Với các doanh nghiệp xuất khẩu – nơi liên quan đến thủ tục hải quan, thanh toán quốc tế, đối tác nước ngoài – việc nắm rõ latest regulations on export invoices là yếu tố sống còn. Từ năm 2025, nhiều quy định mới đã được cập nhật nhằm đồng bộ với hệ thống quản lý thuế điện tử, phòng ngừa gian lận, tạo điều kiện thuận lợi cho thương mại xuyên biên giới.

Hóa đơn xuất khẩu là một trong những loại chứng từ đặc biệt quan trọng trong hoạt động thương mại quốc tế. Khác với hóa đơn GTGT nội địa, hóa đơn xuất khẩu không đơn thuần là một giấy tờ tài chính, mà còn là căn cứ để:

- Thực hiện khai báo hải quan

- Làm chứng từ thanh toán quốc tế (L/C, T/T)

- Làm căn cứ hoàn thuế VAT đầu vào

Giai đoạn tính từ 2022 trở đi, với lộ trình bắt buộc áp dụng hóa đơn điện tử theo Thông tư 78/2021/TT-BTC, nhiều doanh nghiệp đã lúng túng trong việc xử lý hóa đơn cho hàng xuất khẩu, đặc biệt khi phải kết hợp giữa hóa đơn điện tử, hóa đơn thương mại (Commercial Invoice). Bài viết này sẽ giúp bạn bóc tách, hiểu rõ từng quy định, hướng dẫn thi công đúng quy trình hóa đơn điện tử cho xuất khẩu, tránh rủi ro pháp lý, sai phạm hành chính.

1. Quy định mới nhất về hóa đơn xuất khẩu năm 2025

Việc lập, sử dụng hóa đơn trong hoạt động xuất khẩu là một phần không thể tách rời trong quản lý thuế, hải quan, thanh toán quốc tế. Từ năm 2025, các quy định pháp lý tiếp tục được điều chỉnh để đồng bộ với hệ thống thuế điện tử toàn quốc, tăng tính minh bạch, giảm gian lận. Dưới đây là những điểm mà doanh nghiệp xuất khẩu cần hiểu rõ, thực hiện nghiêm túc.

Hóa đơn xuất khẩu là gì? Có bắt buộc phải lập không?

Khái niệm hóa đơn xuất khẩu

Theo khoản 3 Điều 13 Nghị định 123/2020/NĐ-CP, hóa đơn xuất khẩu là chứng từ do tổ chức, cá nhân bán hàng hóa ra nước ngoài lập, không phân biệt có phát sinh thuế GTGT hay không. Đây là loại hóa đơn không có thuế suất GTGT, thường dùng để kê khai giao dịch xuất khẩu với cơ quan thuế, hải quan, để đối chiếu chứng từ thanh toán quốc tế.

Phân biệt với hóa đơn GTGT và hóa đơn thương mại

| Criteria | Export invoices | VAT invoices | Hóa đơn thương mại (Commercial Invoice) |

| Applicable objects | Giao dịch xuất khẩu hàng hóa | Giao dịch nội địa | Đối tác quốc tế |

| Thuế GTGT | No | Có (0%, 5%, 10%) | Không thể hiện |

| Tính pháp lý với cơ quan thuế VN | Have | Have | No |

| Ngôn ngữ | Tiếng Việt hoặc song ngữ | English | Tiếng Anh hoặc song ngữ |

| Giá trị sử dụng | Kê khai thuế, lưu trữ nội bộ | Kê khai thuế | Giao dịch quốc tế, thủ tục hải quan |

Có bắt buộc phải lập hóa đơn xuất khẩu không?

Theo quy định, không phải tất cả các trường hợp xuất khẩu đều bắt buộc lập hóa đơn xuất khẩu. Một số tình huống được phép không lập, nhưng phải có chứng từ thay thế như hợp đồng, chứng từ thanh toán, biên bản giao nhận... Tuy nhiên, với hầu hết các doanh nghiệp hiện nay, đặc biệt là những doanh nghiệp sản xuất, có hoàn thuế, việc lập hóa đơn xuất khẩu là bắt buộc để đảm bảo tính minh bạch, đủ điều kiện kê khai hoàn thuế GTGT đầu vào.

Doanh nghiệp nào cần dùng hóa đơn điện tử khi xuất khẩu?

Bối cảnh pháp lý hiện hành

Từ 01/7/2022, toàn bộ doanh nghiệp tại Việt Nam đã phải chuyển sang sử dụng hóa đơn điện tử theo Thông tư 78/2021/TT-BTC. Riêng với hóa đơn xuất khẩu, điều này được áp dụng theo nguyên tắc:

- Doanh nghiệp xuất khẩu hàng hóa phải lập hóa đơn điện tử xuất khẩu, trừ trường hợp sử dụng riêng hóa đơn thương mại (được quy định rõ trong hợp đồng, tuân thủ thông lệ quốc tế).

- Việc sử dụng hóa đơn giấy (theo Nghị định 51/2010/NĐ-CP) không còn hiệu lực, trừ một số trường hợp được gia hạn riêng (theo từng quyết định địa phương).

Doanh nghiệp bắt buộc sử dụng hóa đơn điện tử xuất khẩu gồm:

- Doanh nghiệp sản xuất, xuất khẩu hàng hóa ra nước ngoài

- Doanh nghiệp gia công xuất khẩu

- Doanh nghiệp xuất khẩu vào khu chế xuất, khu phi thuế quan

- Doanh nghiệp FDI xuất bán hàng hóa cho thị trường quốc tế

Một số điểm pháp lý cần đặc biệt lưu ý:

- Hóa đơn xuất khẩu phải thể hiện đầy đủ thông tin: tên hàng, đơn vị tính, số lượng, đơn giá, mã HS code (nếu có), phương thức thanh toán, đồng tiền thanh toán.

- Nếu sử dụng song song hóa đơn thương mại, phải đảm bảo cả hai chứng từ không mâu thuẫn về thông tin hàng hóa, giá trị, điều kiện giao hàng.

Quy trình lập, phát hành hóa đơn xuất khẩu điện tử theo quy định mới nhất

Dưới đây là quy trình từng bước lập hóa đơn điện tử xuất khẩu, theo chuẩn của Tổng cục Thuế:

Bước 1. Khởi tạo dữ liệu hóa đơn

- Lập hóa đơn trên phần mềm/kê khai theo định dạng XML chuẩn của Tổng cục Thuế.

- Điền đầy đủ các thông tin bắt buộc:

- Tên người mua: tên đối tác nước ngoài (ghi rõ ràng, không viết tắt)

- Địa chỉ người mua: theo hợp đồng ngoại

- Mã hàng, mô tả hàng hóa: nên có mã HS code

- Đơn vị tiền tệ: thường là USD, EUR – phải thể hiện rõ

- Thuế suất: để trống hoặc ghi “Không chịu thuế”

Bước 2. Ký số, phát hành hóa đơn

- Sử dụng chữ ký số đã đăng ký với cơ quan thuế.

- Gửi hóa đơn cho đối tác (qua email, đính kèm chứng từ xuất khẩu).

- Lưu ý thời điểm lập hóa đơn là sau khi hàng đã được thông quan.

Bước 3. Gửi hóa đơn đến cơ quan thuế

- Gửi qua cổng thông tin điện tử: https://thuedientu.gdt.gov.vn

- Hệ thống sẽ phản hồi trạng thái chấp nhận hoặc từ chối hóa đơn (do lỗi định dạng, trùng thông tin...).

Bước 4. Lưu trữ, kê khai

- Hóa đơn sau khi phát hành phải được lưu trữ điện tử tối thiểu 10 năm.

- Doanh nghiệp dùng hóa đơn này để kê khai doanh thu, lập báo cáo thuế theo chu kỳ.

Sai lầm phổ biến: Lập hóa đơn trước thời điểm xuất hàng hoặc ghi sai đơn vị tiền → hóa đơn bị từ chối, ảnh hưởng đến tiến độ thanh toán, kê khai thuế.

Điểm khác biệt giữa hóa đơn điện tử xuất khẩu, hóa đơn điện tử nội địa

Để tránh nhầm lẫn, doanh nghiệp cần phân biệt rõ các điểm dưới đây:

| Criteria | Hóa đơn điện tử xuất khẩu | Hóa đơn điện tử nội địa |

| Thuế GTGT | No | Có (0% – 10%) |

| Đồng tiền | USD, EUR… | VND |

| Đối tượng mua hàng | Khách hàng nước ngoài | Khách hàng trong nước |

| Trình bày ngôn ngữ | Có thể song ngữ | Tiếng Việt bắt buộc |

| Time of establishment | Sau khi thông quan | Khi giao hàng hoặc thu tiền |

| Kê khai VAT | Không phải kê khai đầu ra | Kê khai đầy đủ VAT |

Một số rủi ro nếu dùng sai loại hóa đơn:

- Không đủ điều kiện hoàn thuế GTGT đầu vào.

- Không được công nhận chi phí hợp lệ khi quyết toán thuế.

- Rủi ro bị truy thu thuế, xử phạt hành chính do khai sai hồ sơ.

Các lỗi thường gặp khi lập hóa đơn xuất khẩu, hướng xử lý

Lỗi 1: Lập hóa đơn trước khi hàng thông quan

- Vi phạm Điều 10 Thông tư 78: hóa đơn xuất khẩu chỉ được lập sau khi hàng đã được thông quan.

- Cách xử lý: Hủy hóa đơn cũ, lập lại theo đúng thời điểm.

Lỗi 2: Ghi sai thông tin đối tác nước ngoài

- Tên công ty viết sai/thiếu quốc gia → hóa đơn không hợp lệ.

- Giải pháp: Kiểm tra lại hợp đồng ngoại, nhập liệu cẩn trọng.

Lỗi 3: Không đúng định dạng chữ ký số hoặc không gửi hóa đơn cho cơ quan thuế

- Dễ bị trả về, không hợp lệ khi kiểm tra.

- Giải pháp: Đảm bảo hệ thống ký số đúng chuẩn XML, có báo lỗi rõ ràng.

Lỗi 4: Không lưu trữ đầy đủ hoặc mất hóa đơn

- Vi phạm quy định về lưu trữ hóa đơn điện tử.

- Phạt từ 5 – 20 triệu đồng tùy trường hợp theo Nghị định 125/2020/NĐ-CP.

2. Những lưu ý cho quy định mới nhất về hóa đơn xuất khẩu theo từng trường hợp thực tế

Trong thực tế triển khai hóa đơn điện tử cho hoạt động xuất khẩu, không phải lúc nào quy trình cũng diễn ra theo “mô hình chuẩn”. Doanh nghiệp thường xuyên gặp các trường hợp đặc thù, phát sinh ngoài lý thuyết — ví dụ như nhận tiền trước khi xuất hàng, xuất khẩu phần mềm, bán hàng qua các nền tảng thương mại điện tử quốc tế, v.v.

Nếu không hiểu rõ các quy định liên quan, rất dễ dẫn đến việc lập sai loại hóa đơn, sai thời điểm hoặc bỏ sót nghĩa vụ kê khai thuế. Dưới đây là các tình huống thực tế điển hình, kèm theo hướng xử lý đúng theo quy định hiện hành năm 2025.

Xuất khẩu có thu tiền trước: Có phải lập hóa đơn ngay không?

Đây là một tình huống rất phổ biến ở các doanh nghiệp xuất khẩu. Khách hàng nước ngoài thường yêu cầu thanh toán trước một phần hoặc toàn bộ giá trị đơn hàng trước khi giao nhận.

Legal regulation

- Khoản 1, Điều 9, Thông tư 78/2021/TT-BTC quy định: Thời điểm lập hóa đơn đối với hàng hóa xuất khẩu là thời điểm hoàn tất thủ tục thông quan (đối với hàng hóa) hoặc khi hoàn thành cung ứng dịch vụ (đối với dịch vụ xuất khẩu).

- Việc nhận tiền trước không bắt buộc phải lập hóa đơn, vì chưa phát sinh nghĩa vụ thuế.

Errors frequently

- Doanh nghiệp lập hóa đơn khi nhận tiền, dù chưa xuất hàng → dẫn đến sai thời điểm, có thể bị xử phạt từ 4 – 8 triệu đồng theo Nghị định 125/2020/NĐ-CP.

- Thậm chí nếu sau đó đơn hàng không được giao, doanh nghiệp buộc phải làm thủ tục hủy hóa đơn đã lập – rất phức tạp.

Hướng xử lý đúng

- Ghi nhận khoản thu trước bằng phiếu thu – phiếu kế toán nội bộ.

- Khi hàng hóa đã xuất khẩu xong, được hải quan xác nhận thông quan, mới tiến hành lập hóa đơn điện tử.

- Trong hóa đơn, ghi chú rõ phương thức thanh toán là “đã thu trước”.

Read more:

Xuất khẩu dịch vụ, phần mềm: Dùng loại hóa đơn nào? Có cần hóa đơn xuất khẩu không?

Doanh nghiệp trong các ngành công nghệ, tư vấn, thiết kế, đào tạo… ngày càng nhiều đơn vị xuất khẩu dịch vụ phi hàng hóa. Tuy nhiên, có sự nhầm lẫn lớn về loại hóa đơn cần dùng.

Legal regulation

- Theo Thông tư 219/2013/TT-BTC, dịch vụ xuất khẩu là đối tượng áp dụng thuế suất 0% nếu đáp ứng đủ điều kiện:

- Có hợp đồng ký với tổ chức/cá nhân nước ngoài.

- Có chứng từ thanh toán qua ngân hàng.

- Dịch vụ được tiêu dùng ngoài lãnh thổ Việt Nam.

- Khi đáp ứng đủ điều kiện này, doanh nghiệp phải lập hóa đơn điện tử GTGT (mẫu chuẩn) với thuế suất 0%.

Không sử dụng hóa đơn xuất khẩu trong trường hợp này. Một số ví dụ cụ thể:

- Doanh nghiệp A cung cấp dịch vụ lập trình phần mềm cho khách hàng tại Mỹ → lập hóa đơn điện tử GTGT 0%.

- Công ty B thực hiện thiết kế kiến trúc cho một dự án tại Nhật → lập hóa đơn GTGT 0%, đính kèm hợp đồng & chứng từ thanh toán.

Lưu ý: Nếu không đủ điều kiện (ví dụ: thanh toán bằng tiền mặt hoặc tiêu dùng dịch vụ trong nước), không được áp dụng thuế suất 0%, phải chịu thuế GTGT 10%.

Bán hàng qua nền tảng thương mại điện tử quốc tế (Amazon, Alibaba, Etsy…): Có cần lập hóa đơn không?

Với xu hướng chuyển đổi số, ngày càng nhiều doanh nghiệp Việt Nam bán hàng trực tiếp cho khách hàng quốc tế thông qua các nền tảng thương mại điện tử xuyên biên giới. Tuy nhiên, mô hình này có những điểm đặc thù về quy trình xuất hàng, lập hóa đơn. Có 2 mô hình chính:

Trường hợp 1: Xuất khẩu trực tiếp từ Việt Nam qua hải quan

- Hàng được gửi từ Việt Nam → qua cửa khẩu → đến tay người mua.

- Doanh nghiệp phải lập hóa đơn xuất khẩu điện tử theo chuẩn.

- Ngoài hóa đơn, cần có bộ chứng từ gồm: hợp đồng, vận đơn, tờ khai hải quan, chứng từ thanh toán.

Trường hợp 2: Bán hàng từ kho trung gian ở nước ngoài (fulfillment)

- Ví dụ: Gửi hàng số lượng lớn đến kho Amazon (ở Mỹ), sau đó Amazon phân phối đến người mua lẻ.

- Trong trường hợp này, doanh nghiệp không cần lập hóa đơn cho từng đơn hàng, nhưng phải có chứng từ kế toán về:

- Giá trị hàng gửi đi kho nước ngoài

- Biên bản đối chiếu tồn kho, giao dịch

- Báo cáo thu nhập – chi phí định kỳ theo hợp đồng với Amazon

Những rủi ro nếu áp dụng sai

- Lập hóa đơn trong nước cho khách hàng quốc tế → sai loại hóa đơn

- Không có chứng từ thanh toán hợp lệ → không được hoàn thuế

- Ghi sai thời điểm xuất hóa đơn hoặc đồng tiền → vi phạm định dạng

Read more:

Xuất khẩu qua công ty mẹ hoặc công ty con ở nước ngoài: Lưu ý về hóa đơn, kê khai

Nhiều tập đoàn có chi nhánh/công ty mẹ – con tại nhiều quốc gia. Khi xuất hàng giữa các đơn vị trong cùng hệ thống, vẫn phát sinh giao dịch thương mại, phải tuân thủ quy định về hóa đơn xuất khẩu. Nguyên tắc áp dụng

- Dù thuộc cùng tập đoàn, mỗi đơn vị là một pháp nhân riêng biệt, nên việc xuất hàng giữa các bên vẫn là hoạt động mua bán, cần lập hóa đơn theo đúng quy định.

- Nếu là xuất khẩu hàng hóa → lập hóa đơn xuất khẩu.

- Nếu là chuyển giao dịch vụ → lập hóa đơn GTGT với thuế suất 0%.

Note:

- Giá trị giao dịch phải tuân thủ quy tắc giao dịch liên kết (theo Nghị định 132/2020/NĐ-CP).

- Hóa đơn phải đồng nhất với hợp đồng, chứng từ thanh toán quốc tế.

Xuất khẩu “tái xuất” – hàng hóa được nhập khẩu sau đó xuất lại

Trường hợp doanh nghiệp nhập khẩu hàng hóa từ nước ngoài, sau đó không tiêu dùng trong nước mà xuất ngược trở lại. Đây gọi là giao dịch tái xuất – điển hình trong ngành logistics, thương mại quốc tế, đại lý ủy quyền. Quy định áp dụng

- Phải có đầy đủ hồ sơ: tờ khai nhập khẩu, tờ khai tái xuất, hợp đồng, hóa đơn thương mại.

- Trường hợp này, doanh nghiệp có thể không lập hóa đơn xuất khẩu, nhưng phải có đầy đủ bộ chứng từ hải quan, biên bản kiểm kê, thanh lý hợp đồng.

- Nếu có phát sinh doanh thu, thuế → vẫn phải lập hóa đơn điện tử (xuất khẩu hoặc GTGT tùy giao dịch).

3. Hướng dẫn lựa chọn giải pháp hóa đơn điện tử phù hợp với doanh nghiệp xuất khẩu

Khi triển khai hóa đơn điện tử, doanh nghiệp xuất khẩu không thể dùng các phần mềm đơn thuần dành cho giao dịch nội địa. Cần lựa chọn giải pháp chuyên biệt, đáp ứng đặc thù về:

- Ngôn ngữ, múi giờ, đơn vị tiền tệ

- Kết nối hải quan, quản lý nhiều đối tác quốc tế

- Bảo mật cao, dễ tích hợp với phần mềm ERP

5 tiêu chí lựa chọn phần mềm hóa đơn điện tử cho doanh nghiệp xuất khẩu

| Criteria | Mô tả yêu cầu |

| Khả năng đa ngôn ngữ | Hóa đơn cần thể hiện song ngữ Việt – Anh |

| Tích hợp chữ ký số & mã QR | Đáp ứng chuẩn của cơ quan thuế, hải quan |

| Lưu trữ & truy xuất linh hoạt | Có thể xuất file XML, PDF, gửi qua email |

| Tương thích hệ thống ERP | Dễ kết nối với SAP, Oracle, MISA, AccNet... |

| Hỗ trợ nghiệp vụ xuất khẩu | Có bảng mã HS Code, đơn vị tính quốc tế |

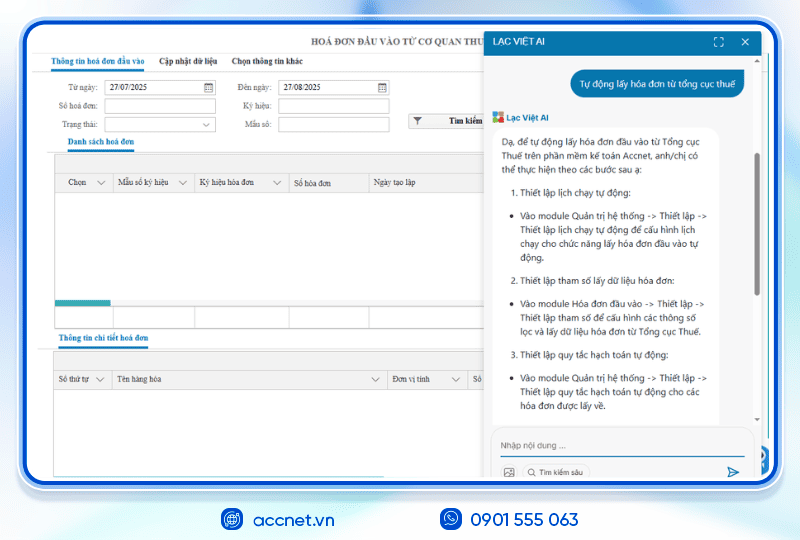

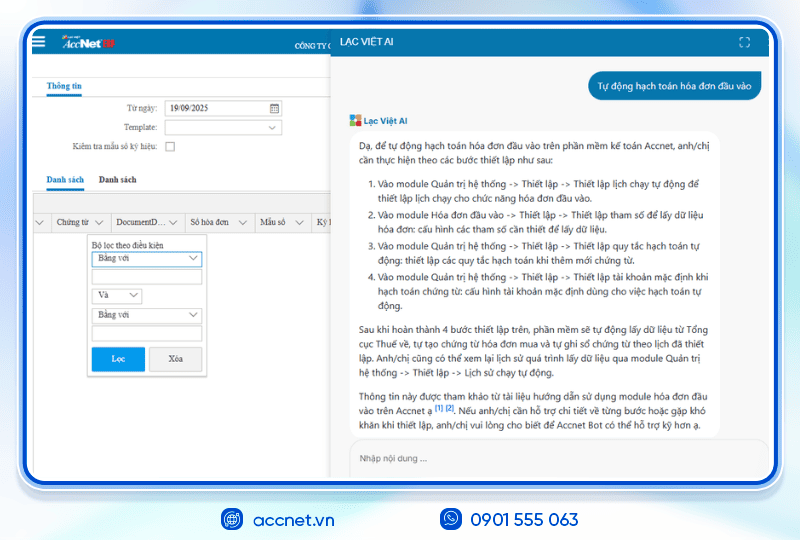

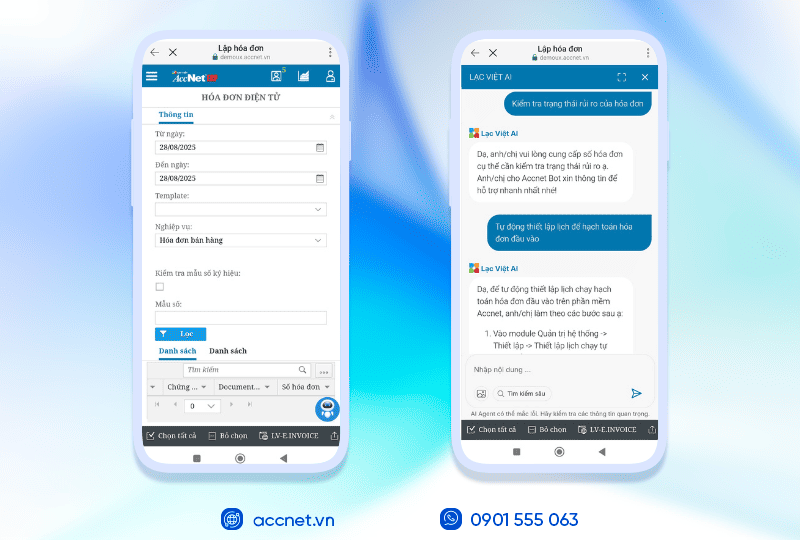

AccNet eInvoice – Giải pháp hóa đơn điện tử tối ưu cho doanh nghiệp xuất khẩu

AccNet eInvoice là phần mềm hóa đơn điện tử được nhiều doanh nghiệp xuất khẩu tại Việt Nam tin dùng, đáp ứng được mọi quy định mới nhất về hóa đơn xuất khẩu. Những ưu điểm nổi bật:

- Tùy biến theo ngành hàng: Có sẵn biểu mẫu hóa đơn xuất khẩu cho các ngành như dệt may, điện tử, thủ công mỹ nghệ...

- Tốc độ xử lý nhanh: Tạo & gửi hóa đơn chỉ trong 30 giây – rút ngắn 70% thời gian xử lý so với phương pháp thủ công.

- Hỗ trợ chuyên sâu: Có đội ngũ tư vấn riêng cho doanh nghiệp FDI, xuất khẩu.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

4. Case Study Thực tế: Công ty May & Xuất khẩu LM Textile

Business introduction

- Tên: Công ty TNHH May & Xuất khẩu LM Textile

- Trụ sở: Biên Hòa, Đồng Nai

- Quy mô: 500‑800 nhân viên, 2 dây chuyền may, xuất khẩu chủ yếu sang EU, Mỹ

- Mục tiêu: Chuyển đổi từ hóa đơn giấy/truyền thống sang hóa đơn điện tử để tối ưu quy trình xuất khẩu

Thực trạng trước khi áp dụng và tuân thủ những quy định mới nhất về hóa đơn xuất khẩu

Trước năm 2023, quá trình phát hành hóa đơn xuất khẩu tại LM Textile gặp nhiều khó khăn:

- Mỗi tháng phát hành trung bình 1.500–2.000 hóa đơn, chủ yếu là hóa đơn giấy, hóa đơn thương mại song ngữ.

- Chi phí in, photocopy, chuyển hóa đơn lên đến 30–40 triệu đ/tháng (bao gồm mực, giấy, phong bì, gửi chuyển phát nhanh).

- Bộ phận kế toán phải dành 3–4 ngày/tháng kiểm đối, nhập thủ công dữ liệu hóa đơn vào hệ thống kế toán, ERP, gửi cho phòng hải quan.

- Lỗi kỹ thuật thường gặp: sai đơn vị tiền tệ, sai mã HS, sai tên đối tác, sai thời điểm xuất hóa đơn – dẫn đến nhiều hóa đơn phải lập lại, gây chậm thời gian thông quan, ảnh hưởng dòng tiền.

Learn more:

Giải pháp triển khai hóa đơn điện tử (embedded case)

Mục tiêu chuyển đổi:

- Tự động lập hóa đơn xuất khẩu đúng lúc (sau thông quan).

- Tạo hóa đơn song ngữ (Việt–Anh) với mẫu hợp chuẩn quốc tế.

- Tích hợp liền mạch: hóa đơn ↔ khai hải quan ↔ kế toán ERP.

- Giảm lỗi thủ công, giảm chi phí in ấn, tăng tốc quy trình.

Mô hình triển khai:

- Tích hợp cổng TCT: hóa đơn xuất tự động được gửi đến cơ quan thuế ngay sau khi tạo, có xác nhận điện tử.

- Đối chiếu hóa đơn – tờ khai: tự động so khớp số lượng, giá trị, đơn vị tiền tệ.

- Không in ấn, ngoài những hóa đơn đặc biệt cần gửi đối tác/kế toán trưởng.

- Đào tạo kế toán: thực hiện ký số, kiểm tra, lưu trữ hóa đơn, tra cứu dễ dàng trên hệ thống điện tử.

Kết quả sau 6 tháng triển khai

| Hạng mục | Trước khi áp dụng | Sau khi áp dụng | Mức giảm (%) |

| Chi phí in ấn & gửi hóa đơn | 35–40 triệu₫/tháng | 5–8 triệu₫/tháng | ~80 % |

| Thời gian xử lý hóa đơn | 3–4 ngày/tháng | ≈ 0.5 ngày/tháng | ~85 % |

| Tỷ lệ sai sót hóa đơn | 20–30 hóa đơn/tháng | < 2 hóa đơn/tháng | ~90 % |

| Rút ngắn thời gian thông quan | Trung bình +1–2 ngày | Gần bằng thủ tục nhanh | ~100 % |

Một số kết quả nổi bật:

- Chi phí: Giảm từ 420–480 triệu ₫/năm xuống còn khoảng 60–100 triệu ₫/năm, tiết kiệm hơn 75% chi phí hóa đơn.

- Hiệu quả hoạt động: Giảm thời gian chờ xử lý hóa đơn, đẩy nhanh dòng tiền, tăng năng suất công việc kế toán + hải quan.

- Tính minh bạc, kiểm soát: Hóa đơn được lưu trữ điện tử, tra cứu dễ dàng và đảm bảo chứng từ chuẩn khi kiểm toán hoặc thanh tra thuế.

Bài học quan trọng từ LM Textile

- Chuẩn hóa quy trình là chìa khóa: lập hóa đơn sau khi hoàn tất thủ tục thông quan, chính xác về nội dung, định dạng.

- Số hóa giúp giảm rủi ro: sai sót thủ công được loại bỏ, hạn chế tình trạng hủy, lập lại hóa đơn.

- Tích hợp hệ thống mang lại lợi ích lớn: đồng bộ dữ liệu giữa hải quan, thuế, kế toán giúp tiết kiệm thời gian, chi phí đáng kể.

- Phát triển văn hóa công nghệ: đào tạo chuyển đổi tư duy từ giấy sang điện tử, giúp nâng cao độ chính xác, chuyên nghiệp.

5. AccNet eInvoice – Giải pháp quản lý hóa đơn xuất khẩu hiệu quả

Theo quy định mới nhất về hóa đơn xuất khẩu, doanh nghiệp khi xuất khẩu hàng hóa phải đảm bảo lập hóa đơn điện tử đúng mẫu, đủ thông tin bắt buộc như tên, địa chỉ người bán, người mua, mã số thuế, số lượng, giá trị hàng hóa và phương thức thanh toán. Hóa đơn xuất khẩu không chỉ là chứng từ pháp lý quan trọng phục vụ kê khai thuế, mà còn là căn cứ để ngân hàng, hải quan và các bên liên quan kiểm tra, đối chiếu khi thanh toán hoặc làm thủ tục xuất nhập khẩu. Việc tuân thủ đúng các quy định giúp doanh nghiệp tránh rủi ro phạt hành chính và đảm bảo minh bạch trong quản lý tài chính.

Tuy nhiên, với doanh nghiệp xuất khẩu thường xuyên hoặc có khối lượng hóa đơn lớn, việc lập hóa đơn thủ công hoặc theo dạng giấy dễ dẫn đến sai sót, mất dữ liệu và khó tra cứu khi cần. Đây là lúc AccNet eInvoice trở thành giải pháp tối ưu. Hệ thống cho phép doanh nghiệp tạo, phát hành và quản lý hóa đơn xuất khẩu điện tử theo đúng chuẩn pháp luật, tự động cập nhật dữ liệu, giảm thiểu sai sót và tăng tốc quy trình nghiệp vụ.

Không chỉ giúp lập hóa đơn nhanh chóng, AccNet eInvoice còn tích hợp tính năng lưu trữ và tra cứu hóa đơn theo thời gian thực. Doanh nghiệp có thể dễ dàng kiểm tra tình trạng hóa đơn, đối chiếu với hải quan và ngân hàng, đồng thời tạo báo cáo chi tiết phục vụ kế toán và quản lý tài chính.

Áp dụng AccNet eInvoice cho hóa đơn xuất khẩu giúp doanh nghiệp tiết kiệm thời gian, đảm bảo tuân thủ pháp luật và quản lý hóa đơn hiệu quả. Đây là bước đi quan trọng để số hóa quy trình xuất khẩu, giảm rủi ro và nâng cao năng lực cạnh tranh trên thị trường quốc tế.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Việc hiểu, áp dụng đúng latest regulations on export invoices không chỉ giúp doanh nghiệp tuân thủ pháp luật, mà còn là chìa khóa để tối ưu quy trình, tăng tính chuyên nghiệp, giảm chi phí vận hành. Tóm tắt 5 điểm doanh nghiệp cần lưu ý:

- Hóa đơn xuất khẩu khác hoàn toàn hóa đơn thương mại, hóa đơn GTGT.

- Chỉ lập hóa đơn khi đã hoàn tất giao hàng – thông quan.

- Doanh nghiệp xuất khẩu dịch vụ dùng hóa đơn điện tử GTGT với thuế suất 0%.

- Việc sử dụng phần mềm hóa đơn điện tử là bắt buộc, cần lựa chọn giải pháp phù hợp cho nghiệp vụ xuất khẩu.

- Các lỗi sai thời điểm, sai loại hóa đơn, hay dùng sai ngôn ngữ – đơn vị tiền – có thể dẫn đến rủi ro pháp lý, mất uy tín với đối tác quốc tế.

Hơn 1.500 doanh nghiệp vừa và lớn đã sử dụng AccNet eInvoice để xử lý hóa đơn xuất khẩu mỗi ngày, giảm đến 70% thời gian – 60% chi phí vận hành. Hành động ngay hôm nay để tránh rủi ro, tăng tốc xuất khẩu. Nếu doanh nghiệp bạn đang:

- Mở rộng thị trường quốc tế,

- Đang thi công giải pháp hóa đơn điện tử,

- Hoặc cần đảm bảo tuân thủ quy định về hóa đơn xuất khẩu,

Hãy để đội ngũ chuyên gia của AccNet eInvoice đồng hành cùng bạn. Đừng để một sai sót nhỏ về hóa đơn khiến cả lô hàng bị chậm thông quan hay mất uy tín với đối tác quốc tế. Hãy chủ động chuẩn hóa ngay từ hôm nay!

CONTACT INFORMATION:- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: