Electronic tax reporting là một trong những dịch vụ cho phép người nộp thuế sử dụng Cổng thông tin điện tử của Cơ quan thuế để nộp tiền thuế vào ngân sách nhà nước một cách trực tiếp. Chính vì tính tiện lợi, nhanh chóng mà hình thức nộp thuế điện tử nhận được nhiều phản hồi tích cực từ phí các doanh nghiệp. Tuy nhiên, nếu bạn còn chưa nắm rõ các bước khai báo thuế thuế qua mạng như thế nào, theo dõi bài viết của AccNet để cập nhật cách khai báo mới nhất 2025

1. Hướng dẫn báo cáo thuế điện tử chi tiết (mới nhất 2025)

After you ensure that there is sufficient the above conditions, the business was able to proceed with the implementation of electronic reporting. To file a report online business just follow the instructions below.

Step 1: login page system for electronic tax reporting

- Truy cập: https://thuedientu.gdt.gov.vn - Trang thuế điện tử của Tổng cục Thuế.

- Select the Business in the system log.

- Enter your login > login

Bước 2: Kê khai/nộp báo cáo thuế qua mạng

To be able to conduct electronic tax reporting, businesses can choose to create a declaration by one of the 2 following ways: Use software support declaration or declaration directly at the tax on the tax electronically.

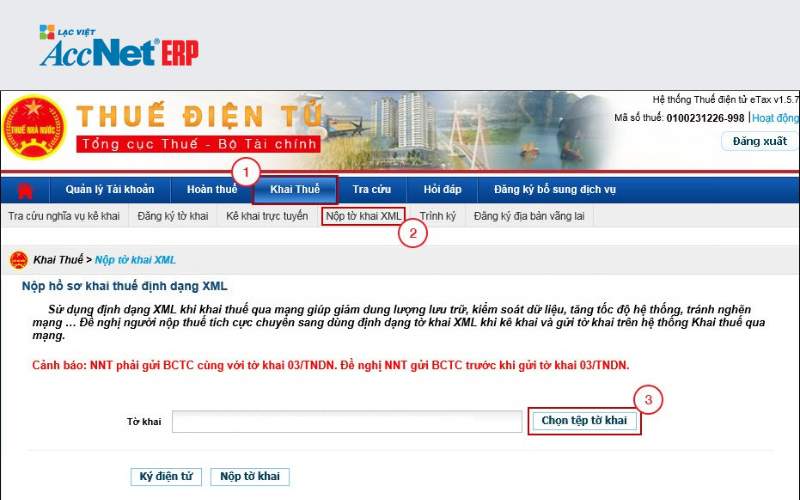

- In the main interface, choose the tax return > Submit a declaration to the XML > continue to press the Select the file declaration.

- Chọn file tờ khai XML đã tạo từ phần mềm Hỗ trợ kê khai, nhấn Open để tải lên hệ thống.

Step 3: electronically Signed and complete tax reporting electronic

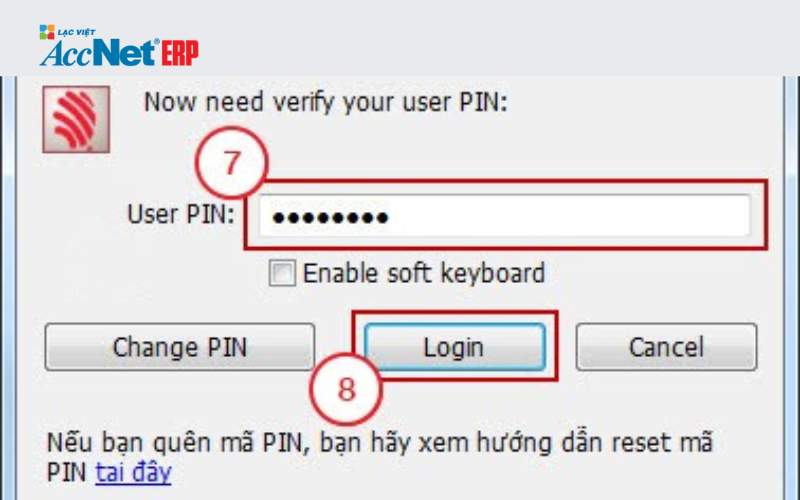

- Plug the USB Token containing electronic digital signature on the computer.

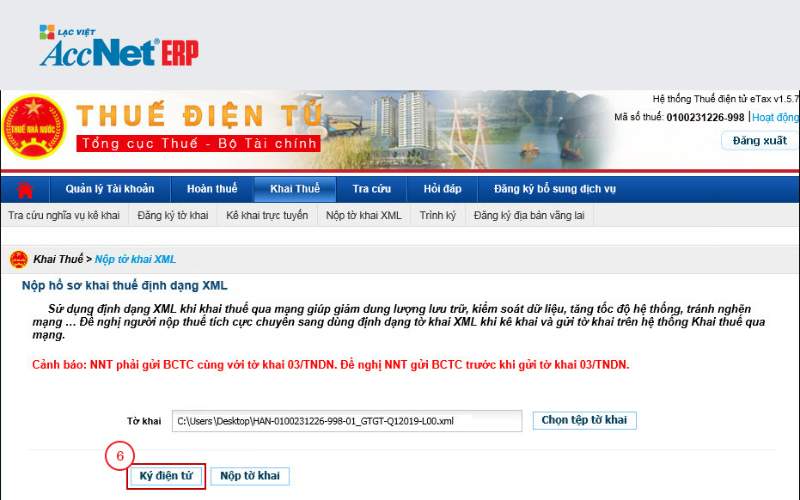

- At the Submission of the declaration XML > select electronic signatures.

- Enter the PIN number into the window just displays > select the Reception.

- After making your success, choose Submit a declaration to complete the process.

Step 4: Check the results declaration

Sau khi hoàn tất quá trình báo cáo thuế online, cơ quan thuế sẽ gửi đến email bạn đã đăng ký 2 thông báo, cụ thể như sau:

- Notice 1: This is a confirmation message to your profile has been received.

- Notice 2: results announced to submit reports electronically will be sent to the business within one day from the time the tax receipt records.

Trong trường hợp, doanh nghiệp nhận được thông báo không chấp nhận hồ sơ báo cáo thuế điện tử thì cần kiểm tra, điều chỉnh hồ sơ kê khai theo hướng dẫn đính kèm tại thông báo.

2. Báo cáo thuế điện tử là gì?

Báo cáo thuế điện tử (eTax) là một hệ thống tích hợp các dịch vụ nộp thuế, khai thuế, hoàn thuế. Tất cả được tổng hợp vào một thế thống trực tuyến duy nhất qua Website thuedientu.gdt.gov.vn của Tổng cục Thuế - Bộ Tài chính.

Via electronic Portal of The tax authorities, businesses can perform the obligation to pay tax to The state Budget in an easy way, quickly. Immediately after that transaction result will be commercial Banks confirmed.

3. Đối tượng doanh nghiệp cần báo cáo thuế trực tuyến

Hiện nay, đa phần các doanh nghiệp đều phải kê khai, nộp báo cáo thuế điện tử thay vì văn bản giấy như trước đây. Vậy đối tượng doanh nghiệp nào có thể thực hiện đăng ký, nộp báo cáo qua mạng? Dưới đây là những điều kiện mà một người nộp thuế cần đáp ứng:

- Tổ chức, doanh nghiệp hiện đang hoạt động sản xuất kinh doanh, đã được cấp mã số thuế, mã số doanh nghiệp.

- Own account at a commercial Bank has links are provided by the General department of taxation.

- Have the digital certificate (valid) due organization that provides services for digital signature certificate, public level.

- Finally, the enterprise has equipped with devices using an Internet connection, Email address stable to contact The tax agency.

So, AccNet have provided the information need to know about electronic tax reporting, cũng như hướng dẫn cách nộp thuế điện tử chi tiết. Chỉ cần với vài bước đơn giản là bạn có thể hoàn thành nhanh chóng công việc này, tiết kiệm được phần lớn thời gian cho cả doanh nghiệp, cơ quan thuế. Nếu còn bất kỳ thắc mắc nào xoay quanh vấn đề trên, liên hệ ngay với AccNet để được giải đáp thắc mắc ngay.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: