other Expenses

Have TK 3331: The VAT amount payable

- Perform the transfer at the end of the accounting period:

Debt TK 911: Identify business results

Have TK 811: the Cost of the other.

- Pay into the state Budget:

Debt TK 3331: The VAT amount payable

Have TK 111, 112: The VAT amount payable

3.3 accounting money, tax arrears after settlement due to late payment of tax

- Accounting arrears on VAT:

Debt TK 4211: profits not distributed the previous year of business

Have TK 3331: The VAT amount payable

- Accounting tax arrears CIT:

Debt TK 421: profits not distributed the previous year of business

Have TK 3334: amount of corporate INCOME tax payable

- Accounting tax arrears PIT:

(1) deduction from the wages of workers who states this:

Debt TK 334: Accounts payable workers

Have TK 3335: The personal income tax payable

(2) Do companies have to pay:

Debt TK 4211: profits not distributed the previous year of business

Have TK 3335: The personal income tax payable

Learn more:

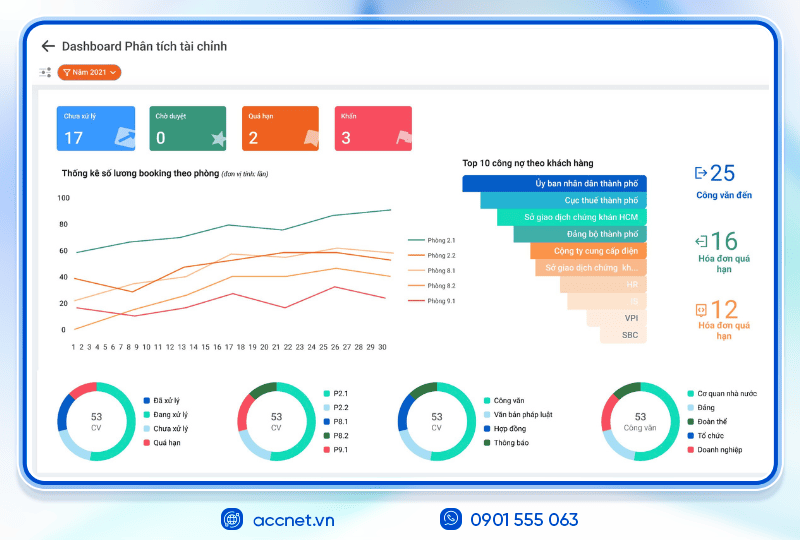

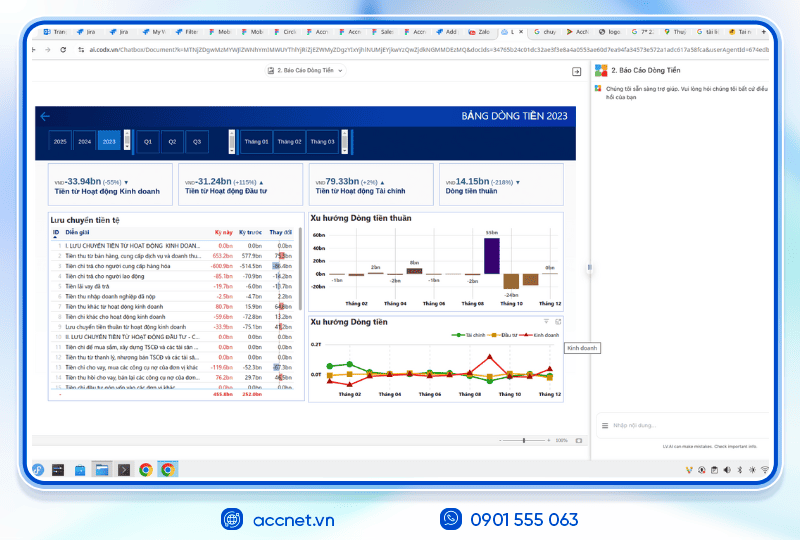

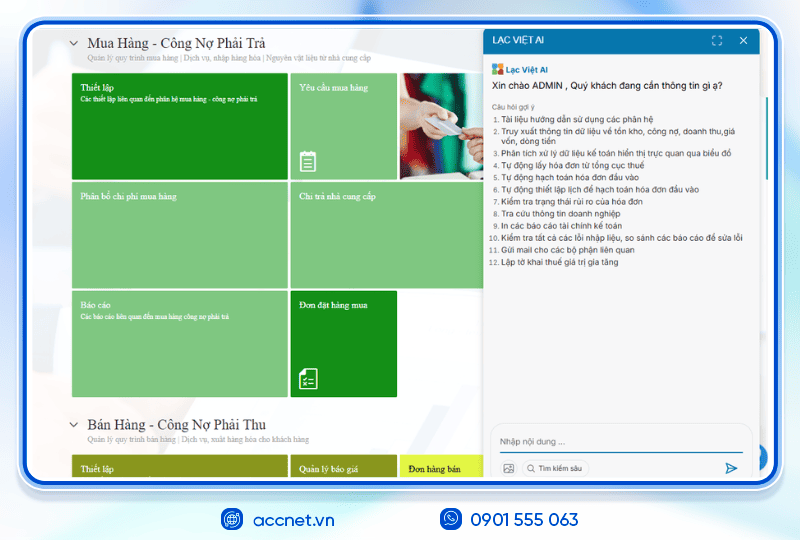

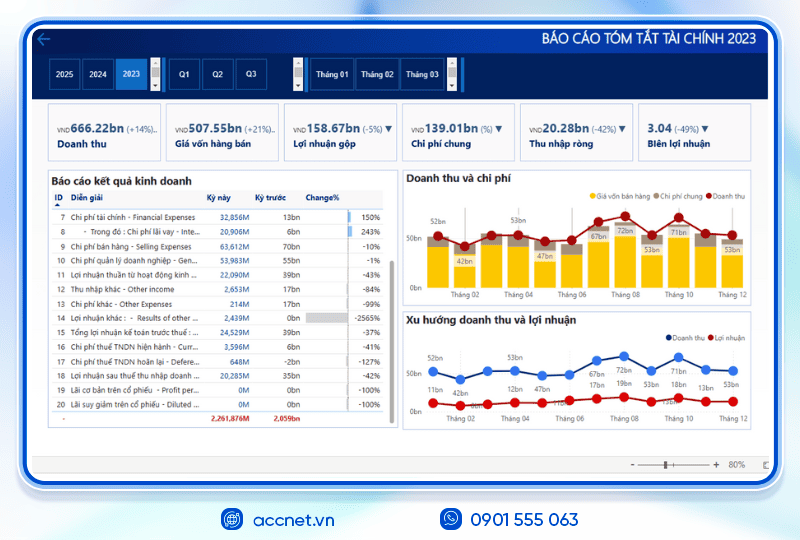

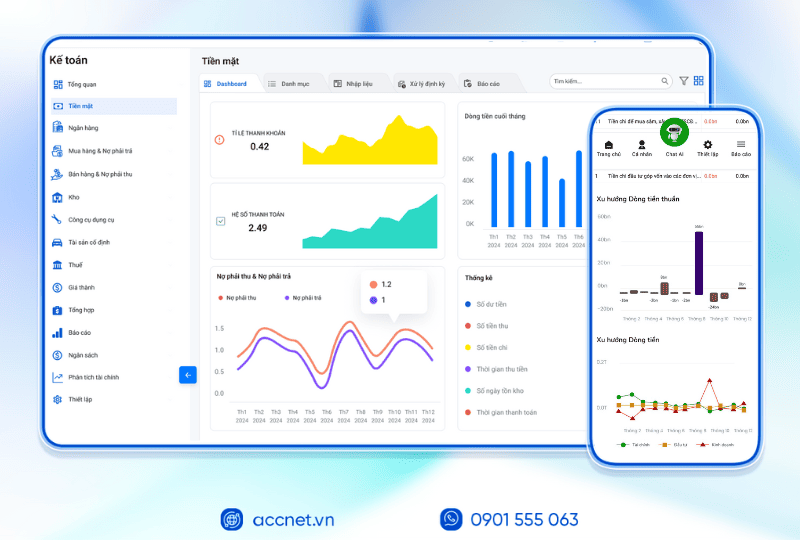

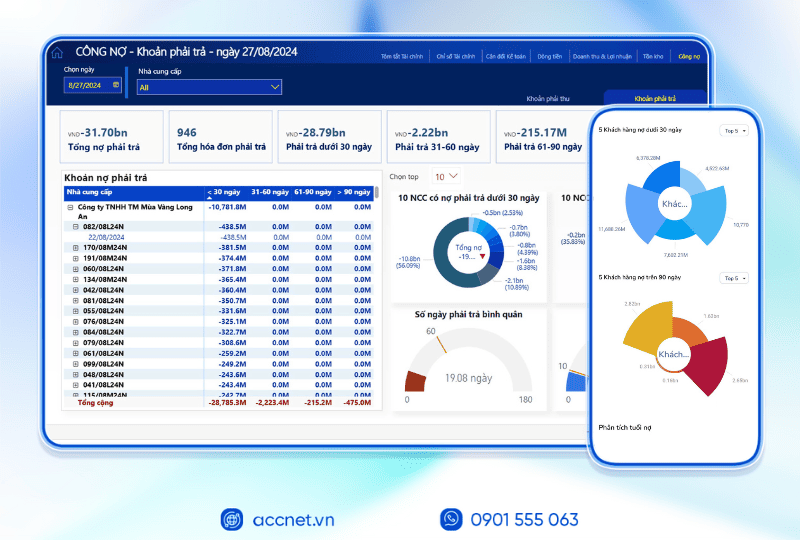

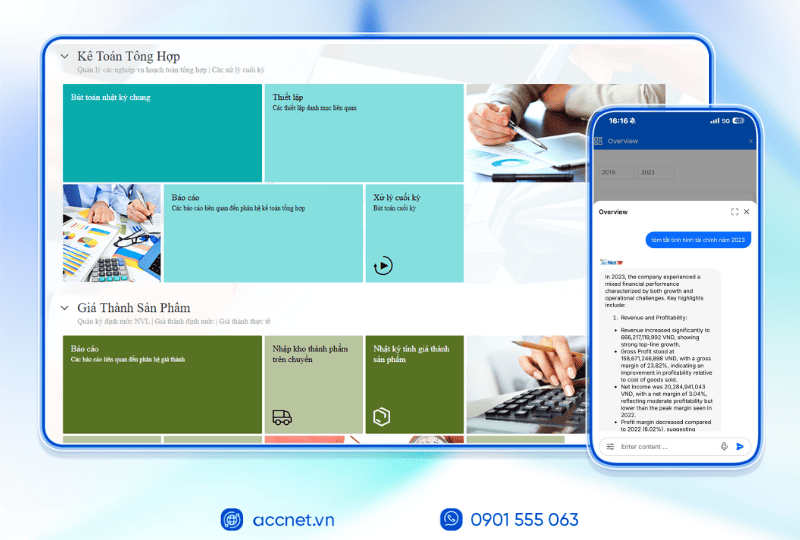

4. Tự động hóa hạch toán tiền chậm nộp thuế với AccNet ERP

Bài viết “Cách hạch toán tiền chậm nộp thuế theo quy định mới nhất” hướng dẫn chi tiết cách ghi nhận phạt chậm nộp, truy thu thuế và xử lý các bút toán liên quan theo đúng quy định. Tuy nhiên, nếu doanh nghiệp vẫn phải thực hiện các bước này bằng tay — nhập liệu, kiểm tra, tính toán — sẽ rất dễ phát sinh sai sót hoặc bỏ lỡ khoản chi phí phạt quan trọng.

Đó là lúc AccNet ERP thể hiện sức mạnh trong quản lý tài chính – kế toán:

- System tự động nhận biết các trường hợp chậm nộp thuế, tính số tiền phạt theo công thức quy định (0,03%/ngày trên số tiền thuế chậm nộp) mà không cần tính bằng tay.

- Khi nhận thông báo từ cơ quan thuế, phần mềm ghi bút toán phạt chậm nộp (Nợ TK 811 – Có TK 3339) ngay lập tức, và khi thanh toán sẽ ghi nợ TK 3339, có TK 111/112.

- Cuối kỳ, hệ thống kết chuyển chi phí phạt vào kết quả kinh doanh (Nợ TK 911 – Có TK 811) mà không cần thao tác thủ công.

- Đối với việc truy thu thuế hoặc truy thu sau quyết toán, AccNet ERP cũng hỗ trợ tự động ghi các bút toán liên quan như thuế truy thu GTGT, thuế TNDN, thuế TNCN…

Nhờ tích hợp chặt giữa module thuế và kế toán tài chính, AccNet ERP loại bỏ rủi ro sai số trong quá trình xử lý tiền chậm nộp thuế, giúp doanh nghiệp đảm bảo tuân thủ pháp luật và vận hành kế toán một cách chuyên nghiệp, nhanh chóng và chính xác.

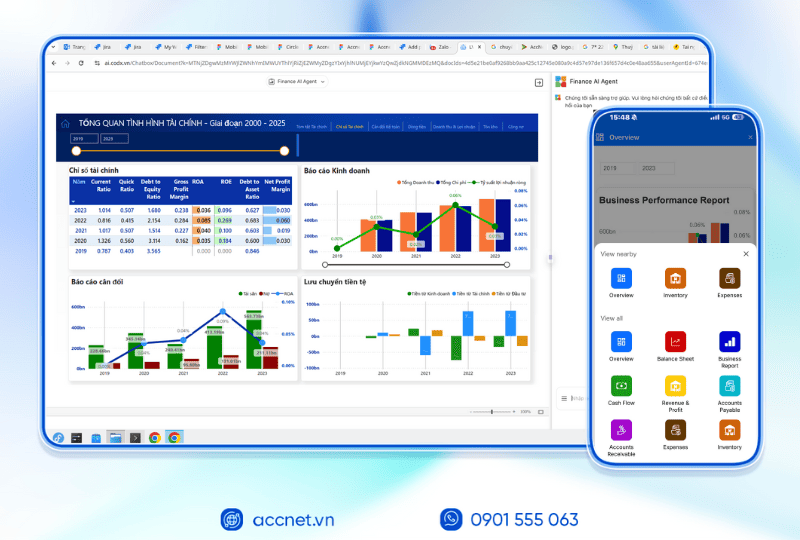

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Thus, AccNet had to share important knowledge and guide the way accounted amount for late payment of tax. Hope this article useful for professional accountants and business to properly execute the law as penalty for late payment of tax. If there are any questions please leave below comments, our team of Accnet always ready to assist you.

|

>>> View more articles or: |

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: