The depreciation of fixed assets should be done properly to accurately reflect the value of the property, the cost in the financial statements. An important tool in this process, the main table is the allocation of depreciation of fixed assets (fixed assets). This article AccNet will provide detailed instructions on the template spreadsheet depreciation of fixed assets related to support the business.

1. Table allocation of depreciation of fixed assets is what?

Table allocation depreciation fixed assets are tables showing in detail the information related to depreciation of each fixed asset in business.

Role of the allocation of depreciation:

- Recorded details of the property value, some of the depreciation period ago, this accumulated.

- Track the remaining value of the asset to service management, business decisions.

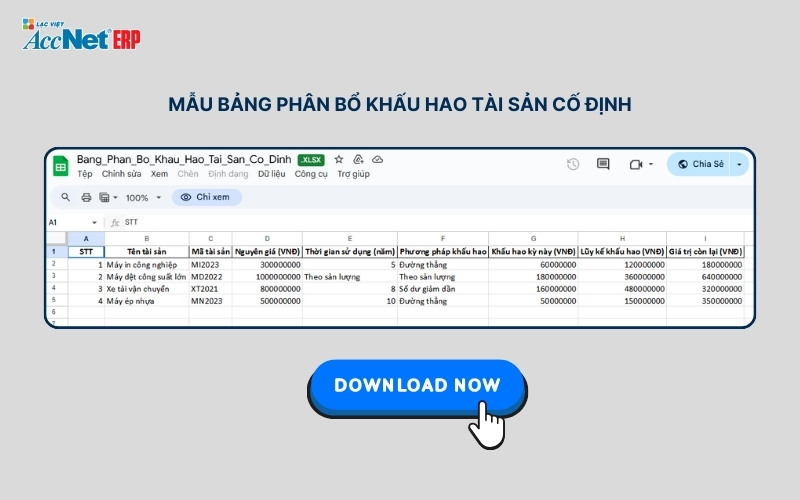

2. Sample table of allocation of depreciation of fixed assets

2.1. Download template new table best

2.2. The content should be in the allocation of depreciation of fixed assets

Table allocation of depreciation need to specify the information related to fixed assets:

- Property name: the Name details of each property.

- Property code: Code unique identifier to manage.

- Original price: original value of the property as recorded in the books.

- Duration of use: useful Time of the property is often determined based on the law or special assets.

- Methods of depreciation: How to calculate depreciation as straight line, declining balance, according to the output.

Table allocation of depreciation of fixed assets should clearly express the information related to depreciation of assets in each of the states:

- Some of the depreciation period ago: Total depreciation expense was recorded in the previous period.

- Depreciation this depreciation Costs incurred in the current.

- Accumulated depreciation: the Total depreciation expense since the asset was put into use to the present.

- Residual value: the value of assets after deducting accumulated depreciation.

Read more:

2.3. The process of allocation table depreciation of fixed assets

Step 1: Create a list of the entire fixed assets of the business, including:

- Property name.

- Property code.

- Original price.

- The duration of use.

- Depreciation method.

Step 2: Select the depreciation method in accordance with each type of property:

- Straight line method: Easy-to-apply, the most popular.

- Method declining balance: in accordance with property value decreases rapidly in the early years.

- The method according to the output: suitable for properties directly related to production.

Step 3: Use the formula corresponding to the depreciation method selected to calculate the depreciation expense:

- Straight line method: depreciation Expense in a period by the cost of the asset divided by the duration of useful life of the property.

- Method declining balance: depreciation Expense in a period equal to the residual value of the asset at the beginning of the period multiplied by the depreciation rate fixed.

- Depreciation method according to the output: depreciation Expense in a period equal to (the cost of the asset minus the salvage value) divided by the estimated production of the whole, then multiplied by real output during the period.

Step 4: Recorded costs in the allocation of depreciation of fixed assets according to the allocation rate for each department, unit/project to use the property.

Step 5: Synthesis of information recently collected, calculated to improve allocation table depreciation. Table structure allocation of depreciation:

- The property name, property code.

- Original price, duration of use, method of depreciation.

- Depreciation the accumulated depreciation, residual value.

- Costs allocated to each department.

3. The importance of the table allocation of depreciation in the management of fixed assets

Table allocation of depreciation of fixed assets provides overview of value, the condition of the fixed assets in business:

- Helps business identify assets which are to operate effectively, the property would need to liquidate/maintenance.

- Management depreciation accurate business forecasts, cost control related to fixed assets.

Read more: Mẫu bảng Excel tính khấu hao tài sản cố định tự động bằng công thức chuẩn

Table allocation depreciation contributes to:

- The account depreciation is allocated exactly to the parts or project, thereby determining the correct profit.

- Business support in preparing financial statements.

Table allocation of depreciation of fixed assets to help businesses evaluate the efficiency of use of fixed assets, from which:

- Detect the need for upgrades or shopping new property.

- Optimize resources, reduce waste in the process of operation.

4. Technology solutions for the process of allocation table depreciation

Sử dụng phần mềm AccNet Asset giúp doanh nghiệp tiết kiệm thời gian trong quản lý tài sản cố định với các chức năng:

- Automatic calculation of depreciation under different methods, in accordance with each type of property.

- Track details from the original price, time use, the accumulated depreciation to the residual value.

- Easily create reports to allocate depreciation according to states, serves for internal management and financial reporting.

SOFTWARE ACCNET ASSET – STOP WASTING ASSETS

- Cut reduction by 15-20% repair costs each year thanks to proper maintenance term

- 50% discount time inventory, and reporting of property

- Avoid losses hundreds of millions of since the property is "missing the mark", using the wrong purpose

- Increase asset life cycle up minimum 25% thanks to the tracking and timely warning

- Reduce errors depreciation – is not tax arrears

A business average savings from 300 to 500 million/year after deployment AccNet Asset

SIGN UP CONSULTATION AND DEMO TODAY

Bài viết trên đã mang đến thông tin chi tiết về bảng phân bổ khấu hao tài sản cố định, đồng thời cung cấp giải pháp thực tiễn để doanh nghiệp áp dụng. Hãy hiện đại hóa quy trình lập bảng tính khấu hao tài sản cố định của bạn ngay hôm nay bằng cách trải nghiệm các phần mềm AccNet Asset.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: