The accounting period is a concept that any accountant would also need to know. However, not everyone understands the exact concept of the accounting period prescribed accounting Law in Vietnam. So accounting period what is and the basic accounting to understand what's included? Let us answer the questions on the article below.

1. The concept of the accounting period, what is?

Accounting period is the period of time is determined from the time the unit begins recording the ledger to the end point of the recording ledger and key accounting to financial reporting.

2. The basic accounting to understand

You've just come across the concept accounting period what is? So include the basic accounting how? According to the accounting Law of Vietnam 88/2015/QH13 will cover the accounting year, accounting period, and quarterly accounting period of months, which is specified as follows:

- Accounting year

The annual accounting period is the period of 12 months, will be charged from the beginning 1 January 1 through December 31, 12-month calendar year.

For the unit of accounting has its own peculiarities of organization and operation will be selected accounting period is 12 months round the calendar year. Will start from the start date 01 first month of the quarter to the end of the last day of the month the end of the previous quarter the following year and must report to the agency of finance.

Read more:

- The accounting profession: hướng dẫn ghi chép và quản lý chính xác

- Hình thức kế toán: các phương pháp ghi nhận và quản lý sổ sách

- Principle of materiality: các quy định quan trọng trong kế toán doanh nghiệp

- Accounting period quarter

The accounting period is any period of 3 months calculated from the beginning of January 1, the beginning of the quarter to the end of the last day of the last month of the quarter.

- Accounting period months

Accounting period month is the period of 1 month, calculated from the start date 01 to the end of the last day of the month.

3. Accounting period of the special objects

Surely you know about the rules of accounting period what is? The same track with the provisions of the law on the accounting period for the special case to apply the right business for you.

Base by The accounting law of Vietnam 88/2015/QH13 then the accounting period of the business and accounting period of the business transformation business registration is specified as follows:

3.1 the accounting Period of the new business establishment

Accounting period the first of the new business is established from the date the government certificate of business registration to the last day of the accounting year, the accounting period or accounting period of the month.

For the accounting period the first of units other accounting will be calculated from the effective date stated on the decision to establish to the end of the last day of the accounting year, quarter, or month.

Note: For the case of the accounting period the first year or accounting year finally have time shorter than 90 days, shall be allowed to plus (+) states the next accounting year or plus (+) accounting year earlier to the case of an accounting year. But the total duration of the period must be shorter than 15 months.

Here are the rules accounting period what is for new business established. Also for the case of business transformation, business registration, then sign the accounting is calculated how? Read the article offline.

3.2 accounting Period of the business transformation business registration

When business fluctuations have led to the need to change business registration (split, consolidation, merger, transfer of ownership, dissolution, termination, or bankruptcy), the accounting period end is calculated from the first day of the accounting year, quarter, months to the end of the day before the date on the decision to split, merge, merger, transfer of ownership, dissolution, termination, or bankruptcy unit accounting effect.

When faced with the accounting period, many businesses have to spend a lot of time to handle books and papers. Keeping track of revenue, expenses, financial reports manually can cause errors, delay, difficulty in managing data correctly. This greatly affects operational efficiency, sustainable development of the enterprise.

Để giải quyết những thách thức này, Accnet ERP ra đời như một giải pháp toàn diện, tự động hóa quy trình kế toán, giúp doanh nghiệp không chỉ tiết kiệm thời gian mà còn tăng độ chính xác, minh bạch trong quản lý tài chính. Với các tính năng vượt trội như cập nhật số liệu tức thì, tạo báo cáo tự động, lưu trữ dữ liệu trên nền tảng đám mây, Accnet ERP mang đến sự an tâm trong việc quản lý tài chính, hỗ trợ doanh nghiệp tối ưu hóa quy trình kế toán. Hãy khám phá Accnet ERP để trải nghiệm một giải pháp đơn giản, hiệu quả hơn cho mọi kỳ kế toán của bạn!

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

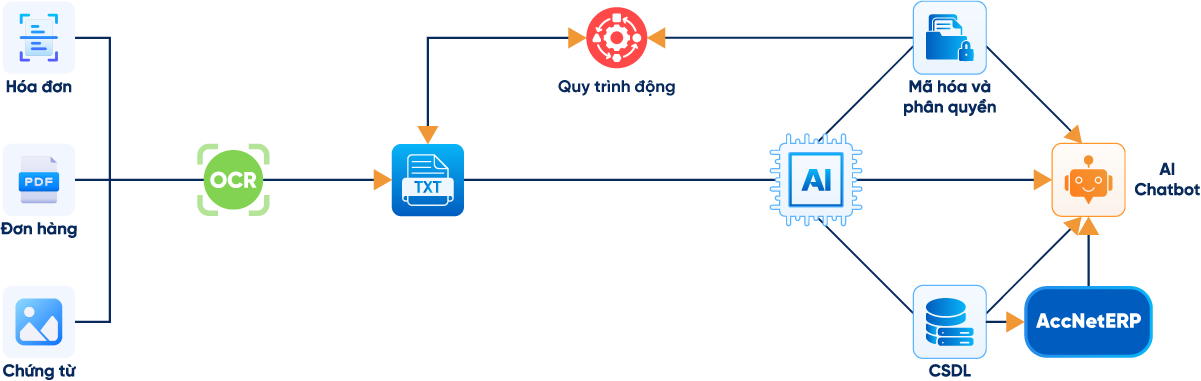

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Article on is the basic information about accounting period what is? The basic accounting to understand. Hope the share of AccNet can add additional knowledge in the field of accounting. You can reference more related articles at the website https://accnet.vn

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: