In the system of financial management and accounting, if the year-end tax report is the stage of total links, then report the tax on a quarterly basis (BCTTQ) is the rhythm, check the financial health periodically. The establishment BCTTQ not only help businesses comply with the law, but also is the basis for cash flow management, control over income and expenditure, thereby making the investment decision – shopping property reasonable.

With the ongoing business accounting system assets, the frequency of BCTTQ help businesses quickly control the expenditures, investment recorded depreciation timely, avoid errors accumulate lasts all year.

This article will instructions for making tax report quarterly details under the process, from theory to practice, from form to note legal help business report fast – correct – on time, at the same time effective integrated with the accounting system property for optimizing the operation of finance.

1. Why business need to do to properly report tax on a quarterly basis?

Report quarterly vat is mandatory activity with the majority of businesses, especially small and medium enterprises. Right, enough not only legal compliance, but also help businesses:

- Monitored financial situation – obligation tax – costs incurred in the short term.

- Detect errors early before they lead to serious irregularities in year-end tax report.

- Increase transparency, reliability with tax authorities, help reduce the risk of inspection and unexpected.

In the case of businesses are investing in machinery, equipment or upgrade fixed assets, the guide to reporting quarterly tax help:

- Track progress depreciation.

- Recorded promptly the eligible costs.

- Determine the deduction of input VAT on the correct states.

Read more:

- System for electronic tax reporting most modern

- How to make tax reporting detailed help new accounting confidently make

- The implementation of tax obligations online simple right accounting process

2. Tax reporting according to you what is? Business must submit the kind?

The concept? What is the difference with the reported year?

Report quarterly tax is the business made the declaration, pay all taxes (VAT, PIT...) to the tax authorities according to cycle, 3 months, instead of monthly declaration.

Distinguished with year-end tax report:

| Criteria | Tax report quarterly | Year-end tax report |

| Frequency of submission | 3 months/time | 1 time at the end of the financial year |

| Target | Track tax obligations short-term | Synthesis of the entire tax obligation during the year |

| Form | Declarations, VAT, PIT, bill... | Settlement CIT, PIT, financial reporting |

| Level of detail | Focus in any quarter | Comprehensive, synthetic |

Guide to report quarterly tax help business adjust soon flaws, avoid cumulative error to the end of the year that cause the risk of arrears, heavy fines.

The type of report business tax payable on a quarterly basis

Here are the types of statements/rules often meet that business need to make quarterly:

Declaration of quarterly VAT – Form 01/VAT

- For business apply the method to a tax deduction.

- Included: VAT deductible input VAT outputs payable.

- Declaration according to the principle arise in the states, no distinction has paid or not.

Declaration of personal income tax by quarter – Pattern 05/KK-TNCN

- Aggregate taxable income, the amount of money withheld by employers.

- Be submitted on a quarterly basis if the business has incurred deduction of personal income tax from wages and remuneration.

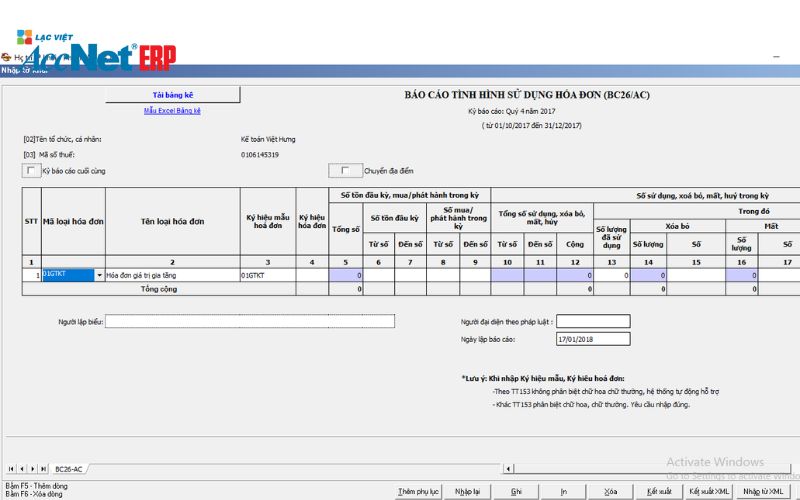

Report on the use of bills (if available)

- Apply with businesses still use paper invoices, invoice printing.

- Do not apply if the business use entirely electronic invoices according to the Decree 123.

Note: The business had revenue under 50 billion/year is quarterly vat declaration. If revenue exceed this level, then have to switch to the declaration according to months, unless registered on the contrary, be approved.

3. Instructions on how to do tax reporting quarterly detailed step by step

DOWNLOAD THE SAMPLE REPORT QUARTERLY TAX - FORM 01/VAT

DOWNLOAD THE SAMPLE REPORT QUARTERLY TAX - PATTERN 05/KK-TNCN

The guide makes tax reporting a quarterly basis not only requires the correct form, time-limit, but also requires business process test – compare accounting data periodically. Below is a practical guide in 5 steps standard:

Step 1. Determine obliged to declare by quarter or by month

Base determined: According to Clause 1, Article 8, Decree 126/2020/ND-CP, the business had gross revenue of the preceding year under 50 billion will declare VAT, personal income tax, according to you.

This is automatically applied, no registration required. However, if the business can change the method declaration (for example: move from the may declaration to you), notice to the tax authority before the date 31/1-year plan.

Suggestions: Businesses should be reviewing revenue year ago lookup on the tax system or exchange with the consultant to determine the correct method declaration.

Step 2. Collect – check your bills, vouchers input/output

This step plays a role platforms to avoid publicity teen – wrong:

- Output: Synthetic VAT invoices for the goods, providing services in the quarter. Check to see if there is destroyed, not adjustable.

- Input: Check the validity of the purchase receipt to (have the code of the tax authority, the right format electronic invoice, the full information).

- Collated with bookkeeping: Must match the ledger accounts, revenue, cost, liabilities, assets...

Special note: With business investment in fixed assets need to check out these shopping bill machinery and equipment to record in assets – service depreciation, accounting for expenses reasonably correct states.

Read more:

- Lookup biểu thuế xuất nhập khẩu điện tử nhanh và chính xác

- Way khôi phục mã số thuế doanh nghiệp bị chấm dứt hiệu lực

- The deadline for filing tax returns theo quy định năm 2025

Step 3. Set sheet quarterly VAT declaration (Form 01/VAT)

Steps taken:

- Calculate the VAT output: Total amount of VAT payable from sales activities and providing services.

- Calculate the input VAT is deducted from the purchase invoices, service, production service – business.

- Determine the amount of VAT payable = VAT output – input.

In no case arising active sales or purchases, the business must still file a declaration in white from view is omitted obliged to declare.

Step 4. Establishment declaration PIT quarterly (Form 05/KK-TNCN)

Applicable objects:

- Businesses can deduct personal income tax from wages, salaries, remuneration of workers.

How to perform:

- Synthesis of the entire taxable income in the quarter of employees.

- Collate the board wages – payment wages – contract of employment – proof of the deduction.

- Calculating the amount of tax withheld in accordance progressive tariff each section.

- Specifies the number of workers, the total income subject to tax, withheld number, have to pay more or is finished.

Note: If in states not incurred a tax deduction, business't need to set up the declaration. However, if incurred in the next, they must declare additional from the previous quarter.

Step 5. Filing electronic tax deadlines

Deadline reports quarterly tax: Slowest day 30 of the first month of the next quarter. For example: report quarter 1 have to submit before the day 30/4.

Submission form:

- Qua cổng thuế điện tử của Tổng cục Thuế: https://thuedientu.gdt.gov.vn

- Using digital signatures, valid file in XML format.

- Can be set directly on the accounting software integrated port taxes (as AccNet Cloud), then the output XML to submit quickly.

Documents required storage:

- Tax, VAT, PIT.

- List of bills, vouchers buy – sell.

- Tax receipts, withholding certificate PIT.

- Details window of fixed assets related to the reporting period (if any).

4. Important note during the implementation guide reporting quarterly tax

To limit errors when reporting tax you – especially when a business has operations recorded assets – need to pay attention to the following points:

Invoice errors – processing before the establishment of the declaration

- Bill is the wrong company name, tax code, unit price, amount... need of the program, or invoice replace before putting on the report.

- According to the Decree 123/2020/ND-CP: If false detection in the same quarter, adjusted in it. If after you → record adjustments in the current quarter, but to annotate clear.

This directly affects the tax VAT is deducted reasonable cost when making a year-end tax report.

Learn more:

- Người có 2 mã số thuế cá nhân cần hợp nhất ra sao?

- Doanh nghiệp bị penalties for late submission of the declaration cần làm gì?

- Way accounted amount for late payment of tax in business

Recorded depreciation of fixed assets according to you

- Property incurred in the quarter to be recorded, start depreciation from next month according to circular no. 45/2013/TT-BTC.

- If the enterprise does not update the data depreciation timely in the quarter → costs will not be charged to tax report correctly states.

- Should use accounting software property to automatic depreciation, the export table to allocate the cost on declare.

Avoid noted the lack of reasonable cost in the quarter

- The expenses such as electricity, water, office supplies, cost of rent in addition to... need to have valid invoice, vouchers to spend money, accounting the correct account.

- If to survival → will not be included in the cost when calculating corporate INCOME tax, increase the amount of tax payable.

Note added: When costs related to the assets (equipment maintenance, operating machines, etc.) not allocated properly, easily lead to false when preparing financial statements.

5. Software support set to report quarterly tax

The use of accounting software to help businesses not only saves time but also ensures the accuracy – complete – the correct term, especially with the volume of large bills, need to manage all fixed assets.

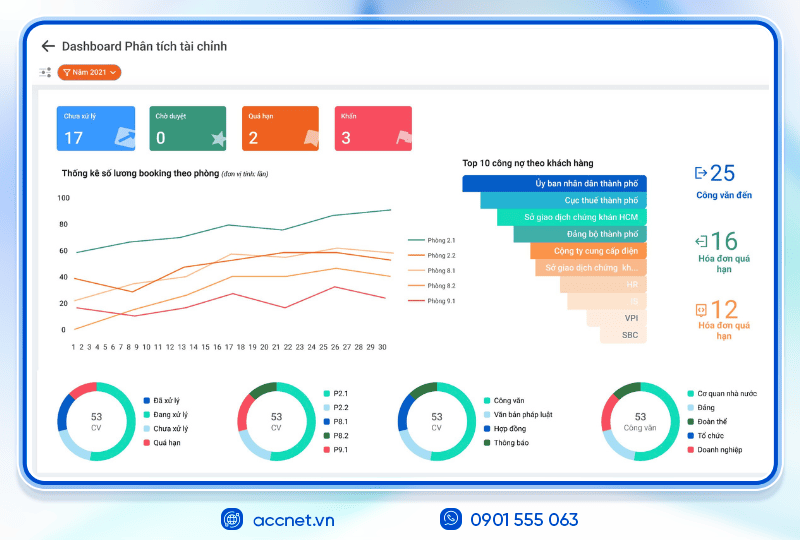

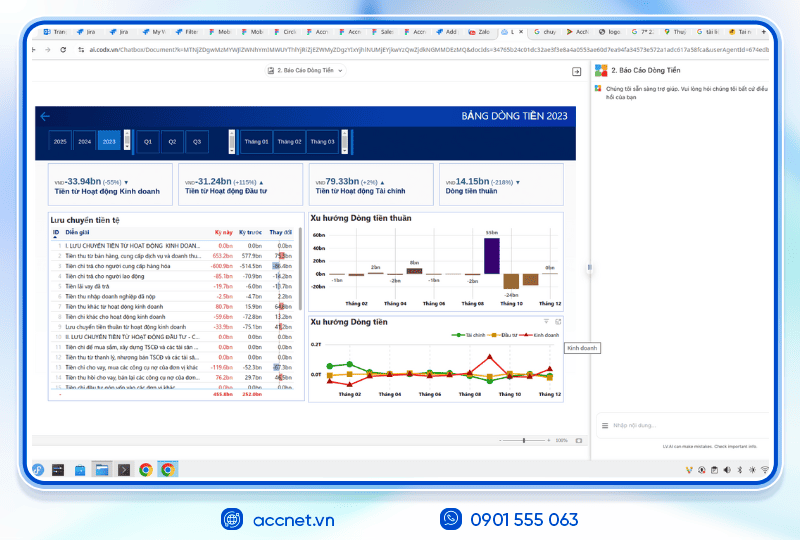

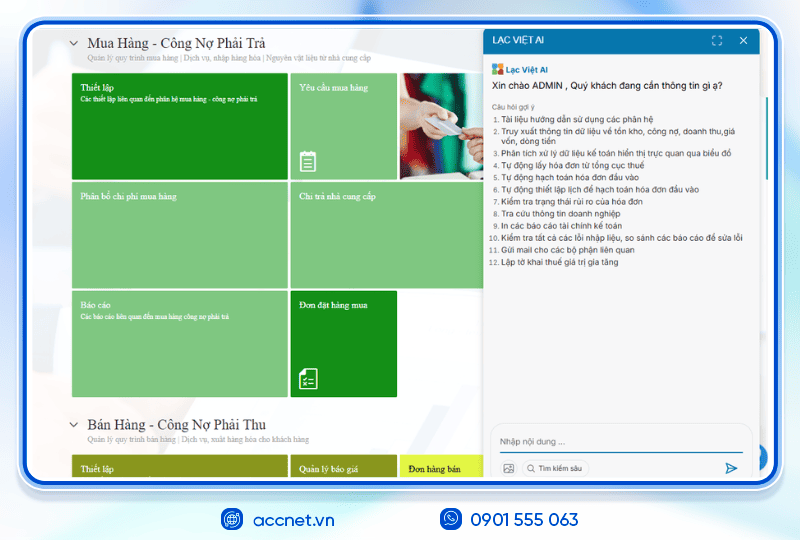

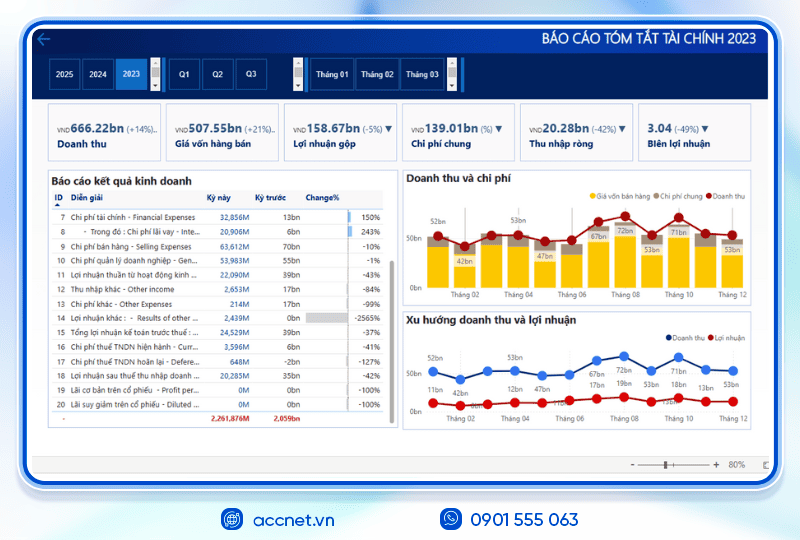

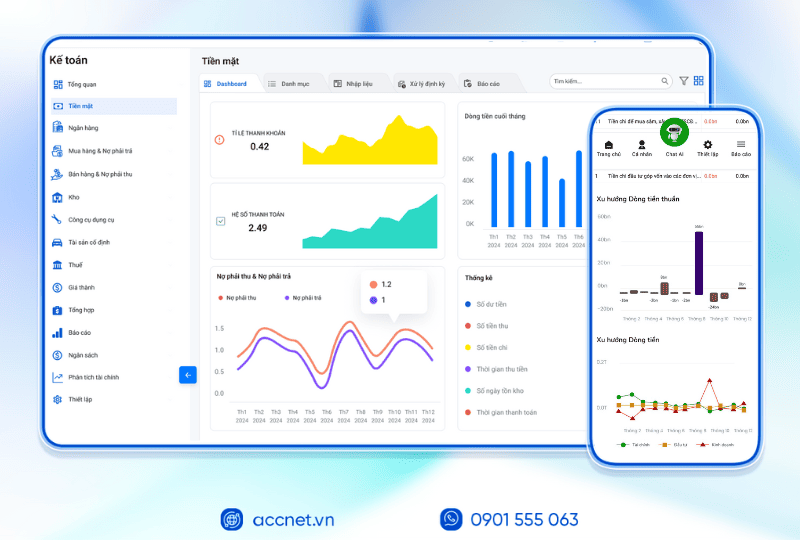

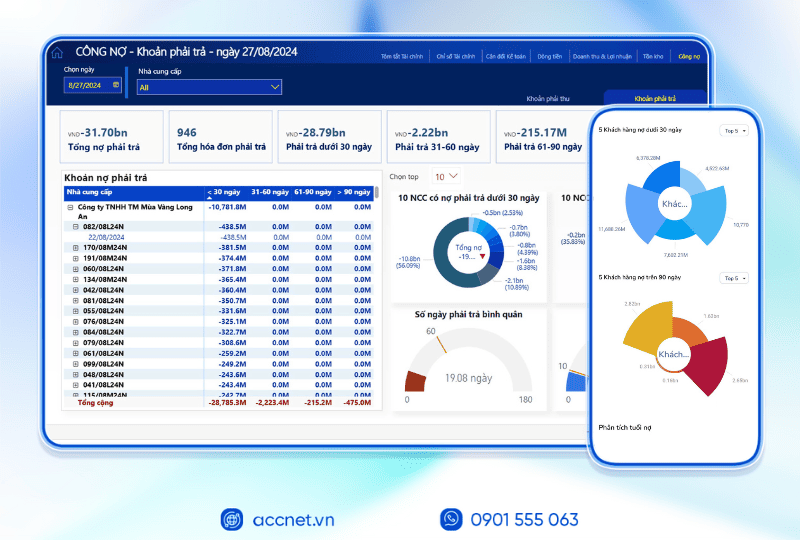

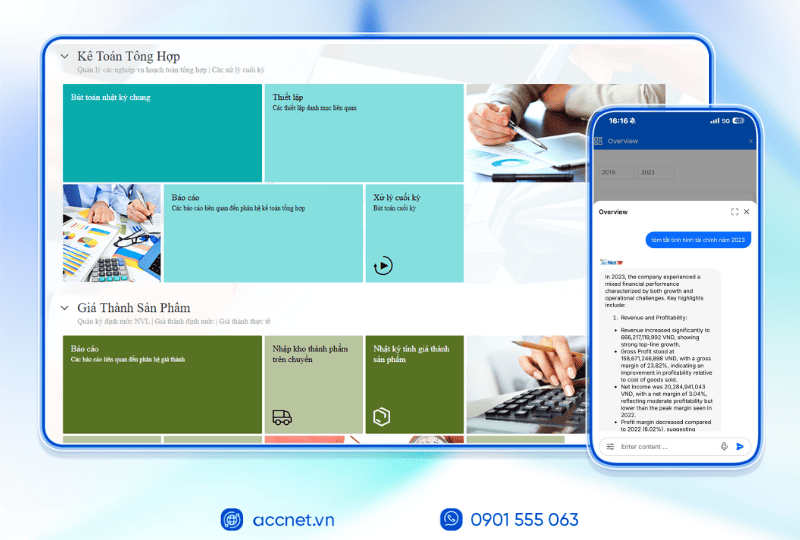

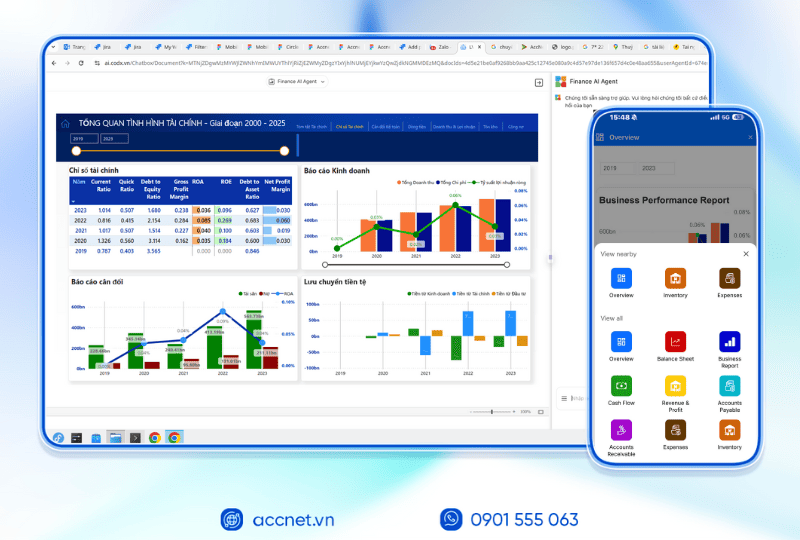

AccNet ERP is accounting software, modern designed exclusively for business, with the ability to connect data accounting – tax – financial only in a single system.

Outstanding features to support tax reporting on a quarterly basis:

- Automatic synthesis invoice output – input coupling data with ledger.

- Create fast tax, VAT, PIT quarterly strictly according to the latest model.

- Alert deadline, tax help, accounting proactively prepare record.

- Export XML file submitted directly through the portal of electronic tax.

- Associated with the assets accounting help accounting depreciation right states – the right of property.

Fits small and medium enterprises are implementing accounting system overall, need a flexible solution, but still exactly the norm.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

6. Checklist report quarterly tax for business

Below is a list of necessary checks to ensure businesses do not survive step – 't wrong term – no flaws:

Before reporting:

- Redefine revenue year ago to the classification method declaration.

- Check out the full invoice buy – sell out in the quarter.

- Collated evidence from payment, payroll, investment decision property.

- Check back record fixed assets (if any investment).

In the reporting process:

- Draw up the declarations, VAT, according to the form 01/VAT, reconcile input tax – output.

- Establishment declaration PIT form 05/KK-TNCN, collated with the pay table.

- Recorded fully depreciated assets if incurred.

- The XML file correct format electronic tax systems.

After submission:

- Check out tax receipts or confirmed electronically.

- Stored electronic records, prints prescribed (minimum 10 years).

- Recorded planning, tax reporting next quarter.

Guide tax report quarterly is “early warning system” to help businesses capture financial situation – obligation tax – cost-effective right from each quarter. In particular, with ongoing business accounting system assets, the report right you'll help:

- Recorded depreciation of property, timely, valid.

- Optimal cost reasonable – avoid incurring tax arrears last year.

- Active control cash flow – investment performance.

Don't let the tax burden is at the end of the year – let's start control from each quarter. Experience now AccNet Cloud – accounting software new generation to help set up tax reporting fast – accurate – smart integrated with the accounting system property.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: