If assets no longer meet the needs of use or loss of value, the implementation of the liquidation of assets is essential to optimize the state budget. This article AccNet will provide detailed instructions on the process of liquidation of assets, from inventory, property assessment to planning, implementation liquidation. Let's track right below the article below!

1. The concept of liquidation of assets is what?

Liquidation is the process handling the property owned by the state, no longer fit or are no longer worth using, through the form of such auction, transfer or destruction.

The process of liquidation of assets not only helps state agencies/state enterprise asset management more efficient, but also:

- Public property is not wasted, losses due to not being inventory and handle properly.

- Provide accurate data serve for financial reporting, budget management.

2. The steps in the process of liquidation of public property

Step 1. Inventory and assessment of public property

Set the category property in need of liquidation:

- Identify those assets no longer value used, damaged, not fit current needs.

- Make a list of details about the type property, the amount of current status.

Reviews the residual value of assets:

- Determine the value of the property based on historical cost, accumulated depreciation, actual status.

- Use unit pricing independently if necessary to ensure objectivity.

Build record inventory of public property: the minutes need to be approved by the stakeholders, including the unit leader, the supervisory authority property.

Read more:

- Báo cáo loại bỏ tài sản cố định theo quy định chuẩn kế toán doanh nghiệp

- Hạch toán thanh lý tài sản cố định theo giá trị còn lại trên sổ sách kế toán

Step 2. Planning for the process of liquidation of public property

Determine the method of liquidation:

- Auction: Apply to the assets of great value.

- Transfer: to Apply when the assets are still worth using, but not consistent with the current purpose.

- Destruction: for the assets no longer in use value, can not be recycled.

Cost estimates liquidation: includes costs related to transport, storage and disposal of property.

Approved plan: Submit plan of liquidation to the asset management company/competent authorities for approval before implementation.

Step 3. Organizations implement process of liquidation of public property

Made public auctions:

- Public notice auction information on means of mass communication, electronic portal.

- Auction held according to the regulations, guarantee the buyer the highest bidder to be the ownership of the property.

Establishment of handover: After the complete liquidation, need to establish the handover of property between related parties, specifies the information assets, the liquidation value, the time taken.

Handle the documents and certificates from: store bills, vouchers related to the liquidation process to serve the audit report after this.

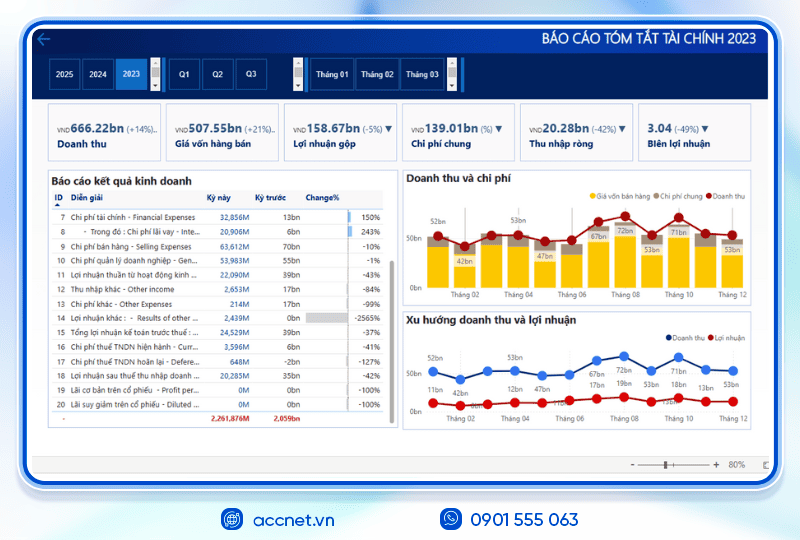

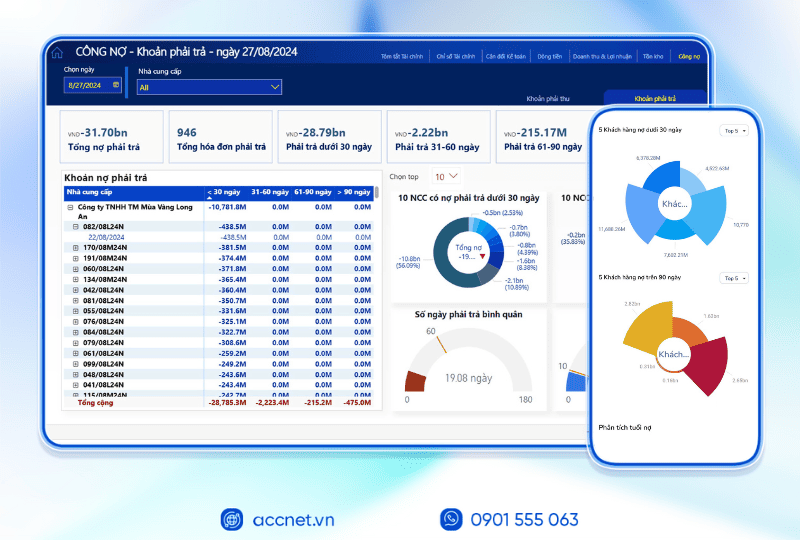

Step 4. Accounting and reporting results liquidation

Revenue recognition, cost from liquidation: recognize revenue from the sale of assets, the costs incurred in the process/procedure of liquidation of public property.

Reporting results liquidation:

- General complete information about the process of liquidation, including the items of property, revenue, cost, profit.

- This report should be sent to the upper management for approval, store.

Updated bookkeeping: Reduction in value of assets on the books, recorded revenues/expense arising from the liquidation.

3. Legal regulations related to disposal of public property

To process the liquidation of assets is to comply with regulations, state agencies, businesses need to adhere to the text of the legislation below:

- The law on Management and use of public property (Law no. 15/2017/QH14): Take out the principles, regulations, overall management and use of public property.

- Decree 151/2017/ND-CP: specific guidance on the management process, use and disposal of public property.

- Circular 144/2017/TT-BTC: detailed Rules of the auction, transfer, destruction of public property.

4. Giải pháp tối ưu hóa quy trình thanh lý tài sản công - AccNet ERP

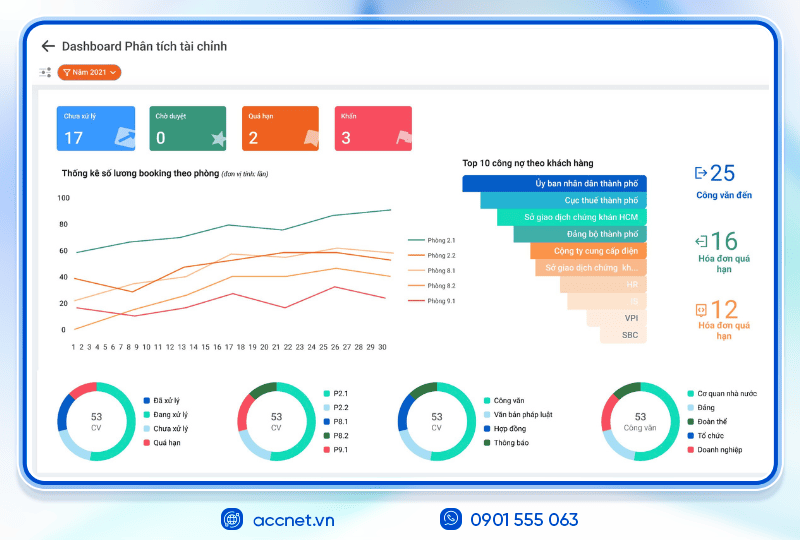

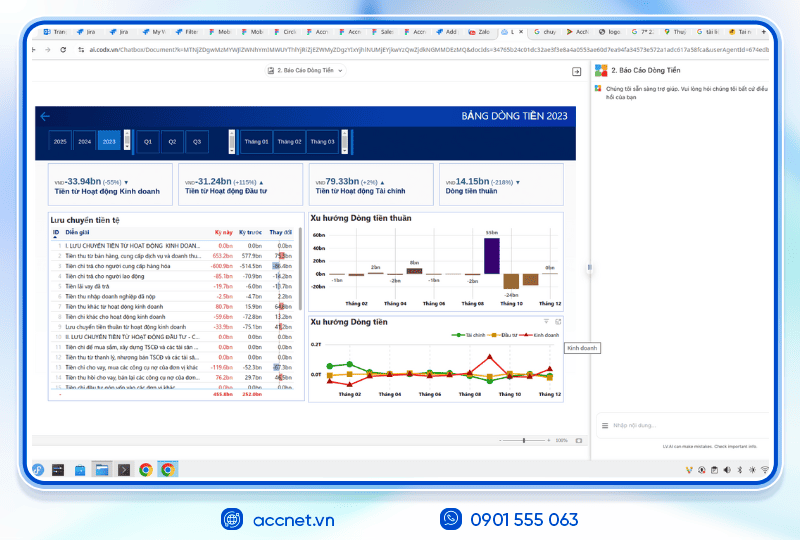

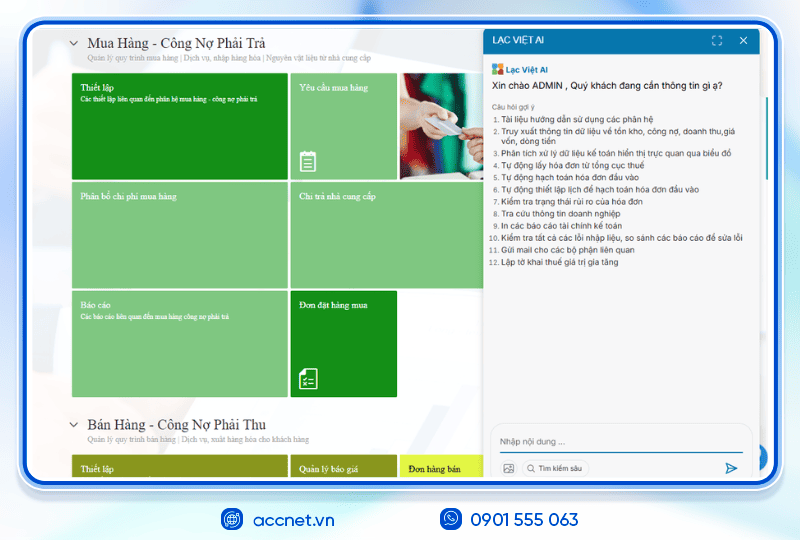

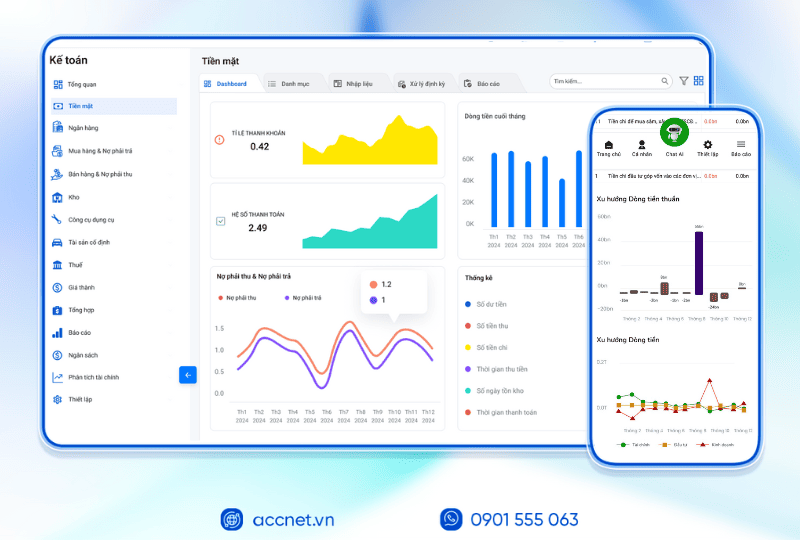

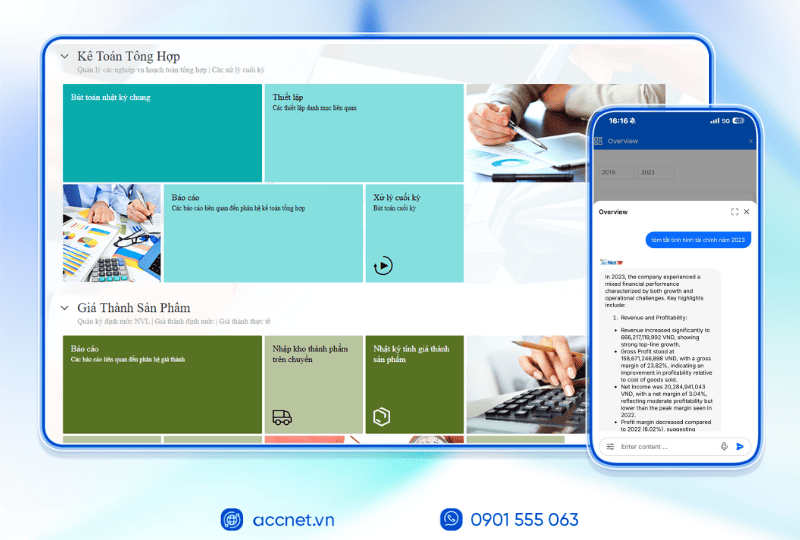

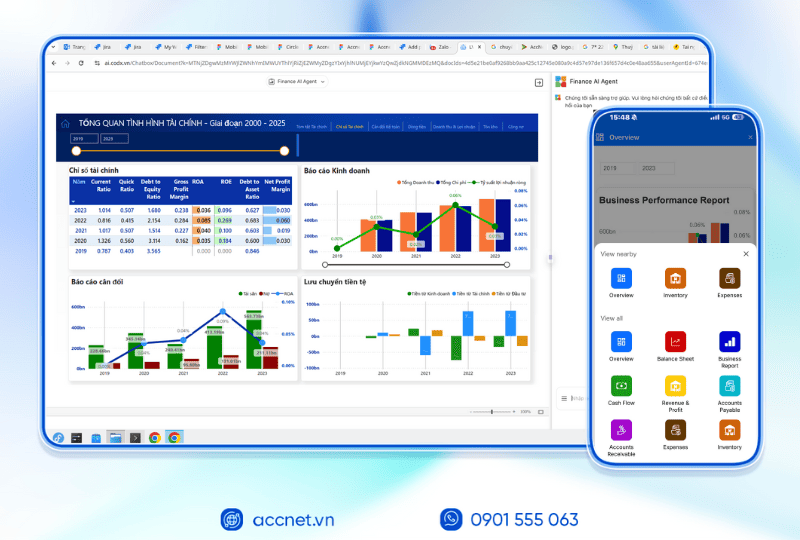

Công nghệ đóng vai trò quan trọng trong việc cải thiện hiệu quả quản lý tài sản công, bao gồm cả quy trình thanh lý. Vì vậy, bạn nên sử dụng phần mềm AccNet Asset với các ưu điểm:

- Inventory, assess, set the category property need to liquidate quickly

- Auto recognition journal entries related to revenue and expenses from operations liquidation.

- Store all records and documents related to property liquidation on digitizing system.

- Transparency in the auction, disposal of public property.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Bài viết này không chỉ cung cấp kiến thức chi tiết về quy trình thanh lý tài sản công mà còn mang đến các giải pháp thực tế để doanh nghiệp hoặc tổ chức nhà nước áp dụng hiệu quả. Hãy hiện đại hóa quá trình thanh lý tài sản công của bạn ngay hôm nay với sự hỗ trợ của phần mềm quản lý tài sản thông minh AccNet Asset!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: