The deadline for filing tax returns được quy định trong Luật Quản lý thuế số 38/2019/QH14, Nghị định 126/2020/NĐ-CP, các thông tư hướng dẫn của Bộ Tài chính. Tùy theo loại thuế, phương thức kê khai, doanh nghiệp/cá nhân cần tuân thủ các mốc thời gian quan trọng. Với mong muốn hỗ trợ, giúp đỡ các doanh nghiệp, cá nhân trong quá trình nộp thuế, AccNet đã hệ thống, biên soạn lại các mốc thời gian đó thông qua bài viết sau.

1. Thuế giá trị gia tăng (GTGT) và thuế thu nhập cá nhân (TNCN)

Thời hạn nộp hồ sơ kê khai theo tháng

- Hạn chót: Ngày 20 của tháng tiếp theo.

Applicable objects:

- Doanh nghiệp có tổng doanh thu năm trước từ 50 tỷ đồng trở lên (theo Điều 8, Nghị định 126/2020/NĐ-CP).

- Cá nhân, tổ chức khấu trừ thuế TNCN theo tháng nếu số thuế phải nộp trung bình từ 50 triệu đồng/tháng trở lên.

For example:

- Thuế GTGT tháng 01/2024 phải khai, nộp trước ngày 20/02/2024.

- Thuế TNCN khấu trừ từ tiền lương tháng 02/2024 phải nộp trước ngày 20/03/2024.

Read more:

Thời hạn nộp hồ sơ khai thuế theo quý

Hạn chót: Ngày 30 của tháng đầu tiên của quý sau.

Applicable objects:

- Doanh nghiệp có tổng doanh thu năm trước dưới 50 tỷ đồng.

- Cá nhân, tổ chức khấu trừ thuế TNCN theo quý nếu số thuế phải nộp trung bình dưới 50 triệu đồng/tháng.

For example:

- Thuế GTGT quý 1/2024 phải khai, nộp trước ngày 30/04/2024.

- Thuế TNCN khấu trừ từ tiền lương quý 2/2024 phải nộp trước ngày 30/07/2024.

2. Thời hạn nộp hồ sơ khai thuế thu nhập doanh nghiệp (TNDN)

Thời hạn tạm nộp thuế TNDN theo quý

- Hạn chót: Ngày 30 của tháng đầu tiên quý sau.

- Đối tượng áp dụng: Tất cả doanh nghiệp có nghĩa vụ nộp thuế TNDN.

- Lưu ý quan trọng: Tổng số tiền thuế tạm nộp 4 quý không được thấp hơn 80% số thuế phải nộp cả năm (Khoản 6, Điều 8, Nghị định 126/2020/NĐ-CP).

For example:

- Thuế TNDN tạm nộp quý 1/2024 phải nộp trước ngày 30/04/2024.

- Thuế TNDN tạm nộp quý 3/2024 phải nộp trước ngày 30/10/2024.

Thời hạn nộp hồ sơ quyết toán thuế TNDN năm

- Hạn chót: Ngày 31/03 năm sau.

- Ví dụ: Doanh nghiệp phải nộp hồ sơ quyết toán thuế TNDN năm 2024 trước ngày 31/03/2025.

3. Thời hạn nộp hồ sơ quyết toán thuế thu nhập cá nhân (TNCN)

Cá nhân tự quyết toán thuế TNCN

Thời hạn nộp hồ sơ khai thuế (hạn chót): Ngày 31/03 năm sau.

Applicable objects:

- Cá nhân có thu nhập từ nhiều nguồn cần quyết toán thuế.

- Cá nhân có số thuế nộp thừa muốn hoàn thuế.

Ví dụ: Cá nhân có thu nhập trong năm 2024 cần nộp hồ sơ quyết toán thuế trước ngày 31/03/2025.

Read more:

Doanh nghiệp quyết toán thuế TNCN thay nhân viên

Hạn chót: Ngày 31/03 năm sau.

Applicable objects:

- Nhân viên ký hợp đồng lao động từ 03 tháng trở lên, chỉ có thu nhập tại một nơi.

- Doanh nghiệp có trách nhiệm khấu trừ, quyết toán thay nhân viên.

Ví dụ: Doanh nghiệp nộp hồ sơ quyết toán thuế TNCN năm 2024 trước ngày 31/03/2025.

4. Thời hạn nộp hồ sơ khai thuế môn bài

- Đối với doanh nghiệp mới thành lập: Phải kê khai, nộp thuế môn bài trong vòng 30 ngày kể từ ngày được cấp giấy chứng nhận đăng ký kinh doanh.

- Đối với doanh nghiệp đang hoạt động: Hạn nộp thuế môn bài hàng năm là ngày 31/01.

For example:

- Doanh nghiệp thành lập ngày 15/03/2024 phải nộp thuế môn bài trước ngày 14/04/2024.

- Thuế môn bài năm 2025 phải nộp trước ngày 31/01/2025.

Lưu ý: Doanh nghiệp vừa, nhỏ được miễn lệ phí môn bài trong năm đầu thành lập (Nghị định 22/2020/NĐ-CP).

5. Một số lưu ý quan trọng về thời hạn nộp hồ sơ khai thuế

- Thời hạn nộp hồ sơ khai thuế cũng chính là hạn nộp thuế. Nếu chậm nộp, doanh nghiệp/cá nhân sẽ bị tính tiền chậm nộp theo mức 0,03%/ngày trên số thuế chậm nộp (Điều 59, Luật Quản lý thuế 38/2019/QH14).

- Nếu ngày cuối cùng nộp thuế trùng với ngày nghỉ lễ, thứ 7 hoặc chủ nhật, thời hạn nộp sẽ được gia hạn sang ngày làm việc tiếp theo (Khoản 4, Điều 8, Nghị định 126/2020/NĐ-CP).

Learn more:

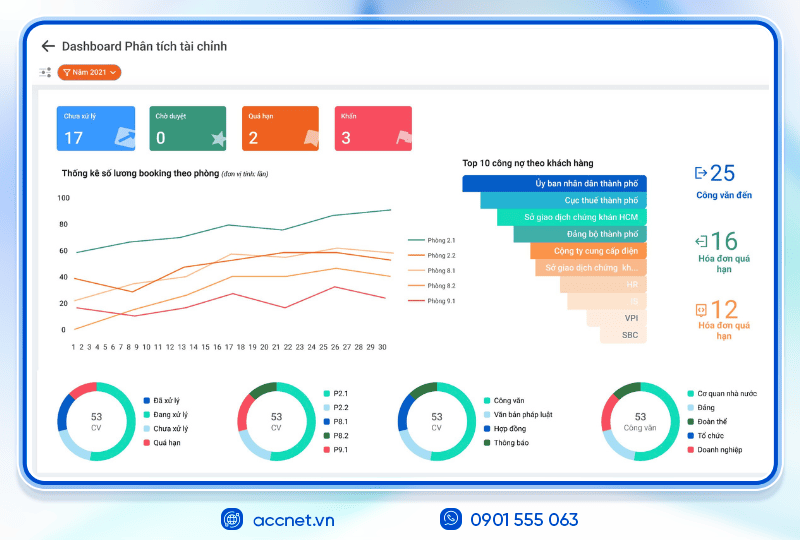

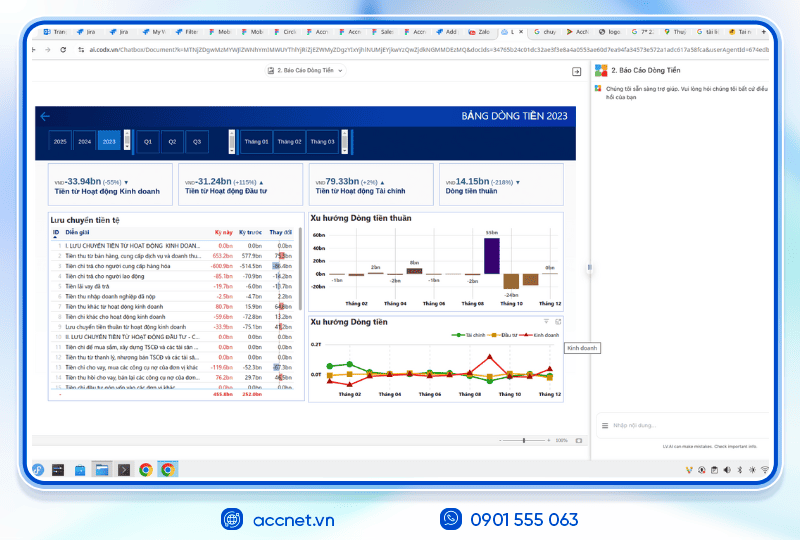

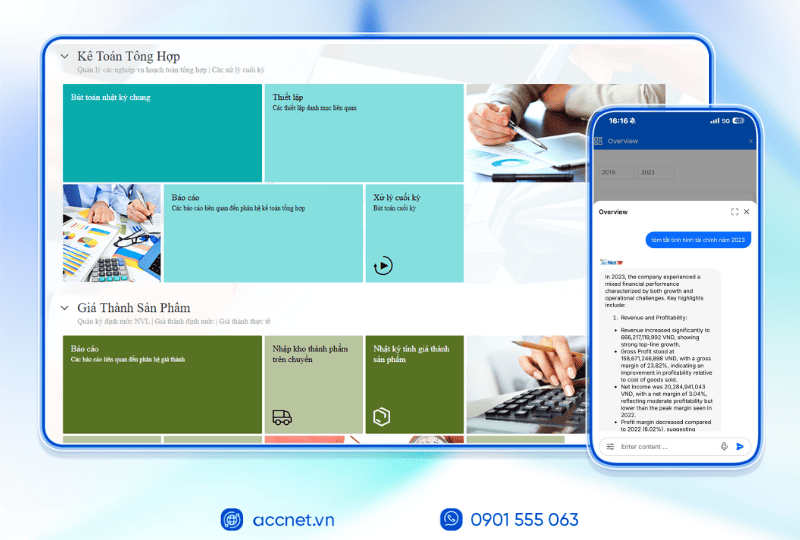

6. Quản lý thời hạn nộp hồ sơ khai thuế hiệu quả với AccNet ERP

Việc nắm vững thời hạn nộp hồ sơ khai thuế là một trong những yêu cầu quan trọng để doanh nghiệp đảm bảo tuân thủ pháp luật và tránh các rủi ro phạt hành chính. Theo quy định, doanh nghiệp phải lập và nộp hồ sơ khai thuế đúng hạn với cơ quan thuế, bao gồm các loại thuế như thuế giá trị gia tăng, thuế thu nhập doanh nghiệp, thuế thu nhập cá nhân và các báo cáo liên quan khác. Việc chậm nộp hồ sơ không chỉ ảnh hưởng đến uy tín của doanh nghiệp mà còn phát sinh tiền phạt, lãi chậm nộp và có thể gây gián đoạn trong hoạt động kinh doanh.

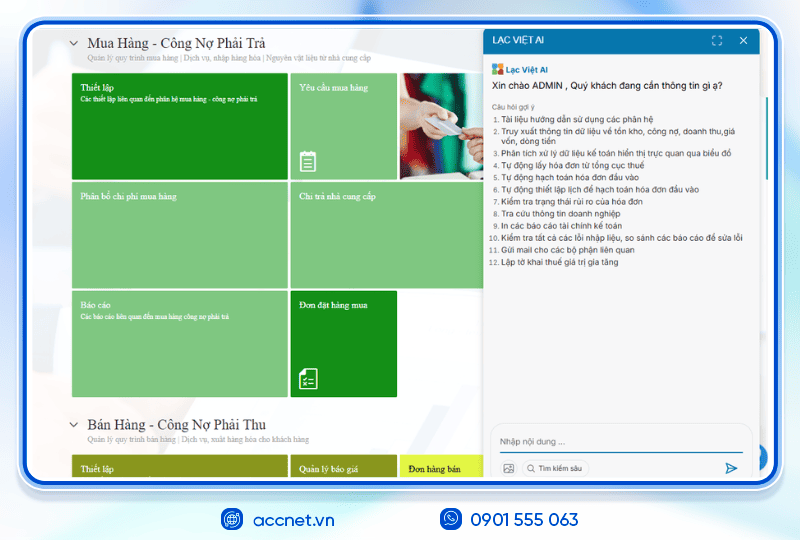

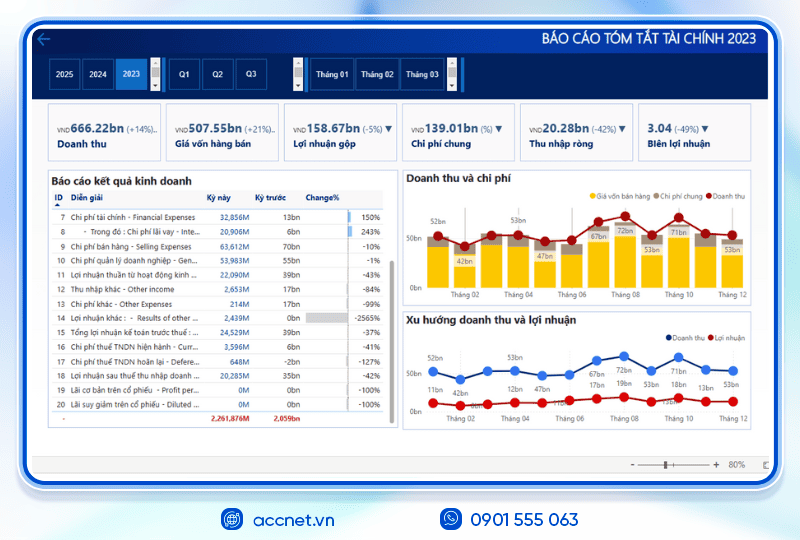

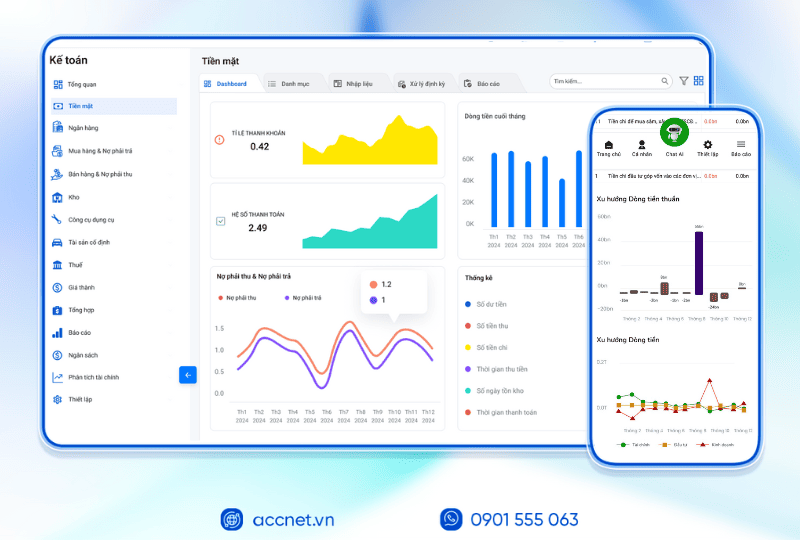

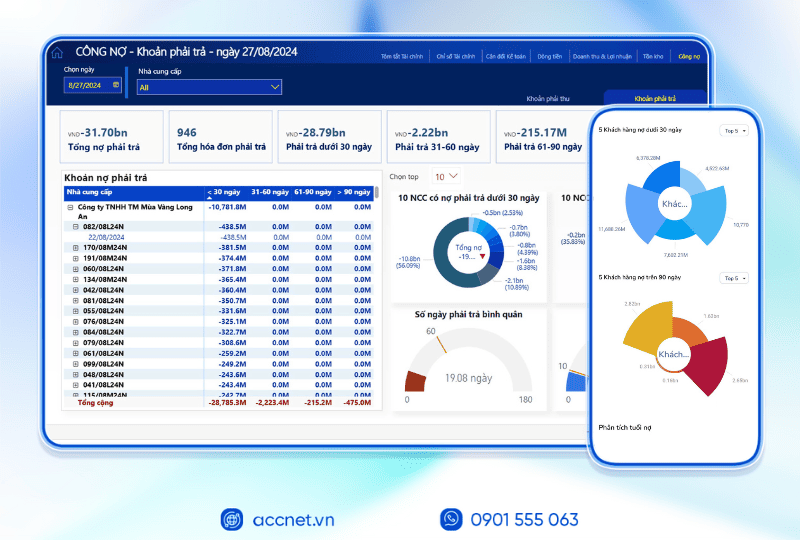

Tuy nhiên, quản lý thủ công các thời hạn này thường gặp khó khăn, đặc biệt với doanh nghiệp có nhiều loại thuế, nhiều chi nhánh hoặc khối lượng hồ sơ lớn. Đây là lúc AccNet ERP trở thành giải pháp tối ưu. Hệ thống ERP giúp tự động theo dõi, nhắc nhở và quản lý tất cả các thời hạn nộp hồ sơ khai thuế. Nhờ tính năng tự động cập nhật dữ liệu, kế toán và quản lý có thể lập báo cáo nhanh chóng, kiểm tra tình trạng hồ sơ và chuẩn bị đầy đủ trước hạn nộp.

Ngoài ra, AccNet ERP còn tích hợp đồng bộ với các phân hệ kế toán, mua hàng, bán hàng và quản lý kho, giúp toàn bộ dữ liệu tài chính minh bạch và chính xác. Doanh nghiệp nhờ đó không chỉ tránh rủi ro phạt do nộp chậm mà còn tiết kiệm thời gian, giảm sai sót và nâng cao hiệu quả quản lý tài chính tổng thể.

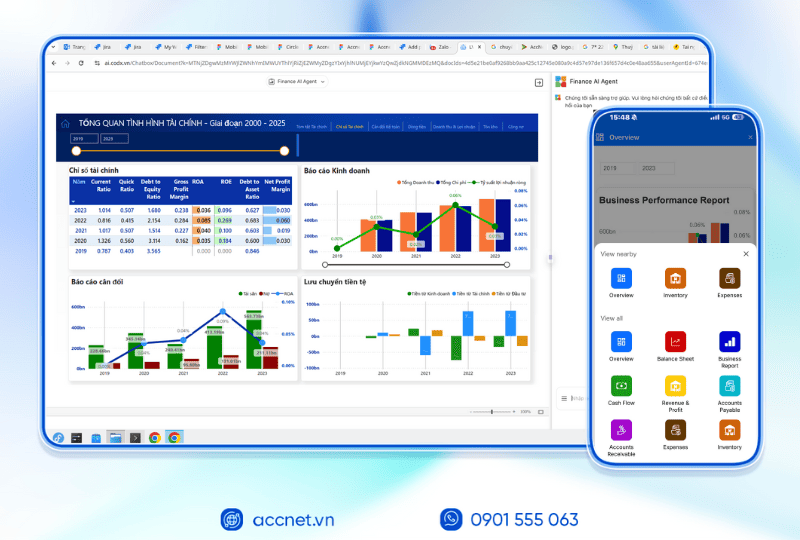

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

AccNet đã chia sẻ các thông tin quan trọng về thời hạn nộp hồ sơ khai thuế. Hy vọng bài viết này mang đến các thông tin hữu ích cho quý doanh nghiệp. Quý doanh nghiệp quan tâm đến giải pháp hỗ trợ nộp thuế vào hoạt động kế toán của có thể đăng ký tư vẫn miễn phí với chúng tôi

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: