Cash is one of the most important assets of any business. Therefore, the cash management efficiency is an essential requirement for every business. In this article Accnet will work with you to learn about cash accounting, includes the basic concepts, tasks, principles, and implementation process. Here is the important knowledge help you to understand more about the management of cash and effectively applied in practice.

1. Cash accounting is what?

Fund accounting, cash is an important work in the accounting system of the business, responsible for tracking and managing the activities to collect and pay cash at the foundation of the business. The implementation of cash management efficiently helps business to manage cash flow better, ensure solvency and sustainable development.

2. The basic task of accounting for cash

The below task of accounting cash resources will help ensure that businesses have the ability to manage finances efficiently, minimize risks to meet payment obligations:

- Catch full and timely with the provisions of the law related to the monetary circulation of The country. At the same time require the executive to take seriously the mode management such as: inventory Management, cash and implementation of processes related to the procedure of import - export fund under the regulations of the treasury.

- For cash accountingto monitor and control the code, fund code account accounting code and The state treasury is impossible to ignore. Ensure that accounting process is done correctly and reliably.

- The monitor revenues and expenditures of The state treasury is very important to timely reflect the amount of reserve fund cash in ledger. This helps to ensure that accounting information joints with actual spending at the treasury, as well as the balance amount that the treasury was deposited in the bank is fully updated and accurate.

Read more:

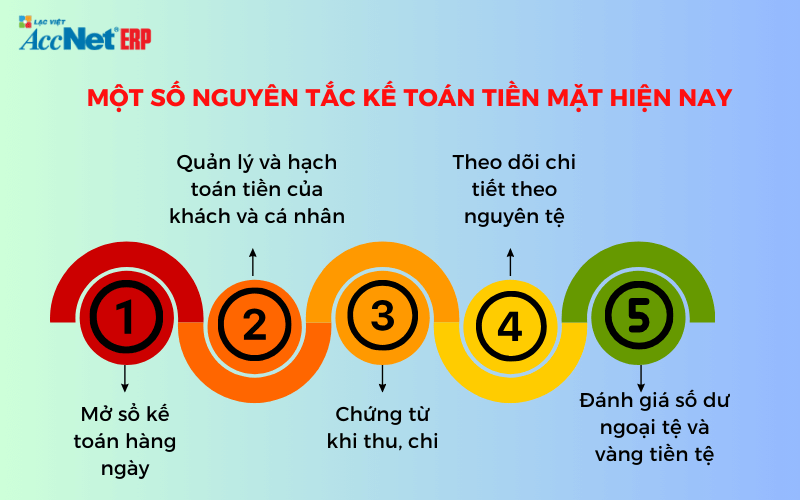

3. Accounting principles, cash, according to circular 200

Under the provisions of Article 11 in circular no. 200/2014/TT-BTCprinciples of accounting amount is determined as follows:

- Open daily accounting: Business accounting implementation of the open ledger and daily records in the order incurred revenues and expenditures, export, import, money, currency. This includes the number exists in the fund and the funds in the bank at any time, convenient for the inspection process and collate.

- Management and accounting of the client's money and personal: The funds that business management and is escrow, sign on by other businesses and individuals will be managed and accounted for as cash of the business.

- Stock from when revenues and expenditures: When the transaction revenue and expenditure, need to have receipts, voucher and enough signatures according to the regulations of the mode of accounting vouchers.

- Track details follow the currency: cash accounting must track down details of money by each unit of raw currency. When there are transactions in foreign currency, the accountant must perform conversion of foreign currency to Vietnamese Dong according to the principle:

+ The Debtor s accounts of money is applied rates, the actual transaction.

+ Sides Have the cash account is applied rates carrying weighted average.

- Reviews the balance of foreign currency and gold currency: At the time of preparing financial statements under the provisions of the law, businesses must re-evaluate the balance of foreign currency and currency according to the exchange rate on the actual transactions.

4. Accounting procedures cash fund new updates 2023

Process cash accounting made in detail the steps to ensure all transactions related to money are recorded and managed correctly.

2 process management, accounting, cash flow, most popular:

- Accounting of cash.

- Accounting and cash expenditures.

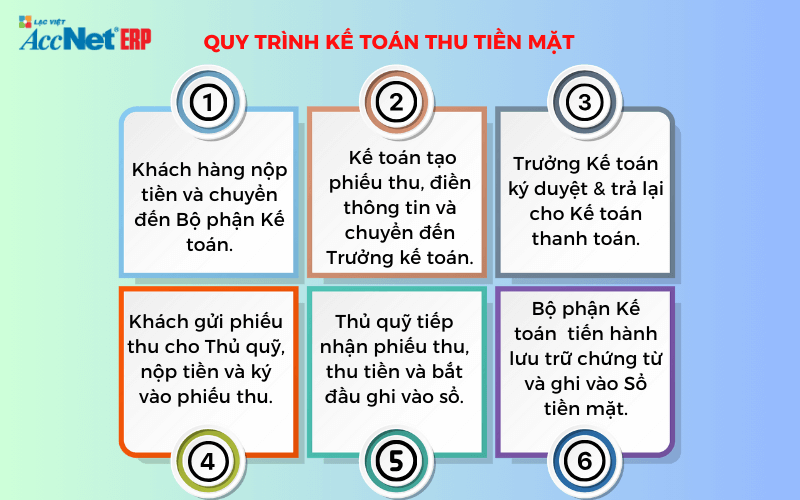

4.1. Accounting procedures cash receipts

In the process of accounting of cash transactions is follow the steps detailed below:

- Step 1: the Customer making the request to pay and transfer to The accounting department for payment.

- Step 2: parts cash accounting payment create receipts (includes 3 copies), fill necessary information and transfer to the Chief accountant.

- Step 3: Chief accountant signed receipt & returned to The accounting department for payment.

- Step 4: Customer send the receipt to the cashier, at the same time pay and sign the receipt.

- Step 5: the treasurer receiving receipts, collect money and start recording on Windows funds. Then, the cashier keep a copy receipt (link 2), returns contact 3 for customers who pay and related 1 to The accounting department for payment.

- Step 6: accounting department billing conduct store vouchers and recorded in the cash (Applied account 111).

With 3 copies of receipts will have a copy stored in office, a copy is kept by the payer. In the case of payment not belonging to the company, this is considered evidence submitted money. For employees the company is the payer, this copy will be delivered to The accounting department to do proof of work have paid in accordance receipts.

Remaining copies will be the cashier kept to record into the Window fund. The end of the day, all the receipts along with the original documents are aggregated and delivered to The accounting department processing. Then, the receipts are stored throughout the year and end of the year will be transferred over long-term storage.

Read more:

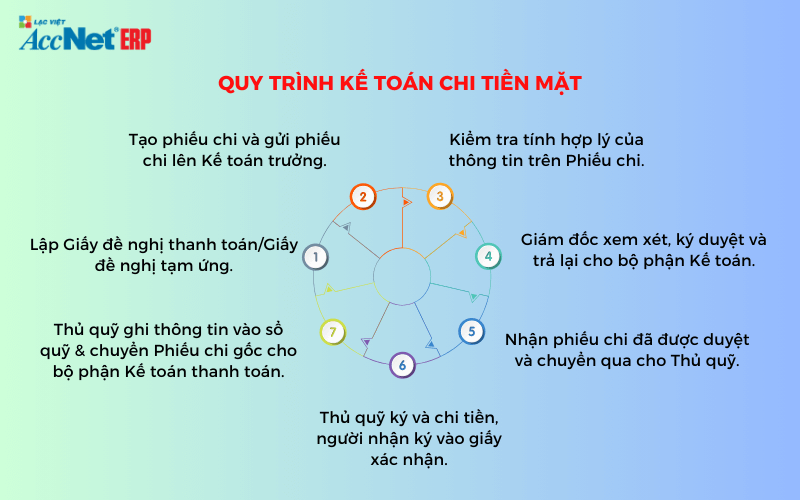

4.2. Accounting process and pay cash

In the process of management - accounting, cash expenditures, more votes played an important role to determine the number of actual cash need and is fundamental to the cashier made the spend money on. Payment receipt is also used to register the fund and transfer the information to the department cash accounting to write to the ledger, helping to ensure clarity and transparency in the process of spending money.

Below is the process of accounting cash expenses, the most detailed:

- Step 1: request Users to spend money establishment request payment, or request an advance and transfer sent to the accounting department for payment.

- Step 2: accounting department billing create payment receipt based on the information from paper proposal and send the payment receipt up chief accountant.

- Step 3: chief accountant to check the rationality of information on the Coupon details. If there are errors or not-logical information, payment receipt will be returned to the accounting department for payment to adjust. In the case of the right information, chief accountant transfer payment receipt up to the director or Person authorized to sign the browser.

- Step 4: director review and signed approval payment, then return it to the accounting department for payment.

- Step 5: The accounting department for payment receipt payment receipt has been approved and transferred over to the cashier.

- Step 6: the cashier and pay for The request, require The recipient to sign the certificate on the payment receipt to verify the receipt of money.

- Step 7: After spending money, cashiers record information on windows funds (retained copy link 2) & shipping payment receipt, original (contact 1) to the accounting department for payment to register, cash (Applied account 111).

Note: If any parts refusal to browse spending money, the accounting department of payments will report back to The requester for further processing.

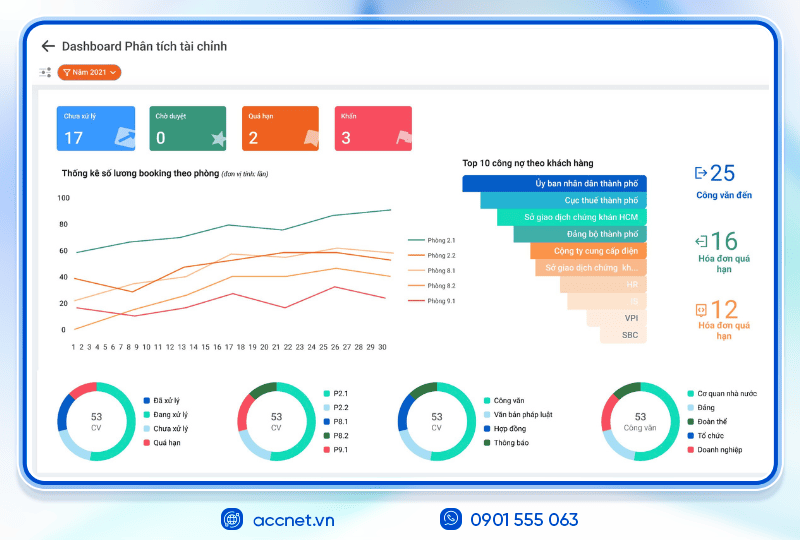

5. Kế toán tiền mặt dễ dàng với phần mềm AccNet ERP

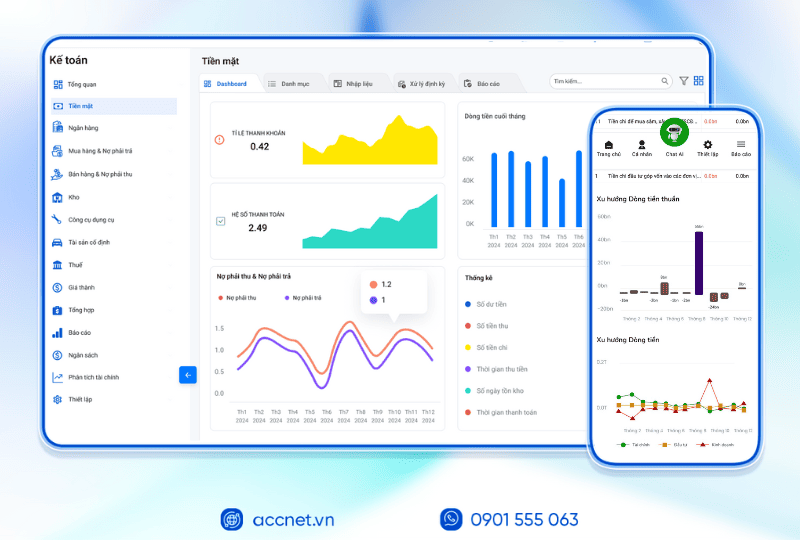

AccNet ERP là một ứng dụng kế toán online hàng đầu được phát triển để đáp ứng đầy đủ các nhu cầu của doanh nghiệp, đặc biệt là trong lĩnh vực quản lý tiền mặt. Được tích hợp trên nền tảng đám mây, AccNet ERP mang lại sự thuận lợi về quản lý và tạo ra môi trường làm việc linh hoạt, mà bạn có thể truy cập mọi nơi, mọi lúc.

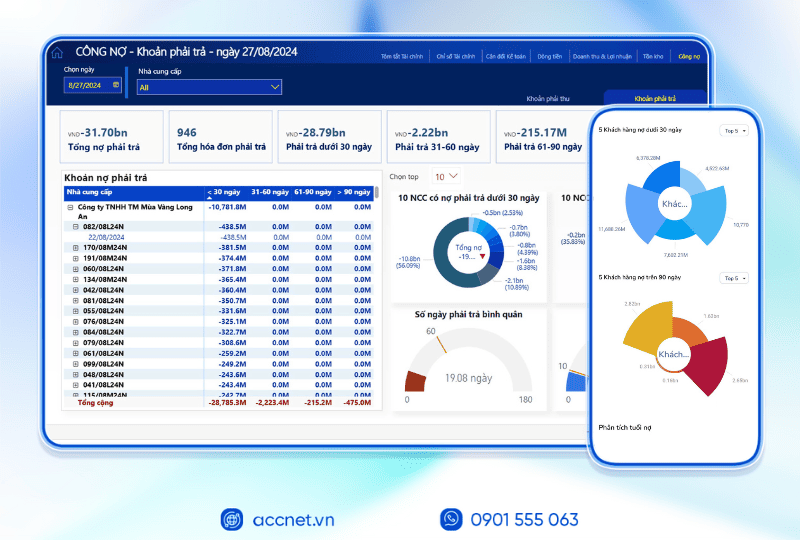

Phần mềm AccNet ERP hỗ trợ đầy đủ các nghiệp vụ kế toán và quản lý tiền mặt, bao gồm:

- Collect the cash.

- Cash expenditures.

- Inventory and cash funds.

Ngoài ra, phần mềm AccNet ERP còn có một số tính năng ưu việt khác, giúp doanh nghiệp quản lý nguồn tiền mặt hiệu quả hơn, bao gồm:

- Automation of accounting help accounting department save time and effort.

- Support reporting cash accounting according to the requirements of the business.

- Phần mềm AccNet ERP được bảo mật theo tiêu chuẩn quốc tế, giúp doanh nghiệp yên tâm về tính bảo mật của dữ liệu.

Với những ưu điểm trên, AccNet ERP not only is a product accounting software but also as a reliable partner in the management of cash in a most effective way. Whether you are a business owner, accountant or financial manager, AccNet Cloud will be the effective support tool to help optimize the process of accounting, cash flow, and enhance job performance.

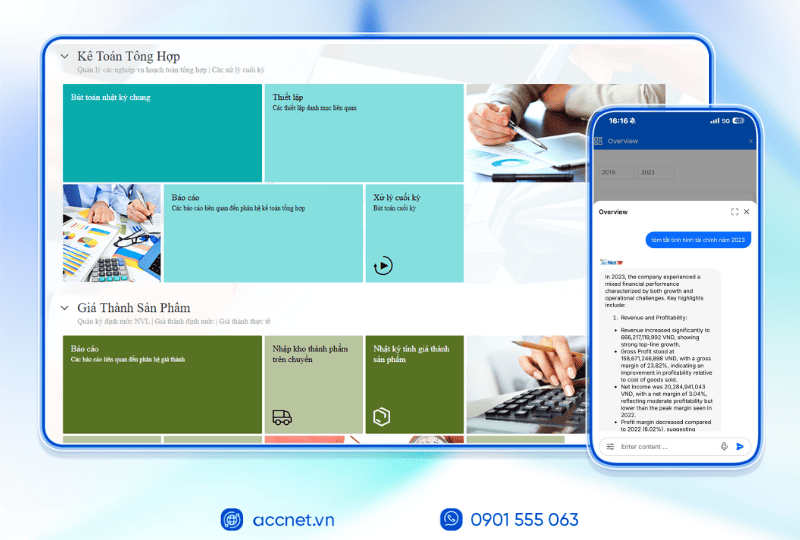

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

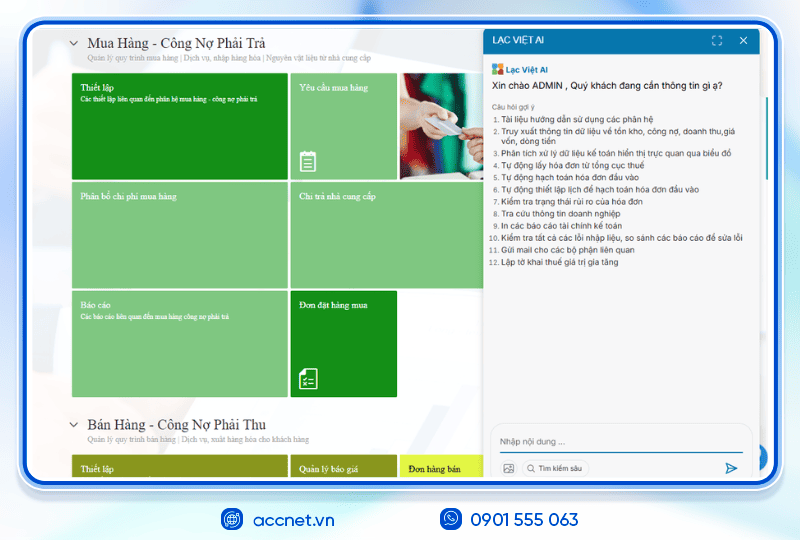

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

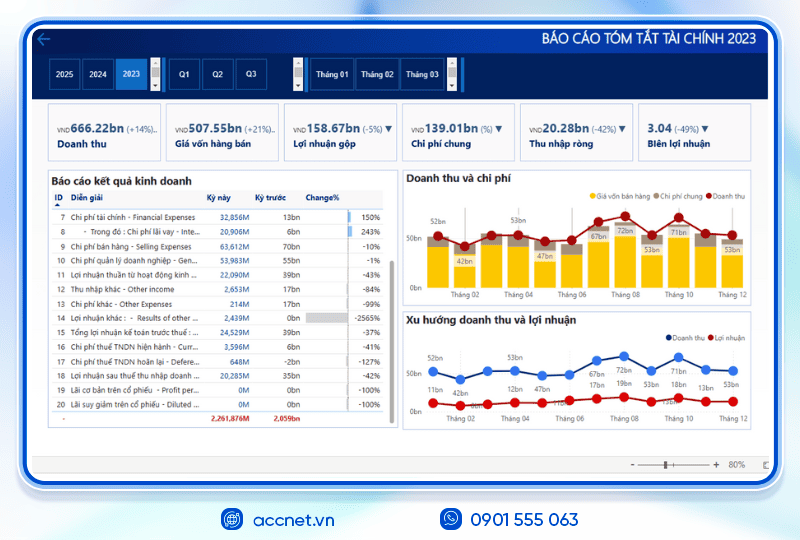

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

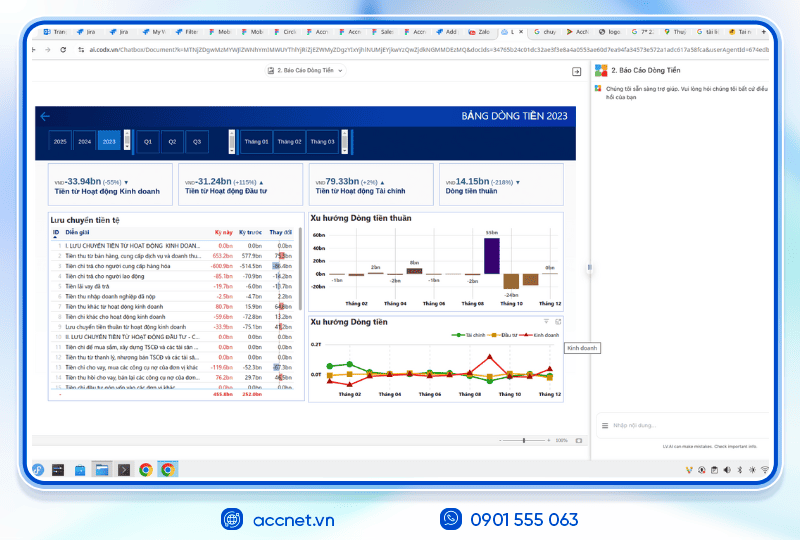

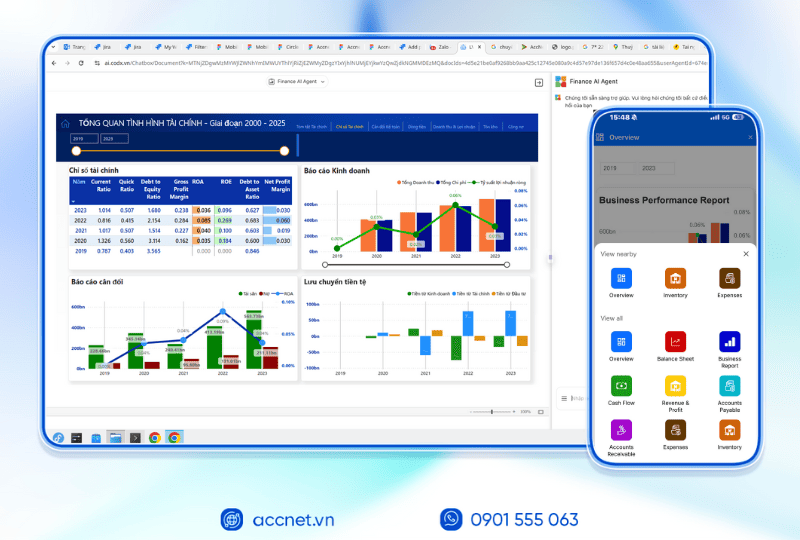

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Article on have provided you with the basic knowledge about cash accounting. Here is the important knowledge help you better understand accounting and effectively applied in practice. Hope this information will help you manage your accounting and cash resources of the business more efficiently, ensuring the solvency and sustainability.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: