Cash flow is the "lifeblood" operation of the business, particularly in the context of market volatility, input costs escalate, the pressure of competition is increasing. Many businesses have accounting profit is positive but falls back into a liquidity shortage, even bankruptcy due to uncontrolled flow of money.

In particular, with the business now in the implementation phase system assets accounting, controlling, coordinating, cash flow became more important. Because investment property often requires large cost, recovery time, long, directly affect the flow of money out – of business.

The article below will help businesses understand the true nature how to manage cash flow effective analysis of the strategy – method – optimization tools in control the flow of money from which to make decisions accounting – finance accurate, durable.

1. Why business need to understand how to manage cash flow?

Cash flow is the key factor decides the ability to survive long-term development of the business. According to the survey of QuickBooks in the year 2023, there to 82% of small businesses fail is due to problems related to cash flow.

Cash flow management is not only keep track of the money available in your bank account, which is the process of actively planning, control, optimum cash flow in – out, intended to ensure liquidity, ability to pay on time, maintain business operations, re-investment.

In particular, when business investment in fixed assets (such as factories, machinery, software,...), if there is no strategy to manage cash flow, it will easily lead to shortage of finance short term, affect the operation or forced to take loans with high fees.

Read more:

- Optimize cash flow business tool of smart

- Revenue and expenditure management business in Excel simple but effective

- Management, sales to help optimize profit per day

2. How to manage cash flow is what?

The concept of cash flow, the type of cash flow

Cash flow (Cash Flow) is the movement of cash into or out of the business in a given time period. This is the only number that reflects the liquidity fact – completely different than accounting profit.

The type of cash flow main business include:

- Cash flow from operating activities (Operating Cash Flow): come from sales revenue, service delivery, operating costs (salaries, rent, raw materials...).

- Cash flow from investing activities (Investing Cash Flow): related to shopping or liquidation of fixed assets, investments in other companies, new projects.

- Cash flow from financing activities (Financing Cash Flow): come from loans, issuing stock, paying dividends, interest expenses.

For example: Business revenue of 5 billion, accounting profit 500 million but negative cash flow of inventory not yet sold, customers delay payments or expenses for investment in large machinery – this potential risk to cash flow.

How to manage cash flow: definition - objectives core

How to manage cash flow is the sum of methods, tools, and techniques to:

- Planning cash flow-specific cycle (week, month, quarter).

- Monitoring, analysis of cash flows fact (for lighting design plan with realistic).

- Forecasting of financial volatility affect cash flow.

- Management decision-making (cost – revenue – investment) based on cash flow analysis.

Target: Ensure cash flow is always positive, help businesses:

- Have enough ability to pay short-term obligations.

- Seize investment opportunities at the right time.

- Avoid dependence on short term loans not necessary.

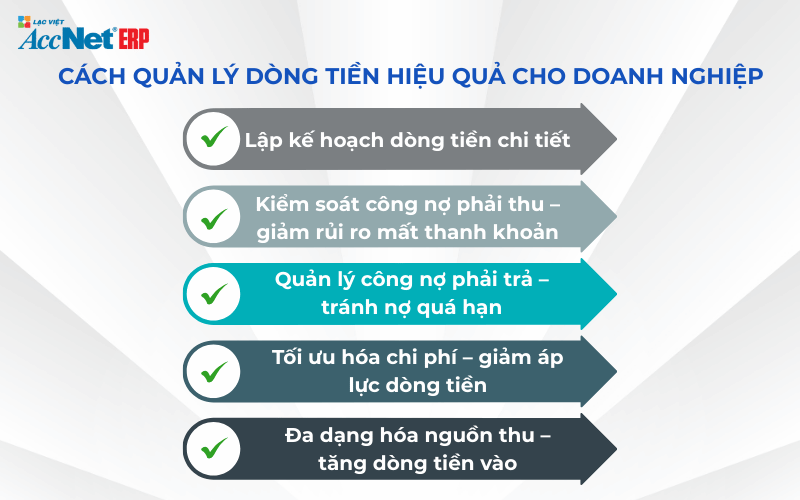

3. The steps to manage cash flow effectively for business

How to manage cash flow effectively not able to perform according to the sense which need to have the process post, particularly when businesses are investing in fixed assets – a field spend a great cash flow, extend the time for capital recovery.

Step 1. Planning cash flow details cyclical

Planning cash flow is the first step, the most important to control the flow of real money. Businesses should:

- Determine the cycle plan: week by week/month/quarter depending on the particular industry scale.

- Forecast cash inflows: from the expected revenue, accounts receivable, revenues from the lease of property, interest on investment...

- Forecast cash flow out: fixed costs (salaries, rent factory), variable costs (raw materials), the investment property, loan repayment...

Practical example: A manufacturing business plan cash flow in the first quarter of 2024 shows months 2 project cost 2 billion for the purchase of new equipment, but the money flow in from customers, only about 1.2 billion. Thanks to the previous forecast, business timely adjust calendar, expenditure, balance loans short term right time.

Read more:

Step 2. Optimization of the revenue – expenditure in how to manage cash flow

Administrator spin cash is a core element. If the slow, detailed, fast, the enterprise always face risks, pussy, cash flow, though still have interest in accounting.

- Managed receivables: set up credit policies closely, deals early payment, apply measures debt collection efficiency.

- Control public debt to pay: negotiable prolonged term reasonable payment that does not affect the relationship with the supplier.

- Optimal inventory: Avoid inventory too much cause remanded cash flow.

Recipe spy: Conversion cycle-cash (CCC) = Number of days of inventory + Number of days receivables – Number of days to pay → CCC as low as possible, as fast money.

Step 3. Cash flow analysis in fixed assets

Fixed assets directly affect cash flow:

- Spend big money at the time of purchase: machinery, vehicle, transport management software,...

- Recorded depreciation according to states: help allocate costs but does not reflect directly the money out in the states.

- Affect cash flow and investment: businesses need to compare investment costs, generating cash flow, after investments.

Suggestions: Combination accounting software to track the life cycle of assets – depreciation – cash flow investment in each project.

Step 4. Check – monitor cash flow in real time

Continuous monitoring to help businesses make timely adjustments in cash flow if deviated from the plan:

- Reporting cash flows on daily/weekly: comparison of forecast and actual.

- Use dashboard finance: display cash flows intuitive, alert sound cash flow.

- Decentralized monitoring departments: in order to effectively control each department (purchasing, sales, investment...).

4. The methods, tools, support, how to manage cash flow effectively

Business can't manage cash flow effectively only by Excel or recorded manually. The application of accounting methods suitable digitizing tool will improve accuracy, save time, increase work productivity.

Accounting methods accrual - cash accounting

| Criteria | Accrual accounting | Cash accounting |

| Recorded revenue/cost | When the transaction | When the money is actually received/spent |

| Matching | Business scale, medium/large | Big business, small business |

| Advantages | Reflect the true financial situation | Simple, easy-to-follow |

| Cons | Can deflect with cash flow real | Not suitable when the need to set up FS |

Note: Businesses use accrual accounting should additional reporting cash flows separately to control liquidity.

Application software assets accounting in how to manage cash flow

Accounting software such modern AccNet Cloud allows:

- Tracking fixed assets is comprehensive: from the moment of purchase – use – depreciation – liquidation.

- With integrated module cash flow: check and record cash flow details for the property as each landmark time.

- Automatic plan investment expense, depreciation → from that business plan, cash flow monitoring, more realistic.

Recommendations: Business should choose software integrated accounting module assets, cash flow to manage sync, avoid skewed data between the parts.

ACCNET CLOUD – ACCOUNTING SOFTWARE ONLINE FOR SMALL AND MEDIUM ENTERPRISES Thousands of businesses SME've been saving 200-500 million per year thanks to standardized accounting work with AccNet Cloud

SIGN UP CONSULTATION AND DEMO TODAY

5. Case study: Business success through optimum cash flow from assets accounting

To illustrate more clearly to the effect of how to manage cash flow, combined with property accountants, we consider a real situation from a business in the manufacturing industry, mechanical equipment in Binh Duong.

Describe the situation before the application of cash flow management

This business investment in automation lines worth nearly 10 billion. However:

- The investment is not planning cash flow details.

- Do not analyze the impact to cash flow the operation.

- Teen monitoring report, monthly cash flow.

Consequence: Though manufacturing operations, increase productivity, businesses still lack the cash to pay wages, deferred payment provider, forced to loan credit mortgage with high interest rates.

Solution deployed: connect cash flow - accounting asset

After working with expert business accounting, implementing accounting software assets:

- Business reallocate investment budget, split phase purchase of machinery so as not to cause “shock” cash flow.

- Software to help automate the asset depreciation, cost planning, investment put into the model cash flow overall.

- Management, financial reporting, cash flow, investment, private to evaluate the possibility of withdrawing funds.

Results achieved after 6 months

| Criteria | Before deployment | After deployment |

| The state of liquidity | Continuous in 3 months | Ocean stability from the 2nd month |

| Planning cash flow | Making crafts, teen accurate | Systematic, automatic reporting |

| Capacity investment decisions | Emotional | Based on data cash flow |

→ Effective: Business increased coefficient of liquidity from 0.9 up to 1.5, at the optimum time is 12% cost of interest on loans only in the 2nd quarter.

6. Note & mistakes to avoid in how to manage cash flow

Manage cash flow effectively seemingly simple but in fact there are many “traps” business predisposed to, especially when not implemented accounting system basically.

Based only on reported profits instead of reporting cash flows

- Common mistakes: Business saw profit accounting high idea of his “healthy” financial.

- Fact: the profit can come from revenue not yet earned cash (receivables), or recorded not cost investment – does not reflect the cash flow real.

No reserve emergency expenses, depreciation of assets

- Many businesses do not provisioning cash flow risks, leading to deficiency of money when there are unexpected costs (repair of machinery and delayed payments...).

- Not planning asset depreciation leads to not see the cost impact long term cash flow.

Budget allocation, investment property, not to cash flow

- Buy large fortune at the same time make cash flow falls into a state of “dried up”.

- Plan, track asset life cycle to know when to replace, sell or re-investment.

Tips: Every investment property should be assessed carefully the impact on cash flow in the short, medium and long term.

How to manage cash flow effectively no longer is the choice that is the condition of survival for any business – especially those units are invested in fixed assets, improving the system of internal accounting. Three important actions businesses should take now:

- Re-evaluate the entire flow of current money: including operating cash flows, investment, financial – to determine the point of obstruction, the opportunity to improve.

- Standardized process for setting up, monitoring, planning, cash flow, fastened with the plan property investment, from which avoid the status of "interest-virtual – money's not there".

- Application accounting software specialized for fixed assets, integrated reporting depreciation, investment planning, long term, to help businesses control over financial more closely.

Business as soon established process for managing cash flow, it increases your ability to actively ago, market volatility, optimal efficient use of capital.

Starting from today, let's standardize the management of cash flow in parallel with the implementation of accounting system – to build a financial foundation solid, smart, sustainable for your business.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: