Today, many businesses are struggling in the recording contents bills under the contract, leading to the legal risk is not worth having. This article AccNet will provide detailed instructions on how to write content invoices under the contract, from the legal regulations related to the implementation process, real-world examples, technology solutions and business support. Let's explore now!

1. Content recorded invoices according to what is contract?

1.1. Definition

Content recorded invoices under the contract is the invoice based on the terms have been agreed in the contract economics. This includes the accurate description of goods/services, quantity, value, conditions of payment.

1.2. The importance of placing the right content invoices under the contract

- Bills to be considered valid, legitimate when tax filing, financial statements.

- Help business tax-deductible VAT, charged a reasonable cost when accounting for corporate income tax (CIT).

- Avoid the account of administrative fines, arrears of taxes from the authorities.

- Help build trust with customers and partners.

2. Guide how to record content invoices under the contract

2.1. Phase 1: analysis contract for invoicing

Before invoicing, business needs analysis the content of the contract to determine the important information:

- Determine the object transaction: means goods, services, or both.

- Check payment terms: specifies the period of payment, amount of each tranche, the way of payment (wire transfer or cash).

- For projector buyer information: Full business information/personal purchase.

Read more:

- Manage electronic invoice hiệu quả giúp giảm thiểu rủi ro sai sót thuế

- Cách hủy hóa đơn điện tử đúng quy trình theo TT 78 mới nhất

- Đăng ký sử dụng hóa đơn điện tử đúng chuẩn theo Nghị định 123

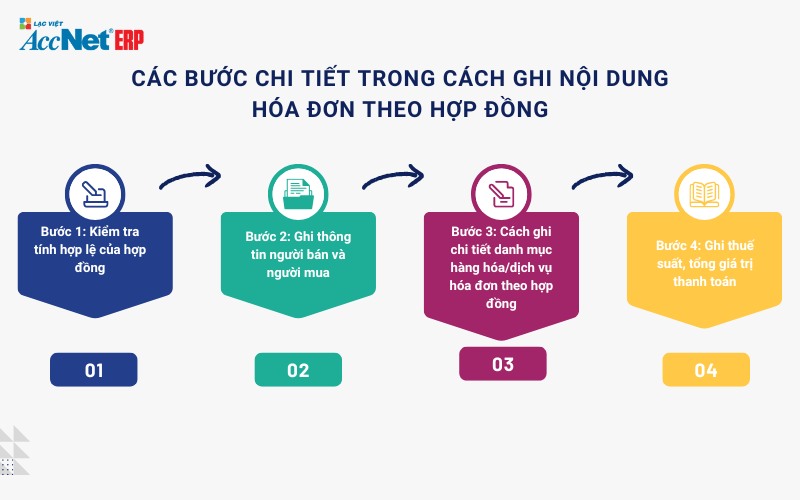

2.2. Phase 2: detailed steps in how to write content invoices under the contract

Step 1: Check the validity of the contract

- The contract must complete the signature, stamp of the parties.

- The terms related to the transaction, goods/services are clearly stated.

Step 2: list the information the seller and the buyer

- Fill in the correct name, address and tax identification number of the seller and the buyer.

- If the buyer is no personal tax code, specify personal information such as NRIC/CCCD.

Step 3: How to record a detailed list of goods/services invoice under the contract

- Write right under the contract: Name of goods, quantity, unit price, unit.

- If there are multiple items, use the detailed list attached.

Step 4: Record the tax rate, the total value of payments

- Determine the correct tax rate applicable for each category of goods/services.

- Calculate, record the total value of payments, inclusive of VAT.

2.3. Practical example on how to write content invoices under the contract

Case 1: Invoice for contract of sale of goods: Supply 500 barrels of cement with unit price 1,500,000 VND/carton. Invoicing:

- Name of goods: cement.

- Quantity: 500 carton.

- Unit price: 1.500.000 VNĐ.

- VAT: 10%.

- Total value: 825.000.000 VND (tax included).

Case 2: Invoice for contract services: maintenance services, network systems January 12/2024 with value 20,000,000 VND (VAT included). Invoicing:

- Services: system maintenance network.

- Tax rate: 10%.

- Value before tax: 18.181.818 VND.

- VAT: 1.818.182 VND.

- Total payment value: 20.000.000 VNĐ.

Read more:

- How to convert electronic invoice sang bản giấy đúng quy trình

- Lưu trữ hóa đơn điện tử theo Luật Kế toán đúng thời hạn quy định

- Instructions transfer paper invoices to electronic invoices regulations

3. Legal regulations about recording content invoices under the contract

How to record content invoices under the contract has been clearly specified in the legal documents for all economic transactions:

- Decree 123/2020/ND-CP: Regulations, bills, vouchers, including the mandatory requirements on the content of the bill as information the seller, buyer, goods and services tax rate, the total value of payments.

- Circular 78/2021/TT-BTC: detailed guide on electronic invoicing regulations, the invoicing right with economic contracts.

- The law on tax Administration no. 38/2019/QH14: Doanh nghiệp phải tuân thủ việc ghi hóa đơn đúng, đủ thông tin, để tránh rủi ro bị xử phạt hành chính, truy thu thuế.

4. The common errors in the recording content invoices under the contract

The recorded content invoices under the contract are often encountered mistakes common as follows:

- Wrong name of goods/services, quantity, unit price than the contract. This error usually occurs when no collation skills between the contract and invoice.

- Don't write the tax code, business address of the buyer/seller. Do not specify the tax rate or omission of the total value of payments.

- False the total value before and after the tax. Sorry, this easy-to arise when done manually instead of using software electronic invoice.

- Date on the invoice does not match the time of delivery or completion of services. Led to the bill being rejected when the tax declaration.

Tìm hiểu thêm: Hướng dẫn cách lưu trữ hóa đơn điện tử đầu vào regulations

5. Sử dụng phần mềm AccNet eInvoice để ghi nội dung hóa đơn theo hợp đồng

Software manage electronic invoice AccNet eInvoice giúp doanh nghiệp tự động hóa toàn bộ quy trình từ cách ghi nội dung hóa đơn theo hợp đồng, phát hành hóa đơn đến convert invoice traditional to electronic:

- Direct connection with the contract

- Accurate calculation

- Save time invoice processing

- Reduce storage costs

- Integrate the new legal provisions, the most

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể: TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

How to record content invoices under the contract is an important part of business accounting. Errors in the invoicing not only cause financial harm, but also affect corporate reputation. So, you can apply how to record a standard through the article on. Experience software invoice electronic (also called apps release bill of sale) AccNet eInvoice ngay hôm nay để tự động hóa việc ghi hóa đơn!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: