Inventory management not only as storage product, but also is the mathematics of optimal cost control, cash flow and maximize profits. One of the core issues that the business concern is pricing inventory – factors that directly affect the financial statements, the cost of production, cost of sales , strategic decisions in business.

Applying the correct method of pricing inventory helps to medium businesses meet the legal requirements, just effective control costs, avoid losses, and improve the ability to make decisions about procurement, production , distribution of goods. This article will provide detailed insight on the legal basis, definitions, component inventory, as well as the method of inventory accounting popular, from it support business in the process of solution deployment management, inventory optimization.

1. The legal basis when calculating the value of inventories

The accounting method , how to calculate inventory valuation is specified in the accounting Standards no. 02 (VAS 02) about inventory, issued by the Decision 149/2001/QD-BTC date 31/12/2001. This norm ensure businesses comply with the principle of transparency and honesty in recognition , reporting, inventory value, from which the basis for the calculation of cost of goods sold , profit.

2. The method of inventory accounting

Business can choose one of two methods of inventory accounting, depending on specific business requirements management.

| Method | Concept | Advantages | Cons | Applicable objects |

| Declare regular | Track , reflecting the ongoing situation, import, export, inventory in the states | Control the amount of inventory every time; reduce errors; support business decisions | The volume of work is large, requires inventory and notes daily | Business manufacturing, industrial, construction, or trading items are of great value |

| Inventory periodically | Reflect only the beginning , the end, no tracking import constant | Simple, reduce work load accounting | No regular control; easy to miss; the work put into the end of the period | A retail business, a variety of goods, low value, import constant |

Meaning the application of accounting methods

The choice of accounting methods directly affect the calculation of price, inventory from that impact:

- Financial statements: cost of goods sold, gross profit, CIT.

- Management and business decisions: Determine the production cost, product pricing.

- Compliance with accounting principles: ensuring transparency, consistency , the ability to compare data between the states.

Read more:

3. In principle, the meaning of the price inventory

Significance

Determining pricing, inventory accuracy not only the legal requirements but also are important tools in business management. Specific:

- Impact on financial statements: inventory value end of period directly affect the balance sheet, while cost of goods sold decide gross profit. If the price of inventory is not properly, businesses can report profit or cost deviations, leading to business decisions, not optimal.

- Support management & decision-making: Know the exact value of inventory to help businesses estimate manufacturing costs, determine the selling price reasonable planning, import – export, forecasting, cash flow effectively.

- Compliance with accounting principles: The application of the method of calculating the right price helps financial reporting transparency, honesty, easy to compare with the accounting period ago.

The core principles

In inventory valuation, businesses need to adhere to four basic principles:

- Principle of original Price (Cost Principle): inventory Recorded at cost, including cost of purchase and shipping costs, processing costs, but exclude the cost of enterprise management , the cost of sales.

- Principle of prudence (Prudence Principle): Recorded inventory according to the lower price between the original price , net value can be realized. When market prices fell, businesses must make provision for diminution in value of inventory.

- Principle of consistency (Consistency Principle): Apply the method of calculating prices throughout the accounting year. If changes need overs reason , the impact on the financial statements.

- Matching principle (Matching Principle): The capital of the sale must be recorded simultaneously with the corresponding revenue in the same accounting period.

These principles ensure that the process of price, inventory just exactly just transparency, help businesses manage costs effectively , take business decisions in a timely manner.

4. Methods of inventory valuation in common

According to accounting Standards VAS 02, businesses can choose one of the following methods to calculate inventory valuation:

Method Purpose of the (Specific Identification)

- Principle: the Price of capital is calculated based on the actual price of each shipment or product.

- Pros: Very accurate, properly reflect the actual value of the inventory, in accordance with the matching principle.

- Disadvantages: complexity Management, cost tracking.

- Applicable objects: Business has less code goods stable, great value (for example, machinery, technical equipment, goods can code series).

Method the weighted Average (Weighted Average Cost – WAC)

- Principle: the inventory value is calculated according to the price weighted average of the inventory of the goods in the states.

- Types:

- Weighted average end of period: Charged once at the end, simple but low accuracy.

- Weighted average instantaneous: continuously Updated after each input, accurate but laborious.

- Applicable objects: Businesses with fewer categories, goods, homogeneous, regular rotation. This method is popular because it is easy to apply , standard SEO for optimizing information inventory.

Input method before, before (FIFO – First In, First Out)

- Principle: Every first-ago; the price of the capital stock is calculated according to the first shipment.

- Pros: value inventory end of period close to the market price; provide timely data for inventory management , reports.

- Cons: When prices increase, gross profit increased, leading to CIT higher.

- Applicable objects: perishable goods, limited use, for example, cosmetics, food, drugs.

Method Enter the following Export ago (LIFO – Last In, First Out)

- Principle: import after export ago; the price of the capital stock calculated according to the latest shipment.

- Condition applies: use is Not allowed in Vietnam according to VAS 02 , international standards IAS 2.

- Theory: the Price of capital with actual cost, but value inventory end of period does not reflect the true reality.

5. Calculate inventory end of period

Basic recipe

Inventory, end of period (Ending Inventory) is the value of the items remaining in inventory has not been sold at the end of the accounting period. The basic formula to calculate inventory valuation:

Inventory, end of period = inventory the beginning of the period + net Purchases during the period − cost of goods sold

In which:

- Net purchases: flow Of goods in stock in the period after deducting the account return or discount.

- Cost of goods sold (COGS): the actual Cost of the goods have stock in the period.

This recipe is the basis for enterprises to estimate the value of inventory , financial reporting accuracy.

Read more: Hướng dẫn đo lường hiệu suất quay vòng tồn kho doanh nghiệp

The method estimates the value of inventory end of period

When physical inventory the whole not feasible, the business can apply the method to estimate the following:

- Method gross profit (Gross Profit Method)

- Estimated inventory value based on the percentage of gross profit.

- Steps taken:

- Calculate the total price of capital goods that can be sold (the beginning of the period + buy in the states).

- Multiply the rate of gross profit to revenue to calculate cost of goods sold estimate.

- Take the total price of capital goods – the price of capital is estimated to inventory end of period.

- Methods of inventory retail (Retail Inventory Method)

- Based on the ratio between the retail price , the price of capital.

- Formula: inventory, end of period = cost of goods sold can be sold – cost of goods sold real.

- Inventory counts are in the process of production (WIP)

- Value is calculated by: the Cost of unfinished production + Cost of production of finished products – the Price of manufactured goods.

- This method is suitable with business production, help control costs , reviews production efficiency.

6. Giải pháp quản lý kho có ứng dụng công nghệ tốt nhất - AccNet ERP

Inventory management is the not only the track number, but also optimize the cost, time , decision-making abilities. Businesses can apply technology solutions to calculate prices, accurate inventory , auto:

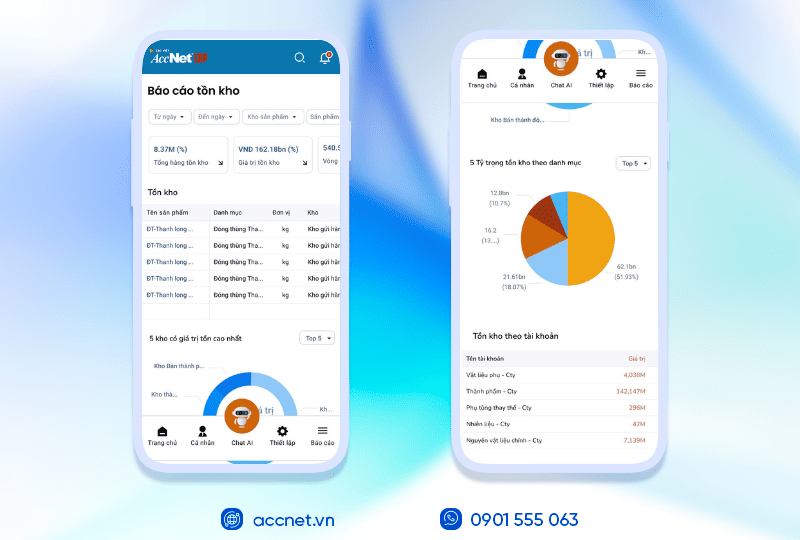

- Software inventory management AccNet ERP

For businesses that are looking for solutions to digitize , effective inventory management, AccNet ERP is the optimal choice. With the features:

- Track inventory in real time.

- Support price, FIFO, WAC, Purpose of the.

- Multi-warehouse management, multi-branch.

- Detailed reports on inventory, the price of capital , profits.

AccNet ERP helps business process automation inventory management, guarantee the price of inventory quickly, accurately, optimize resources. This is the ideal solution for medium-sized businesses , are deployed convert number to control efficiently the costs, cash flow , inventory value.

- Software inventory management AritoERP: Support valuation FIFO, WAC, Purpose of the automation inventory in real-time, multi-warehouse management, supply reports, in-depth analysis.

- System WMSX of VTI Solutions: track products via barcode, QR code, serial/lot number; automatically calculate the price of capital; inventory management over time import – export.

- ERPNext (MBW Digital): Help business inventory control realtime, support calculate inventory end of period according to the various methods of pricing.

PHẦN MỀM QUẢN LÝ KHO ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

Không chỉ là một phần mềm nhập – xuất thông thường, AccNet ERP chính là nền tảng quản lý kho thông minh, tích hợp thiết bị, kết nối dữ liệu, cảnh báo tức thời, giúp doanh nghiệp:

- Phân loại hàng hóa linh hoạt: Tạo mới danh mục theo nhu cầu; phân nhóm theo thuộc tính; thống kê doanh số, lãi gộp theo nhóm; mỗi mã hàng kèm đầy đủ thông tin tồn kho, tài khoản, giá vốn, thuế, phương pháp xuất kho.

- Quản trị kho đa dạng – kết nối thiết bị: Phần mềm quản lý kho AccNet ERP hỗ trợ QR code, barcode, thiết bị kiểm kê; quản lý tồn kho theo trạng thái (tài chính, vật lý, sẵn sàng bán); cho phép xuất kho theo hạn sử dụng, chuyển đổi đơn vị tính; hỗ trợ nhiều phương pháp tính giá xuất (BQGQ, FIFO, đích danh...).

- Quản lý tồn kho chính xác, đa chiều: Theo dõi theo màu sắc, kích thước, cấu hình, vị trí kho, mã lô; cho phép khai báo song song đơn vị đo lường, kiểm đếm; đối chiếu tồn kho thực tế với sổ sách.

- Tối ưu hiệu suất kho: Truy xuất nhanh hạn sử dụng, nguồn gốc hàng; tìm kiếm thông minh; quản lý định mức nguyên vật liệu; cập nhật tồn kho tự động theo đơn bán; cân đối hàng tồn toàn hệ thống, lưu lịch sử điều chuyển.

AccNet ERP mở ra một bước tiến mới trong quản lý kho khi tích hợp trợ lý tài chính AI, giúp doanh nghiệp vận hành chủ động và ra quyết định chính xác hơn.

- Phân tích tồn kho 24/7 trên cả desktop & mobile: AI liên tục cập nhật số liệu thực tế, cảnh báo khi hàng sắp thiếu hoặc tồn đọng quá lâu.

- Dự báo nhu cầu và rủi ro hàng hóa: Từ dữ liệu lịch sử, hệ thống đưa ra dự báo xu hướng nhập – xuất, giúp doanh nghiệp tối ưu kế hoạch mua hàng.

- Tra cứu tức thì chỉ trong vài giây: Tìm nhanh sản phẩm, số lượng tồn kho, công nợ liên quan, giá trị hàng hóa,… chỉ qua một thao tác trò chuyện với AI.

- Tự động hóa nghiệp vụ kho: Từ phiếu nhập, phiếu xuất đến kiểm tra tồn, hệ thống tự động hạch toán, đối chiếu và kết nối trực tiếp với báo cáo tài chính.

✅ Quản lý kho chủ động – Không còn “tồn kho ảo, thất thoát khó kiểm soát”

- Tự động hóa đến 80% nghiệp vụ nhập – xuất – tồn, chuẩn hóa quy trình kho vận.

- AI hỗ trợ dự báo nhu cầu hàng hóa, cảnh báo tồn kho cận date hoặc ứ đọng.

- Đồng bộ dữ liệu kho theo thời gian thực, kết nối trực tiếp với tài chính – kế toán.

- Vận hành đa nền tảng trên desktop & mobile, tra cứu số liệu kho tức thì.

✅ Hiệu quả rõ rệt khi ứng dụng quản lý kho tích hợp AI

- Giảm đến 30% chi phí lưu kho nhờ tối ưu tồn và tự động hóa quy trình.

- Rút ngắn 50% thời gian kiểm kê và xử lý hàng hóa cận date.

- Increase 82% độ chính xác dữ liệu, giảm sai sót và thất thoát hàng hóa.

- Cải thiện hiệu suất dòng tiền nhờ kiểm soát chặt vốn lưu động bị “giam” trong kho.

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

The pricing inventory are key steps in financial management , warehousing and transportation of any business. A method of calculating true not only ensure financial reporting transparency, honesty but also help business control costs, optimize cash flow , improve efficiency in production and business.

Apply the principles , the method of calculating price match, combined with technology, inventory management, modern business will understand the situation of inventory decisions to buy – sell – precision production, minimize risks and losses. In the digital age, the choice of solution integrated warehouse management as AccNet ERP also helps automate the process of tracking inventory realtime, from which optimize pricing, inventory quickly , accurate.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET ERP

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: