Apply the discount policy is an integral part to promote sales and create benefits for customers. To ensure legitimacy in bookkeeping, business needs to set up invoice discounting (HĐCK) đúng quy định pháp luật. Hiểu rõ các loại hóa đơn giảm giá và quy trình lập hóa đơn đúng cách giúp doanh nghiệp quản lý tài chính hiệu quả. Hãy cùng AccNet tìm hiểu ngay dưới bài viết sau!

1. Invoice discounting is what?

Hóa đơn chiết khấu (hóa đơn giảm giá) là loại hóa đơn mà doanh nghiệp lập để ghi nhận khoản giảm giá (chiết khấu) được áp dụng cho khách hàng trong các giao dịch mua bán hàng hóa/cung cấp dịch vụ. Chiết khấu có thể được áp dụng ngay tại thời điểm bán hàng hoặc sau khi doanh thu đạt được một mức nhất định theo thỏa thuận giữa hai bên. Các loại chiết khấu bao gồm:

- Trade discount

- Payment discount

- Discount sales

- Discount by promotion

Read more:

2. How to create/export bill discounting under the Ministry of Finance

2.1. Cách lập HĐCK thương mại

Chiết khấu thương mại là khoản giảm giá dành cho khách hàng khi họ mua hàng với số lượng lớn hoặc đạt được doanh số nhất định trong một khoảng thời gian. Chiết khấu thương mại thường được áp dụng để tăng khối lượng bán hàng, khuyến khích khách hàng thực hiện các giao dịch lớn hơn (Điều 4, Thông tư 219/2013/TT-BT)

Cách lập HĐCK thương mại:

- Specifies the number of goods, the rate of trade discount is applied on the invoice.

- Account trade discount is deducted from the total value of goods/services.

Business sales worth $ 200 million, applied trade discount of 5% for orders from 100 million or more.

- Debt TK 111/112 (Cash/Bank): 190 million

- Debt TK 521 (trade Discount): 10 million

- Have TK 511 (sales revenue): 200 million

2.2. How to set up bill payment discount

Payment discount is the discount is applied when customers pay earlier than the prescribed period. The purpose of the payment discount is encouraging customers to pay immediately or in a short period of time, help businesses improve cash flow (Article 16, circular no. 39/2014/TT-BTC)

Cách lập HĐCK thanh toán:

- Recorded the discount rate payment (for example: 2%) and the amount of the discount directly on the bill.

- Account the discount is deducted from the total payment amount.

Customers purchase worth $ 100 million, which is 2% discount if paid within 10 days.

- Debt TK 111/112 (Cash/Bank): 98 million

- Debt TK 635 (financial Costs): 2 million

- Have TK 511 (sales revenue): 100 million

2.3. How to create invoice discounting business number

Discount sales is the discount to be applied based on total sales accumulated that the client has achieved in a certain business. Kinds of discount is usually used to encourage the long-term cooperation, increase transaction value (circular 219/2013/TT-BTC and circular no. 39/2014/TT-BTC)

Cách lập HĐCK doanh số:

- Account discount sales be recorded on the invoice corresponding to the sales achieved in the states.

- Discount is deducted from the total amount to be paid by the customer.

The client achieved the turnover of 500 million in a quarter, enjoy a 3% discount on sales.

- Debt TK 521 (Discount sales): 15 million

- Have TK 511 (sales revenue): 15 million

Read more:

2.4. How to set the invoice discount/discounted by the promotion

Chiết khấu theo chương trình khuyến mại là khoản giảm giá áp dụng trong các chương trình khuyến mại đặc biệt, thường diễn ra trong một khoảng thời gian giới hạn nhằm thúc đẩy doanh số bán hàng/tiếp cận khách hàng mới (Điều 7, Thông tư 119/2014/TT-BTC)

Cách lập hóa đơn chiết khấu theo chương trình khuyến mại:

- Notes discounted by the promotion on the bill with a rate of % (percent)/specific amount.

- Account the discount is deducted from the total amount of payment or apply for the next order.

Customers buy 10 products, get 10% discount for next orders worth $ 50 million.

- Debt TK 641 (Cost of sales): 5 million

- Have TK 511 (sales): 5 million

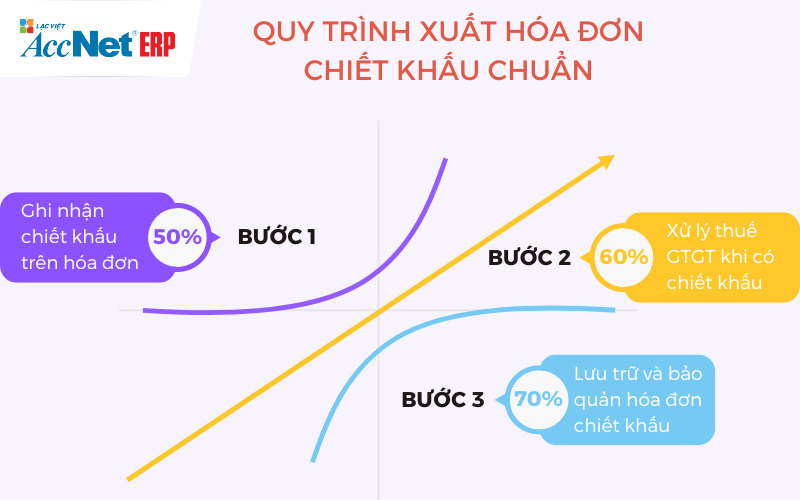

3. Process invoice discount/discount standard

Step 1: sign up to receive the discount on the bill

According to circular no. 39/2014/TT-BTC, the adjusted bill in the case of the discount after the establishment of the original invoice is mandatory- When the student discount (payment, commerce, sales, promotion), businesses need to recognize the discount directly on the bill of sale. The discount is deducted from the sale price, including the discount rate, the discounted amount.

- If the discount arises after the invoice has been set (for example: discount sales final), business to invoice adjustment. Bill adjustments will specify the chargeback, the information necessary to adjust the value recorded on the original invoice.

Learn more:

Step 2: Handling VAT when there is discount

According to circular 219/2013/TT-BTC, the business must declare and pay VAT based on the value subtract the discount (for trade discount) or value hasn minus discount (for payment discount)- Thuế GTGT được tính trên giá bán đã trừ chiết khấu thương mại. Nếu chiết khấu áp dụng sau khi lập HĐCK gốc, thuế GTGT phải được điều chỉnh tương ứng trên hóa đơn điều chỉnh.

- Payment discount does not affect the TAXABLE price. VAT is charged on the value of goods before payment discount.

Step 3: storage and preservation invoice discounting

Invoice discounts shall be stored together with the relevant documents. Storage time invoice discount is 10 years according to the Decree 123/2020/ND-CP.

Doanh nghiệp cần áp dụng các biện pháp quản lý nội bộ như kiểm tra đối chiếu hóa đơn, lưu trữ HĐCK cùng với hợp đồng mua bán, biên bản điều chỉnh, các chứng từ liên quan.

Refer to: Những điểm cần biết về chứng từ kế toán áp dụng hình thức trực tiếp

Invoice discounts play an important role in the recognition of the discount deals and help business maximize profit. Hopefully, through this article, you have captured the necessary knowledge about how to create/export invoice discounting to apply efficient in business operations.

HĐ chiết khấu thường khiến nhiều doanh nghiệp đau đầu với những rắc rối trong cách lập, hạch toán, đảm bảo tuân thủ quy định pháp luật. Nhưng tại sao phải loay hoay với quy trình phức tạp? Với phần mềm AccNet eInvoice, mọi thao tác từ tạo, quản lý đến điều chỉnh HĐCK đều được thực hiện nhanh chóng, chính xác, hoàn toàn tự động. Trải nghiệm ngay để biến HĐCK từ thử thách thành lợi thế cho doanh nghiệp của bạn!

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: