A minor deviations on the invoice, such as deviation of 1 copper, also can make many businesses wondering whether this could affect the validity of the bill, the tax rules or not? In fact, this is a condition not uncommon. This article AccNet will help you answer the question “bill deviation 1, are you ok?” by analyzing the detailed causes, risks, how to handle problems.

1. Bill deviation 1, are you ok?

1.1. Answer

Bill deviation 1 usually does not cause serious problems if the business can give clear explanations, causes, especially when the wrong number of incurred due to rounding or tax. However, businesses need to check, handled promptly.

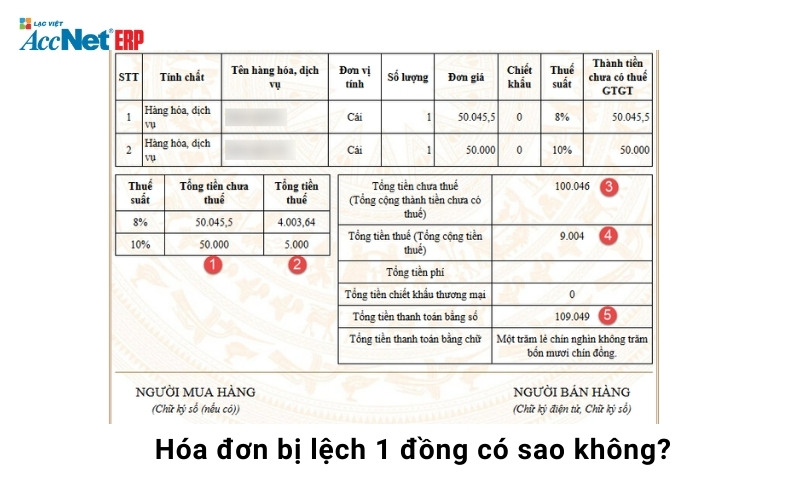

Bill deviation 1 is phenomenal amount on the invoice does not coincide exactly with the actual amount of the transaction.

1.2. Causes of deviation 1 on bills

This discrepancy is usually happen in the following cases:

- Invoice rounding: Total bill value after tax or split into sections payments may be rounded up/down. For example: rounding to the unit (do not display the decimal part).

- Error VAT calculator: For example, when applying VAT to 10% on the value of goods/services has more decimal places, small errors can appear due to rounding.

- Unit price multi-digit decimal number: VD: 99,9999 VND.

- System rounding is not homogeneous: some systems do round step by step (unit price, amount, tax) instead of rounding the total value.

- Enter data manually: When billed paper or enter data manually, accounting can accidentally recorded the wrong 1. This error is common in small businesses not to use electronic invoice

Read more:

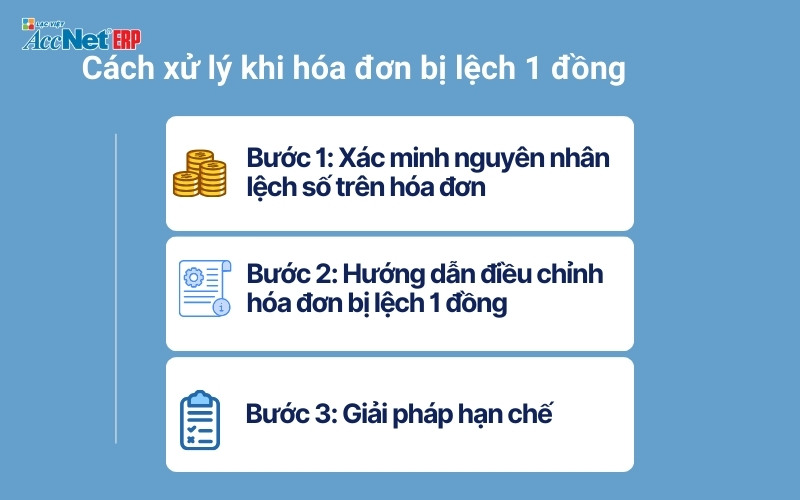

2. How to handle when the bill deviation 1

Step 1: Identify the cause deviation number on the invoice

Check the system software:

- Collation rules rounding is applied in software electronic invoice.

- Verify the calculation of VAT, in particular when the prices are decimal.

Compare with the contract and quote:

- The information on the bill joint with payment terms in the contract.

- Check out the stage payment (if the transaction is split).

Step 2: guide the invoice correction deviation 1

Establishment memorandum of agreement:

- Business partners need to establish a memorandum of receive errors, uniformly adjusting bills.

- This is the legal basis to make modifications, alternative bill.

Adjusted invoice:

- With electronic invoicing: Access to software, select the function "adjust the bill," updates to the true value.

- With paper bills: bill new replacement bills wrong, stating the reason for the adjustment on the invoice.

Declare tax adjustments: If the bill is deviation 1 has to declare tax, businesses need to submit a declaration complement to adjust the value to declare.

Read more:

Step 3: the Solution prevention

- Use software electronic invoice professional: software as LV eInvoice features automatic calculation, rounding regulations, to detect flaws before issuing the invoice.

- The set up process check internal: Enterprises need to check all bills before the release, collated with the contract, quote.

- Training staff accounting: advanced skill to use invoicing software, get to know the error as small as the wrong number of rounded, skewed tax.

3. Risks and consequences when bill deviation 1

3.1. Impact on the validity of the bill

According to the Decree 123/2020/ND-CP, the bill must ensure full and accurate information related to the transaction. However, in the case of bills deviation 1 due to wrong round number/software bugs, tax authorities often do not consider this to be a serious breach if:

- Wrong number does not change the nature of the transaction.

- Businesses can explain the apparent cause deviations.

However, if the wrong number is not explaining properly, is discovered in audits, tax bills can be evaluated as invalid, leading to the risk of arrears of tax, penalty administration.

3.2. Bill deviation 1 affect accounting, tax declaration

Bill skewed though only 1 can still cause many problems in the process of accounting, tax declaration:

- Deviation VAT report: When the total invoice value deviation compared with actual data, electronic tax systems can error warning or require adjustment.

- Deviations in bookkeeping: accounting will encounter difficulties when comparing data between bills, contracts, affecting the financial reporting.

- The risk of tax authorities to check: If the business does not remedied promptly, the tax authority may conduct detailed inspection to verify.

Learn more:

4. Data analysis the real state bill deflection at the Vietnam business

Bill deviation 1 is a common condition in the invoicing process at many businesses in Vietnam. According to statistics from the General administration of the Tax year 2023:

- About 8% of electronic invoicing arising wrong number of small, mainly due process of rounding heterogeneity between the software and invoice.

- Almost 12% of small and medium enterprises have difficulty in adjusting bills when errors are detected.

- 5% business is tax arrears of bills invalid, in which case related to wrong round number.

5. Phát hiện & xử lý hóa đơn lệch 1 đồng — giải pháp với AccNet eInvoice

Hóa đơn bị lệch 1 đồng — dù nhỏ — cũng có thể khiến doanh nghiệp lo lắng về tính hợp lệ của hóa đơn, sự thống nhất giữa báo cáo thuế và sổ sách kế toán. Theo phân tích, lệch 1 đồng thường do việc làm tròn số, tính thuế GTGT với đơn giá thập phân, hoặc sai sót nhập liệu thủ công.

Ở trường hợp này, AccNet eInvoice là công cụ giúp phòng ngừa và xử lý hiệu quả:

- Hệ thống sẽ kiểm tra và cảnh báo nếu hóa đơn có sai lệch nhỏ trước khi phát hành, giúp người dùng rà soát kịp thời.

- Việc điều chỉnh hóa đơn (điều chỉnh nội dung, cập nhật số liệu đúng) được thực hiện ngay trong phần mềm mà không cần thao tác rời rạc.

- Hóa đơn phát hành được liên kết tự động với module tài chính, đảm bảo doanh thu, công nợ và sổ sách kế toán đều được cập nhật đồng thời.

- Lưu trữ mọi phiên bản hóa đơn — cả bản gốc và bản sửa — giúp dễ tra cứu, đối chiếu và giải trình khi cần kiểm tra thuế.

Nhờ khả năng tự động phát hiện, điều chỉnh, đồng bộ và lưu trữ hóa đơn, AccNet eInvoice không chỉ giúp bạn tránh rủi ro từ sai lệch nhỏ mà còn biến việc lập hóa đơn trở nên chuyên nghiệp, chuẩn xác và an toàn hơn.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Khái niệm chứng từ giảm giá bán hàng áp dụng cho doanh nghiệp

“Hóa đơn bị lệch 1 đồng có sao không?” tuy là một vấn đề nhỏ nhưng có thể gây ra những rủi ro lớn nếu không được xử lý đúng cách. Việc xác minh nguyên nhân, điều chỉnh kịp thời, áp dụng các giải pháp là chìa khóa để hóa đơn luôn hợp lệ. Trải nghiệm AccNet eInvoice ngay hôm nay để hóa đơn của doanh nghiệp không bị sai lệch!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: