In financial management – business accounting, the valuation of stock is an extremely important step, directly affects the price of goods sold, profit, taxes , and the financial health of the business. Statistics show that up to 63% Vietnam business concerns , to find information about the method of calculating the price of stockespecially in the context of inventory management increasingly complex reporting needs exactly soar.

The choice of the method of calculating the price of stock suitable not only help businesses reflect the true cost, the price of capital and profit, but also for decision support economic efficiency, optimize cash flow, reduce the loss of goods, construction mechanism, inventory management, scientific and standardized. This article will analyze in detail the common method, advantages – disadvantages, application objects, which help the business have the facility to choose the right method.

1. Overall , the importance of the export warehouse

Basic concepts

Price of stock is the value of goods, raw materials are taken out of inventory for use in production or service delivery. Other than the entry price stock price of stock reflects the actual cost incurred when the goods leave the warehouse , to be charged to cost of goods sold (COGS).

The basic components of the price to enter the warehouse often include:

- Original purchase price: the Price on the invoice, not include shipping cost or unloading.

- Costs incurred: Freight, shipping, handling, insurance when the goods enter the warehouse.

- Processing costs: If yes, include machining, surface treatment, or other direct costs.

About the legal basis, the valuation of inventory is adjusted by accounting Standards Viet Nam VAS 02, circular no. 200/2014/TT-BTC and circular 133/2016/TT-BTC, help business to ensure the accuracy of financial reports, including profit and loss statement, balance sheet , statements of cash flows.

Importance to business

- Ensure accurate financial reporting: the Price of stock is the basis for calculating COGS, from which affect gross profit, net profit , CIT.

- Support optimize profit margins: Choose the right method, calculate the price of stock to help businesses accurately reflect the cost-optimal profit , decision price products accordingly.

- Effective inventory management: accurately track shipments – survive from that forecast demand, reduce excess inventory, avoid loss.

Read more:

- Chi phí sử dụng phần mềm quản lý kho cho doanh nghiệp vừa và nhỏ

- Cost of storage và cách tối ưu quản lý hàng tồn trong doanh nghiệp

- Cách xác định giá trị vật tư và hàng hóa tồn kho trong doanh nghiệp

2. The method of calculating prices export warehouse details

Today, businesses often apply three popular methods, each method has advantages and disadvantages , to suit each type of different businesses.

Method purpose of the (Specific Identification)

Principle: Each unit of goods is determined individually, price stock equal to the actual price of the shipment.

Advantages:

- High accuracy, most closely reflects the actual cost.

- Compliance with matching principle (matching principle), ease of traceability of goods.

Cons:

- Manage the complex , costly, especially when the number of plots of log.

- Does not fit with the homogeneous material or multiple numbers.

Applicable objects:

- The automotive industry, luxury goods, expensive components.

- Enterprises with the number of items less but great value.

- Requires warehouse management system closely, can incorporate technology to access data quickly.

Method the weighted average (Weighted Average Cost)

Principle: the value of each type of inventory is calculated based on the average value of inventory the goods in the states.

Advantages:

- Easy to apply, simple, fit cargo batches of income.

- Help reduce the impact short-term price fluctuations on the price of stock.

Cons:

- Does not reflect the costs in detail according to each batch import.

- When necessary economic decisions quickly, the information may lack precision.

Applicable objects:

- Enterprise medium-sized enter multiple shipments at a discounted price difference is too big.

- The business has many categories of goods, but the price is stable.

Details average method:

- Average end of period: Charged once at the end, simple but not determine the price of stock at the time incurred.

- The average instantaneous/mobile: Updated after each import, valuation of stock accurately according to each business, but the volume of calculations significantly increased.

The method first in – first out (FIFO – First In, First Out)

Principle: imports ago is ago the price of stock by price batch import the earliest. Inventory last states as batch import nearest.

Advantages:

- Closely reflects the fact when perishable goods or limited use.

- Value of inventory on FINANCIAL statements close to the market price.

Cons:

- Can make revenue current does not correspond to the current cost.

- Requires volume management when the number of items , batch import multiple continuous.

Applicable objects:

- Food industry, pharmaceutical, chemical, cosmetics...

- Businesses have strict requirements about term use.

Other methods such as LIFO, the cost norms, the retail price is also business considerations, but less popular in Vietnam, due to current regulations.

3. The influence of the method of calculating the price of stock to the financial statements

Choose the method of calculating the price of stock not just a matter of technical accounting, but also directly affect the financial statements, especially the cost of goods sold (COGS), gross profit, corporate INCOME tax, the rate of short-term assets.

The impact to the price of capital , profits

| Case | FIFO | Average | LIFO |

| Price increase continuously | COGS low → high profits → CIT increased | COGS is, on average, less volatility, reflecting the cost of stability | COGS high → low profit → Reduce the corporate INCOME tax |

| Discount | Recorded rates higher capital market → profit temporary reduction | Reflects average cost, reduce the oscillation profit | COGS low → high profits temporary → CIT increased |

As the table shows, businesses need to weigh the options method in accordance with the situation fluctuations in the price of raw materials, strategy, profit , tax policy.

Read more: Phương pháp xác định tốc độ luân chuyển vật tư và hàng hóa trong kho

Affect the inventory value

- FIFO: inventory value, end of period close to the market price, to help accurately assess the short-term assets.

- Average: Balance between the batch import, reflect average value stability, but the lack of details.

- LIFO: inventory value lower than the market price when the price increases, can affect the ability to borrow capital or review the property.

Other impact to business

- Change the method of calculating the price of stock between accounting period can cause difficulties in the comparison report from time to time.

- Managers need to ensure consistent, and transparent explanation of the changes in the notes to FINANCIAL statements.

4. The important note , the solution warehouse management

Effective inventory management doesn't just stop in the method of calculating the price of stock but also in relation to the application of accounting principles, operating procedures , and technology management.

Principle of consistency

- Enterprises need to adopt a method of accounting, at least in an accounting year.

- This principle is not forced to apply a method for all types of goods. Can choose own method for each product group or account inventory.

- If you change your method needs to be carried out from the beginning of the next fiscal year, explain the reason , the influence of notes to FINANCIAL statements, at the same time informed the tax authority.

Solution inventory management in the digital age

In the context of business is now under pressure rising costs, inventory management, intelligence is a vital element:

Application technology

- Use ERP/WMS to automate the process input – output – inventory.

- Apply the barcode/QR code, RFID to track shipments, term of use, location in warehouse.

Management science

- Set inventory levels, safety: minimum – maximum for each item.

- Applicable model EOQ (Economic Order Quantity) to calculate the order quantity, optimal, reducing excess inventory.

Forecast demand

- Analyze sales data to the past incorporating AI/ML to predict demand accurately, from which planning import – export warehouse logical.

Link financial – operated

- Coordination between finance, accounting, sales to a decision to enter orders, liquidation inventory, slow rotation.

- Tool use Cash-to-Cash Cycle to optimize cash flow, reduced costs of storage , which is appropriated.

Common mistakes

- Enter the wrong formula or calculated data.

- Change the method of calculating the price of stock between states.

- No tracking details for each shipment.

- Teen archival stock from the root, causing difficulties when audit or tax reporting.

5. Some notes enhance in the price calculation method of stock

In addition to the choice of the method of calculation base price, the business should be interested in the issue of raising to optimum inventory management , financial statements.

Cost control , profit margin

- Businesses should compare the prices of stock in each method with market volatility to ensure the production cost practical observation.

- This analysis determines the actual profit from that decision price sale, promotion or optimize production costs.

Batch management term use

- With the perishable products or have limited use short, FIFO method is still the preferred option, but need to integrate technology to track the shipment.

- Use the QR code, RFID helps to control each batch, limit losses , errors in the repository.

Tuning , track costs incurred

- When applying the method of calculating the price of stock average or FIFO, the cost arising out of the norm, such as shipping, insurance, or processing costs should be constantly updated to ensure factory stock properly reflect actual costs.

- Warehouse management system smart help automatically updates the cost incurred, avoid errors crafts , to enhance transparency.

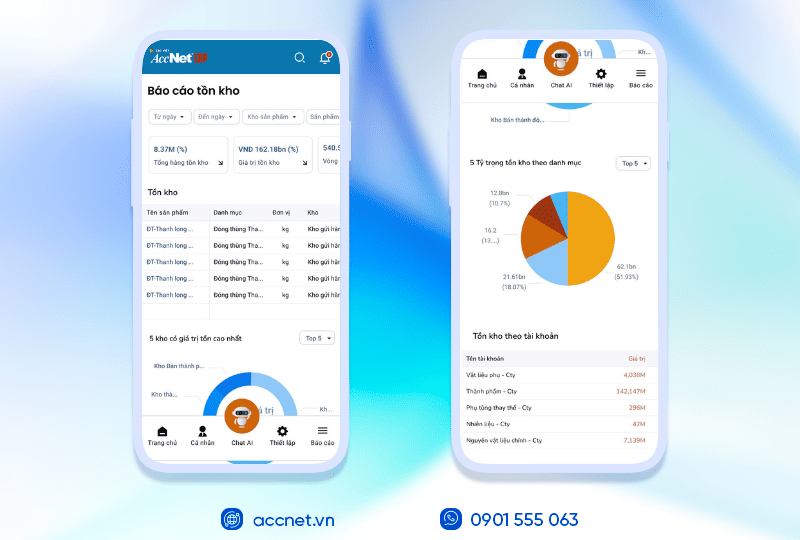

6. Management solutions & price stock precision - AccNet ERP

To support business in the inventory management , calculate the price of stock accuracy, AccNet ERP provides comprehensive solution:

- Automatic calculation of price inventory according to FIFO method, the weighted Average Destination list.

- Shipment tracking, expiry date, location warehouse, by barcode , QR/RFID.

- Updates costs incurred instant price guarantee capitalization reflects true fact.

- Financial statements intuitive: the Price of capital, inventory, gross profit, help a decision fast and accurate.

- Forecast demand , optimize inventory by AI, reducing the cost of storage and increase business efficiency.

With AccNet ERP, medium business , minor in Vietnam can deploy inventory management of goods, synchronized accounting – operation and apply the method to calculate the price of stock a correct way, saving time and resources.

PHẦN MỀM QUẢN LÝ KHO ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

Không chỉ là một phần mềm nhập – xuất thông thường, AccNet ERP chính là nền tảng quản lý kho thông minh, tích hợp thiết bị, kết nối dữ liệu, cảnh báo tức thời, giúp doanh nghiệp:

- Phân loại hàng hóa linh hoạt: Tạo mới danh mục theo nhu cầu; phân nhóm theo thuộc tính; thống kê doanh số, lãi gộp theo nhóm; mỗi mã hàng kèm đầy đủ thông tin tồn kho, tài khoản, giá vốn, thuế, phương pháp xuất kho.

- Quản trị kho đa dạng – kết nối thiết bị: Phần mềm quản lý kho AccNet ERP hỗ trợ QR code, barcode, thiết bị kiểm kê; quản lý tồn kho theo trạng thái (tài chính, vật lý, sẵn sàng bán); cho phép xuất kho theo hạn sử dụng, chuyển đổi đơn vị tính; hỗ trợ nhiều phương pháp tính giá xuất (BQGQ, FIFO, đích danh...).

- Quản lý tồn kho chính xác, đa chiều: Theo dõi theo màu sắc, kích thước, cấu hình, vị trí kho, mã lô; cho phép khai báo song song đơn vị đo lường, kiểm đếm; đối chiếu tồn kho thực tế với sổ sách.

- Tối ưu hiệu suất kho: Truy xuất nhanh hạn sử dụng, nguồn gốc hàng; tìm kiếm thông minh; quản lý định mức nguyên vật liệu; cập nhật tồn kho tự động theo đơn bán; cân đối hàng tồn toàn hệ thống, lưu lịch sử điều chuyển.

AccNet ERP mở ra một bước tiến mới trong quản lý kho khi tích hợp trợ lý tài chính AI, giúp doanh nghiệp vận hành chủ động và ra quyết định chính xác hơn.

- Phân tích tồn kho 24/7 trên cả desktop & mobile: AI liên tục cập nhật số liệu thực tế, cảnh báo khi hàng sắp thiếu hoặc tồn đọng quá lâu.

- Dự báo nhu cầu và rủi ro hàng hóa: Từ dữ liệu lịch sử, hệ thống đưa ra dự báo xu hướng nhập – xuất, giúp doanh nghiệp tối ưu kế hoạch mua hàng.

- Tra cứu tức thì chỉ trong vài giây: Tìm nhanh sản phẩm, số lượng tồn kho, công nợ liên quan, giá trị hàng hóa,… chỉ qua một thao tác trò chuyện với AI.

- Tự động hóa nghiệp vụ kho: Từ phiếu nhập, phiếu xuất đến kiểm tra tồn, hệ thống tự động hạch toán, đối chiếu và kết nối trực tiếp với báo cáo tài chính.

✅ Quản lý kho chủ động – Không còn “tồn kho ảo, thất thoát khó kiểm soát”

- Tự động hóa đến 80% nghiệp vụ nhập – xuất – tồn, chuẩn hóa quy trình kho vận.

- AI hỗ trợ dự báo nhu cầu hàng hóa, cảnh báo tồn kho cận date hoặc ứ đọng.

- Đồng bộ dữ liệu kho theo thời gian thực, kết nối trực tiếp với tài chính – kế toán.

- Vận hành đa nền tảng trên desktop & mobile, tra cứu số liệu kho tức thì.

✅ Hiệu quả rõ rệt khi ứng dụng quản lý kho tích hợp AI

- Giảm đến 30% chi phí lưu kho nhờ tối ưu tồn và tự động hóa quy trình.

- Rút ngắn 50% thời gian kiểm kê và xử lý hàng hóa cận date.

- Increase 82% độ chính xác dữ liệu, giảm sai sót và thất thoát hàng hóa.

- Cải thiện hiệu suất dòng tiền nhờ kiểm soát chặt vốn lưu động bị “giam” trong kho.

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

The selection , application the method of calculating the price of stock is the key element in financial management – accounting, directly affecting cost of sales, profits, corporate INCOME tax , the quality of financial reporting. Businesses not only need to understand the advantages and disadvantages of each method but also to combine inventory management, modern technology, automation , process control cost.

A strategy for inventory management, it will help entrepreneurs optimize cash flow, reduce the loss of goods, demand forecast accuracy , improve the efficiency of business.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET ERP

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: