Understanding the accounting profession không chỉ là yêu cầu của phòng kế toán mà còn là nền tảng để ban lãnh đạo ra quyết định tài chính chính xác. Mỗi nghiệp vụ kế toán – từ ghi nhận mua bán, chi phí, thuế đến kết chuyển cuối kỳ – đều là “mắt xích” quan trọng trong toàn bộ chu trình vận hành doanh nghiệp.

Đặc biệt, khi các tổ chức triển khai hệ thống ERP (Enterprise Resource Planning – hoạch định nguồn lực doanh nghiệp), tính thống nhất, tự động hóa của dữ liệu kế toán càng trở thành yếu tố then chốt. Việc nắm vững nghiệp vụ giúp doanh nghiệp không chỉ đảm bảo tuân thủ pháp lý mà còn tối ưu hiệu quả quản trị tài chính trong môi trường số hóa.

1. Khái niệm, vai trò của nghiệp vụ kế toán

Nghiệp vụ kế toán là gì?

Hiểu một cách đơn giản, nghiệp vụ kế toán là toàn bộ các hoạt động kinh tế – tài chính phát sinh trong doanh nghiệp có ảnh hưởng đến tài sản, nguồn vốn, chi phí hoặc kết quả kinh doanh. Đây là quá trình ghi nhận, đo lường, xử lý, cung cấp thông tin kinh tế phục vụ cho việc ra quyết định quản trị, kiểm soát nội bộ.

Theo Ủy ban Nguyên tắc Kế toán Mỹ (APB), nghiệp vụ kế toán là “tiến trình ghi nhận, đo lường, cung cấp các thông tin kinh tế để hỗ trợ người sử dụng trong việc đánh giá, ra quyết định”. Nói cách khác, mỗi bút toán được ghi nhận chính là một “bản sao tài chính” phản ánh hiện thực kinh tế của doanh nghiệp.

Vai trò của nghiệp vụ kế toán trong quản trị doanh nghiệp

Trong hệ thống quản trị tài chính hiện đại, nghiệp vụ kế toán đóng vai trò như một “bộ nhớ trung tâm” lưu giữ mọi hoạt động tài chính, từ giao dịch mua bán đến các khoản đầu tư, chi phí, thuế, lợi nhuận. Cụ thể, các nghiệp vụ kế toán được sử dụng để:

- Lập báo cáo tài chính: Giúp theo dõi tài sản, lãi/lỗ, dòng tiền, vốn chủ sở hữu.

- Quản lý thuế: Đảm bảo doanh nghiệp kê khai, tính toán, nộp thuế đúng quy định.

- Lập kế hoạch ngân sách: Hỗ trợ kiểm soát chi phí, phân bổ nguồn vốn hiệu quả.

- Kiểm toán nội bộ, độc lập: Đảm bảo tính minh bạch của báo cáo tài chính.

- Quản lý tài sản, rủi ro tài chính: Giúp doanh nghiệp kiểm soát dòng tiền, giảm thất thoát, ra quyết định đầu tư hợp lý.

Vì vậy, việc thực hiện đúng, đầy đủ các nghiệp vụ kế toán không chỉ giúp doanh nghiệp tránh rủi ro pháp lý mà còn là nền tảng cho chiến lược quản trị bền vững.

Read more:

2. Tổng hợp các nghiệp vụ kế toán cơ bản

Trong hệ thống quản trị tài chính doanh nghiệp, các nghiệp vụ kế toán đóng vai trò trung tâm, giúp ghi nhận toàn bộ hoạt động kinh tế – tài chính một cách có hệ thống, chính xác. Việc hiểu rõ từng nghiệp vụ không chỉ giúp doanh nghiệp kiểm soát tốt chi phí, doanh thu, mà còn tối ưu dòng tiền, đảm bảo tính minh bạch trong báo cáo tài chính.

Dưới đây là hơn 10 nghiệp vụ kế toán cơ bản mà bất kỳ doanh nghiệp nào – từ sản xuất, thương mại đến dịch vụ – đều cần nắm vững để đảm bảo hạch toán đúng chuẩn, tuân thủ quy định kế toán – thuế Việt Nam.

Nghiệp vụ mua hàng

Đây là nghiệp vụ nền tảng trong mọi doanh nghiệp. Nó phản ánh quá trình mua nguyên vật liệu, hàng hóa, công cụ dụng cụ hoặc dịch vụ phục vụ hoạt động sản xuất – kinh doanh.

Khi mua hàng, kế toán phải xác định rõ:

- Hàng hóa có nhập kho hay sử dụng ngay.

- Thuế GTGT đầu vào được khấu trừ hay không.

- Chi phí phát sinh đi kèm (vận chuyển, bốc xếp, lắp đặt…) có được cộng vào giá trị hàng hóa hay hạch toán riêng.

Bút toán hạch toán điển hình:

- Mua nhập kho: → Nợ TK 152, 153, 156 (giá chưa VAT) → Nợ TK 1331 (thuế GTGT đầu vào) → Có TK 111, 112, 331 (tổng thanh toán)

- Nếu sử dụng ngay (không qua kho): → Nợ TK 621, 623, 641, 642 / Có TK 111, 112, 331

Việc hạch toán chính xác nghiệp vụ mua hàng giúp doanh nghiệp kiểm soát chi phí đầu vào, đồng thời tránh sai sót trong kê khai thuế GTGT.

Nghiệp vụ bán hàng

Các nghiệp vụ kế toán liên quan đến bán hàng phản ánh doanh thu, giá vốn, nghĩa vụ thuế GTGT đầu ra. Đây là nghiệp vụ quan trọng nhất trong chu trình kế toán vì liên quan trực tiếp đến lợi nhuận.

Cách hạch toán phổ biến:

- Ghi nhận doanh thu: → Nợ TK 111, 112, 131 / Có TK 511, 3331

- Ghi nhận giá vốn: → Nợ TK 632 / Có TK 156, 152

Trong doanh nghiệp hiện đại, phần mềm kế toán ERP có thể tự động khớp dữ liệu giữa hóa đơn điện tử, phiếu xuất kho, bút toán doanh thu – giá vốn, giúp giảm thiểu sai lệch số liệu, tăng tốc quá trình chốt sổ.

Nghiệp vụ công cụ dụng cụ (CCDC)

CCDC là nhóm tài sản có giá trị nhỏ, thời gian sử dụng ngắn, nhưng nếu không quản lý chặt chẽ, dễ gây thất thoát chi phí.

Kế toán cần phân biệt giữa:

- Xuất dùng 1 lần: hạch toán toàn bộ chi phí vào kỳ hiện tại.

- Xuất dùng nhiều lần: ghi nhận vào tài khoản 242, phân bổ dần theo thời gian sử dụng.

Hạch toán mẫu:

- Mua CCDC: Nợ TK 153, 1331 / Có TK 111, 112, 331

- Xuất dùng 1 lần: Nợ TK 641, 642 / Có TK 153

- Xuất dùng nhiều lần: → Xuất kho: Nợ TK 242 / Có TK 153 → Phân bổ dần: Nợ TK 641, 642 / Có TK 242

Khi được thực hiện đúng, nghiệp vụ này giúp phân bổ chi phí chính xác cho từng kỳ kế toán, từ đó phản ánh đúng hiệu quả hoạt động.

Nghiệp vụ tài sản cố định (TSCĐ)

Tài sản cố định là “xương sống” trong cơ cấu tài sản doanh nghiệp. Việc hạch toán đúng nghiệp vụ TSCĐ ảnh hưởng trực tiếp đến chi phí khấu hao, giá trị tài sản ròng.

Các bước quản lý, hạch toán TSCĐ gồm:

- Mua, ghi nhận nguyên giá: → Nợ TK 211 (giá chưa thuế), Nợ TK 133 / Có TK 111, 112, 331

- Trích khấu hao định kỳ: → Nợ TK 154, 641, 642 / Có TK 214

- Thanh lý, nhượng bán: → Nợ TK 214, 811 / Có TK 211

Ngày nay, nhiều doanh nghiệp ứng dụng ERP để tự động tính khấu hao TSCĐ hàng tháng, gắn mã tài sản với phòng ban, giảm thiểu thao tác thủ công, sai sót định kỳ.

Read more:

Nghiệp vụ tiền lương, các khoản trích theo lương

Đây là một trong các nghiệp vụ kế toán phức tạp nhất do liên quan đến cả nhân sự, bảo hiểm, thuế.

The basic process:

- Hạch toán chi phí lương phải trả: → Nợ TK 154, 641, 642 / Có TK 334

- Trích BHXH, BHYT, BHTN, KPCĐ phần doanh nghiệp chịu: → Nợ TK 154, 641, 642 / Có TK 3383, 3384, 3386, 3389

- Trừ phần người lao động đóng: → Nợ TK 334 / Có TK 3383, 3384, 3386, 3389

- Thanh toán lương: → Nợ TK 334 / Có TK 111, 112

Trong doanh nghiệp sử dụng ERP, bảng lương có thể liên kết trực tiếp với dữ liệu chấm công, hợp đồng, bảo hiểm, giúp tính toán, hạch toán tự động, đảm bảo tính minh bạch, tuân thủ pháp luật lao động.

Discounting payment

Phát sinh khi khách hàng thanh toán sớm hơn hạn hoặc doanh nghiệp được nhà cung cấp ưu đãi.

- Bên mua (được hưởng chiết khấu): → Nợ TK 111, 112, 331 / Có TK 515, 711

- Bên bán (chiết khấu cho khách): → Nợ TK 635 / Có TK 111, 112, 131

Nghiệp vụ này phản ánh chính sách tài chính, quản lý dòng tiền của doanh nghiệp. ERP có thể tự động áp dụng chiết khấu dựa trên ngày thanh toán thực tế, điều khoản hợp đồng.

Nghiệp vụ chiết khấu thương mại, giảm giá hàng bán

Phát sinh khi doanh nghiệp bán số lượng lớn hoặc hàng bị lỗi, hư hỏng, cần ghi nhận giảm trừ doanh thu.

- Bên mua: Nợ TK 111, 112, 331 / Có TK 152, 156, 133

- Bên bán: Nợ TK 5211, 5213, 3331 / Có TK 111, 112, 131

Quản lý tốt nghiệp vụ này giúp doanh nghiệp kiểm soát chính sách giá bán, chiết khấu minh bạch, đặc biệt trong các mô hình phân phối nhiều cấp hoặc đại lý.

Nghiệp vụ hàng bán bị trả lại

Khi khách hàng trả lại hàng, doanh nghiệp cần ghi nhận giảm doanh thu, hoàn nhập hàng tồn kho.

- Giảm doanh thu: Nợ TK 5212, 3331 / Có TK 111, 112, 131

- Nhập kho hàng trả lại: Nợ TK 156 / Có TK 632

Phần mềm kế toán ERP hiện đại có thể tự động ghi nhận nghiệp vụ trả hàng ngay khi phiếu nhập được duyệt, đồng thời cập nhật lại số lượng tồn kho, điều chỉnh doanh thu trên báo cáo.

Nghiệp vụ hoa hồng đại lý

Dành cho doanh nghiệp gửi hàng qua đại lý hoặc kênh phân phối.

- Xuất kho hàng gửi: Nợ TK 157 / Có TK 155, 156

- Khi đại lý bán hàng: Nợ TK 632 / Có TK 157

- Ghi nhận hoa hồng phải trả: Nợ TK 641 / Có TK 111, 112, 3388

Nghiệp vụ này đòi hỏi hệ thống kế toán có khả năng theo dõi từng mã hàng, đại lý, tỷ lệ hoa hồng — một tính năng mà các phần mềm ERP chuyên nghiệp như AccNet ERP hỗ trợ.

Nghiệp vụ bút toán cuối kỳ

Đây là giai đoạn tổng hợp, kết chuyển dữ liệu để xác định kết quả kinh doanh thực tế trong kỳ.

Bao gồm:

- Trích khấu hao, phân bổ chi phí trả trước

- Kết chuyển doanh thu, chi phí

- Tính, kết chuyển thuế TNDN

- Xác định lãi/lỗ chuyển sang TK 421

Đây là nghiệp vụ đòi hỏi tính chính xác cao, khả năng tổng hợp toàn hệ thống – nếu sai lệch chỉ một định khoản, có thể ảnh hưởng toàn bộ báo cáo tài chính.

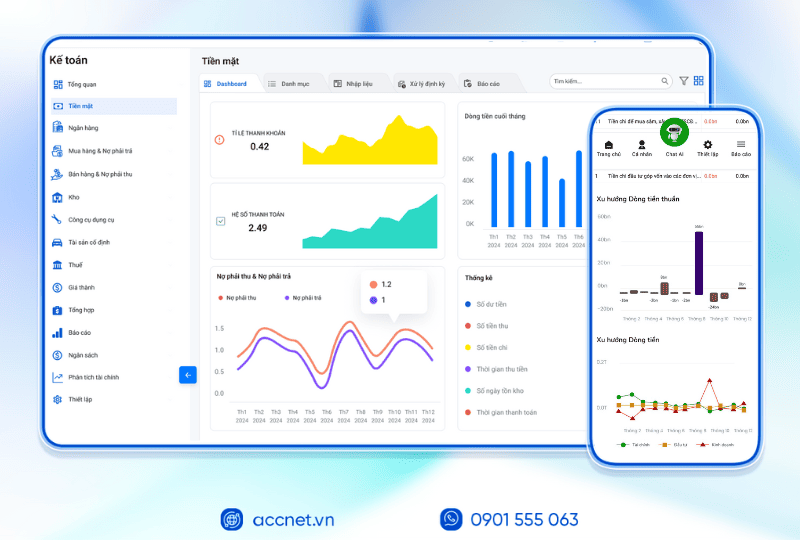

Nghiệp vụ kế toán vốn bằng tiền

Đây là nhóm nghiệp vụ phát sinh thường xuyên nhất trong mọi doanh nghiệp, bao gồm:

- Thu, chi tiền mặt: ghi nhận khi có giao dịch tiền mặt tại quỹ.

- Giao dịch qua ngân hàng: gồm chuyển khoản, thanh toán nhà cung cấp, nhận tiền khách hàng, hoàn tiền, vay hoặc trả nợ ngân hàng.

- Kiểm kê quỹ, đối chiếu sổ phụ ngân hàng: đảm bảo số dư thực tế trùng khớp với sổ sách.

Ví dụ hạch toán:

- Thu tiền bán hàng: Nợ 111/112 – Có 131

- Chi tiền mua vật tư: Nợ 152,133 – Có 111/112

Nhóm nghiệp vụ này đòi hỏi kế toán phải kiểm soát chứng từ đầy đủ, tránh sai lệch giữa sổ quỹ, thực tế.

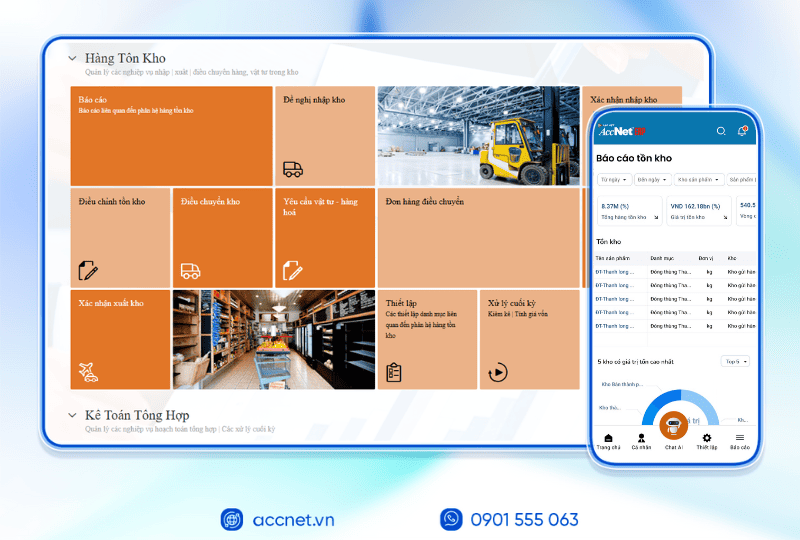

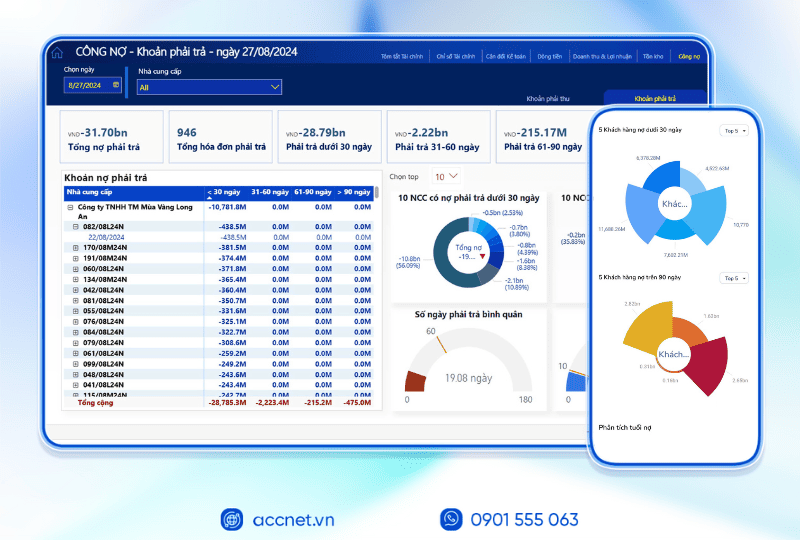

Nghiệp vụ kế toán mua hàng, công nợ phải trả

Đây là các nghiệp vụ kế toán phản ánh quá trình doanh nghiệp mua nguyên vật liệu, hàng hóa, dịch vụ từ nhà cung cấp. Bao gồm:

- Nhận hàng, kiểm tra chứng từ đầu vào

- Hạch toán hóa đơn mua hàng

- Theo dõi công nợ phải trả

- Chi trả hoặc bù trừ công nợ

Ví dụ hạch toán:

- Nhận hàng có hóa đơn: Nợ 156,133 – Có 331

- Trả tiền nhà cung cấp: Nợ 331 – Có 111/112

Việc ghi nhận chính xác giúp doanh nghiệp quản lý được hạn thanh toán, chiết khấu mua hàng, tránh nợ đọng không kiểm soát.

Learn more:

Nghiệp vụ kế toán bán hàng, công nợ phải thu

Nhóm này phản ánh doanh thu, nghĩa vụ thuế GTGT đầu ra. Bao gồm:

- Xuất hóa đơn bán hàng hóa, dịch vụ

- Ghi nhận doanh thu, công nợ phải thu

- Theo dõi thu tiền, đối chiếu công nợ khách hàng

- Ghi nhận chiết khấu, giảm giá, hàng bán bị trả lại

Ví dụ hạch toán:

- Ghi nhận doanh thu: Nợ 131 – Có 511, 3331

- Khách hàng thanh toán: Nợ 111/112 – Có 131

Nhóm nghiệp vụ này đặc biệt quan trọng vì ảnh hưởng trực tiếp đến doanh thu, dòng tiền, báo cáo kết quả hoạt động kinh doanh.

Nghiệp vụ kế toán chi phí, giá thành

Đối với doanh nghiệp sản xuất hoặc dịch vụ, đây là nhóm nghiệp vụ trọng yếu:

- Tập hợp chi phí nguyên vật liệu, nhân công, sản xuất chung

- Phân bổ chi phí vào sản phẩm hoặc đơn hàng

- Tính giá thành, kết chuyển chi phí sang giá vốn

Ví dụ hạch toán:

- Kết chuyển chi phí: Nợ 154 – Có 621, 622, 627

- Xác định giá vốn hàng bán: Nợ 632 – Có 154

Kiểm soát chặt nhóm nghiệp vụ này giúp doanh nghiệp đánh giá chính xác hiệu quả sản xuất, lợi nhuận gộp.

Nghiệp vụ kế toán thuế, các khoản phải nộp Nhà nước

Bao gồm:

- Thuế GTGT đầu vào – đầu ra

- Thuế TNDN, TNCN, thuế xuất nhập khẩu

- Các khoản phí, lệ phí khác

Ví dụ hạch toán:

- Thuế GTGT phải nộp: Nợ 3331 – Có 111/112

- Thuế TNDN: Nợ 821 – Có 3334

Việc cập nhật kịp thời các quy định mới, hạch toán các nghiệp vụ kế toán đúng giúp doanh nghiệp tránh rủi ro pháp lý, bị phạt thuế.

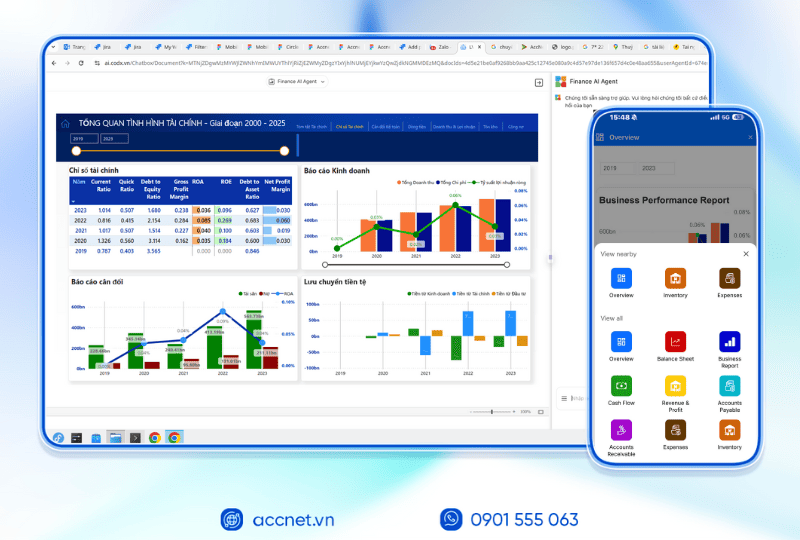

Nghiệp vụ kế toán tổng hợp, khóa sổ cuối kỳ

Sau khi hoàn tất các nghiệp vụ trong kỳ, kế toán thực hiện:

- Kết chuyển doanh thu, chi phí để xác định lãi/lỗ

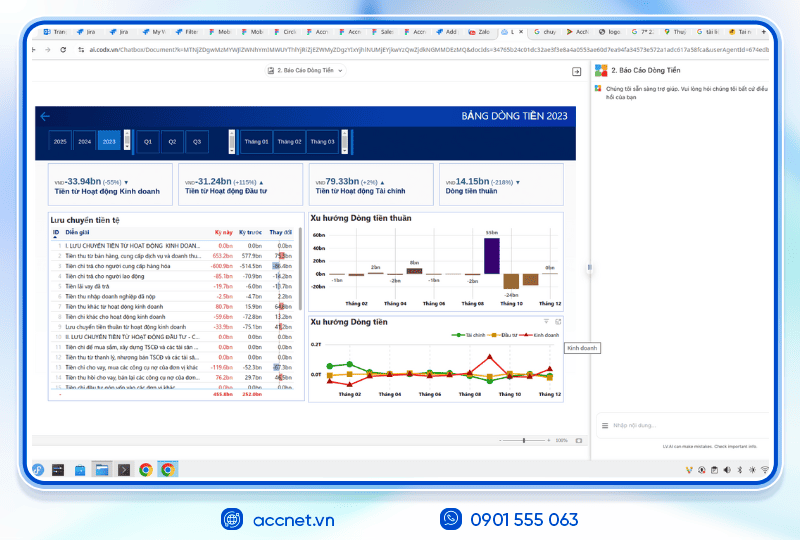

- Lập báo cáo tài chính (Bảng cân đối kế toán, Báo cáo KQKD, Lưu chuyển tiền tệ)

- Phân tích chỉ số tài chính, đề xuất chiến lược

Ví dụ hạch toán kết chuyển:

- Kết chuyển doanh thu: Nợ 511 – Có 911

- Kết chuyển chi phí: Nợ 911 – Có 632, 642

Nhóm nghiệp vụ này đòi hỏi tính chính xác tuyệt đối vì ảnh hưởng trực tiếp đến kết quả kinh doanh, nghĩa vụ thuế.

Refer to: Giải thích các khoản dư nợ và dư có trong sổ sách kế toán doanh nghiệp

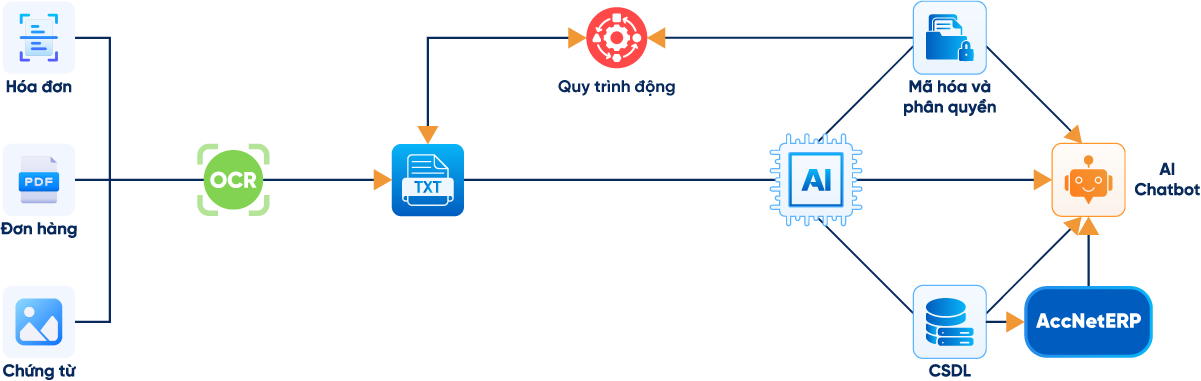

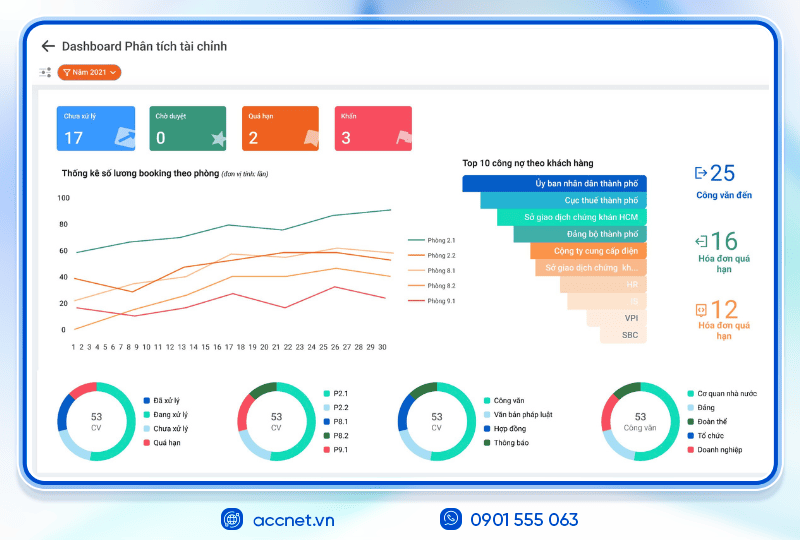

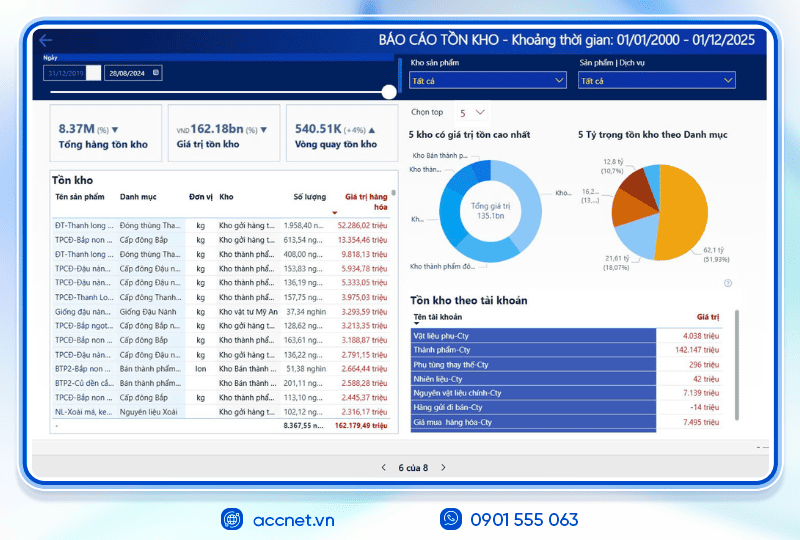

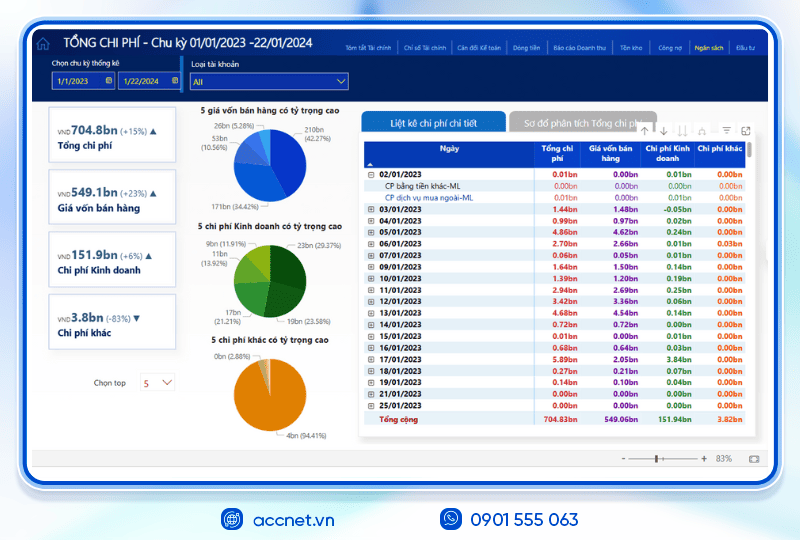

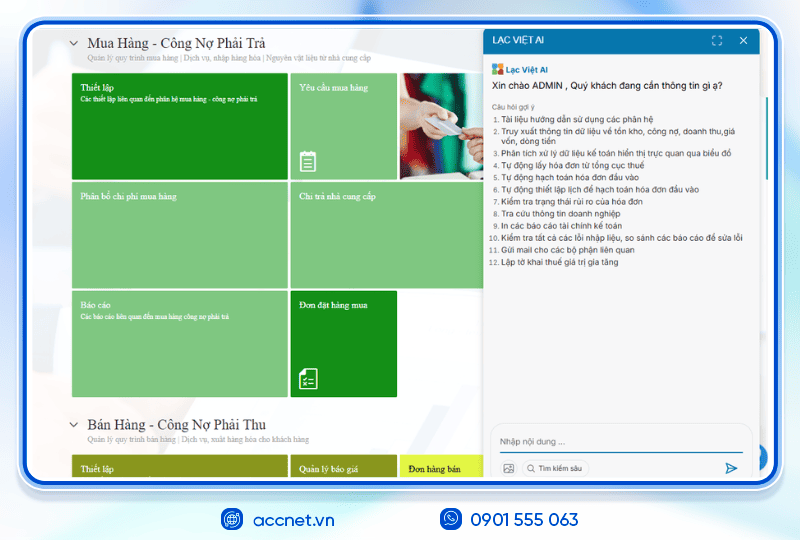

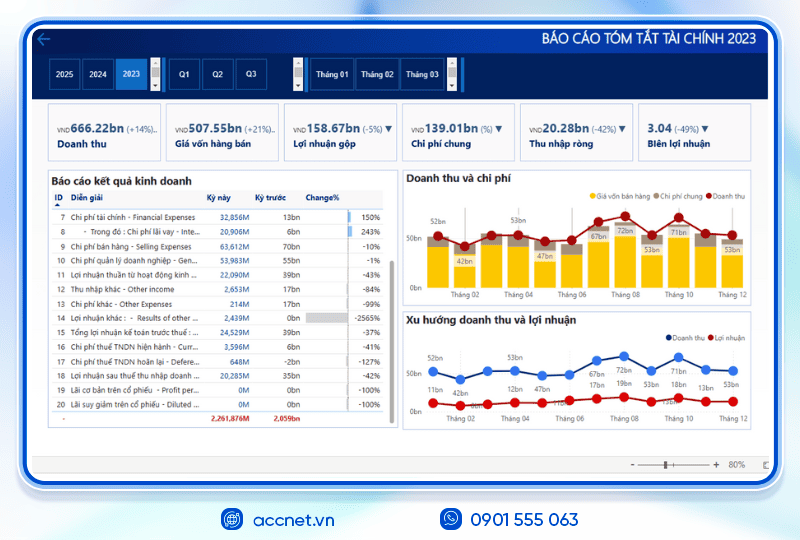

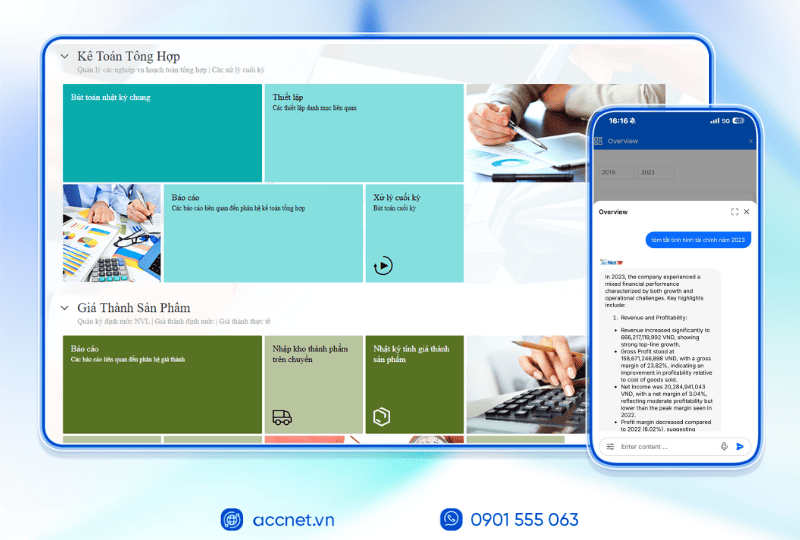

3. Công cụ hỗ trợ – Tự động hóa các nghiệp vụ kế toán AccNet ERP

Phần mềm AccNet ERP của Lạc Việt được thiết kế chuyên biệt cho doanh nghiệp sản xuất, với khả năng:

- Tự động hạch toán chi phí sản xuất theo từng công đoạn, phân xưởng;

- Tính giá thành linh hoạt theo định mức, theo đơn hàng hoặc theo sản phẩm;

- Theo dõi tồn kho – nguyên vật liệu – bán thành phẩm – thành phẩm chi tiết;

- Kết nối dữ liệu kế toán – sản xuất – bán hàng trong một hệ thống duy nhất;

- Báo cáo tài chính, phân tích sản xuất theo thời gian thực.

Nhờ đó, doanh nghiệp dễ dàng kiểm soát chi phí, rút ngắn thời gian tính giá thành, nâng cao năng suất vận hành. Công cụ này giúp giảm khối lượng công việc thủ công, nâng cao độ chính xác, hỗ trợ nhà quản trị ra quyết định dựa trên dữ liệu thời gian thực – điều mà hệ thống ERP hiện đại luôn hướng đến.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Tổng hợp lại, the accounting profession là nền tảng quan trọng giúp doanh nghiệp quản lý toàn diện mọi hoạt động tài chính – từ ghi nhận giao dịch, kiểm soát chi phí, tính giá thành cho đến lập báo cáo, tuân thủ nghĩa vụ thuế. Khi các nghiệp vụ này được tổ chức khoa học, vận hành chính xác, doanh nghiệp không chỉ đảm bảo minh bạch mà còn có thể phân tích sâu dữ liệu tài chính, ra quyết định nhanh, duy trì sự ổn định lâu dài.

Việc ứng dụng phần mềm kế toán hiện đại giúp tự động hóa toàn bộ các nghiệp vụ kế toán, giảm thiểu sai sót thủ công, đồng thời hỗ trợ nhà quản trị theo dõi tình hình tài chính theo thời gian thực. Doanh nghiệp vì thế có thể chuyển trọng tâm từ “ghi chép sổ sách” sang phân tích – dự báo – tối ưu hiệu quả kinh doanh.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: