When the errors in need of correction information, the recognition accounting entries for the invoice replace (HĐTT) becomes necessary. This article will help you understand more about how accounting alternative billthe note is important to grasp in order to ensure legal compliance for business. Let's AccNet learn in detail under the following article!

1. How accounting invoice the correct replacement

Pen mathematics, general applied for all the cases:

| Get pen original payment |

|

| Record the journal new |

|

Below are specific examples in the case of accounting related to bill alternative:

- Accounting alternative bill to invoice is cancelled

- Accounting HĐTT for lost bills

- Accounting HĐTT due to errors

- Accounting HĐTT due to price adjustment

- Accounting HĐTT due to changes in customer information

1.1. Accounting alternative bill to invoice is cancelled

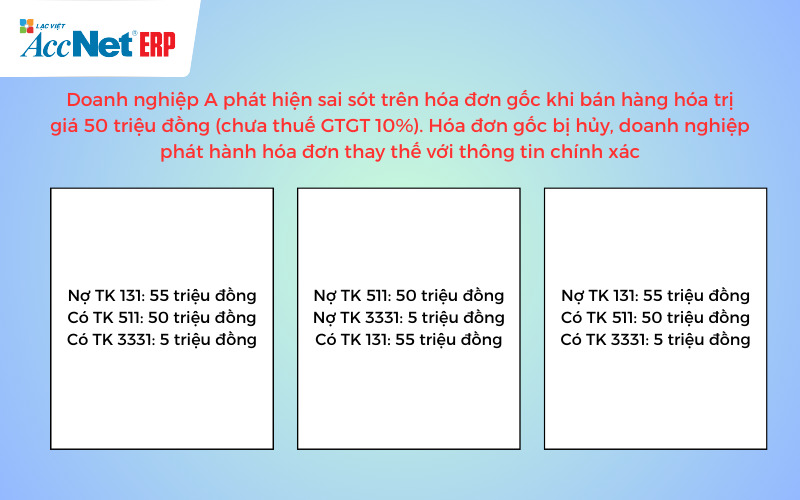

Business A detect flaws on the original invoice when selling goods worth $ 50 million (not VAT 10%). The original invoice is cancelled, the business issuing the bill replaced with the correct information.

Pen initial payment:

- Debt TK 131: 55 million

- Have TK 511: 50 million

- Have TK 3331: 5 million

Get pen original payment:

- Debt TK 511: 50 million

- Debt TK 3331: 5 million

- Have TK 131: 55 million

Recorded pens payment by invoice replace:

- Debt TK 131: 55 million

- Have TK 511: 50 million

- Have TK 3331: 5 million

1.2. Accounting invoice replacement for lost bills

Business B has invoice for client C $ 100 million (not VAT 10%). The original invoice is lost, businesses need to issue an invoice instead.

Pen initial payment:

- Debt TK 131: 110 million

- Have TK 511: 100 million

- Have TK 3331: 10 million

Accounting when released alternative bill:

- Due to the original invoice is lost, no need to cancel the entry if you've accurately recorded earlier.

- In the case of adjusted or not recorded, need recorded by invoice instead.

Read more:

1.3. Accounting HĐTT due to errors

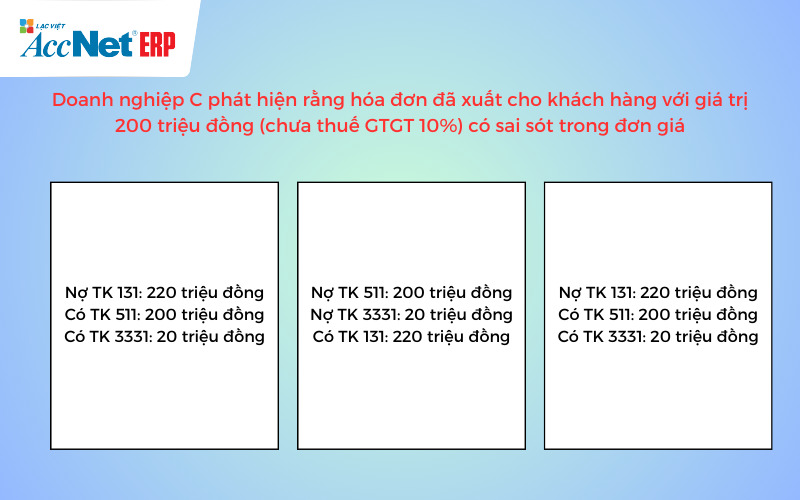

Business C discovered that bill was for customers with value 200 million (excluding tax, VAT 10%) had errors in the unit price. Way accounting alternative bill as follows:

Pen initial payment:

- Debt TK 131: 220 million

- Have TK 511: 200 million

- Have TK 3331: 20 million

Get pen original payment:

- Debt TK 511: 200 million

- Debt TK 3331: 20 million

- Have TK 131: 220 million

Record the journal right by invoice replace:

- Debt TK 131: 220 million

- Have TK 511: 200 million

- Have TK 3331: 20 million

1.4. Accounting invoice replaced due to price adjustment

Business D discovered that the selling price of goods have changed from 300 million to 350 million (not VAT 10%) after invoice.

Pen initial payment:

- Debt TK 131: 330 million

- Have TK 511: 300 million

- Have TK 3331: 30 million

Get pen original payment:

- Debt TK 511: 300 million

- Debt TK 3331: 30 million

- Have TK 131: 330 million

Record journal entries according to new price:

- Debt TK 131: 385 million

- Have TK 511: 350 million

- Have TK 3331: 35 million

Read more:

1.5. Accounting HĐTT due to changes in customer information

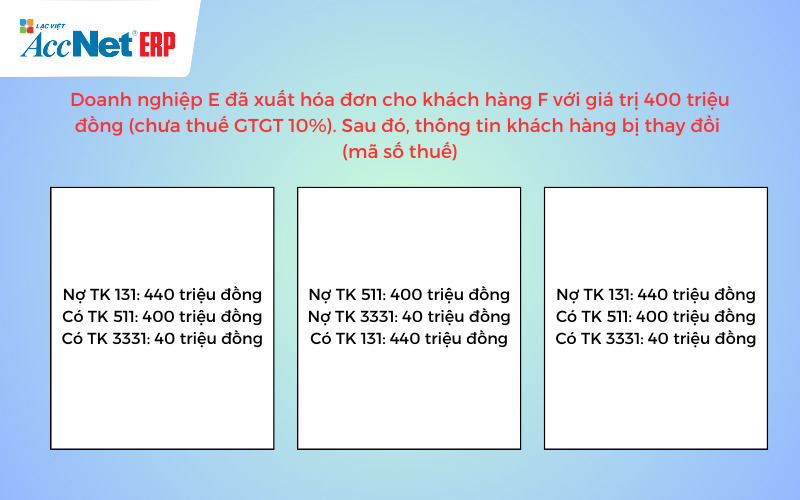

Business E has invoice for customer F with value 400 million (excluding tax, VAT 10%). Then, customer information changed (tax code)

Pen initial payment:

- Debt TK 131: 440 million

- Have TK 511: 400 million

- Have TK 3331: 40 million

Get accounting when accounting alternative bill:

- Debt TK 511: 400 million

- Debt TK 3331: 40 million

- Have TK 131: 440 million

Recorded journal entries with new information:

- Debt TK 131: 440 million

- Have TK 511: 400 million

- Have TK 3331: 40 million

2. Accounting alternative bill that affect the financial statements do not?

Yes accounting alternative bill may affect the financial statements, particularly when the original invoice was recorded in the previous period:

- Change in revenue/expense was recorded directly affect gross profit/net profit of the business.

- When released alternative bill, businesses need to adjust to declare VAT, leading to arrears of taxes.

- Bill replaced, re-adjust the balance of the accounts receivable of clients, pay to the supplier, affect public debt/cash flow.

- If alternative bill related to the states before, businesses need to adjust the financial statements were published to ensure authenticity.

- Do fluctuations in the financial indicators as important as the profit margin, the ratio of debt to equity.

Learn more:

- Accounting goods on previous bills later theo quy định kế toán hiện hành

- Hóa đơn điều chỉnh tên hàng hóa theo quy định kế toán hiện hành

- Bill, what is direct? Giải thích chi tiết cho doanh nghiệp

3. Accounting HĐTT for insider trading other nothing compared to transactions outside?

Accounting alternative bill for insider trading basically the same with the transaction outside, but there are some differences to note:

- Insider trading should be excluded when making financial statements consolidated to avoid recorded two times the revenues, expenses and assets.

- When issuing bills, replace both units involved in the transaction internal to sync recorded to ensure the books consistency.

- Requires the thorough inspection between the units to avoid discrepancies in the books.

- The bill substitutes for insider trading still must fully comply with the tax regulations, accounting as transaction outside.

4. Xử lý hóa đơn thay thế dễ dàng hơn nhờ AccNet eInvoice

Khi có sai sót, mất hóa đơn hoặc cần điều chỉnh thông tin, doanh nghiệp phải thực hiện hạch toán hóa đơn thay thế (HĐTT) — tức là hủy bút toán gốc và ghi lại hóa đơn mới theo đúng giá trị, thông tin hiện tại.

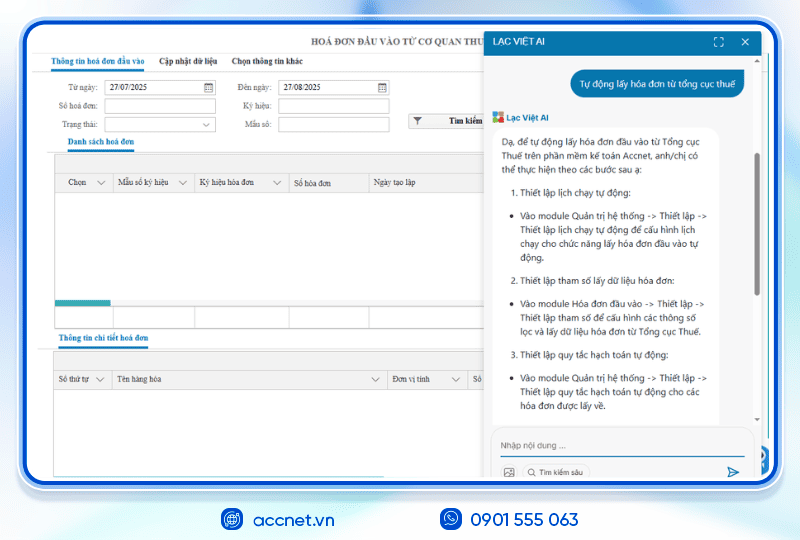

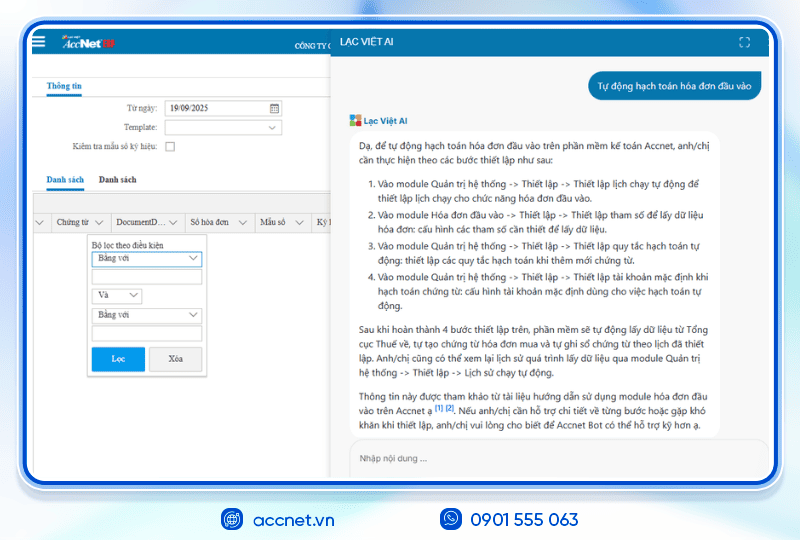

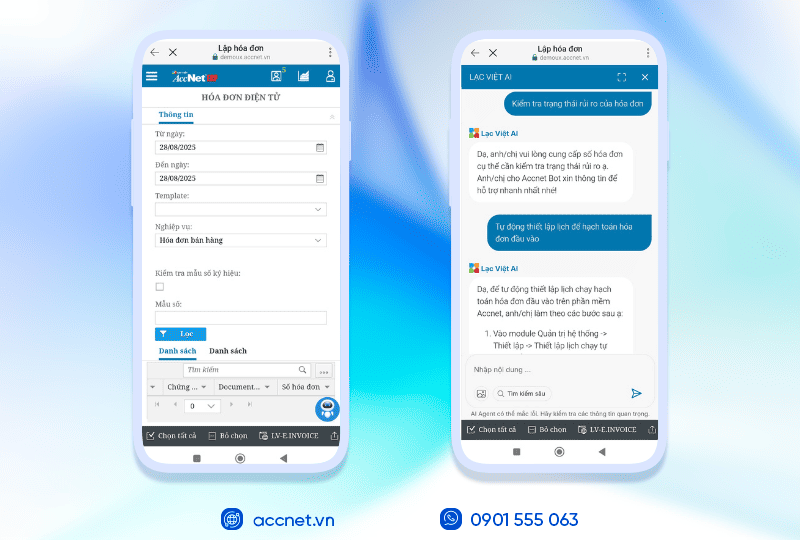

With AccNet eInvoice, việc xử lý hóa đơn thay thế trở nên chuẩn xác, nhanh chóng và an toàn:

- Hệ thống tự động phát hiện hóa đơn cần thay thế và hỗ trợ hủy bút toán gốc & ghi lại bút toán mới theo đúng thông tin cập nhật.

- Khi ghi điều chỉnh (do hủy, sai sót, mất, điều chỉnh giá, thay đổi khách hàng…), module bán hàng, tài chính và công nợ sẽ đồng bộ cập nhật theo.

- Hệ thống lưu trữ cả phiên bản gốc và phiên bản thay thế, dễ tra cứu để đối chiếu hoặc giải trình nếu cần.

- Nhờ liên kết chặt giữa eInvoice và ERP, mọi thay đổi hóa đơn đều phản ánh chính xác đến báo cáo tài chính, giảm rủi ro sai lệch.

Đến khi doanh nghiệp áp dụng AccNet eInvoice, việc hạch toán hóa đơn thay thế không còn là quy trình khó – mà trở thành một bước xử lý thông minh, bảo đảm tuân thủ và tối ưu quản lý hóa đơn.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Invoice discounting là gì? Giải thích chi tiết cho doanh nghiệp

After mastering the way accounting alternative bill and a number of related problems, hope you will obtain the knowledge necessary to carry out this work on bookkeeping correctly. Thank you for taking the time to read this article, wish you success in the financial management and accounting of yourself!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: