Today, many businesses still vague about threshold minimum amount necessary to invoice the red lead to the undue risk. So, are you sure I already know this rule? Let's AccNet explore deeper to the question: “invoice red minimum how much money?” – a elements may seem trivial, but leave a big impact to the financial operations of the business.

1. Invoice maker red minimum how much money?

1.1. Minimum amount to red invoice according to current regulations

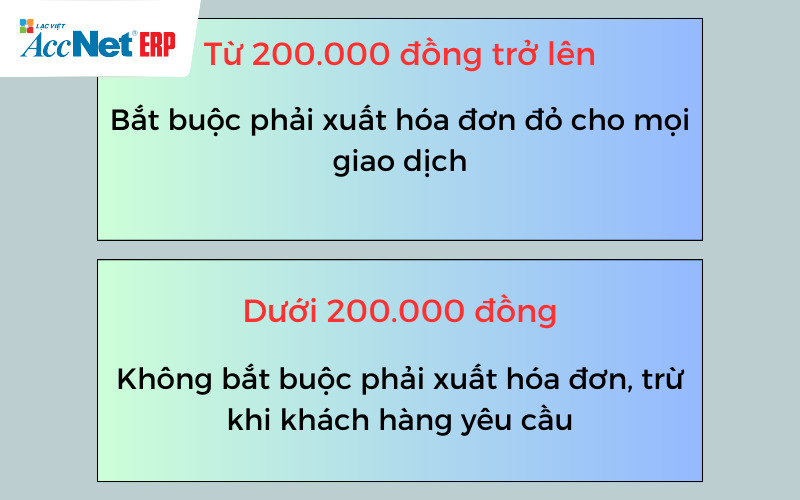

As specified in Article 4 of circular no. 39/2014/TT-BTC (được sửa đổi, bổ sung bởi Circular 119/2014/TT-BTC), business required to invoice red when providing goods and services valued from 200,000 or more. This means that every transaction has a value from 200,000 or more must be recorded by bill red. Specific:

- When the total value of a payment of a transaction (including VAT) reached from vnd200, 000 and above, the business must establish, deliver invoices to customers, regardless of whether the customer has requested or not.

- In the case of value under 200,000, if the customer invoice requests, businesses still have to invoicing red as prescribed.

Read more:

2.2. Invoice maker red minimum how much money for exceptions?

Theo Điều 16, Thông tư 39/2014/TT-BTC (được sửa đổi, bổ sung bởi Thông tư 119/2014/TT-BTC), quy định về việc lập hóa đơn khi bán hàng hóa, cung ứng dịch vụ, có một số trường hợp đặc biệt mà doanh nghiệp phải xuất hóa đơn đỏ ngay cả khi giá trị giao dịch dưới 200.000 đồng. Cụ thể:

- Customer invoice requests red (applicable for all transactions at retail stores or small transactions, retail, other)

- Sales transactions of goods and services for the agencies and organizations

Exact quote from Article 16, Paragraph 1, circular no. 39/2014/TT-BTC:

"The seller to invoice when selling goods and services, including the case of goods and services used for promotional, advertising, restaurant template; goods and services used to give, donation, exchange, pay salaries to employees and internal consumption (except the goods internal to continue the production process). Case the total value of payments under 200,000 each, if buyer no request, then the seller is not billed, except in cases where the buyer requires establishment and delivery invoices"

Theo quy định, các giao dịch từ 200.000 VND trở lên phải xuất hóa đơn đỏ, với giao dịch dưới mức này, hóa đơn vẫn phải xuất nếu khách hàng yêu cầu. Quy trình thủ công dễ gây nhầm lẫn hoặc mất nhiều thời gian, ảnh hưởng đến hiệu suất làm việc. Hãy để phần mềm lập hóa đơn bán hàng AccNet eInvoice hỗ trợ bạn. Với khả năng tự động hóa, chính xác, tuân thủ quy định pháp luật, management system invoice electronic AccNet eInvoice giúp bạn xuất hóa đơn dễ dàng, nhanh chóng, bất kể giá trị giao dịch. Trải nghiệm ngay để tối ưu hóa quy trình kinh doanh của bạn!

2. Why the minimum amount to invoice red so important to business?

Understand the minimum amount to invoice is important for business because of the following reasons:

- The minimum amount is determined when to invoicing red, affect the tax declaration.

- No invoice red right regulations could lead to penalties, loss of reputation

- Revenue is not recorded in full, the cost teen legitimate basis for accounting, causing discrepancies in the accounting records.

- Cause errors in the declaration of VAT, difficult to deduct input tax, leading to the risk of arrears of tax, penalty administration.

Read more:

3. Guide invoice simple red below the minimum amount for small transactions

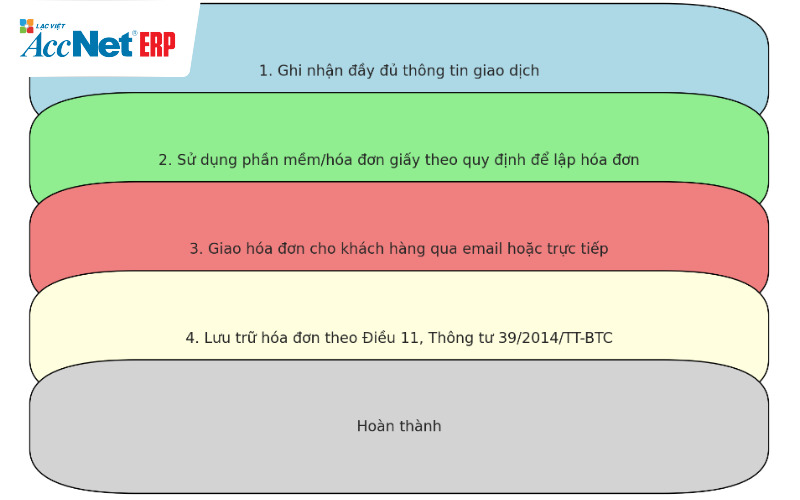

In real business, not less times business encounter situations transaction value lower than 200,000, but the client still requires bill red. In this case, the business needs to fulfill the following steps:

- Ensure that all of the information about transactions is accurately recorded, from customer information to details of goods/services provided.

- Use software electronic invoice/bill paper as specified in Decree 119/2018/ND-CP to bill, even if the transaction value is small.

- Invoice must be delivered to our customers as through email (electronic invoice), direct (paper bills - set in the correct form, stored carefully under Article 11 of circular no. 39/2014/TT-BTC).

4. Consequences when not red bill reached the minimum amount specified

Theo quy định tại Điều 23, Nghị định 125/2020/NĐ-CPbusinesses can be fined from 4,000,000 to 8,000,000 if no invoice red right rules for transactions valued from 200,000 or more. Rate this penalty may be increased depending on the severity of the violation and the number of re-offending.

In addition, the business is still the tax inspection, tax arrears, apply coercive measures of tax. Cause loss of trust of customers for business activity long-term

Learn more:

5. Xuất hóa đơn đúng quy định với phần mềm AccNet eInvoice

Khi đã nắm rõ quy định xuất hóa đơn đỏ tối thiểu từ 200.000 đồng, câu hỏi tiếp theo là: làm sao để thực hiện việc này nhanh chóng, đúng chuẩn và hạn chế sai sót? Câu trả lời chính là phần mềm hóa đơn điện tử AccNet eInvoice.

Với AccNet eInvoice, toàn bộ quy trình xuất hóa đơn được tự động hóa và chuẩn hóa theo quy định pháp luật. Cụ thể:

- Tự động phát hành hóa đơn hợp lệ cho các giao dịch từ ngưỡng 200.000 đồng trở lên, giúp doanh nghiệp không bỏ sót nghĩa vụ xuất hóa đơn.

- Ký số và gửi hóa đơn ngay trên hệ thống, không cần thêm phần mềm trung gian.

- Đồng bộ dữ liệu với kế toán – tài chính, đảm bảo doanh thu, công nợ và báo cáo thuế chính xác, kịp thời.

- Lưu trữ và tra cứu dễ dàng, đáp ứng cả yêu cầu quản lý nội bộ lẫn thanh kiểm tra của cơ quan thuế.

Nhờ đó, doanh nghiệp vừa đảm bảo tuân thủ quy định pháp luật, vừa tiết kiệm thời gian và nâng cao hiệu quả quản lý.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Understand invoice red minimum how much money is an important part in the operation of the business. Just master these rules, you always protect the business from legal risks, dedication to customers. Hope that information Accnet share will help you feel more confident in managing bills every day.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: