Get cash advance from customers is an integral part to deploy the project. However, this raises the important question: "Advance have to invoice no?". This article AccNet will answered in detail, accurate, current regulations, help you understand when to invoice for advance payment and how to handle the situations that arise.

1. Advance have to invoice?

“The advance has to invoices not?” “Advance contract there must be a receipt?” - The answer is Yes, in some cases, the business must produce the invoice when you receive advance payment from the customer/partner.

According to circular no. 39/2014/TT-BTC of the Ministry of Finance, specified on the invoice when a sale of goods and services, businesses must produce the invoice immediately upon receipt of advance payment or security deposit from the customer, if the amount of the advance that is defined as part of the total value of the contract for sale of goods/provision of services.

2. A bill when receiving the advance

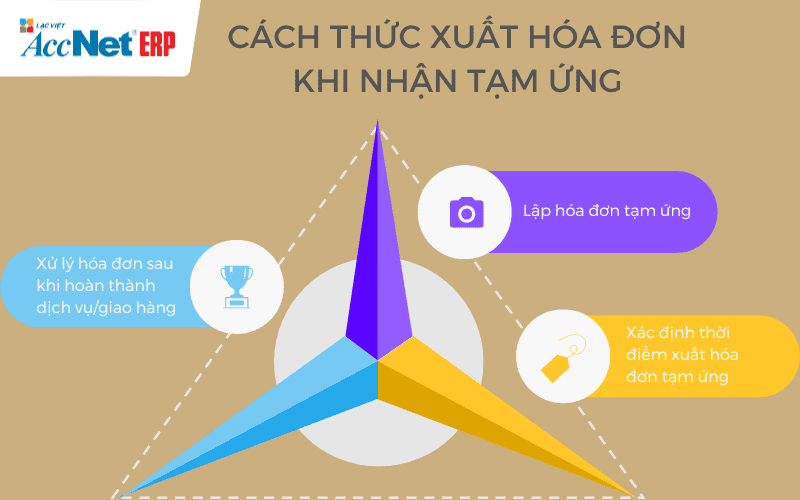

Invoice receipt advance need to follow the following steps:

Step 1: invoicing advance

Follow Article 4 of circular no. 39/2014/TT-BTC and Article 9 of circular 219/2013/TT-BTC invoice must include the full the following information:

- Name, address and tax identification number of the seller.

- Name and address of the buyer (customer).

- Specifies the amount of the advance content advance what is (for example, "advance to the contract of sale of goods XYZ").

- The amount of the advance, the tax rate, the amount of value added tax (VAT) calculated on the amount of the advance.

- The date of invoice.

Step 2: Determine the time of invoice advance

Invoice must be set right when businesses receive the advance amount, not depends on the goods delivered or services completed.

Read more:

Step 3: invoice Processing advance after the completion of the service/delivery

- When the goods have been delivered/services have been completed, businesses need to establish official invoices for the entire contract value. The amount of the advance which will be deducted from this value.

- If necessary, the business may have to set the adjustment for the difference between the amount of the advance and the actual value of the goods/services.

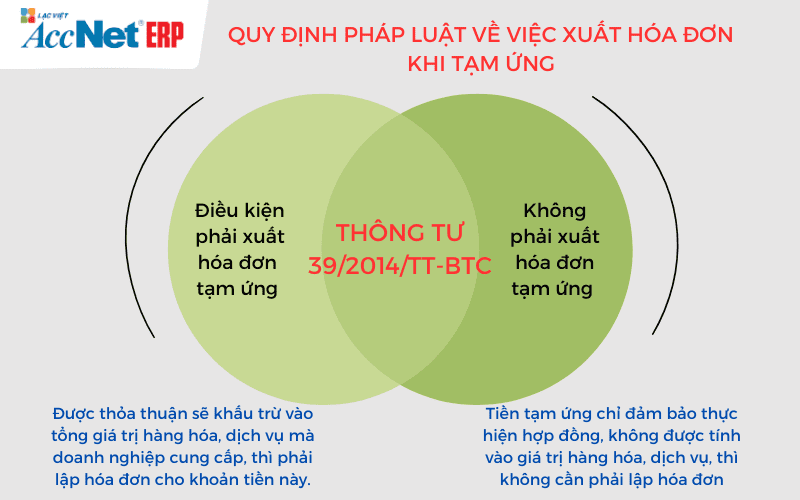

3. Provisions of the law on the invoice when advance

| Circular no. 39/2014/TT-BTC, Article 16: specified on the invoice when you receive money advance in the transaction of sale of goods and supply services |

3.1. Prescribing the conditions to the invoice when advance

- When businesses receive the advance amount and this amount has been agreed will be deducted from the total value of goods and services that the business offers, then to invoice for this amount of money.

- Invoice must be made immediately upon receipt of advance payment, don't wait until the completion of the service/delivery.

3.2. Rules on cases not invoice advance

If advance payment only intended to ensure the implementation of the contract, are not included in value of goods and services, it is not necessary to invoice. This case can occur when the cash advance is just a deposit, not directly related to the value of the contract.

4. Real examples about the advance to the invoice

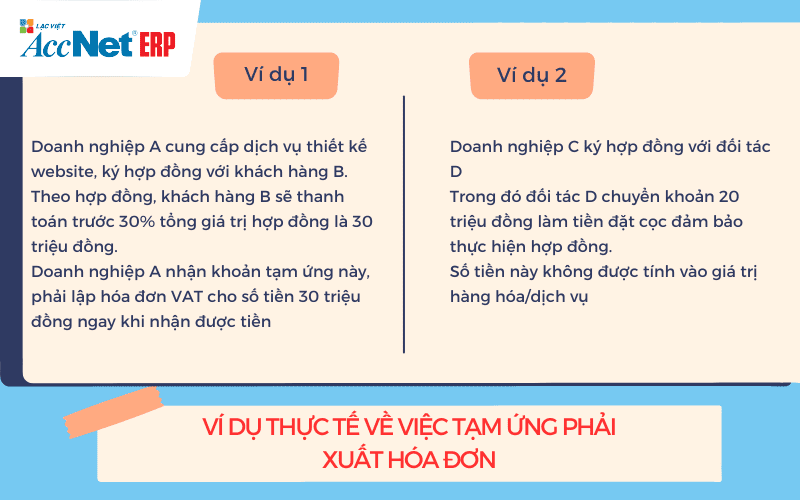

Example 1: Business service provider received an advance from customers

Business A service provider, website design, sign the contract with the customer B. According to the contract, customer B will pay 30% of total contract value is 30 million. Business A get account advance this require a VAT invoice for the amount of 30 million as soon as you receive the money.

>> Doanh nghiệp A lập hóa đơn với nội dung "Tạm ứng 30% giá trị hợp đồng thiết kế website", ghi rõ số tiền tạm ứng là 30 triệu đồng, thuế suất VAT là 10%, số tiền thuế là 3 triệu đồng.

Read more:

Example 2: Situation not invoice upon receipt advance

Business C signed a contract with partner D, in which the partners D transfer 20 million dollar deposit guarantee performance of the contract. This amount is not calculated on the value of goods/services.

>> Business C does not need to invoice for the amount of 20 million this because this is only the deposit, not the contract value was determined.

5. Handle the situation arises when to advance to the invoice

In the process of the receipt/invoice for the advance amount, there may arise a number of unintended situation, here's how to handle:

5.1. After receiving advance payment and invoicing, transaction is cancelled

Businesses need to set the minutes cancel the invoice, refund money advance for the clients. Issued invoices should be handled cancel in accordance with the regulations in Article 20, circular no. 39/2014/TT-BTC.

5.2. The amount of the advance initial change due to adjustment of the contract

Business invoice adjusted according to the amount of the advance, send to customers, at the same time noted this change in accounting books.

Learn more:

5.3. Detect flaws on the amount/content on the bill advance after casting

Under the rules, businesses will set a memorandum of agreement with the customer about the flaws, then invoicing adjust/pay bills, replace and send back to the client.

6. Xuất hóa đơn cho khoản tạm ứng dễ dàng với AccNet eInvoice

Khi nhận được tiền tạm ứng từ khách hàng trong hợp đồng mua bán hoặc cung cấp dịch vụ, doanh nghiệp thường băn khoăn: liệu có phải xuất hóa đơn ngay? Theo quy định, nếu khoản tạm ứng này sẽ được khấu trừ vào tổng giá trị hợp đồng thì phải lập hóa đơn ngay khi nhận. Ngược lại, nếu chỉ là tiền đặt cọc đảm bảo thực hiện hợp đồng, doanh nghiệp không nhất thiết phải lập hóa đơn ngay.

Nhưng quản lý tạm ứng và hóa đơn thủ công dễ bỏ sót — xuất hóa đơn trễ, sai thông tin hoặc nhập liệu không khớp. Với AccNet eInvoice, bạn có thể:

- Tự động phát hiện khoản tạm ứng cần lập hóa đơn khi nhận tiền, đảm bảo không bỏ sót.

- Tạo hóa đơn tạm ứng ngay trong hệ thống, với đầy đủ thông tin: nội dung “tạm ứng cho hợp đồng”, thuế suất, số thuế.

- Khi hoàn thành hợp đồng, hệ thống sẽ đối chiếu giá trị tạm ứng và tạo hóa đơn chính thức, khấu trừ tự động phần đã tạm ứng.

- Nếu có sai sót hay điều chỉnh (ví dụ thay đổi giá trị hợp đồng, hủy tạm ứng), AccNet eInvoice hỗ trợ lập hóa đơn điều chỉnh / hủy / thay thế đúng quy định.

- Đồng bộ dữ liệu với module tài chính – kế toán: khi hóa đơn tạm ứng phát hành, doanh thu, công nợ, chi phí sẽ cập nhật ngay mà không cần nhập tay.

With AccNet eInvoice, việc xuất hóa đơn cho khoản tạm ứng không còn là gánh nặng thủ tục — mà trở thành quy trình chuẩn, tự động và chắc chắn tuân quy luật pháp lý.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Problems “Advance have to invoice no?” is considered legal requirements, important factor in financial management business. Hope that this article has provided you with useful information in order to efficiently handle the account of advance in business, from which maintain operations financially stable, legitimate.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: