According to regulations issued by the state, businesses will have to switch to using electronic invoicing mandatory on January 1/7/2022. This shows, using the electronic invoice is inevitable. This conversion requires accountants and small business owners need to find out in detail the knowledge related to electronic invoicing in the process of use. One of which is to find out model the minutes cancel electronic bill latest correct current legislation. Let's AccNet learn in detail this issue in the article today.

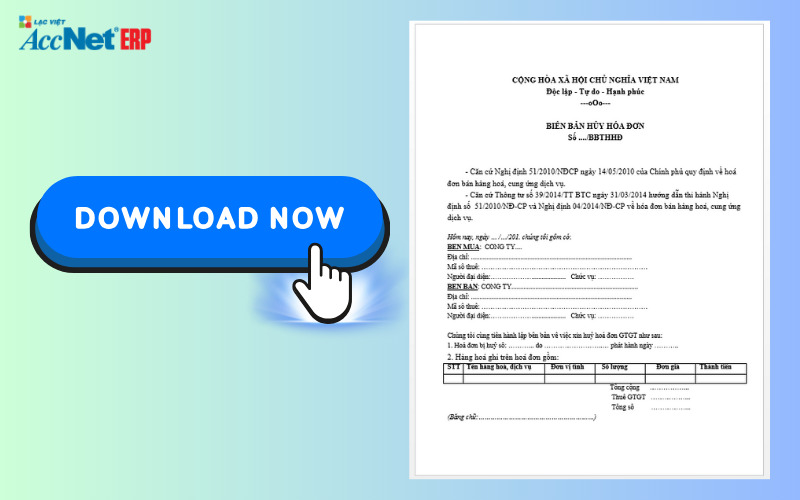

1. Form cancel electronic bill latest 2024

Businesses and organizations need to cancel the invoice will have to use the form to cancel the invoice according to circular no. 39/2014/TT-BTC issued on 31/3/2014. Follow the instructions in Decree no. 51/2010NĐ-CP and Decree no. 04/2014/ND-CP on the bill of sale or provision of services as below.

THE REPUBLIC SOCIALIST OF VIETNAM

Independence - freedom - happiness

---oOo---

THE MINUTES CANCEL INVOICE

Number ..../BBTHHĐ

- Pursuant to resolution no. 51/2010/NĐCP date 14/05/2010 of government regulations on invoices, sale of goods and supply of services.

- Circular no. 39/2014/TT-BTC dated 31/03/2014 guiding the implementation of Decree no. 51/2010/ND-CP and Decree 04/2014/ND-CP on the bill of sale of goods and supply of services.

Today, ... /.../201. we have included:BÊN MUA: CÔNG TY....

Địa chỉ: ..............................................................................................

Mã số thuế: ……………………………………………………………….

Người đại diện:……………….................... Chức vụ: …………….

BÊN BÁN: CÔNG TY..........................................................................

Địa chỉ: ..............................................................................................

Mã số thuế: ……………………………………………………………….

Người đại diện:……………….................... Chức vụ: …………….

Chúng tôi cùng tiến hành lập bên bản về việc xin huỷ hoá đơn GTGT như sau:

1. Hoá đơn bị huỷ số: ………... do ……………………..… phát hành ngày ………..

2. Hàng hoá ghi trên hoá đơn gồm:

STT Name of goods, services Unit Number Unit price The money ............ ............ ............ ............ ............ ............ Tổng cộng ……………...

Thuế GTGT ……………...

Tổng số ……………...

(In words:.........................................................)

3. Lý do huỷ hoá đơn: .............. ( ví dụ: Do ghi sai số lượng hàng hóa )

Vậy chúng tôi lập biên bản này để làm cơ sở huỷ hoá đơn viết sai trên và cam kết không sử dụng hoá đơn trên để kê khai thuế GTGT.

Biên bản được hai bên nhất trí và lập thành 02 bản, mỗi bên giữ 01 bản và có giá trị pháp lý như nhau.

We are committed and fully responsible for the recovery and delete this invoice.

This set of 02, A Party keeps 01 copy, Side B 01.

REPRESENTED BUYER REPRESENTED THE SELLER

Set template the minutes cancel electronic bill is one of the accounting important major influence to the process of filing your Business tax. Therefore, the accountants need to thoroughly understand and properly implement the law. The article has detailed instructions how to cancel the invoice, as well as provide a form memorandum get latest bill. Hope the above information helpful for businesses.

2. How to cancel electronic bill the law

To make a pattern the minutes cancel electronic bill latest correct process and law regulations should follow the following steps.

Phase 1: Prepare profile to cancel electronic bill

The legal requirements of the profile done cancel electronic bill latest:

- Except in the case of households and individuals in business, the business organizations need to establish a council to cancel the invoice.

- A list of invoices that get should have items such as bill name, symbol, template, symbol of bills, the amount of destruction detail.

- The minutes cancel invoice

- Bulletin board result cancel should contain content of symbols, type, number, cancel, reason, date and time of cancellation. Based on model number 3.11 appendix 3 according to circular no. 39/2014/TT-BTC.

Read more:

- Hướng dẫn doanh nghiệp cách hủy hóa đơn điện tử details

- Thủ tục hủy hóa đơn điện tử đã phát hành theo quy định hiện hành

- Hướng dẫn doanh nghiệp sử dụng sample memorandum of alternative electronic invoice

Phase 2: perform the cancellation process electronic invoices

The cancellation process electronic invoices is based on Article 29 circular no. 39/2014/TT-BTC:

- Step 1: Set up the inventory panel number of bills that need to get

- Step 2: establishment Of the council, cancel invoice compulsory representatives, representatives of the accounting department.

- Step 3: perform border cancel goods: Board to sign the minutes cancel responsible before the law to complete the cancellation process the invoice.

3. The case should set the minutes cancel electronic bill

Many of the accounting staff new to the profession questions question when set template the minutes cancel electronic bill is strictly regulated. In Article 29 circular no. 39/2014/TT-BTC has clearly made up cancel there are many cases apply different. So accountants need to learn and master these cases:

- Business no longer use electronic invoice

This is the case at most however, this is a required field. If the business organization, business has released electronic invoice, but no longer used in current and future it needs to perform cancel electronic bill.

Duration implementation of measures and cancel the invoice no later than 30 days after no longer use.

Read more:

- Hướng dẫn doanh nghiệp lập memorandum to withdraw the bill details

- Hướng dẫn lập the custom electronic invoice details

- Hướng dẫn lập the minutes lost bills chi tiết cho doanh nghiệp

- Business no longer in operation, switch tax authorities, change information

When business facilities business information changes, or transfer the tax authority will have to make cancel the old bill, released bill new electronic respectively.

If the business ceased business operations shall be carried out cancel electronic bill.

- Electronic invoices shall be set have errors

This is a common case, the most common need to make a pattern the minutes cancel electronic bill.

Specifically, there are flaws in electronic invoicing following:

- Bill electronic detection has flaws but not yet sent to the buyer

- Electronic invoice made and sent to the buyer but not yet delivered goods and services.

- Electronic invoice has been set up to send to the buyer but not yet to declare tax.

- Bill printing false information, be duplicated, in excess must be done cancel.

- Bill of storage period prescribed by Law accounting

Bill electronic storage period is 10 years under the provisions of the accounting Law. Therefore, upon expiration of which no other decision of the state agency, the enterprise needs to get the number of electronic invoices.

Note that the cancellation of the bill to ensure the integrity of the bill has not cancel, ensure data information normal operation. In addition, the bill is set but violates the provisions of French law to cancel in accordance with applicable laws.

The establishment report form cancel electronic bill often cause business concerns, by this process requires compliance with strict process, avoid errors affecting the data, accounting and tax reporting. Lack of tool support fit can cause the cancellation of the bill become more complex, takes more time.

Accnet eInvoice giúp đơn giản hóa quy trình này, cung cấp giải pháp tự động hóa việc lập biên bản hủy hóa đơn điện tử, đảm bảo tuân thủ đúng quy định pháp luật, tránh sai sót. Phần mềm tạo hóa đơn bán hàng này hỗ trợ doanh nghiệp thực hiện nhanh chóng, chính xác, giúp giảm thiểu rủi ro trong quá trình xử lý hóa đơn. Hãy trải nghiệm Accnet eInvoice để quy trình hủy hóa đơn trở nên dễ dàng hơn bao giờ hết!

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

On here is complete information about the minutes cancel electronic bill according to the latest circular 78 new best year 2024 that Vietnam Accnet have compiled. Cancellation of electronic bill becomes easier with software electronic invoice Lac Viet, the app has many features to support business/organization/individual make the switch and use electronic invoices efficiently.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: