Diagram accounting accounts 511 circular 200 is specified how? This article AccNet will share the information related to the problems on to you easy to remember and accounting transactions related to sales revenue, and provide services offline.

1. Account 511 is the account?

In accordance with Article 79 Circular no. 200/2014/TT-BTC:

Account 511 - Revenue from sale of goods and supply of services is the account you used to reflect the revenue earned by the business during an accounting include sales of products, goods and provides services of both parent company and subsidiary company in a group.

Account 511 reflect the revenue of manufacturing operations, business from the business to sell goods, provide services and other sales.

Read more:

2. Textured account 511

Before finding out about diagram accounting accounts 511 circular 200 let's go through the structure of the accounts 511, including the account level 2 as follows:

- Account 5111 - sales of goods: This account is used to reflect the turnover of goods sold in an accounting period of the company. Account 5111 mainly used in commodity trading, food,...

- Account 5112 - sales of the finished products: Reflect revenue and net sales of products, goods sold in an accounting period of the business. Account 5112 mainly used in the manufacturing industry material, such as industrial, construction, agricultural, fishery,...

- Account 5113 - Sales service provider: this account reflects the revenue and net revenue for the volume of services have completed the offer for customers during an accounting period. Account 5113 mainly used in services such as transport services, travel, accounting, technology,...

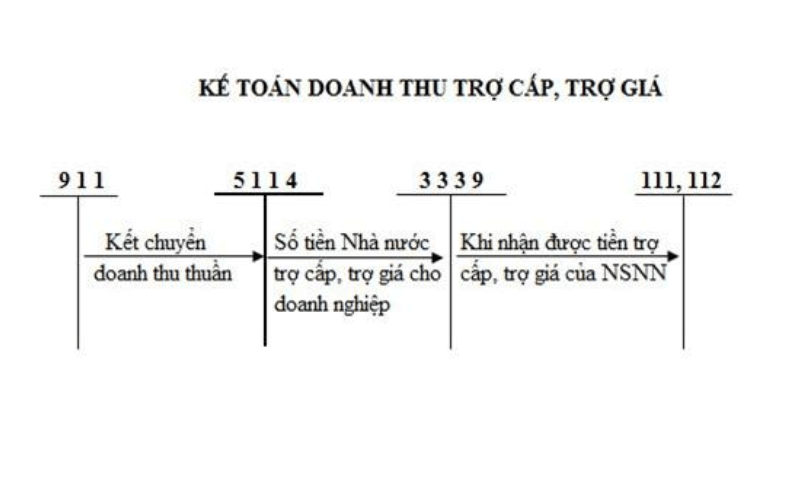

- Account 5114 - revenue grants, subsidies: Reflects the revenue from grants, subsidies of state when performing business that provides goods and products according to the requirements of The state.

- Account 5117 - Business sales real estate investing: Reflects revenue from the rental of real estate investment and revenue from sell, liquidate real estate investment.

- Account 5118 - revenue other: This account is used to reflect the revenue accounts other than 5 accounts listed above, as revenue from sale of materials, scrap, sell, instruments, tools and other sales.

3. Diagram accounting accounts 511 circular 200

To perform properly accounted for accounts 511, refer to the diagram accounting accounts 511 circular 200.

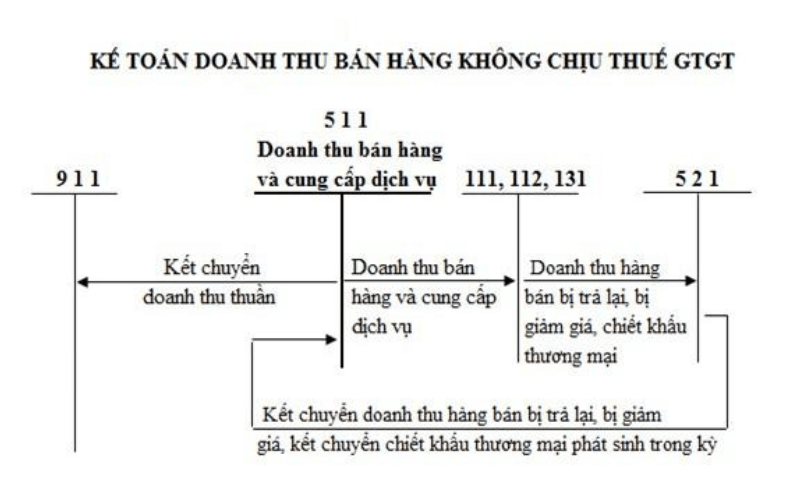

3.1 diagram of accounting revenues are not taxable value

Accounting economic transactions through selling goods not subject to VAT are summarized in the diagram accounting as follows:

Read more:

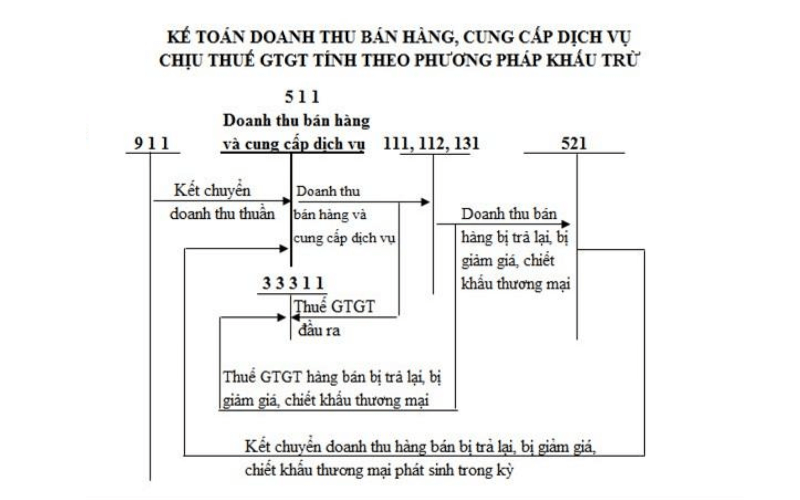

3.2 diagram of accounting revenue subject to value added tax according to the method of deduction

Accounting economic transactions related to the sale of goods and supply of services subject to VAT according to the method of deduction is summarized as the following diagram:

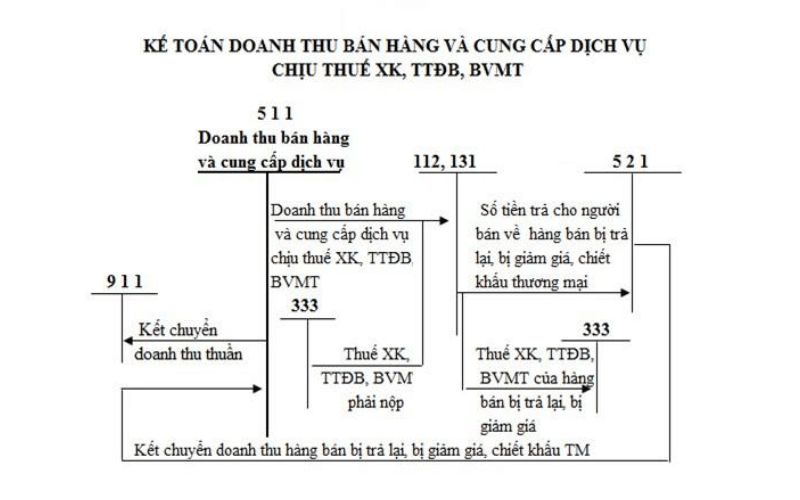

3.3 revenue subject to export tax, environment and excise

Accounting economic transactions related to the export tax, environmental tax and the excise tax be summarized as diagram accounting accounts 511 circular 200 below:

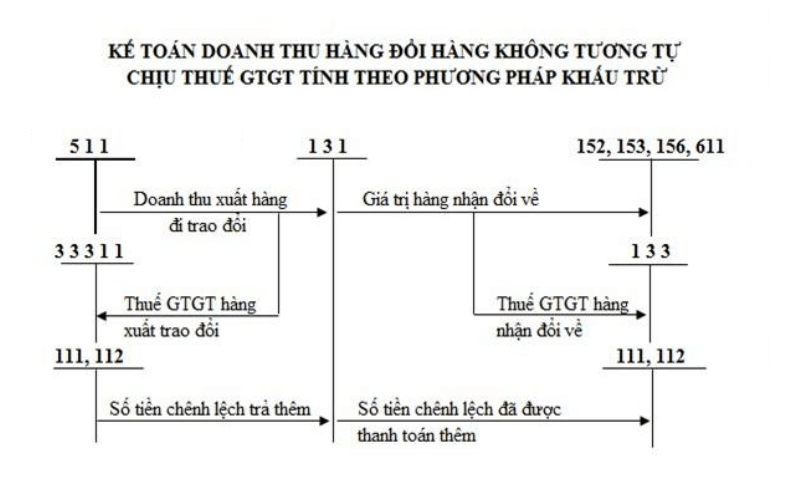

3.4 revenue barter not similar according to the method of deduction

Accounting economic transactions related to the sales order change is not similar according to the method of deduction is summarized as the following diagram:

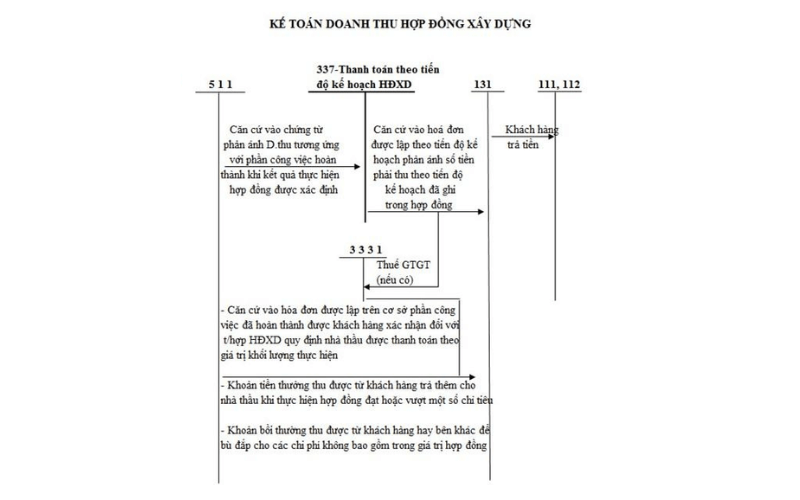

3.5 diagram of accounting revenue construction contracts

Diagram accounting accounts 511 circular 200 economic transactions in terms of revenue building activities are summarized as the following diagram:

3.6 accounting revenue subsidies, subsidies

Economic transactions related to revenue subsidies, subsidies of state are summarized as the following diagram:

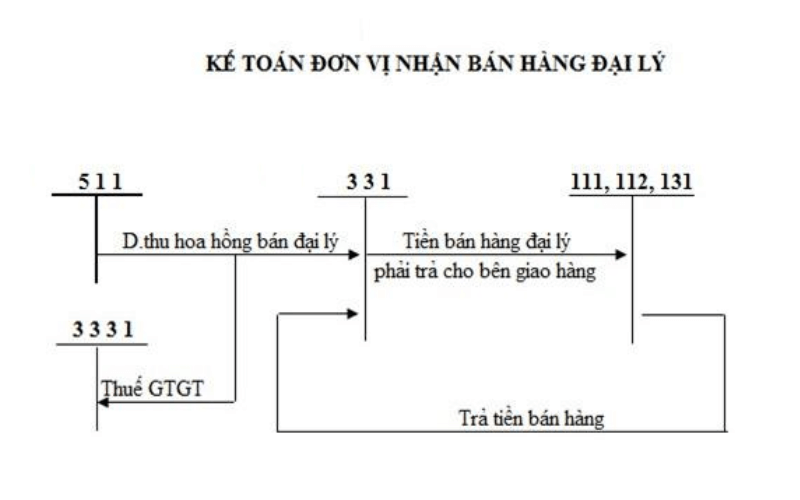

3.7 accounting revenue for unit sale agent

Accounting economic transactions related to revenue for unit sale agents are summarized as follows:

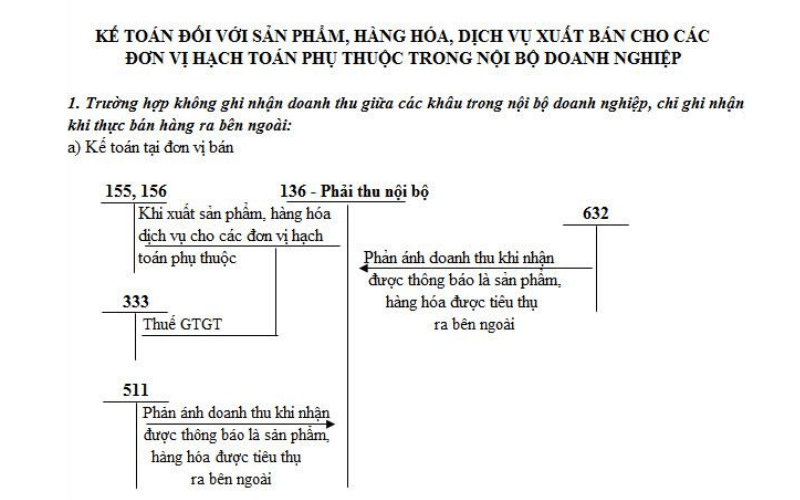

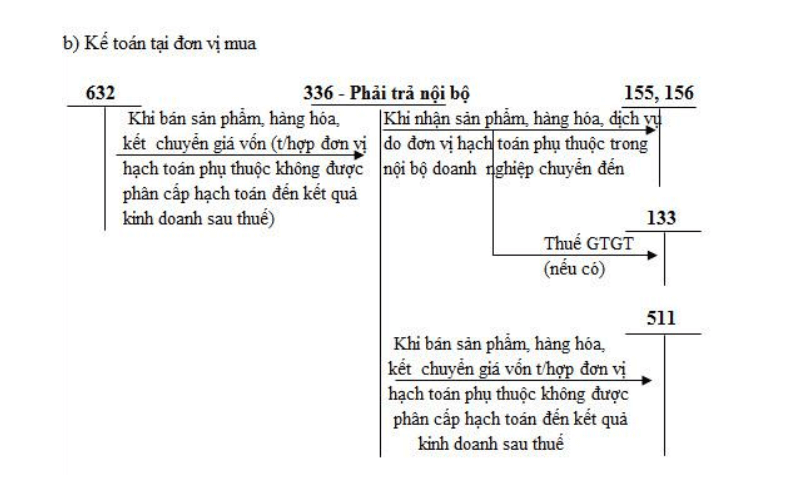

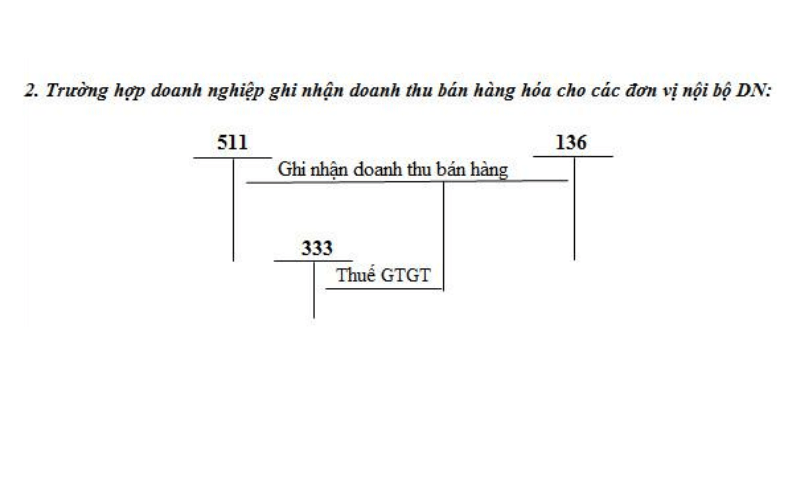

3.8 revenue from the unit dependent accounting business insider

Accounting for the economic transactions of revenue from the accounting units depend internal business be summarized as diagram accounting accounts 511 circular 200 below:

On this is the diagram accounting accounts 511 circular 200 was AccNet detailed summary help you easily remember and implement the service quickly. Next is the share about how accounting sales and service provider details of each business. Continue to monitor the articles offline.

4. How accounting accounts 511 details

Circular 200 are instructions on how accounting accounts 511 in a number of business mainly below:

4.1 accounting sales volume of product

- For goods and services, real estate investments, which are subject to VAT, excise tax, export tax, environmental protection. Accounting revenue sale of goods and services according to the prices do not include tax. the account to submit (in detail each type of tax) are separated when revenue recognition.

Debt 111, 112, 131: the Total price payment

There are 511: revenue from sale of goods and services do not include tax.

There are 333: Taxes and other payables to the state budget.

- Case no cup is the right amount of tax not paid, they must maintain receipts recorded the amount of tax not paid. Periodically determine the tax obligations and reduced revenue:

Debt 511: revenue from sale of goods and supply of services.

There are 333: Taxes and other payables to the state budget.

Learn more:

4.2 accounting for revenue in the form of installments

Revenue in the form of installments, the amount of deferred receivables of the customer is reflected into account 3387 “unearned revenue”. Amount of interest periodically be transferred to the account 515 “revenue from financial operations”.

- When selling goods in installments, accounting reflects the revenue by the price paid immediately without tax:

Debt 131: receivable of clients

There are 511: revenue from sale of goods and supply of services (the price paid immediately not including tax).

There are 333: Taxes and other payables to the state budget.

There are 3387: unrealized revenue (the amount of the difference between the total amount calculated according to the price installment sale and sale price paid immediately).

- Revenue recognition interest installment sales in the period reflected on the account:

Debt 3387: unrealized revenue

There are 515: revenue from financial activities (the amount of interest installment)

4.3 accounting for revenue in the form of rent fixed assets, real estate

For operating lease of fixed assets and real estate, the accounting revenue is in accordance with rental service, fixed assets and real estate investment completed in each of the states. When the invoice-payment of rent fixed assets and real estate from accounting records:

Debt 131: the receivable of the customer (in case of not receiving the money now)

Debt 111, 112: (in case of obtaining money right)

There are 511: revenue from sales and service provider

There are 3331: VAT payable

- Case received before many states revenue from operating lease of fixed assets and lease of real estate investment, accounting record:

Debt 111, 112: the Total money received in advance

There are 3387: unrealized revenue (price excluding tax)

There are 3331: VAT payable

- And transfer revenue period end:

Debt 3387: unrealized revenue (price excluding tax)

There are 511: sales and service provider (5113 and 5117)

- Amount to be refunded to the customer due to the contract for lease of fixed assets and real ESTATE investment is not made or the contract period is shorter than the time was collecting money earlier, the record is as follows:

Debt 3387: unrealized revenue (price excluding tax)

Debt 3331: VAT payable (Number reimburse lessee on VAT not done)

There are 111, 112: the Total amount repaid

4.4 revenue sales through agents commission

a) accounting side dealer delivery

- When exporting goods to the dealer to set “warehouse consignment agents”, accounting record:

Debt 157: Goods sent for sale

There are 155, 156

- After goods send agents have been sold, based on the declaration and the bill of goods sold by dealers set and send it to accounting, perform accounting sales revenue by selling price excluding tax:

Debt 111, 112, 131,...: the Total price payment

There are 511: sales and service provider

There are 3331: VAT payable

At the same time recorded the price of capital goods:

Debt 632: cost of goods sold

There are 157: consignment

- The amount of commission paid to agents, record:

Debt 642: Cost management business (excluding VAT)

Debt 133: VAT deductible

There are 111, 112, 131,...

b) accounting units get as agents for the price is right commission

- If the receiving agent has sold, based on VAT invoices or sales receipts and other vouchers or other related accounting recorded cash sales agent must pay for the delivery are as follows:

Debt 111, 112, 131,...

There are 331: Total amount to be paid by the seller

- When determining the revenue commission agent is entitled, inscribed:

Debt 331: paying the seller

There are 511: sales and service provider

There are 3331: VAT payable

- When to pay sales agent for the delivery, recorded as follows:

Debt 331: paying the seller

There are 111, 112.

Refer to: Giải thích cơ cấu bút toán và vận hành sổ kế toán cuối kỳ

4.5 accounting revenue construction activities

- When accounting for revenue operations, construction, accounting, invoicing, VAT, based on the finished work is verified customers, note:

Debt 111, 112, 131:

There are 511: sales and service provider

There are 3331: VAT payable

- Bonuses obtained from customer to pay for the contractor when completing the contract reaches, or exceeds some only target specified in the contract, the accounting records:

Debt 111, 112, 131:

There are 511: sales and service provider

There are 3331: VAT payable

- Compensation received from the customer to compensate the costs not included in the contract value accounting:

Debt 111, 112, 131:

There are 511: sales and service provider

There are 3331: VAT payable

- If payment is received volume of work completed or the advance of the customer record:

Debt 111, 112...

There are 131: receivable of clients

5. Tối ưu hóa quy trình hạch toán doanh thu (TK 511) với AccNet ERP

Việc hạch toán doanh thu – phản ánh qua tài khoản 511 – theo Thông tư 200/2014/TT-BTC thường gặp nhiều thách thức như: sơ đồ phức tạp, nhiều trường hợp cần xử lý linh hoạt với thuế GTGT, doanh thu xuất khẩu, xây dựng, trả góp… Khi chỉ sử dụng phương pháp thủ công (Excel, sổ sách giấy…) dễ dẫn đến sai sót, thiếu sự đồng bộ, thiếu kiểm tra chéo.

AccNet ERP – giải pháp quản trị tài chính kế toán toàn diện không chỉ đáp ứng đầy đủ các yêu cầu của Thông tư 200 mà còn giúp doanh nghiệp:

-

Tự động hóa sơ đồ hạch toán tài khoản 511 theo từng trường hợp cụ thể như doanh thu không chịu thuế, doanh thu chịu thuế GTGT, xuất khẩu, xây dựng, trợ giá…, đảm bảo tính chính xác, đúng quy định.

-

Liên kết các nghiệp vụ ngay trong luồng xử lý bán hàng: từ lập hóa đơn, ghi nhận doanh thu, xác định thuế, đến ghi nhận công nợ, ghi sổ kế toán – tất cả diễn ra thống nhất trên hệ thống ERP.

-

Giảm thiểu sai sót, tăng hiệu quả kiểm soát: các trường hợp doanh thu đặc thù như trả góp, thuê tài sản, hoa hồng đại lý… được xử lý đúng nghiệp vụ, đầy đủ tài khoản liên quan (511, 333, 3387…) như quy định trong phần hướng dẫn chi tiết.

-

Báo cáo tức thời, đa chiều: hệ thống tự động tổng hợp số liệu từ TK 511, TK 333, TK 3387… giúp kế toán viên, lãnh đạo dễ dàng theo dõi doanh thu theo từng loại, so sánh thực chi, dự toán, phân tích biến động, từ đó ra quyết định nhanh, kịp lúc.

-

Tuân thủ pháp lý chặt chẽ, nâng cao tính minh bạch: mọi nghiệp vụ hạch toán đều có audit trail (khi – ai – làm gì), đảm bảo khả năng truy xuất dữ liệu trong kiểm toán, tránh sai phạm, bảo vệ lợi ích doanh nghiệp.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Trên đây là thông tin tổng quan về tài khoản 511 - Doanh thu từ bán hàng, cung cấp dịch vụ. Đặc biệt với sơ đồ hạch toán tài khoản 511 theo thông tư 200 có thể giúp kế toán viên hoàn thành công việc hạch toán một cách nhanh chóng. Nếu bạn còn thắc mắc hay hay câu hỏi nào đừng ngần ngại liên hệ với AccNet theo thông tin liên hệ sau.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: