Today many businesses encounter problem about the handling of cash reserve fund at the end of the financial year. Accounting, then bewilderment don't know how to solve for the most effective. So, Does this issue have really worrying or not? And the accountants need to know what information to solve the problem above? AccNet will work with you to find a solution through the following article.

1. Cash reserve fund's assets or capital of the business?

Under section 1.4, article 112, circular no. 200/2014/TT-BTC has mentioned content as follows:

Method of setting targets “short-term Assets (Code 100)” on the balance Sheet include “Money”, in particular:

“Money (Code no. 111)

Is the indicator reflects the entire amount of business available at the time of the report, including: Cash in fund of business, deposits bank deposits and money is moving. Data to write to the only goal of “Money” is the total outstanding balance of the account 111 “Cash”, 112 “bank deposits” and 113 “Money transfer”.”

But so from the information on the cash reserve fund is considered short-term assets of the business.

Besides the classification, it also has its own rules, requirements for handling cash reserve fund according to article 12 and circular no. 200/2014/TT-BTC as following:

“Fund accounting, cash must be responsible for opening the window, fund accounting, cash, notes, daily, continuously in sequence arising revenues and expenditures, export, import, funds, cash, foreign currency and out of the reserve fund at all times.

The treasurer is responsible for management and import and export of cash funds. Daily treasurer must inventory number conservation fund actual cash, collated data cashbook and ledger cash. If there are any discrepancies, accountants and cashiers have to check the back to identify the causes and propose measures to handle the difference.”

Therefore, keeping track of cash is to very important for every business. Requires the department of accounting, especially income and expenditure and the treasurer must regularly check and collate the data. To ensure that data is recorded in a truthful and accurate way that I can.

Read more:

2. Case cash survive too much on the FINANCIAL statements, then the accountant should be how?

Determining whether cash balances are high or does not require to calculate the percentage of cash in total assets of the company. Made compare it with the components of other assets appear on the balance sheet at that time and compare with in need of cash at the time of making balance sheet.

If a company leaves a large amount of cash on the financial statements, the accountant should find out why. Can be classified into the following reasons:

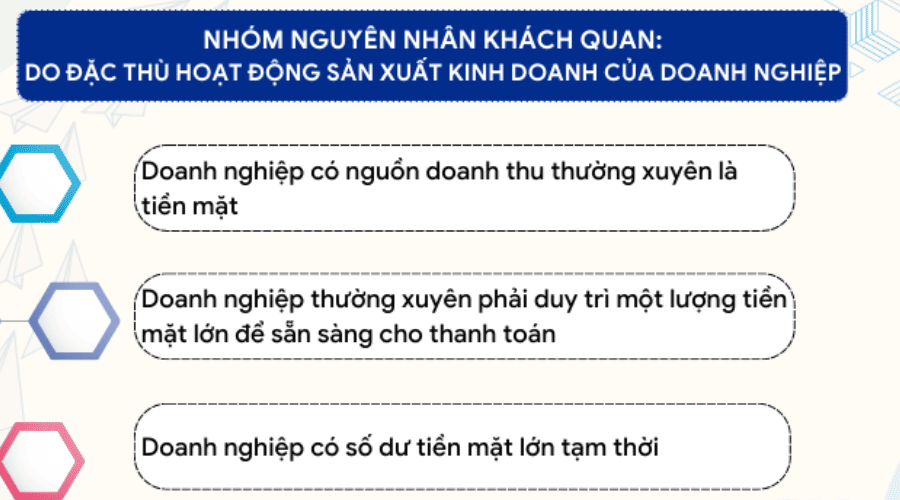

2.1 objective reasons

Handle cash funds exist many due to the peculiarities production activities of business:

- Source ordinary income of the company is cash. In this case, the revenue generated by a regular and constant, so the company has a large cash on the books.

For example, retail stores, supermarkets, English language center, training base for the department of labor export... usually have a large amount of customers prefer to pay by cash.

- Businesses often hold a large amount of cash to prepare for the payment. This is the unit operations and cash expenditures often. So must always have available a large amount of cash to be ready when needed.

For example, a company specialized in collecting products from the farmer to pay cash for everyday purchases.

- Businesses have temporary cash balances large. The cause is due to accounting just to the bank perform withdrawal of deposits of cash funds to prepare payment transactions. In some units, businesses, salaries of officers, workers, officials,... be paid in cash should pre-pay period (usually the end of the month and end of the year), accounting often withdraw large amount of money deposit in a bank of funds . And may this occasion coincides with the date of the end of the financial reporting should be to present information on the financial statements, the amount of cash on the financial statements can be big.

For example, some businesses in mountain areas and islands where the bank account is not uncommon to have to select cash method paid. Payment by cash is also very popular in the construction company where the majority of the employees are unskilled workers, and in companies that use temporary workers or contract.

So, the accountant does not need too worry about the balance of cash when handling cash funds exist many, due to the group of people from the peculiarities of operation of the company. Accounting can record more of the additional notes to the financial statements to help the reader grasp the operational details manufacturing business.

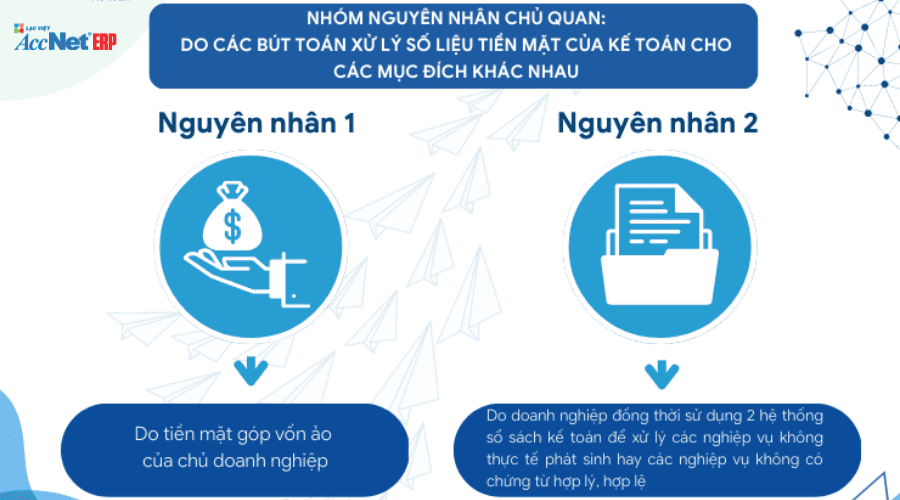

2.2 subjective

Due to the accounting entries for data processing cash of accounting for various purposes:

- According to the contributed capital virtual of the business owner:

This usually occurs in company liability due to one or a number of people master. In sign up business capital of establishment of the company and contribution term is defined under the law. If to limit capital contribution that business has not deposit the full amount of capital has been committed, then the accounting records of capital virtual: debit 111/have TK 411.

The amount of cash, this is purely virtual. This money exists only on account balances 111 or cashbook to meet the local project capital contribution according to the provisions of the law. So, the books of the company always express cash balance due to the influence of the recorded accounts capital contributions virtual talk on.

- Business simultaneous use of two accounting systems to handle the transaction does not actually incurred or transactions not have valid documents.

Businesses often incurred the expenses without receipts vouchers, the cost of “not official”. So, the auditors did not want to see it on the books of the company, the publication of information to the outside... These costs usually be spent from the fund in cash.

Handle cash funds exist many do not arise or there is not enough evidence from the reasonableness of the expenses on the should be some accounting, business owner, for that is not recorded in accounting books submitted to the tax authorities. Therefore, the business uses a system of private accounting to record and track the actual costs incurred, the longer the official account to submit to the tax authorities do not show their current cash is reduced.

For this cause shall a of the direction handles still ensure compliance with legal regulations as follows:

- Do not use pens payment of capital contributions virtual to deal with regulations on term capital contribution. Which should perform accounting on the books according to the amount of capital contributed. Expiration of contributions that the capital contribution has not contributed enough capital, the company must register the change of initial capital.

- Post the account disbursement in cash without evidence from support on bookkeeping

Read more:

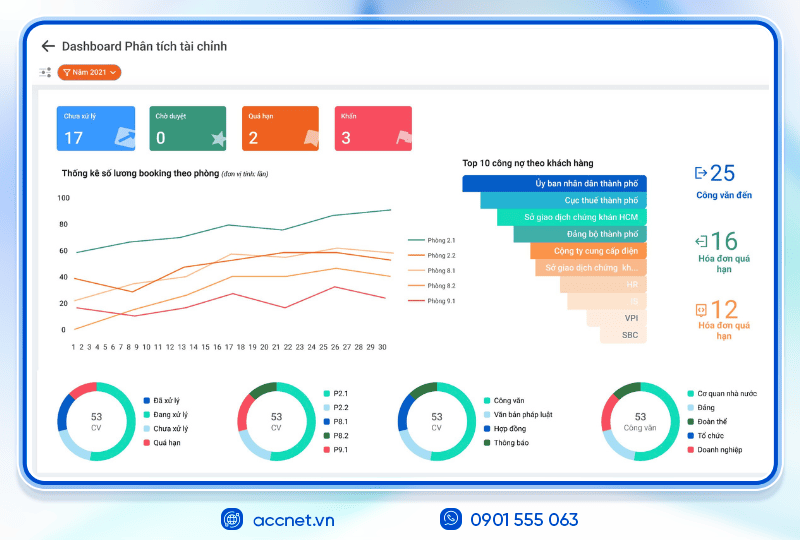

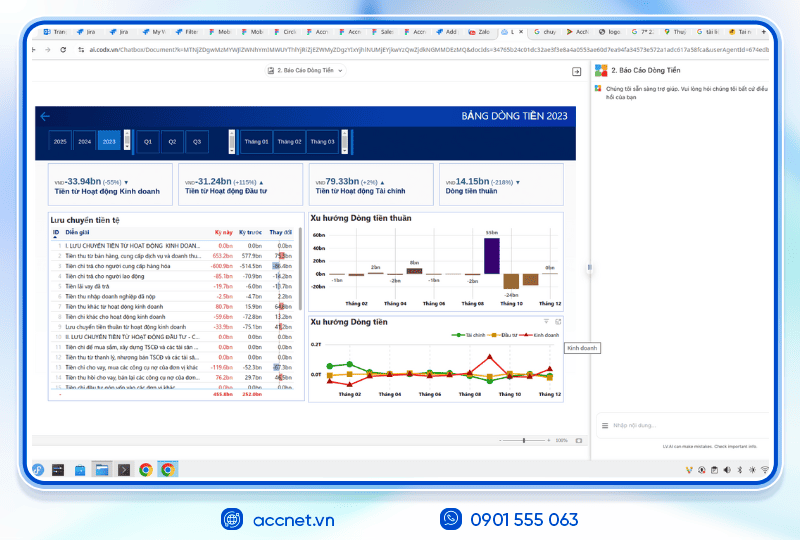

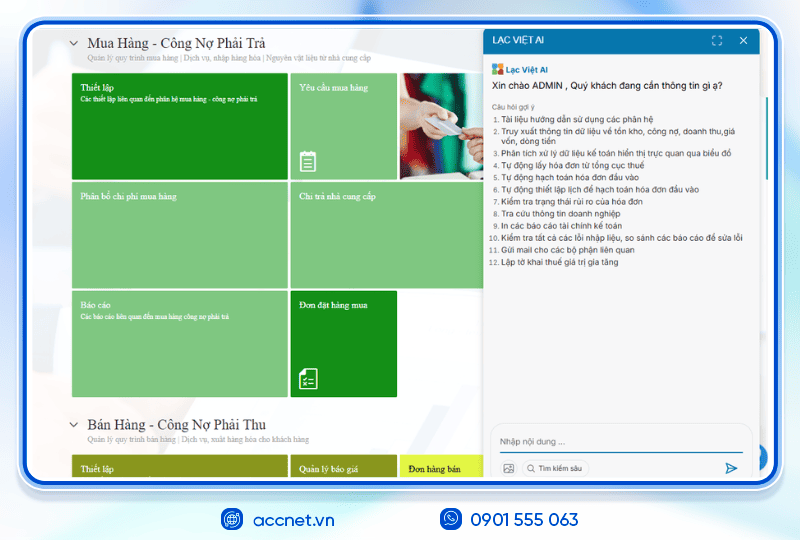

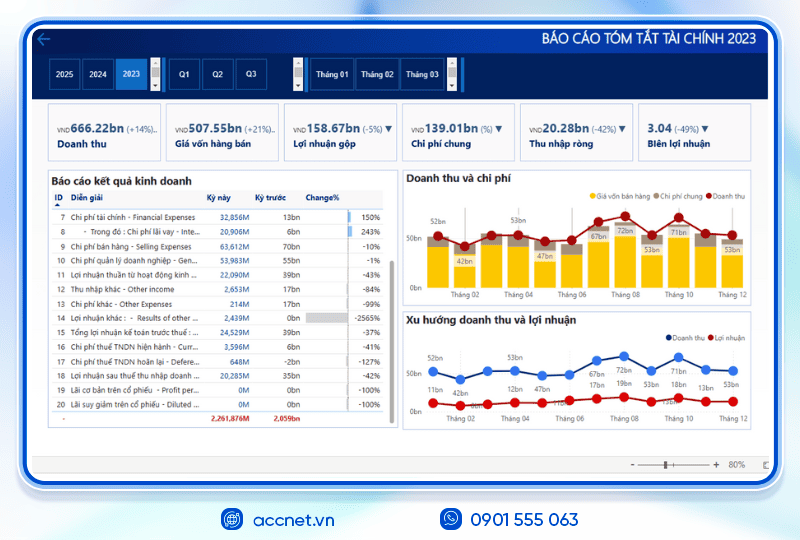

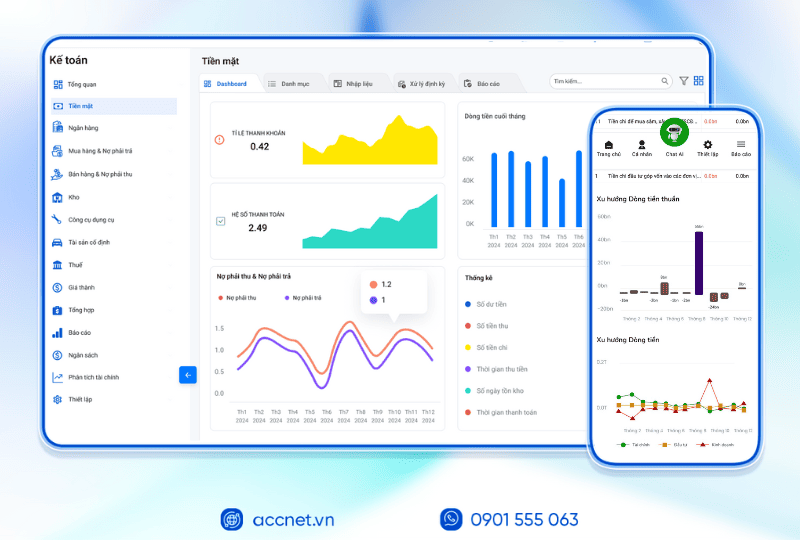

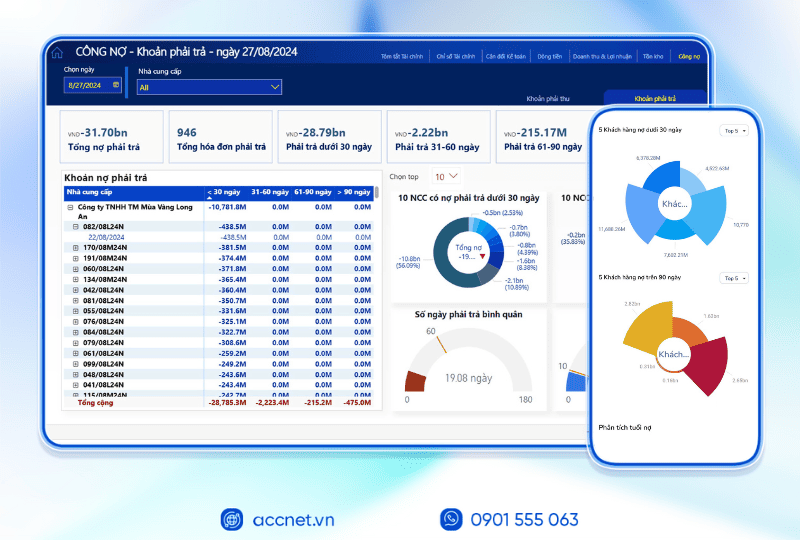

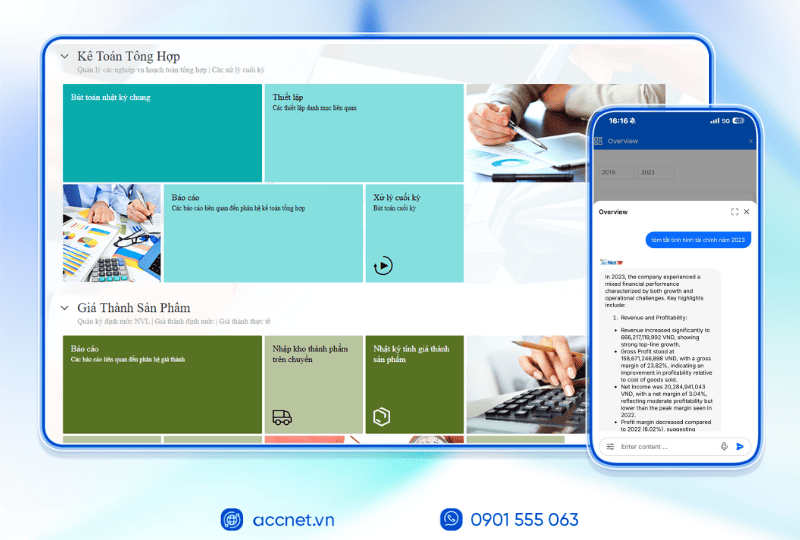

3. Tự động quản lý “Tiền mặt – Tồn quỹ” với AccNet ERP

Trong bài “Tiền mặt – Tồn quỹ và những điểm cần lưu ý”, bạn dễ dàng nắm được các nguyên tắc kiểm soát quỹ, đối chiếu số dư thực tế với sổ sách, xử lý chênh lệch và tuân thủ quy định tài chính. Tuy nhiên, việc theo dõi dòng tiền mặt thủ công — ghi sổ, so sánh, kiểm tra — dễ phát sinh sai sót, thiếu sót hoặc chậm trễ cập nhật.

Đó chính là lúc AccNet ERP phát huy vai trò của mình như công cụ quản lý tài chính tự động:

- Cập nhật số dư quỹ theo thời gian thực: các phát sinh thu – chi được đẩy ngay vào hệ thống, quỹ luôn được phản ánh chính xác.

- Kiểm soát chênh lệch tự động: khi phát sinh sai lệch giữa thực tế và sổ sách, hệ thống sẽ cảnh báo để người quản lý kịp tra soát.

- Ghi nhận phát sinh vào tài khoản tương ứng: mọi giao dịch tiền mặt—chi phí, thu nhập, tạm ứng—được ghi đúng vào tài khoản liên quan mà không cần nhập tay.

- Báo cáo quỹ chi tiết: bạn có thể xem báo cáo tình hình quỹ theo ngày, theo loại giao dịch, so sánh giữa kỳ; dễ dàng tổng hợp và đối chiếu.

- Liên kết với module khác: khi mua hàng, bán hàng, thanh toán phát sinh tiền mặt, module kho – bán hàng – tài sản đều kết nối, đảm bảo số dư quỹ trong hệ thống luôn khớp với từng hoạt động.

With AccNet ERP, quản lý tiền mặt và tồn quỹ không còn là công việc thủ công mệt nhọc mà trở thành quy trình chuẩn, tự động và an toàn — giúp doanh nghiệp tối ưu dòng tiền, giảm rủi ro sai sót và kiểm soát quỹ chặt chẽ hơn.

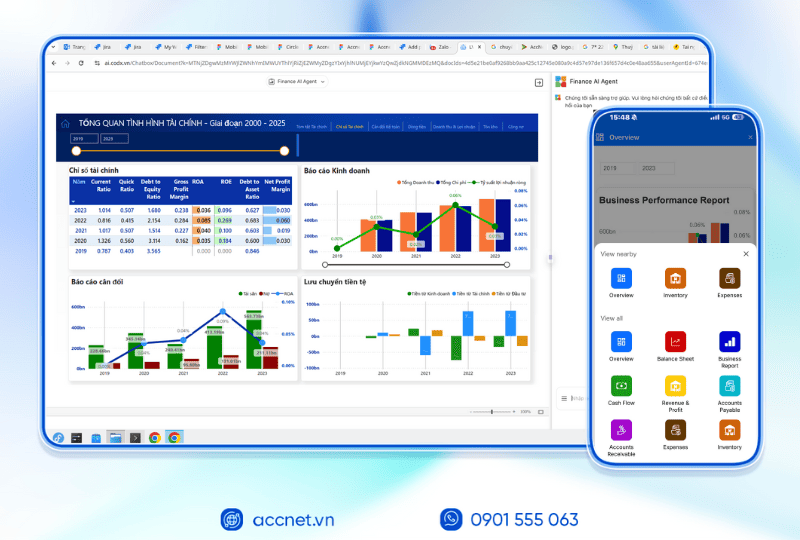

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

If you want to learn more about software Accnet Cloud as well as would like to get more advice about the right software for your business, then please contact with parts of our consultants.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: