In every business there are business activities, goods and services, value-added tax (VAT) is the most important tax need to declare and pay on time, properly regulated. This is not only a legal obligation but also the factors that affect directly to the right deductions, tax refund, the cost of short-term financing of the business.

In particular, those businesses are in the construction phase system, tax accounting, understanding, properly executed declaration and VAT help:

- Avoid the risk of errors that lead to arrears, tax penalties.

- Good control flow invoice input – output.

- Mounting efficiency between data and tax accounting module, asset cost.

The article below will provide detailed guidance from theory to practice how to declare VATupdated according to the latest regulations 2024, comes an in-depth analysis, checklist, practical for business apply now.

1. What is VAT? Who should declare? Businesses need to understand before making

Definition of VAT & principle of operation

Value added tax (VAT) are indirect taxes, calculated on the value added of goods and services in the process of production – circulation – consumption.

According to Article 2 – the Law on VAT (modified):

“VAT is the tax on the added value of goods and services incurred in the process from production, circulation to the final consumer.”

Mechanism of action:

- VAT output: the number of corporate tax collected from customers through the bill of sale.

- Input: the number of corporate tax paid to suppliers when purchasing goods and services.

- VAT payable = VAT output – input

Business declaration right – enough – time will be deducted valid input, can be refunded the VAT, if incurred the number of input tax is greater than the first in some cases (for example, investment projects, export...).

The method of current VAT

Currently there are 2 methods to declare VAT:

Method deductible (usually applies)

- Apply for business has a revenue of over 3 billion/year or eligible for registration.

- Advantages: tax-deductible input → reduce the tax payable.

- Conditions: Must use VAT invoices, there are bookkeeping the full implementation of accounting under the accrual method.

Direct method

- Apply for business, small business are not eligible to apply methods of deduction.

- VAT percentage on sales.

- Non-deductible input tax.

Note: the Majority of business development, system implementation, accounting, tax, they use accounting software that are declared by the method of deduction.

Read more:

- Accounting software tax to help businesses reduce the risk flaws tax

- Report software latest tax support declaration accurate, timely

- Settlement tax business income standard according to the latest regulations

Those who have to declare VAT periodically?

In accordance with Article 8 – Decree 126/2020/ND-CP, the organization, the business development activity for buy – sell goods and services subject to VAT are obliged to declare periodically.

Classified according to the frequency of the declaration:

- Monthly declaration: enterprises With total revenue year ago > 50 billion.

- Declaration of quarterly: an enterprise With total revenue year ago ≤ 50 billion.

New business establishment be temporarily declared a quarterly basis in the first year. From year Monday, the tax will be based on the actual revenue to reclassify.

2. How to declare VAT (additional/electronic) step by step standard

To avoid errors, ensure the rights of tax and businesses that need to comply with the process of VAT declaration under the 4 following steps:

Step 1. Prepare records, accounting data, the beginning of the period

Before the declaration, accountants need the full set of types of evidence related words:

- VAT invoices input, output: e-bills, bills, conversion bill, adjustable...

- Window, the window details the account: 511 (revenue), 133 (input VAT), 3331 (VAT payable)...

- Minutes adjustment errors bills: if there is an adjustment in the states.

- List of the bill buy – sell out (if you do crafts or for data projector).

Note for business is asset management: Shopping bill machinery, equipment... if not updated right time will affect the amount of VAT deductible. So, the accounting should be coordinated with the property manager to ensure information synchronized.

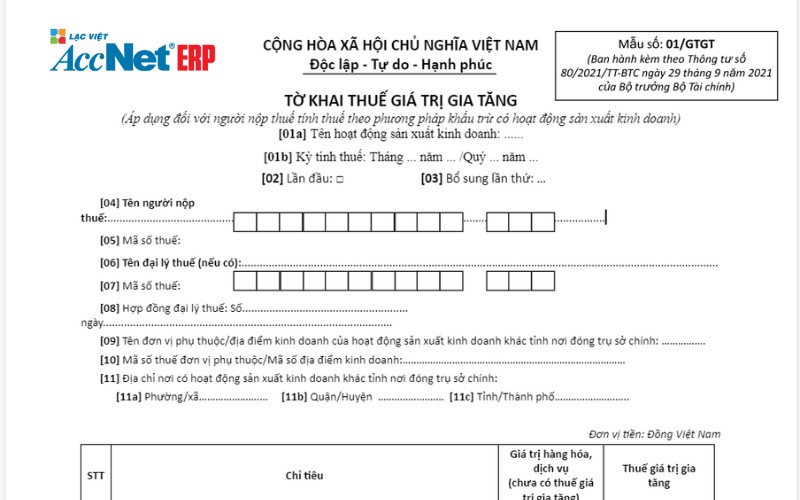

Step 2. Set the VAT declaration form 01/VAT

Here is a sample declaration for business declaration according to the method of deduction, according to circular 80/2021/TT-BTC.

DOWNLOAD NOW: SAMPLE 01/VAT

DOWNLOAD NOW: TEMPLATE 04/VAT

The steps to complete a declaration form to make how to declare VAT:

- Indicator 21 – 23: Total value of goods and services sold in the period (before tax), the number of output VAT payable.

- Indicator 25 – 29: Total invoice value input be deducted according to each type (domestic purchases, imports, investment...).

- Only target 32 – 34: Calculate the VAT payable = output tax – input tax.

Special note:

- If the investment project is in the stage of investment, businesses can record the number of input tax at only own goal to please complete the following.

- If in the states does not arise operations, businesses still have to submit a declaration to the white.

Step 3. Use accounting software support implementation of VAT declaration

Today, most businesses use accounting software to automate the process of tax declaration, minimize the risks of errors:

Benefits of software as AccNet Cloud:

- Automatic synthesis of data from books, electronic invoice.

- Automatic data matching the input – output, calculate tax payable.

- Deviation alerts about bills, term, duplicate data.

- Output file Correct XML format of the General department of Taxation, ready to apply through the electronic gate.

For ongoing business accounting asset, AccNet Cloud also supports integrated distribution system assets → ensure the bills invest large deductible valid, correct states.

ACCNET CLOUD – ACCOUNTING SOFTWARE ONLINE FOR SMALL AND MEDIUM ENTERPRISES Thousands of businesses SME've been saving 200-500 million per year thanks to standardized accounting work with AccNet Cloud

SIGN UP CONSULTATION AND DEMO TODAY

Step 4. Filing due date & records storage

Deadline:

- According to the months: Before the 20th day of next month.

- By quarter: Before 30 days of the first month of the next quarter.

Form submission of VAT declaration electronic:

- Truy cập: https://thuedientu.gdt.gov.vn

- Log in tax code, digital signature.

- Upload declarations XML → save → sent → get the confirmation message.

Storage:

- Receipts confirming the submission of the declaration.

- VAT invoices electronic original.

- List of goods and services to buy – sell.

- XML File has file (stored for at least 10 years).

3. These flaws are often met & how to avoid the implementation of VAT declaration (additional) electronic

The errors can still occur if not checked. Here are the common error in business or acquired:

Declaration of electronic VAT, teen or false invoice, input – output

- Bill input overlooked → lose the right to deduct.

- Invoice output recorded the wrong date → influence states to declare.

- The bill has not yet signed a valid number → not be accepted.

Solution:

- Using the software may connect the electronic invoice, bill alerts unfinished.

- For data projector recurring bills with the system of internal accounting.

The wrong industry code or applicable tax rate non-right

- 5% service be wrong 10% → pay the tax balance.

- Goods not taxable, be is taxable goods → increase the wrong obligations.

Solution:

- Check out digital industry code of business on the business registration contract.

- Reference chart current VAT circular 219/2013/TT-BTC.

Declaration wrong states, late or submit missing profile

- Put month bill 5 on September 6 → device type deduction.

- Submit the following term → sanctioned by Decree 125/2020/ND-CP (the penalty from 2 to 8 million/times).

Solution:

- User software has the function prompt-term declaration.

- The set up process cross-checked before submission.

Recorded wrong or missing VAT on the purchase of fixed assets

- Bills machinery recorder VAT 10% but not put into the system → lose the right to deduct.

- Declaration wrong any depreciation → do wrong cost, CIT.

Solution: Integrate the property into the accounting system to track depreciation, expenses, VAT sync.

Read more:

- Settlement tax personal income the correct term to avoid administrative sanctions

- License tax due date to avoid fines and business interruption

4. Checklist how to declare VAT (additional) electronic periodically for business

To ensure the process for how to declare VAT is implemented in full – term right – no flaws, businesses should apply table checklist below is particularly useful for the unit is implementing the accounting system integration:

Before the declaration

- Reviewing invoice input/output is full, valid, signed electronically.

- Reconcile ledger accounts, 133, 3331, 511 with list of bills.

- Check the data arise related to fixed assets (bills investment, handover...).

- Update this privacy policy from VAT latest (tax rates, audience free/reduced...).

In the process of declaration

- Establishment declaration form 01/VAT true in the form of circular 80/2021/TT-BTC.

- Calculate, record the correct target output VAT is deductible input.

- Carefully check the data entered before the export XML (avoid misleading arithmetic).

- Part of the program, if there are bills flaws in the states.

After submission of the declaration

- Archive file XML, receipts, confirmation of the tax authority.

- Hosted prints declarations, tables, statistics, bills, receipts adjustment (if applicable).

- Collate the data internal to prepare for the declaration and the next.

- Updated tax report, internal sync with accounting software financial.

How to declare VAT (additional) electronic is the professional accounting imperative, but also an opportunity for businesses to control system for income and expenditure – tax in a transparent, professional. In particular, in the context of ongoing business accounting solutions, tax items, the process to declare the tax will:

- Optimize the right to deduct tax refund.

- Avoid risks, arrears, penalties for late declaration.

- Closely linked data with the division of property, investment, internal finance.

When a business applies accounting software is the ability to auto-aggregate – declaration – data connection taxes, the whole process will become faster, more accurate, more secure.

If you are looking for an accounting software can help make the way of VAT declaration electronic efficiency, at the same time links coherent with assets accounting, management, invoice modules related – then AccNet Cloud is the solution you should consider.

With AccNet Cloud, you will get:

- Automatic data aggregation invoice input/output according to states.

- Automatic establishment of the declaration of VAT properly form the XML file standard.

- Error alert, prompt tax payment extension.

- Closely connected with the data property, investment, depreciation, help declare right – enough – time.

Experience consulting & demo for free today AT THIS

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: