In the system of business accounting, fixed assets, not only represents the value of long term investment but also plays a key role in planning, budgeting, cost allocation, the optimal tax. However, one of the problems that many businesses – especially the small and medium business – trouble is how to calculate depreciation of fixed assets stars for properly regulated, at the same time closely reflects the real situation of use of property.

The applicable depreciation method wrong may cause the financial statements is false, influence decision management, tax risks. Standing from the perspective of a specialist property accountants, AccNet will guide enterprise deployments true enough, process efficiency, depreciation calculation according to accounting standards, the current, combined with the automation tools are being applied in the solution, accounting software, asset modern.

1. The concept of depreciation of fixed assets

Depreciation is the process of allocating the cost of fixed assets at cost throughout the period of useful life of that asset. Each accounting period, the business will donate a portion of the depreciation value, reducing the residual value of the property, recorded in cost of production – business.

Why must calculate depreciation?

- Reflect actual costs: depreciation help evenness value of the property through the u.s., avoiding the recognition of the entire cost at the time of shopping.

- Optimal tax obligations: the value of depreciation is deducted from the taxable income, helping business reduce the tax burden reasonable.

- Help financial planning – investment: data depreciation, business, expected time of replacement, maintenance, property.

- Serving the financial statements correct: This is a mandatory element in the financial reporting according to regulations.

Read more:

- Software asset management business help reduce the loss of property

- Report liquidate business assets the correct standard, easy to establish, easy to understand

- Report inventory of assets 2025 – based financial reporting

2. How to calculate depreciation of fixed assets

Conditions to assets is depreciation

Not every business property owners are depreciation. According to current regulations in circular 45/2013/TT-BTC, fixed assets must satisfy 3 conditions:

- Certainly obtained economic benefit in the future from the use of the property.

- Duration of use 1 year.

- Raw asset prices are determined in a reliable manner, are full of bills, vouchers are valid under applicable law.

For example: A printer worth 25 million users in the company have red bills, expected use 5 years → eligible to record depreciation.

The method used in the calculation of depreciation of fixed assets common today

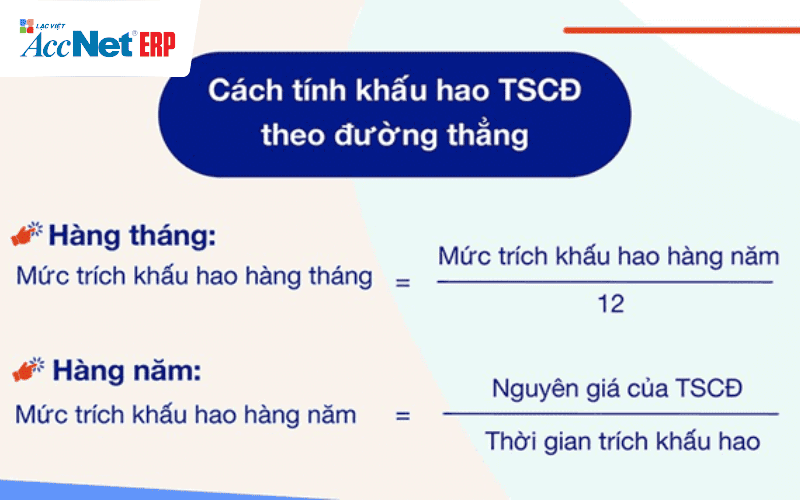

Method straight line depreciation (Straight-line depreciation)

Recipe: annual depreciation = Original cost of property / use Time useful

Advantages:

- Easy to apply widely.

- In accordance with the asset using stable over time.

For example: plastic injection molding Machine with original price of 500 million, the duration of use of 10 years → per year depreciation: 50 million.

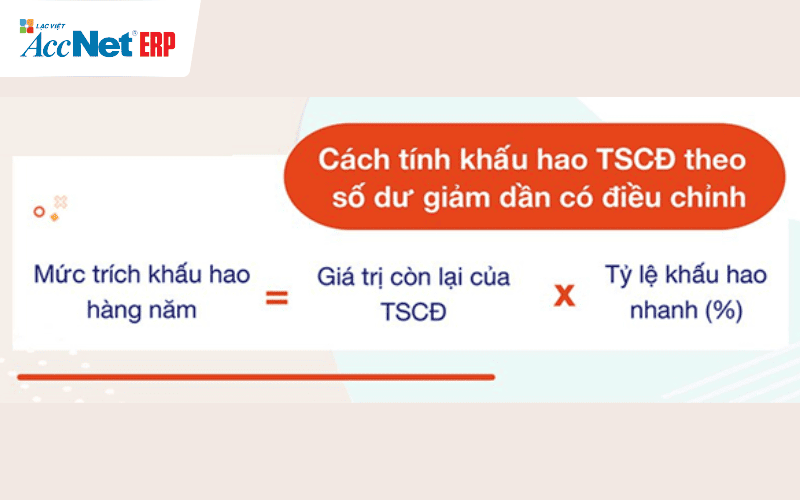

Method declining balance adjustable (Declining balance)

Apply for the property performance used in the early stages, such as: electronic devices, high-tech machinery.

- Recipe of the n-th year: depreciation year n = residual value beginning of year x depreciation Rate fast

- The rate of accelerated depreciation = (1 / Time use) x correction coefficient (1.5 or 2 custom scale business)

Advantages of this method in the calculation of depreciation of fixed assets:

- Reflect efficient mining assets in the first year.

- To help businesses push up the cost in the early years, the tax relief.

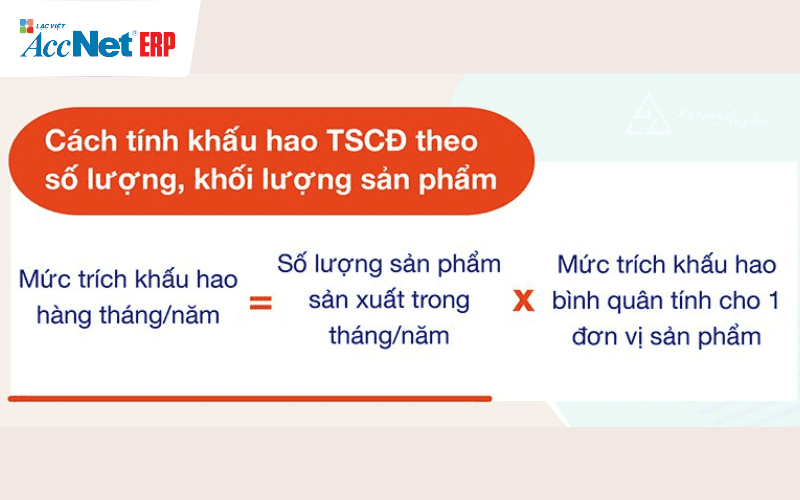

Methods of depreciation according to the number of products (Unit of production)

Apply for the property created the product measurement is as bottling line in...

Formula:

- Depreciation per unit = cost / Total output estimates

- Depreciation period = depreciation unit x output states

Advantages:

- The accuracy in performance practice.

- Flexible adjustment when there are fluctuations in output.

Note: Need to have production plan, inventory and accurate output.

Compare the methods in how to calculate depreciation of fixed assets

| Criteria | Straight line | Declining balance | According to the output |

| Simple calculator | Very high | Average | Low |

| Practicality | Average | High | Very high |

| Apply popular | Widely | Limit industry | Limit industry |

| Matching | Most types of tangible fixed assets | Machinery technology | Production line |

| Main advantages | Stable, easy to manage | Optimal tax expense | Closely reflects the performance property |

Legal rules on depreciation of fixed assets

Business mandatory to apply the right circular 45/2013/TT-BTC (latest updates if available) when calculating depreciation. Some key provisions include:

- Duration depreciation: Is specified in detail according to each type of asset in appendix I of the circular. For example:

- Computer: 3 – 5 years

- Cars: 6 – 10 years

- Factory: 20 – 50 years

- Depreciation method in the calculation of depreciation of fixed assets: Enterprise is choose 1 of the 3 methods mentioned above, but must register with the tax authorities, consistently applied.

- Change in depreciation method: allowed Only in some special cases, there must be a written notice to the tax authority.

Way of accounting for depreciation of fixed assets

Depending on the purpose of use of fixed assets, the enterprise will cost allocation depreciation of the item, respectively.

The account used frequently:

- TK 214 – Depreciation of fixed assets

- TK 623, 627, 641, 642 – Set expenses by function:

- 623: the Cost of production directly

- 627: production Costs, general

- 641: Cost of sales

- 642: Cost management business

For example the account: depreciation months 5/2025 for printer users in the accounting department (allocated on 642):

- Debt TK 642: 2.000.000

- Have TK 214: 2.000.000

Read more: Accounting for wear and tear of fixed assets standard circular accounting

3. The common fault when making calculation of depreciation of fixed assets

Recorded wrong original price

- Does not include shipping cost, installation, test run → reduce the value of the property, the wrong depreciation.

- Solution: Compliance with guidelines for determining the original price at The 4 circular 45.

Wrong use time useful

- Business application time is too short or long, skewing the cost.

- Solution: reference the correct table frame duration depreciation by property type.

Do not update the custom property

- Fixed assets increase/decrease in value but does not adjust original price → depreciation deviations.

- Solution: Update property records, periodic, adjust the window list when there are fluctuations.

No consistent method of depreciation

- Change the middle, causing data loss comparison calculator.

- Solution: change Only when there are reasonable grounds to properly perform the procedures with the tax authorities.

4. Case study reality from business apply depreciation efficiency

To illustrate more clearly how to calculate depreciation on fixed assets bring practical value as the how, let's analyze the case of companies LIMITED Production Equipment Specifications A – a medium sized businesses at the INDUSTRIAL park, Long Thanh, Dong Nai.

Initial situation:

- The company owns 45 types of fixed assets (machinery, factory, car carriage).

- The depreciation initial is handcrafted by Excel.

- Errors often occur: wrong time, wrong number generation, allocation wrong expense account.

- Results: financial statements is tax authorities require adjustment 2 consecutive years.

Solution deployment:

- Business decision application accounting software assets dedicated functions:

- Automatic depreciation according to the chosen method available.

- Warning assets were fully depreciated.

- Allocation of costs according to the centers for use.

- Connect directly with the system of accounting and finance master.

Results achieved after 6 months:

- Reduce 30% of the time reporting on the property each month.

- Ensure proper regulatory depreciation circular 45.

- Minimize fully errors in depreciation.

- Contribute to improve the transparency, efficiency, financial support investment decisions better.

Lessons learned: The calculation of depreciation of fixed assets the correct method of combined specialized software to help businesses not only legal compliance, but also optimal operation, saving personnel costs.

5. The research & the latest data related to fixed asset management

According to a report from Deloitte Vietnam 2024, have to 68% of small and medium enterprises have difficulty in determining the right time, the method of depreciation of fixed assets.

An internal survey of the General administration of the Tax year 2023 on more than 1,200 business show:

- 35% of businesses skewed data depreciation of accounting is not the correct method.

- 22% of businesses do not update the status property leads to the depreciation excess.

Trends 2025 onwards:

- The accounting software assets are integrating AI technology to predict the cycle the replacement property, the proposed depreciation method optimization by industry.

- Many businesses start connecting system asset management (Asset Management) with the accounting system overall (ERP) to ensure cross-cutting automation.

Depreciation of fixed assets is not merely the accounting profession imperative that stuff is financial management important, to help businesses control costs, optimize performance, increase transparency.

To make efficient calculation of depreciation of fixed assets:

- Understand the methods of calculating depreciation, legal regulations apply.

- Choosing the right method to match the type of property, business model.

- Technology application software to automate depreciation, reduce risk, save resources.

If your business is implementing the accounting system or build process, asset management, fixed, let's preferred option solutions, accounting software, asset-intensive AccNet Asset – this is the key to help enterprises move from “true” to “effective governance”.

SOFTWARE ACCNET ASSET – STOP WASTING ASSETS

- Cut reduction by 15-20% repair costs each year thanks to proper maintenance term

- 50% discount time inventory, and reporting of property

- Avoid losses hundreds of millions of since the property is "missing the mark", using the wrong purpose

- Increase asset life cycle up minimum 25% thanks to the tracking and timely warning

- Reduce errors depreciation – is not tax arrears

A business average savings from 300 to 500 million/year after deployment AccNet Asset

SIGN UP CONSULTATION AND DEMO TODAY

6. Frequently asked questions (FAQ)

Question 1. Assets under 30 million, there is depreciation not? → No. Assets under 30 million are not eligible recorded as fixed assets, not being depreciated under current regulations. However, it can still cost allocation if appropriate.

Question 2. Can change the method of depreciation after having applied not? → Can, but there must be legitimate reasons, to register with the tax authorities in writing. Not be arbitrarily changed midway.

Question 3. Accelerated depreciation can affect income tax business? → There. If businesses apply the method of accelerated depreciation in the allowed range, expenses are recognized sooner, reduce taxable income in the states.

How to calculate depreciation of fixed assets the correct method is not only required in accounting, but also is the foundation for business planning, budgeting, cost control, ensuring financial transparency. When understanding the nature of depreciation, choosing suitable methods, technology applications, support, business will minimize the risk of errors, save time, improve operational efficiency.

As businesses increasingly expand the scale, the number of assets increases, the continued management depreciation manually is no longer sustainable solutions. The time has come you need a specialized tool, strong to comprehensive control of fixed assets.

Let's experience AccNet Asset – accounting software assets to help businesses automate the entire process of depreciation, asset management, science, comply with current regulations. Contact consultation and free demo at this!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: