Red invoice is useful tool to manage financial efficiency. To ensure the legality, avoiding the associated risks, businesses need to master the conditions, the process of making red bill. This article AccNet will guide you how to make red bill accurate, comply with the provisions of current legislation.

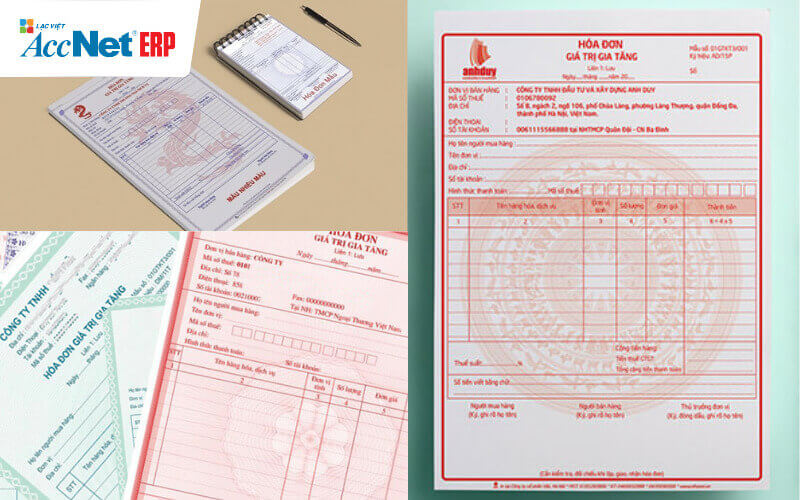

1. How to make red invoice form paper

Step 1: Prepare information and invoice template red

Chuẩn bị đầy đủ các thông tin bắt buộc theo quy định tại Điều 4, Thông tư 39/2014/TT-BTC:

- Name, address and tax identification number of the seller.

- Name, address, tax code of the buyer (if any).

- Name of goods, service, unit, quantity, unit price, amount.

- VAT, VAT amount, total paid amount.

Use invoice template red paper that has been printed according to the sample registration with the tax authority, in accordance with the provisions of Article 10, circular no. 39/2014/TT-BTC.

Step 2: Complete information on the invoice, red paper

Fill the correct information has been prepared on the union of the red invoice (usually related 1 for storage, related 2 delivery to the customer).

- Specifies the day, month and year invoicing red .

- Complete details of goods/services provided, including quantities, unit price, amount.

- Calculate the exact tax, VAT and total payment amount.

Note: do Not erase, repair on red invoice, use the ink does not fade, write clearly, accurately.

Read more:

Step 3: Sign/seal after the bill red

Legal representative/authorized person of the business must sign the name on the invoice, then the seal of the enterprise in the rules section.

How to make red bill only valid when there is full signature of business representative and seal in accordance with Article 16, circular no. 39/2014/TT-BTC.

Step 4: The red bill has done for clients

The 2 of the bill for the customer, can directly delivered or sent by mail.

Liên 1 của hóa đơn phải được lưu trữ tại doanh nghiệp theo quy định về lưu trữ hóa đơn trong thời gian tối thiểu 10 năm theo Điều 11, Nghị định 51/2010/NĐ-CP.

2. How to make red bill electronic form

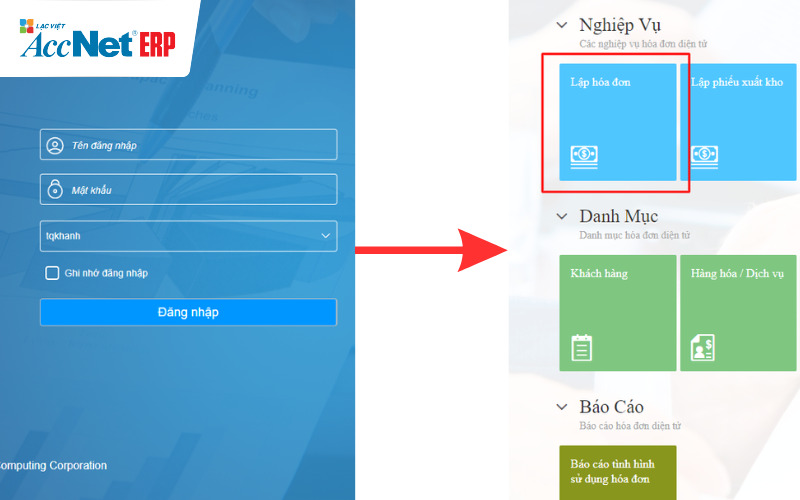

Step 1: log into the system red bill electronic

Mở trình duyệt, truy cập hệ thống hóa đơn điện tử mà doanh nghiệp đã đăng ký (AccNet eInvoice, VNPT, MISA).

Use the user/pass was granted in order to log into the system as specified in Decree 119/2018/ND-CP.

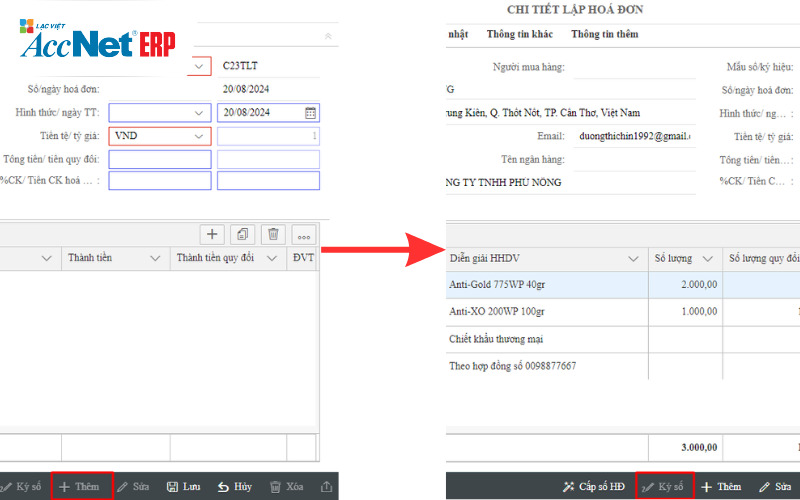

Step 2: Create a red bill electronic new

In the system interface, select the type of bills that need to set up (bill of sale, bill, services).

Enter the correct information:

- Name, address and tax identification number of the seller, the buyer.

- Details of goods/services: quantity, unit price, VAT.

- Total amount of payment, including VAT.

Read more:

- Hóa đơn sai lệch vài đồng có cần lập hóa đơn điều chỉnh không?

- Cách xử lý khi mất chứng từ đầu vào trong quá trình lưu trữ hóa đơn

- Doanh nghiệp cần biết cách hạch toán hóa đơn bị loại đúng chuẩn

Step 3: Check and sign the invoice number red electronic did

Carefully check the entire information on the bill before release to ensure there are no errors.

Use the digital signature of the enterprise to sign the invoice number, verify the invoice as prescribed in Article 6, circular 68/2019/TT-BTC.

Step 4: release/bill has made to the customer

Press “release” to complete how to make red bill. Invoices will be stored on the system

Hóa đơn đỏ điện tử có thể được gửi cho khách hàng qua email, hệ thống cung cấp hóa đơn điện tử theo quy định tại Điều 10, Nghị định 119/2018/NĐ-CP.

Hóa đơn đỏ điện tử phải được lưu trữ đúng quy định trên hệ thống doanh nghiệp, cơ quan thuế trong thời gian tối thiểu 10 năm theo Điều 11, Thông tư 32/2011/TT-BTC.

Learn more:

- Doanh nghiệp cần biết cách accounting goods on previous bills later

- Doanh nghiệp cần biết cách bill adjusted the name of goods đúng chuẩn

- Learn hóa đơn trực tiếp là gì và cách áp dụng trong kinh doanh

3. Bill what is the red?

Bill red or also known as bill value-added (VAT), is a type of important words in business transactions. This bill is:

- Proof the legitimate of the purchase and sale of goods and services

- The basis for enterprises to deduct and pay tax or VAT under the provisions of the law.

How to make red bill it helps a business in full compliance with the tax regulations.

4. Necessary standards to perform the right way to do red bill

- Requirements for the registration and use of invoices with tax authorities.

- Have the necessary software to create/release red bills, such as software, electronic invoice accounting software features an integrated invoicing.

- Information required on a red bill and valid, including name, business name, tax code, invoice number, date of invoice, details of goods/service, the value payment and VAT.

Tham khảo thêm: Tìm hiểu invoice discounting và cách áp dụng trong kinh doanh

5. Lập hóa đơn đỏ dễ dàng cùng AccNet eInvoice

Việc lập hóa đơn đỏ truyền thống thường mất nhiều thời gian do phải chuẩn bị thủ công, in ấn và kiểm tra thông tin từng hóa đơn. Với AccNet eInvoice, doanh nghiệp có thể tạo và xuất hóa đơn đỏ chỉ trong vài bước đơn giản, hoàn toàn trực tuyến và chuẩn pháp lý. Các lợi ích khi sử dụng AccNet eInvoice để lập hóa đơn đỏ:

- Tự động hóa quy trình: Từ việc nhập thông tin khách hàng, mã số thuế đến tổng hợp giá trị hàng hóa/dịch vụ, phần mềm giúp giảm tối đa sai sót.

- Xuất hóa đơn nhanh chóng: Hóa đơn được tạo ra ngay lập tức, có thể gửi qua email hoặc lưu trữ điện tử mà không cần in giấy.

- Tuân thủ pháp luật: Hệ thống luôn cập nhật các quy định mới nhất về hóa đơn GTGT, đảm bảo hóa đơn xuất ra hợp lệ với cơ quan thuế.

- Lưu trữ và tra cứu tiện lợi: Tất cả hóa đơn được lưu trữ tập trung, dễ dàng tra cứu, đối chiếu khi cần.

Nhờ AccNet eInvoice, việc lập hóa đơn đỏ trở nên nhanh chóng, chính xác và tiết kiệm thời gian cho bộ phận kế toán, giúp doanh nghiệp tập trung hơn vào hoạt động kinh doanh chính.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

How to make red billwhether is in the form of bills traditional paper or electronic invoice, requiring the careful, strict adherence to the legal provisions. Hope that this guide will assist you in the establishment/release invoice simple red than before.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: