Accounting purchase be considered a work place quite often in the business. The accounting the master process and professional service. To go deeper and understand more details on how accounting purchasing the same Accnet read article later.

1. Accounting purchase order what is it?

Accounting purchase is the observation, measurement, calculation and recording of economic activity. In order to manage the process that is more closely. Related to the volatility of cash flows, sources of capital and assets of the business.

Realization principle the accounting purchase:

- Account is used to reflect the value of raw materials, tools, purchase goods, goods enter the warehouse or goods brought into use in the states. With account 611 “Purchase” is only applicable to those performing business accounting inventory methods inventory periodically.

- Value of raw materials, tools, goods purchased to be reflected on your account 611 “Purchase” when made according to the principle of the original price.

- Also in case of accounting of inventory made by the method of inventory periodically. Businesses need to inventory inventory last states to determine the number and value of materials, products and tools exist to determine the value in use and selling in the states.

- Accounting inventory method inventory periodically, when purchasing materials, tools and goods. Will be based on invoice: purchase order, shipping, receipt, import taxes payable. To make the recorded original price purchase orders into account 611 "Purchase". To when the sale or use of record only once at the end of the accounting period as a base inventory.

- Made open to accounting the original price inventory when purchased on the materials, tools, goods.

Read more:

2. Content reflects the accounts 611

With respect to the Debtor:

- Perform the transfer of goods, raw materials, tools survive the beginning of the period based on the results of the inventory.

- The original price of the goods, materials, tools to buy in the states

For parties, there are:

- Perform the transfer of the original price of goods, raw materials, tools survive the end of the period based on the results of the inventory.

- The original price of the goods, materials, tools to use in the states, or maybe the original price of goods sold, but has not yet been determined are sold in the states.

- The original price of raw materials, tools or goods purchased to pay back the seller or discounts.

Account 611't have the final balance.

Account 611 - Purchase, there are 2 accounts level 2:

- Account 6111 make a purchase raw materials: used to reflect the value of the materials, tools, goods purchased

- This account is used to reflect the value of raw materials, tools, goods purchased for use in the accounting period and the transfer value of raw materials, tools, buy goods inventory beginning and end

Account 6112 - Purchase: to reflect the value of purchased goods on sale in the states and the transfer value on the inventory, the inventory period end.

3. Accounting purchase the right professional regulation

A number of professional accounting purchase according to the regulations common:

3.1 Purchase warehousing

Based on the invoice value-added tax (VAT), implementation of receipt to acknowledge:

- Debt TK 152,156: value enter

- Debt TK 1331: the amount of VAT

- Have TK 111/112/131: the total value of payments

3.2 accounting for purchases not in stock

Often is the case, the business purchased for use or sale to the customer not have to enter the warehouse, so accounting purchase on the price of capital and the cost.

- Purchase of raw materials and goods used or shipping immediately:

Debt TK 621/632: purchase Price g hasn value added tax

Debt TK 1331: the Money value added tax

Have TK 111/112/331: the Total payment amount.

- Buying tools using now:

Debt TK 242: value tools plugins many times

Debt TK 641/642: value tools to allocate 1 times

Debt TK 1331: the Money value added tax

Have TK 111/112/331: Total price paid.

3.3 accounting purchasing ago, bill has the following

Purchase to enter the warehouse, but the vendor has not sent a VAT invoice. Accounting must remain in stock but do not accounted for and declare VAT. But to prove the purchase ago, bill added later, then in the contract that 2 sides to communicate the need to express clearly the information: delivery invoice, freight, warehouse, warehouse import.

And when entering inventory accounting will record the value:

Debt TK 156, 153, 152...: estimated Price

Have TK 331: estimated Price

After receiving the invoice from supplier accounting purchase additional VAT:

Debt TK 133

Have TK 331

3.4 Purchase invoice before order later

In case received a VAT invoice, but order still hasn't returned, then the accountant noted that goods in transit.

When there are bills, then accounting recorded:

- Accounting purchase recorded "Debt TK 151: Goods in transit"

- Recorded "Debt TK 1331: the VAT Amount"

- Recorded "Have TK 111 TK 112, TK 331: the Total price payment"

When the row was about, and enter the warehouse, then:

- Debt TK 152/156/1561: bonded Goods.

- Have TK 151: buy go

3.5 accounting purchase has incurred costs purchase

Đối với các trường hợp mua hàng có phát sinh các chi phí liên quan như: : bảo hiểm hàng hóa, tiền thuê kho bãi, vận chuyển, bốc xếp, bảo quản…thì căn cứ vào các hóa đơn, chi phí mua hàng liên quan. Kế toán mua hàng sẽ phân bổ chi phí đó vào các mặt hàng đã mua theo số lượng hoặc giá trị hàng hóa.

For the purchase of materials, goods and services:

- Debt TK 152, 153, 156, 641, 642...

- Debt TK 133 VAT is deductible, if any.

- Have TK 111, 112, 331...

Costs incurred on purchases

- Debt TK 152, 156, 641, 642... Cost of purchase

- Debt TK 133 VAT is deductible, if any,

- Have TK 111, 112, 331... the Total price payment

3.6 accounting return the purchased goods

Goods purchased in addition to not properly, quality as described and agreed in the contract economy must return to the seller, then the accountant recorded:

- Debt of TK 111, 112,... made a payment, and get the seller to return the money

- Debt TK 331 – pay to the seller if unpaid

- Have TK 156, 152, 153 – cargo

- Have TK 133 – VAT is deductible (1331), if available.

3.7 accounting purchase deferred installments

Accounting will make the account the account such as:

- Debt TK 156, 152, 153... – goods according to the purchase price paid immediately.

- Debt TK 133 – VAT is deductible, if any.

- Debt TK 242 – prepaid Expenses [the deferred interest is the difference between the total amount to be paid minus (-) the purchase Price paid now deduct VAT (if deductible)]

- Have TK 331 – pay to the seller

Periodic calculation of interest on the purchase pay deferred or installment pay in finance charges, record:

- Debt TK 635 – financial Expenses

- Have TK 242 – prepaid Expenses.

Read more:

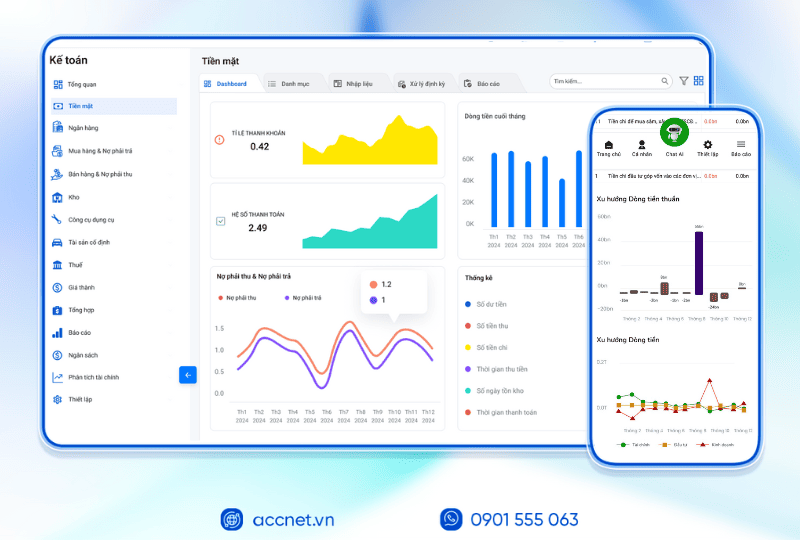

4. Hạch toán mua hàng dễ dàng cho doanh nghiệp với Accnet ERP

Xu hướng số hóa đang được chú trọng vào tất cả các ngành nghề, lĩnh vực. Nếu cứ mãi dậm chân với lối làm việc truyền thống, sẽ làm bộ phận kế toán khó khắn thể kiểm soát công việc và dẫn đến những khó khăn trong công tác quản trị nói chung, bộ phận kế toán nói riêng. Với phần mềm quản lý mua hàng Accnet Mua hàng:

- Fully responsive accounting profession according to the circular, the latest decision of the Ministry of Finance and the tax authority.

- Automation in the synthesis of the data, transfer the revenue, established a tax return, financial statement with just 1 click.

- Technology applications, cloud computing, users easy to use anytime, anywhere.

- Fully meet all the accounting profession adjoin with the accounting standards.

The time has come the business should change to match the increasing tendency for development of the future.

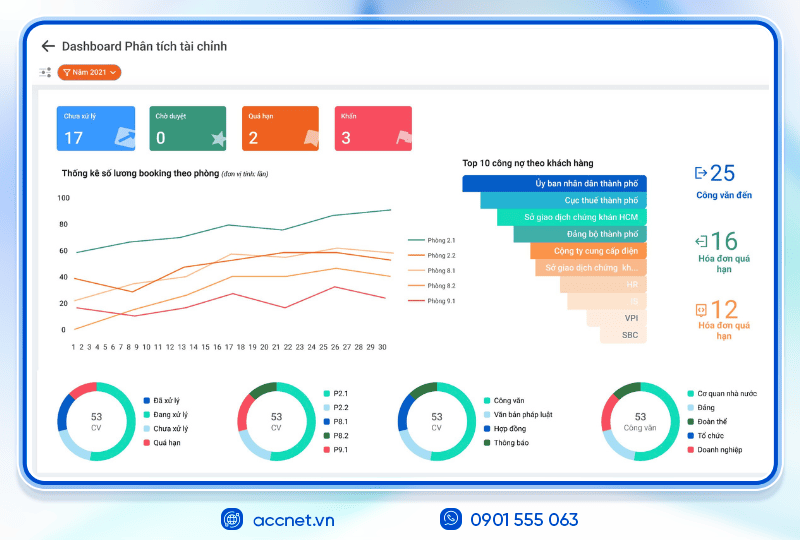

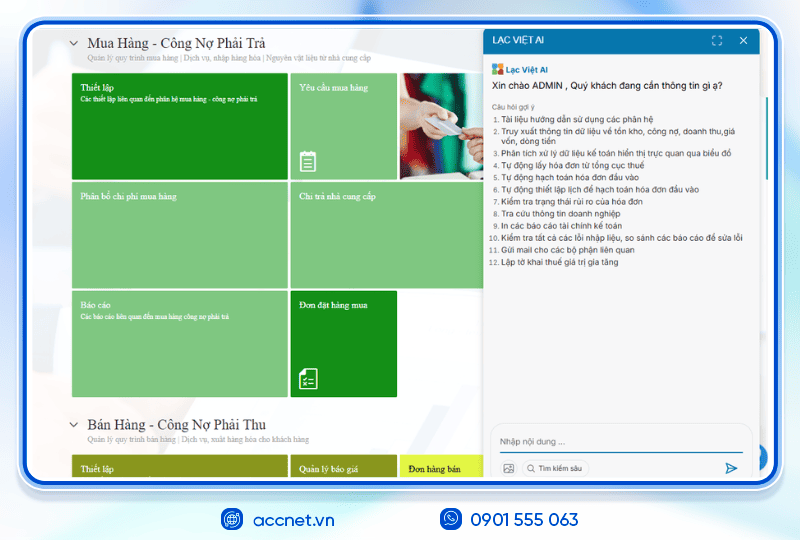

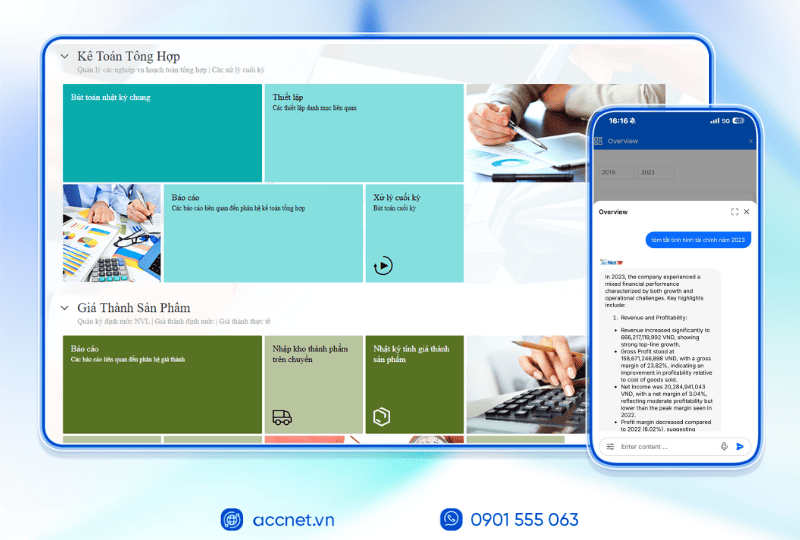

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

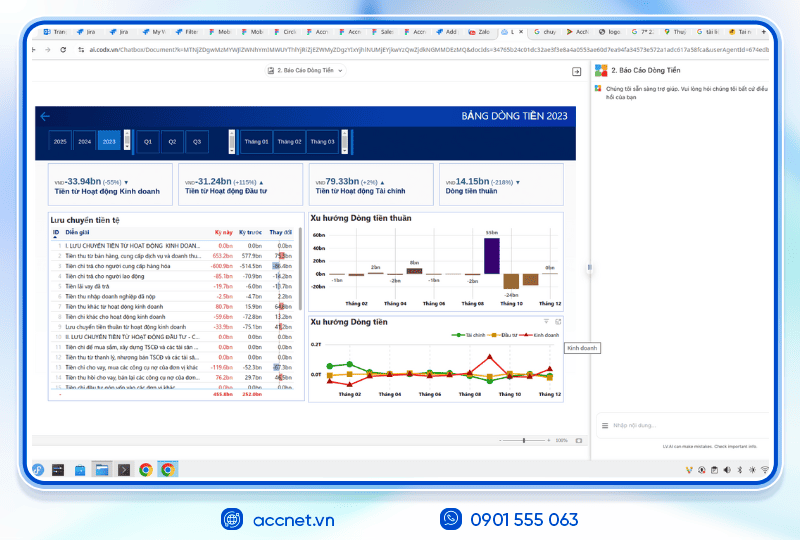

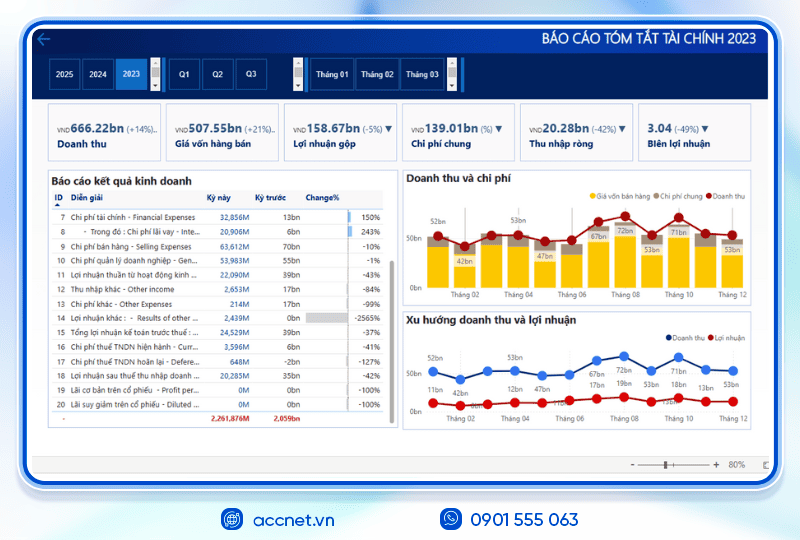

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

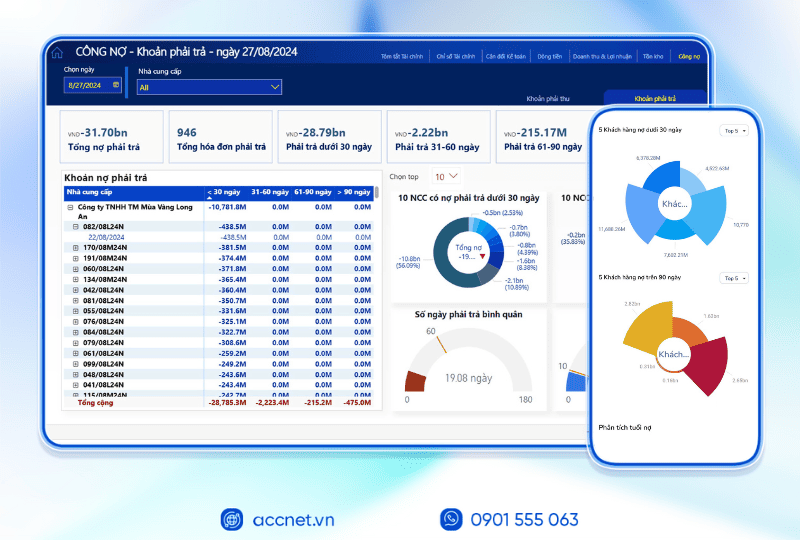

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

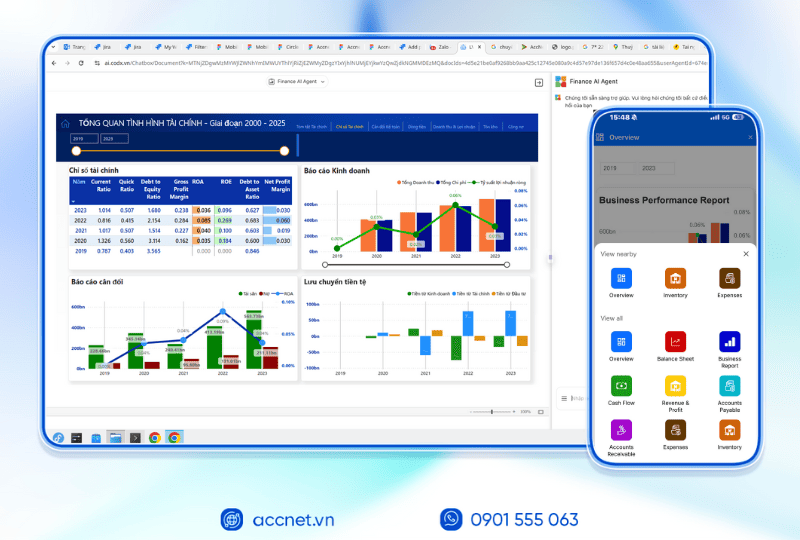

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Hope the information about accounting purchase help professional accountants and business done right the correct accounting profession this.

CONTACT INFORMATION:- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: