Hệ thống quản lý tài chính kế toán toàn diện

AccnetERP

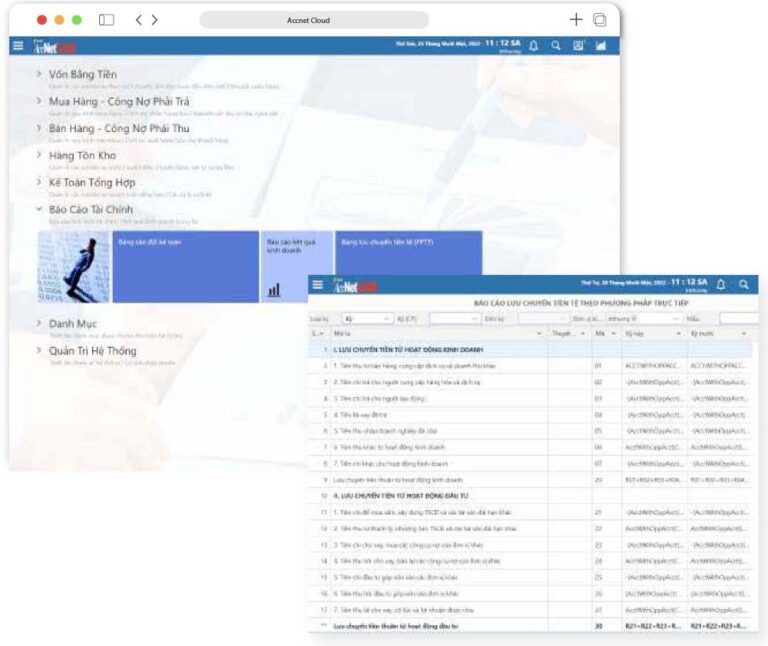

AccNet Cloud

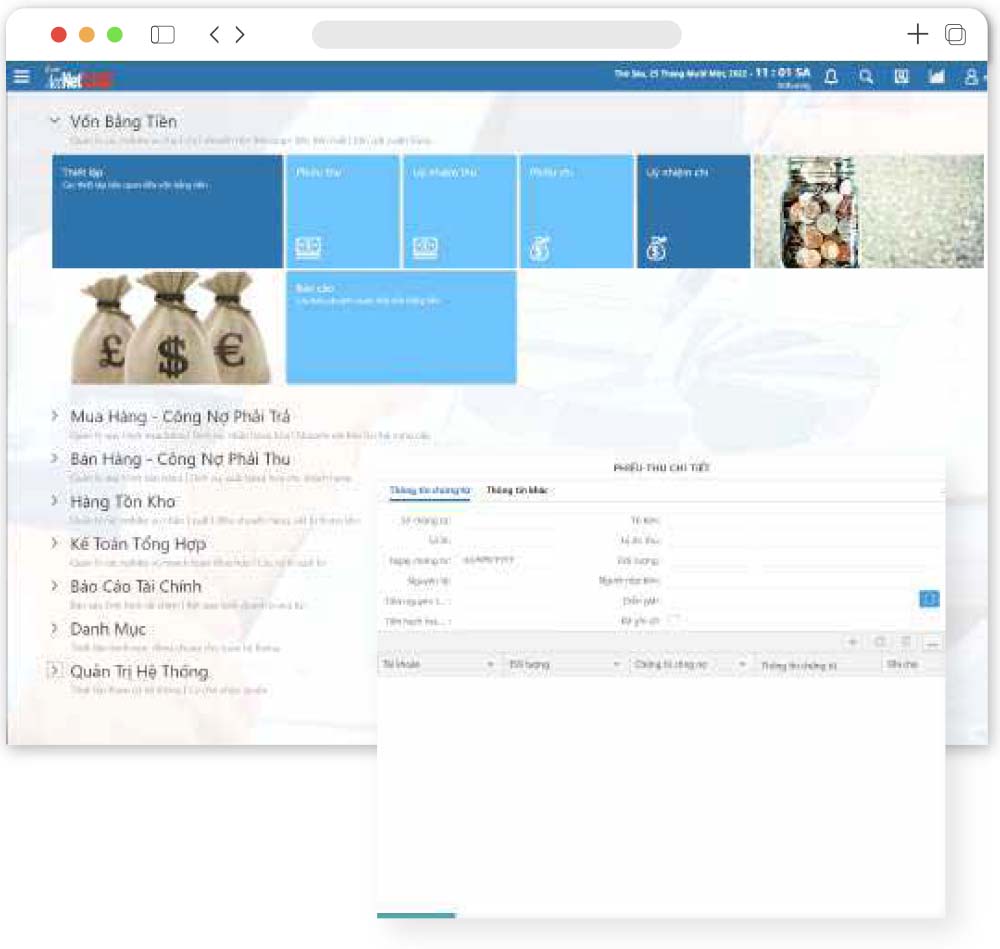

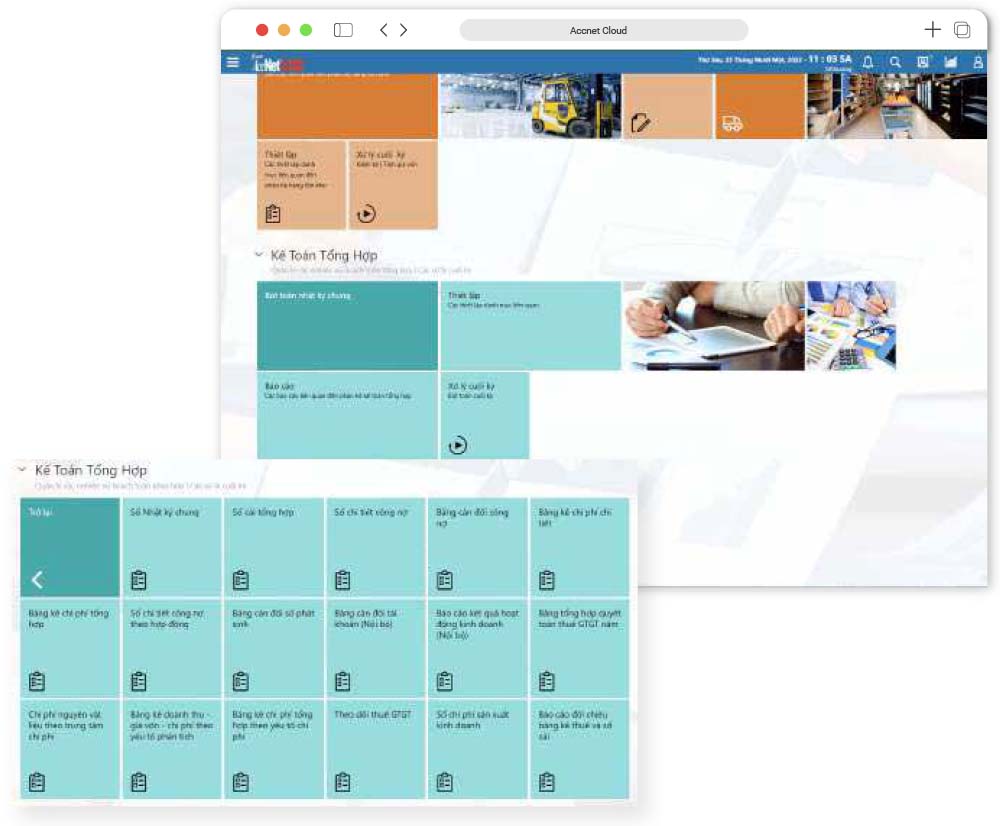

Phần mềm AccNet Cloud đáp ứng 6 nghiệp vụ kế toán CHUẨN - CHỈNH

Kế toán vốn bằng tiền

Kế toán mua hàng và công nợ phải trả

Kế toán hàng tồn kho

Kế toán tổng hợp

Kế toán bán hàng và công nợ phải thu

Kế toán tài sản cố định, CCDC

Lợi ích từ phần mềm AccNet Cloud mang lại

- Phần mềm kế toán online có giao diện thân thiện, dễ sử dụng, đặc biệt phù hợp với cả những người mới làm quen với phần mềm kế toán.

- Các chức năng được bố trí khoa học, giúp người dùng dễ dàng tìm kiếm và thực hiện các thao tác.

Khi thuê phần mềm kế toán trực tuyến AccNet Cloud, Lạc Việt sẽ hỗ trợ chuyển đổi dữ liệu từ các phần mềm kế toán khác, giúp bạn tiết kiệm thời gian và công sức khi chuyển đổi sang sử dụng phần mềm mới.

Tùy theo độ phức tạp của yêu cầu mà việc chuyển đổi dữ liệu có thể tính phí hoặc không.

Tại sao chọn chúng tôi?

Giải pháp Hữu ích - Chuyên nghiệp - Tiên phong

Phần mềm an toàn, bảo mật đạt chuẩn quốc tế

Bảng giá phần mềm AccNet Cloud

Gói 1

2,000,000đ

- Kế toán vốn bằng tiền;

- Kế toán mua hàng và công nợ phải trả;

- Kế toán bán hàng và công nợ phải thu;

- Kế toán hàng tồn kho;

- Kế toán tổng hợp;

- Kế toán tài sản cố định, CCDC.

Gói 2

3,500,000đ

- Kế toán vốn bằng tiền;

- Kế toán mua hàng và công nợ phải trả;

- Kế toán bán hàng và công nợ phải thu;

- Kế toán hàng tồn kho;

- Kế toán tổng hợp;

- Kế toán tài sản cố định, CCDC.

Gói 3

4,500,000đ

- Kế toán vốn bằng tiền;

- Kế toán mua hàng và công nợ phải trả;

- Kế toán bán hàng và công nợ phải thu;

- Kế toán hàng tồn kho;

- Kế toán tổng hợp;

- Kế toán tài sản cố định, CCDC.

- Liên kết hóa đơn điện tử: 400,000đ

- Đào tạo tại khách hàng 01 buổi 3 giờ (nội thành HCM): 1.000.000đ

- Tinh chỉnh nghiệp vụ theo yêu cầu: Xem ngay

Quy trình triển khai của AccNet Cloud

1. Tư vấn

Tiếp nhận thông tin và tư vấn phù hợp với tình huống cụ thể của khách hàng.

2. Demo

Demo online phần mềm kế toán Lạc Việt AccNet Cloud theo yêu cầu đã khảo sát trước đó.

3. Báo giá

Báo giá chi tiết các gói dịch vụ, ký kết hợp đồng, thanh toán.

4. Khởi tạo

Khởi tạo hệ thống phần mềm theo hợp đồng và chuyển giao hệ thống cho khách hàng.

5. Đào tạo

2 giờ đào tạo sử dụng hệ thống từ xa hoặc đào tạo trực tiếp tại Lạc Việt.

Tư vấn

Tiếp nhận thông tin và tư vấn phù hợp với tình huống cụ thể của khách hàng.

Đăng ký nhận tư vấn và Demo về Phần mềm AccNet Clould

Dịch vụ bảo hành, bảo trì hệ thống

Hệ sinh thái quản trị tài chính AccNetERP

Kết hợp cùng hơn 100 đối tác để ứng dụng CNTT