When Businesses perform accounting transactions related to paper invoices or electronic invoices will be difficult to avoid the case of lost bill. So these cases will use the template the minutes lost bills how? The treatment process like? The AccNet track't miss this article to know more detail, please.

1. Quy trình xử lý mất hóa đơn GTGT - Liên 2 đầu ra

Process takes bill is divided into several different cases. Depending on the specific case in which way the handle will also be different.

TH1: Lose invoice input hasn tax declaration

With case invoice not tax declaration will be treated as follows: buy-Side and sell-side up explanations about the loss of bill. Memorandum of get requests as:

- Specifies the events, buy-side or sell-side losing bills

- Specifies information related 1 of the seller about the time a filing.

- Specifies the full name of the individual legal representative or authorized person of the 2 sides.

- Setting explanation writing about losing bills are paper verify clear.

Read more:

TH2: the specified handle losing bills related 2

Perform processing according to the circular 176/2016/TT-BTC as following:

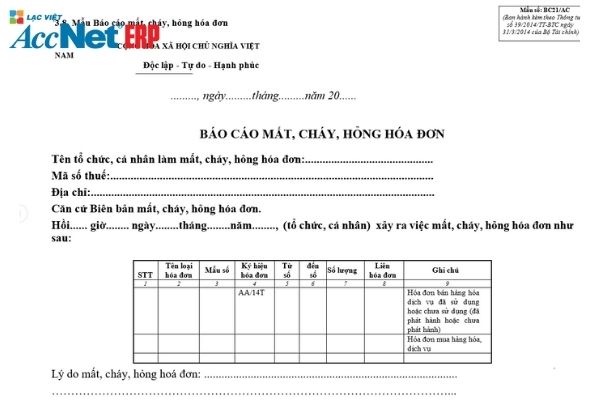

- Use the form BC21/AC to notice the loss of invoices to the tax authorities. As a rule, the case of loss or damage be considered a violation of bills. The deadline to send notifications no later than 5 days from when discovered the loss or damage of the invoice. Note, the loss shall be responsible for reporting to be submitted to the tax authorities.

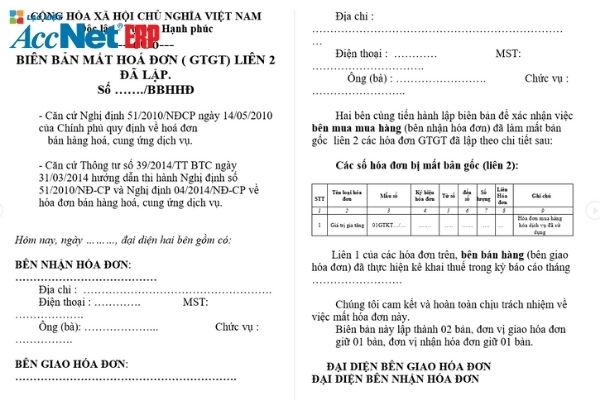

- Establishment the minutes lost bills: The seller will contact the buyer to make a record explanations about the loss of the invoice to get the job. In which, the seller specifies the bills related 1 has declare and pay tax on time specific. Representative 2 sign stamped onto the minutes.

- Sell-side copying bills related 1 may sign a confirmation of legal representative and stamped record to assign to the buyer.

- A copy of the invoice related 1 is signed and stamped will be used to do the accounting, tax declaration and tax settlement for business.

TH3: Handle missing bills related 2 related to party Tuesday

If there are side Tuesday related to the loss of the bill need to define 3rd party is due to buyer or the seller hired to determine how to handle as well as sanctions.

3rd party is any party rental, then it will have to be responsible for the handling of lost bill.

2. Tải mẫu biên bản mất hóa đơn liên 2 đầu vào

Below is a sample memorandum of lost invoices are issued and latest updates. Includes 2 templates

Model 1: minutes lose invoice confirmation between the buyer and the seller

>>> DOWNLOAD FORM

Model 2: the minutes take the invoice sent to the tax agency

>> DOWNLOAD FORM

3. Quy định mức xử phạt khi làm mất hóa đơn

According to him, private 176/2 th016/TT-BTC, the penalty of losing bills related 2 input will be from 4.000.000 VNĐ to 8.000.000 VNĐ. Specific:

Case is warning

The case of loss due to fire damage (except bill link 2) when there are natural disasters, fire, force majeure events if you have the declaration, tax payment, and documents to clear the goods for sale will slightly reduce the fines or no fines if there are from 2 details above.

Losing incorrect invoice, and this invoice has been removed, there are other bills instead, it is only a warning.

Read more:

Fine case of

- A fine of between 3 - 5 million contract with the behavior:

Loss, fire damage, invoice related 2 set while using bills if there are extenuating circumstances as there are records, documents proving buying and selling goods and services.

The buyer lost the bill and has a written explanation about the loss of the bill between the two sides noted the work.

- Fines from 4 - 8 million contract with the following cases:

Losing bills issued by the tax authority released but not yet in progress invoicing.

Losing bills related to 2 has been set but not yet the tax declaration, the stakeholders making explanations about the loss of the bill noted the work.

Why dehydration bill occurred popular?

Lost status invoice occurs frequently is that the business use the invoice paper. When receiving the invoice from the seller, the accounting will be stored in filing cabinets and enter data into the computer for tracking.

This has limitations led to the loss of the bill as:

- Over the years, bill increasingly more storage space too download easily lead to a situation of lost bill.

- Accounting forget not store bills into cabinets or condition occurred, burnt, damaged by weevil circle.

- This may cause inconvenience in the lookup when making settlement or explanations when you check from the tax authority.

4. Giải pháp AccNet eInvoice xử lý tình trạng mất hóa đơn hiệu quả nhất

Khi hóa đơn GTGT liên 2 đầu ra bị mất, doanh nghiệp phải lập biên bản mất hóa đơn theo đúng mẫu & gửi thông báo đến cơ quan thuế trong thời hạn quy định (Ví dụ mẫu BC21/AC, thông báo mất hóa đơn theo Thông tư 176). Việc này nhằm bảo vệ quyền lợi, tránh bị xử phạt về hóa đơn sai sót hoặc thiếu sót trong khai thuế.

Tuy nhiên, quy trình truyền thống — soạn biên bản, gửi email, lưu hồ sơ giấy — dễ dẫn đến chậm trễ, thất lạc hoặc sai sót. Đây là lúc AccNet eInvoice vào vai “cứu cánh” giúp xử lý biên bản mất hóa đơn nhanh gọn, chuẩn xác:

- Tạo biên bản mất hóa đơn tự động theo mẫu chuẩn — bạn chỉ cần nhập số hóa đơn, ngày phát hiện và lý do mất, phần mềm sẽ sinh biên bản cùng nội dung cần thiết.

- Gắn liên kết hóa đơn – biên bản – sổ sách: khi biên bản được lập, các module bán hàng, tài chính, công nợ đồng bộ cập nhật để số liệu vẫn nhất quán.

- Cảnh báo thời hạn thông báo thuế: hệ thống sẽ nhắc nhở bạn gửi thông báo mất hóa đơn đến cơ quan thuế đúng thời hạn để tránh rủi ro.

- Lưu trữ và tra cứu lịch sử: tất cả biên bản mất hóa đơn đều được lưu trong hệ thống, dễ truy xuất khi kiểm tra thuế hoặc đối chiếu nội bộ.

- Đồng bộ với lập hóa đơn thay thế (nếu cần): nếu cần thay thế hóa đơn đã mất, AccNet eInvoice hỗ trợ xử lý điều chỉnh / phát hành hóa đơn mới một cách liền mạch.

Với AccNet eInvoice, việc xử lý biên bản mất hóa đơn không còn là căng thẳng giấy tờ mà trở thành quy trình tự động, minh bạch và an toàn — giúp bạn tránh rủi ro pháp lý và giữ dữ liệu kế toán – thuế luôn rõ ràng.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Contact AccNet to get detailed advice on manage electronic invoice and answer questions related to the minutes lost bills in this article, okay. Hope the information in the article to bring more accounting knowledge useful for business.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: