Finance is considered as the source of life of the business, if you lose financial resources, then the business will go bankrupt. So businesses need to know financial management to the company is always growing. So, financial management what is the business and financial management how effective? The following article will answer for you those questions.

1. Quản Lý Tài Chính Là Gì?

Quản lý tài chính là quản lý nguồn vốn. Trong đó có nguồn vốn tiền mặt, tài sản và các quan hệ tài chính khác như khoản phải thu, khoản phải trả,... nhằm tăng lợi nhuận cho doanh nghiệp.

Quản lý tài chính là công việc vô cùng quan trọng đối với người quản lý doanh nghiệp, việc quản lý tài chính có hiệu quả không những giúp tăng lợi nhuận mà còn giúp doanh nghiệp phát triển hơn ra nhiều thị trường thế giới.

2. Vai Trò Và Mục Tiêu Của Cách Quản Lý Tài Chính, Kinh Doanh Đối Với Doanh Nghiệp Là Gì?

Financial management, more accurately manage cash flow out into the business, every business will have a way to manage its own financial efficiently as possible. But the role of financial management for business are the same. The following are the roles and objectives of financial management for business.

- Decide on the development and survival of the business.

- Manage the cash flow of all production activities of business there.

- Plan the financial plan of the business.

- Decide what category of investment and funding.

- To help businesses easily search for profit from equity capital or from borrowed funds.

- Maximize target profit after tax.

- I maximize profit target return on equity.

Read more: Phân tích tình hình tài chính doanh nghiệp để đánh giá hiệu quả hoạt động

3. Các Nguyên Tắc Và Chức Năng Của Quản Lý Tài Chính Doanh Nghiệp

Every business will have a financial manager for his own, the financial management will depend on the scale, the business sector of the company. But where there are still the principles of financial management general for most businesses. The following are the principles and functions of management, business finance today.

Review of capital requirements

The financial management of the business need to plan the estimates related to the capital requirements of the company. The plan this would be expected to be the cost and profit brought back from the deployment plan during the year.

Determine the composition of capital

When planning the audit has been completed, the financial manager needs to restructure capital. The restructuring of capital is intimately related with the analysis about long-term debt and short-term. This will decide the company can use its finances to solve the problem of not or need for additional funds to be raised from outside.

Cash management efficiency

The cash management is considered important principles in the management of financial. Cash of the business to be used for payment of salaries, payment of debts, maintaining stock, purchase of raw materials,... not cash management efficiency will make the business difficult to manage.

Select funds fitting

To bring more profit for the business, managers need to consider and take out options such as: issuance of bonds, shares and left, the period for loans received from the bank,... choose a suitable form that will help the business be more profitable and avoid risks.

Smart investment

The plan clearly and accurately for the investment in the project incurred a profit, will help the business has been a source of big profits significantly. But if the wrong investment your business will have to shedding to pay the debt.

Consider the value of currency

Before you decide to spend a period of huge costs, then, besides finding out about profit bring. Businesses need to learn more about the value of currency (increase or decrease) over time due to external factors such as inflation,... to allocate cash flow accordingly.

Control all activity

The financial management must cooperate with people other administrators in the enterprise, to ensure the operation of the business effectively. Every business results are related to financial issues and it need to be taken into the calculation for completeness before implementation.

4. Khó Khăn Trong Cách Quản Lý Tài Chính?

- 't control public debt, tight, frequently, not have the policy to collect the debt reasonably lead to business is the deficit of money.

- No plans to buy materials, goods, supplies,... wasting funds.

- Not strictly control the import, inventory, loss of goods leads to business to the temple of the contract.

- No financial plan is clear.

- Non-management employees, to employee fraud, profiteering nefarious influence capital business.

- Do not use the software in financial management.

5. Cách Quản Lý Tài Chính Kinh Doanh Doanh Nghiệp Hiệu Quả

Many businesses have to go to bankruptcy or debt flooded head do not know how to manage her finances effectively, and the following is the financial management for business in the world that you should refer to the business to avoid the losses should not be.

Financial management system

The financial management business in a systematic way will help your business grow best. All loans, leases, income and expenditure, wages, cost of investment,... need to be followed in detail carefully.

Use a software, financial management is essential for big businesses, or those businesses that want to manage their finances in a detailed way.

Revenues and expenditures clear

The income and expenditure account of the business you need to understand one plan income and expenditure will obviously help you manage the cash flow of more accurate, avoid the budget deficit.

To not succumb to the debt, you should not spend more than profit that the business earns.

Investment profit is the financial management, business efficiency

Continuous investment the amount of money groove salvation of business on the project profitable, will create more profit for the business over. The cost-effective investments, there's high profit margin will generate cash flow earned very big.

Balance between risk and rate of return

A good financial management will certainly know how to balance between risk and return performance: A level of risk, will bring a profit and a small level of risk will bring you a large profit. If you want to carry on for a business account, big profits, they must accept the risk will occur.

Pay attention to tax

Everyone knows the account to which of us are under the state tax, so the review calculated the investments under the influence of the tax right from the start is essential.

Always have a plan B

Although the above embodiments of you are good to, where it is the case of unforeseen risk that can happen. Let's equip in advance for his plan B is equal to the savings reserve, use of insurance services, to be able to easily overcome the crisis no doubt, comes as: loss-making, tricked, due to natural disasters, fire,...

The have a plan B, C or D is something that most of the financial managers have to do.

Using the software, financial management

According to the survey of the financial expert, then about 95% of medium and large businesses are using software to manage finance for your business. Software financial management brings many benefits for businesses, such as:

- Easily manage capital

- Management of capital and capital structure

- Revenue and expenditure management clear

- Make timely payments

- Establishment and approval of the budget plan easy

- Allocate resources appropriately for the operation of the business

- Provide the reports, KPI helps control the details of item, avoid excessive spending

- System security

- Data entry easier, save time for users

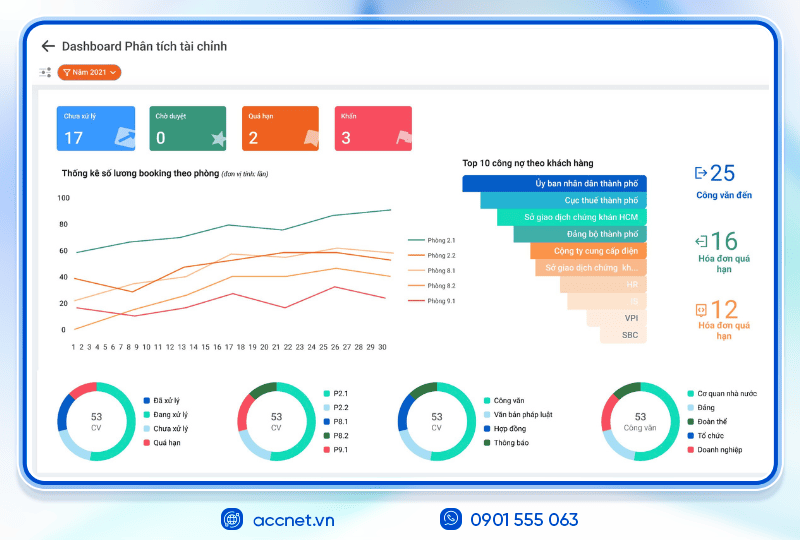

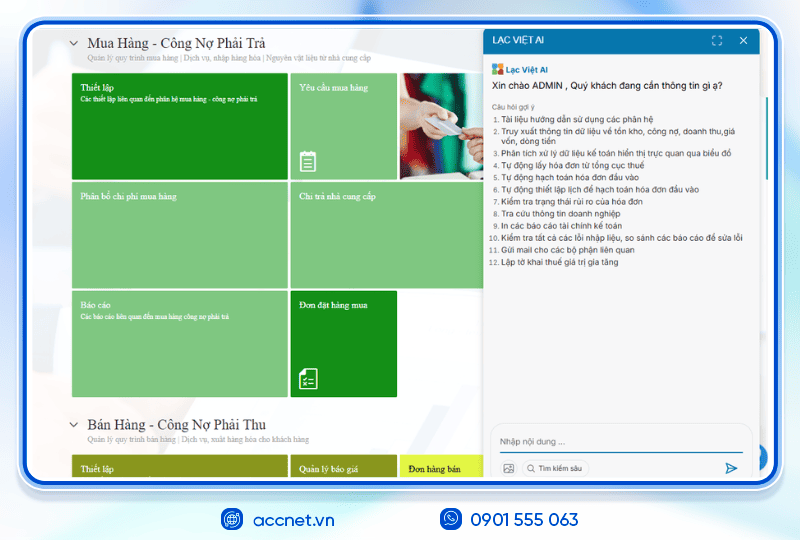

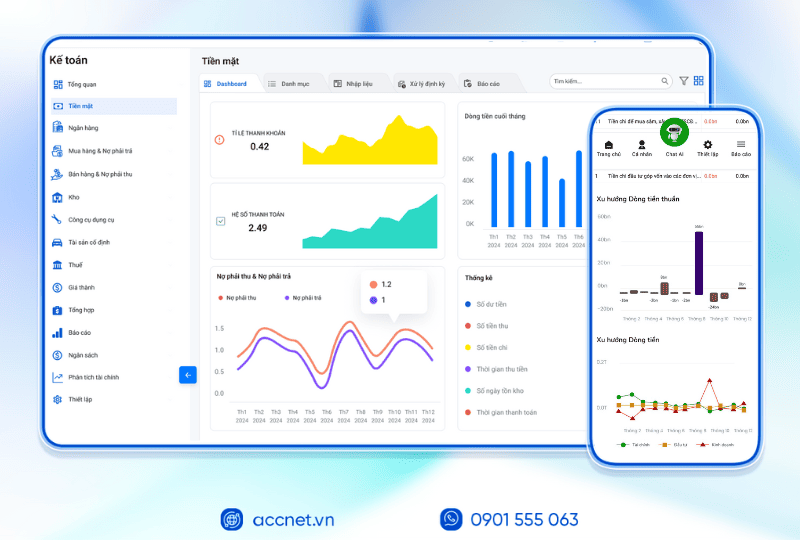

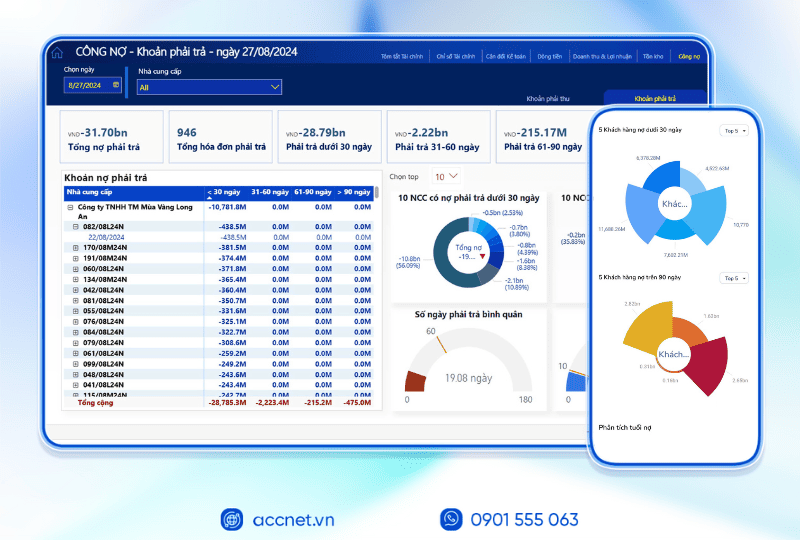

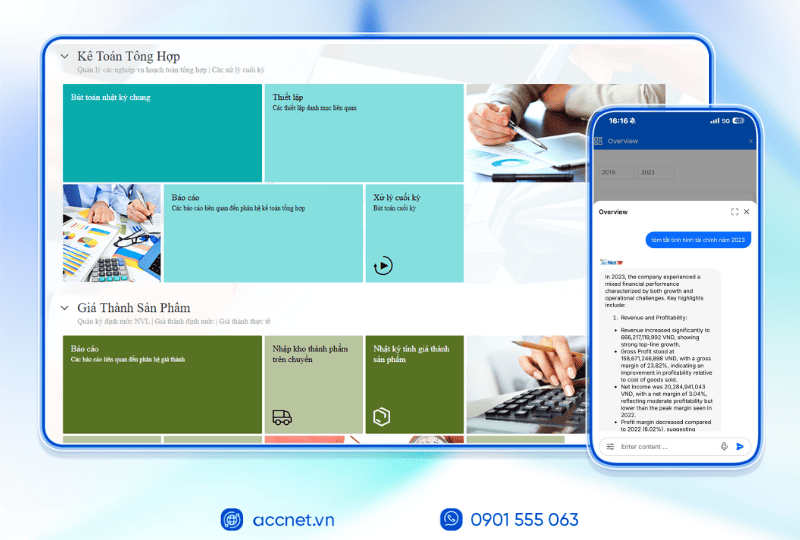

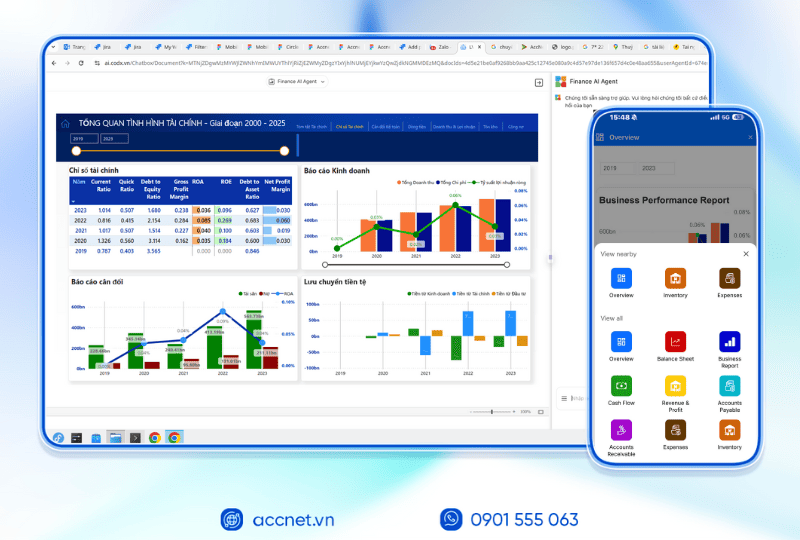

When it comes to software, financial management, it can not fail to mention the software business management AccNetERP. The analysis of financial Management in software enterprise management AccNetERP with many features, the interface is easy to use and fully meets the features that a financial manager needs. Most of the big business in Vietnam has information using management software, business AccNetERP for your business.

6. Từ “Quản lý tài chính” đến giải pháp kế toán toàn diện AccNet ERP

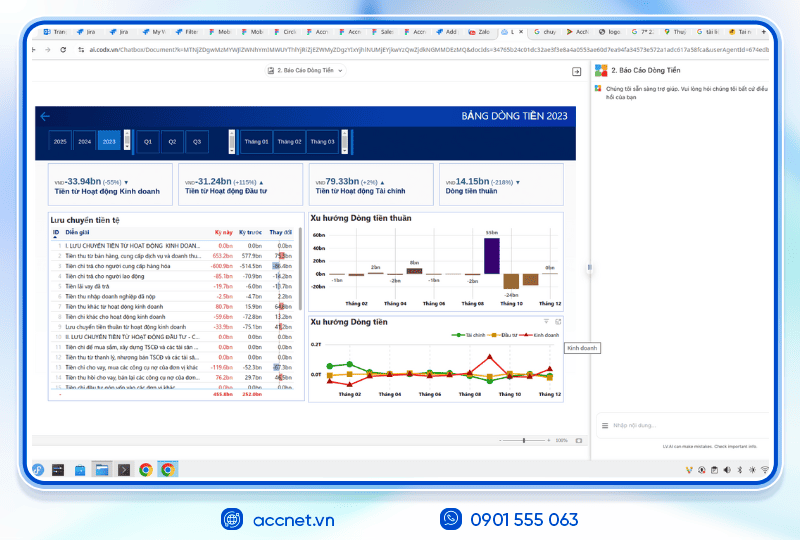

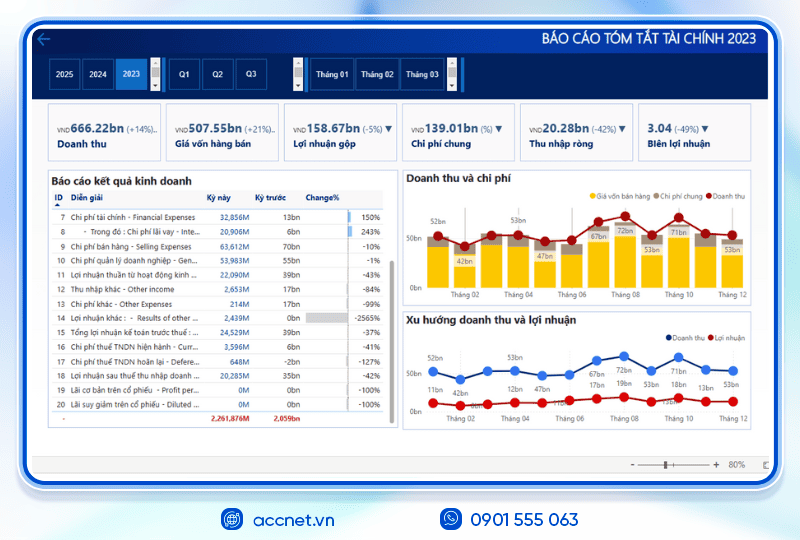

Quản lý tài chính — bao gồm dòng tiền, tài sản, công nợ, thu chi — chính là xương sống để doanh nghiệp vận hành hiệu quả và bền vững. Bài viết “Quản lý tài chính là gì” đã chỉ ra tầm quan trọng của việc kiểm soát nguồn vốn, thu – chi rõ ràng, lập kế hoạch ngân sách và sử dụng phần mềm để thu thập số liệu một cách hệ thống.

Tuy nhiên, khi sử dụng nhiều công cụ riêng lẻ hoặc ghi chép thủ công, doanh nghiệp dễ gặp phải tình trạng dữ liệu phân mảnh, chậm cập nhật và khó theo dõi tổng thể. Đây chính là lúc AccNet ERP thể hiện giá trị vượt trội:

- Tích hợp đầy đủ phân hệ tài chính – kế toán: mọi phát sinh từ mua hàng, bán hàng, kho, công nợ… đều tự động cập nhật vào hệ thống tài chính chung.

- Cập nhật số liệu theo thời gian thực: dòng tiền, tồn quỹ, công nợ đều hiển thị số liệu mới nhất để bạn ra quyết định kịp thời.

- Lập và theo dõi ngân sách tài chính: AccNet ERP giúp phân bổ ngân sách theo phòng ban hoặc dự án, cảnh báo khi vượt mức.

- Báo cáo & phân tích tài chính thông minh: với dashboard và báo cáo chi tiết, người quản lý dễ dàng theo dõi hiệu suất tài chính và các chỉ số quan trọng.

- Tuân thủ quy định trong nước: hệ thống đáp ứng các chuẩn mực kế toán, yêu cầu thuế và báo cáo tài chính tại Việt Nam.

Khi áp dụng AccNet ERP, quản lý tài chính không còn là bài toán rối rắm với nhiều bảng tính rời rạc, mà trở thành quy trình đồng bộ, minh bạch và kiểm soát dễ dàng hơn.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

With all of the above information, accnet.vn hope to help be a part for the financial management, business or those who are learn about how to manage finance for your business. If you want to use the software, financial management, or learn more about software, financial management, you can contact us in the chat below. We are ready to advise you right now.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: