To ensure the legality of the transaction, the lookup bills on the system of the General department of Taxation is an important step that every business/individual all need to master. This article AccNet will guide you how to lookup bills on the General department of Taxation detailed, most accurate, to help you feel more confident in managing/checking electronic invoice.

1. Cách tra cứu hóa đơn trên Tổng cục Thuế là gì?

1.1. Definition

Cách tra cứu hóa đơn trên Tổng cục Thuế là quá trình kiểm tra thông tin hóa đơn, bao gồm tính hợp lệ, mã hóa đơn, các chi tiết giao dịch liên quan thông qua hệ thống trực tuyến của Tổng cục Thuế.

1.2. Tại sao cần tra cứu hóa đơn?

- Hóa đơn không hợp lệ có thể khiến doanh nghiệp bị xử phạt hành chính, chịu trách nhiệm pháp lý.

- Giúp phát hiện hóa đơn giả/sai lệch

- Doanh nghiệp có thể kiểm tra thông tin giao dịch với đối tác.

1.3. Đối tượng cần tra cứu hóa đơn

- Doanh nghiệp: Cần xác minh hóa đơn mua hàng, bán hàng.

- Kế toán viên: Đảm bảo các hóa đơn hợp lệ trước khi hạch toán, kê khai thuế.

- Cơ quan quản lý: Phục vụ công tác thanh tra, kiểm toán doanh nghiệp.

Read more:

2. Cách tra cứu hóa đơn trên tổng cục thuế theo Thông tư số 78/2021/TT-BTC

Here are detailed instructions on the steps lookup bills on the General department of Taxation:

- Visit the website of the general department of taxation

- Navigate to the lookup bills

- Enter the information required to lookup

- Check/confirm information

- View and download lookup results

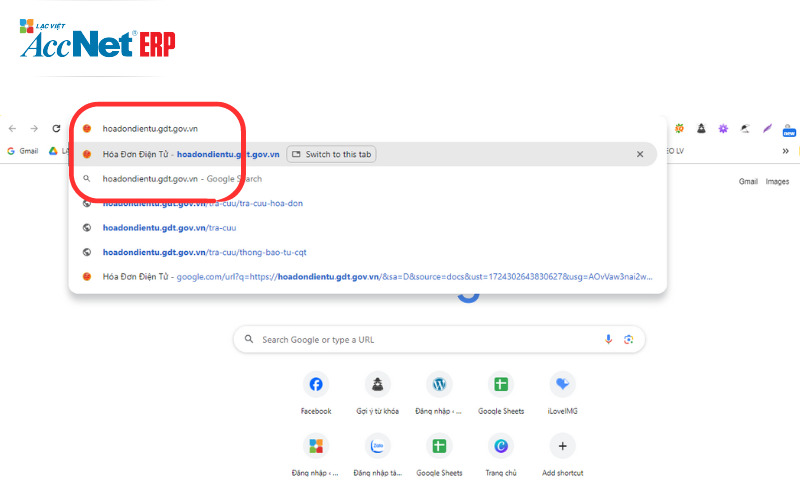

Step 1: Visit the website of the General department of Taxation

Để thực hiện cách tra cứu hóa đơn trên Tổng cục Thuế, trước tiên, bạn cần truy cập vào trang web chính thức của Tổng cục Thuế Việt Nam. Đây là cổng thông tin chính thức được cung cấp bởi Tổng cục Thuế, nơi bạn có thể kiểm tra/xác minh các hóa đơn đã phát hành.

- Mở trình duyệt web trên máy tính/điện thoại. Nhập đường dẫn https://hoadondientu.gdt.gov.vn/ vào thanh địa chỉ, nhấn "Enter".

- Wait few seconds to website loads and displays the main interface of the system of electronic invoices.

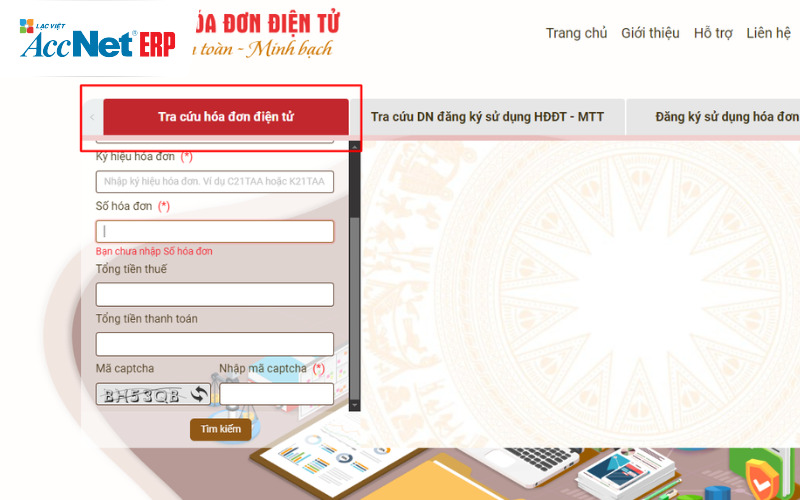

Step 2: navigate to the lookup bills on the General department of Taxation

After the home page of the system of electronic invoices, you need to navigate to the lookup bills. This is the function allows you to check the authenticity of the bill was released.

- On the main interface, find the "lookup receipts". This item will be located on the main toolbar of the page.

- Click on the "lookup receipts" to open the page lookup.

Để thực hiện cách tra cứu hóa đơn trên Tổng cục Thuế ở bước 3, bạn cần chuẩn bị:

- Tax code of business released a bill, usually consisting of 10 or 13 digit number.

- The unique number on the invoice, usually located in the upper right corner.

- Date the invoice was issued, in the format day/month/year (dd/mm/yyyy).

- Computer, laptop, mobile devices have a web browser updates.

- Internet connection is needed stability, avoid using networks with a weak signal.

- Web browser support such as Chrome, Firefox, Edge is updated to the latest version.

Read more:

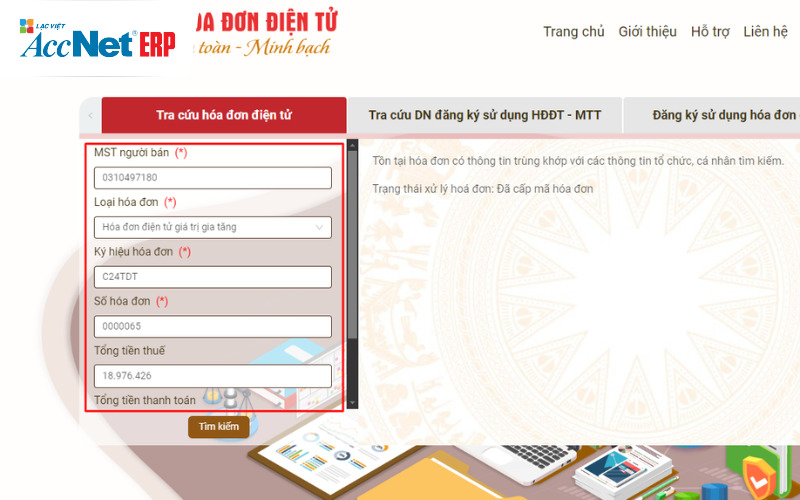

Step 3: Enter the necessary information to perform a lookup bills on the General department of Taxation

To conduct research, you need to provide the full, correct the necessary information related to the invoice you want to check out.

- Enter the tax code of business or personal issue an invoice

- Enter the invoice number is stated on the voucher that you want to lookup.

- Select/enter the date of invoice issuance. The date format is "day/month/year" (dd/mm/yyyy).

- Nhập ký hiệu hóa đơn đi kèm (bạn vô các hệ thống hóa đơn điện tử từ nhà cung cấp mà doanh nghiệp đang sử dụng như AccNet eInvoice, MISA,... để lấy)

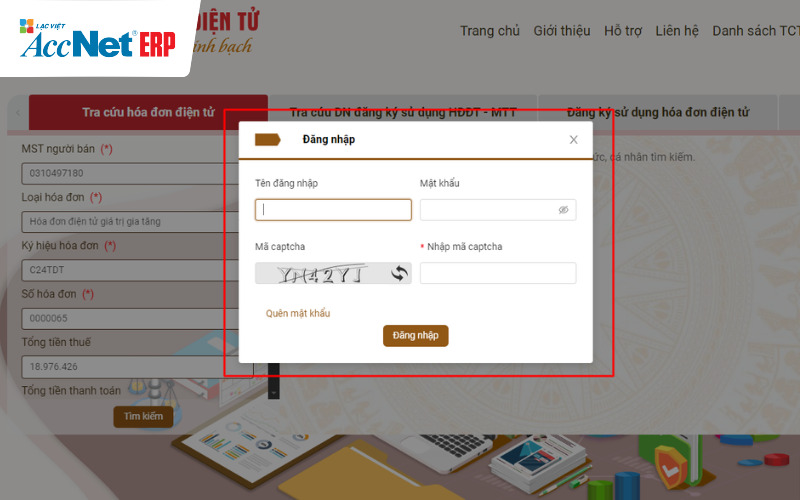

- Enter the captcha code (character string displayed on the screen), verify that you are not a robot.

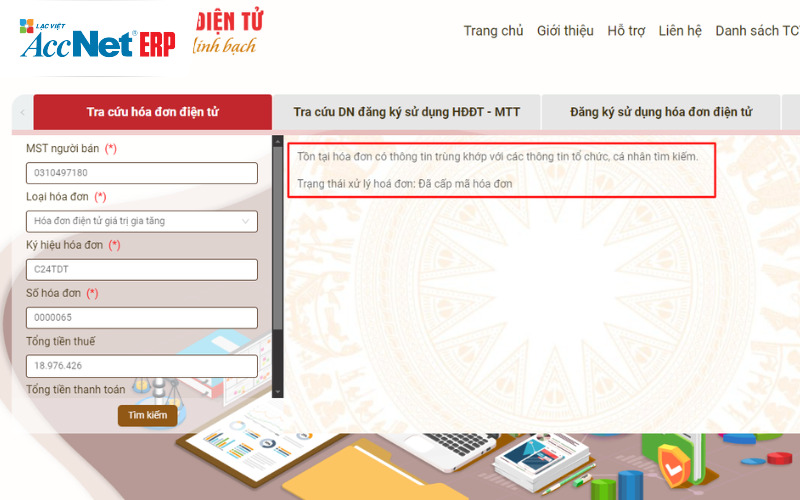

Step 4: Check/confirm information

Bạn cần kiểm tra lại toàn bộ thông tin đã nhập chính xác, tránh các lỗi có thể xảy ra khi thực hiện cách tra cứu hóa đơn trên Tổng cục Thuế

- Carefully check the tax code, invoice number, the release date was entered.

- Captcha code must be entered properly, match the string of characters on the screen.

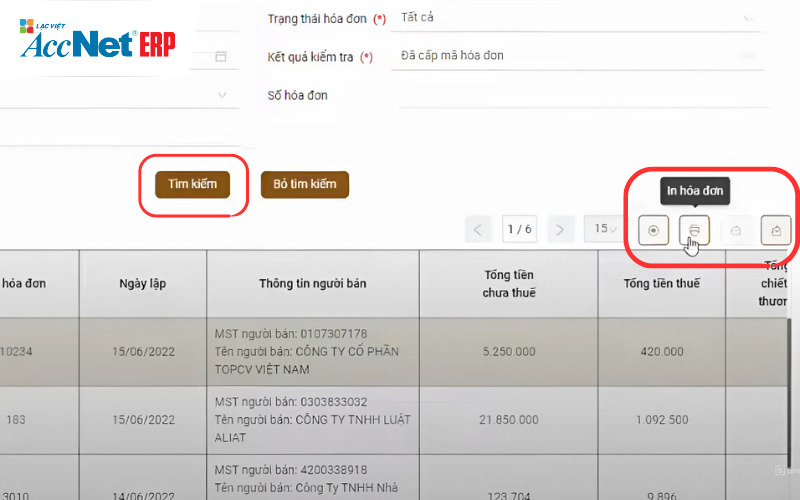

- If all information are correct, click the "Search" button to start system lookup.

- Next, the system will return results for the, you know: Bill there exists/doesn't exist and status invoice processing

Step 5: View/download the result after lookup bills on the General department of Taxation

Users who want to view detailed invoice information, need to sign up/log into the system the electronic invoice of the Total Tax department, enter information similar to Step 3, press the button “Search”

Processing system requires the lookup, the results will be displayed on the screen. You can see details about the invoice and download if necessary.

- Lookup results will show the information on the invoice as the name of the seller, amount, tax, valid status of the bill.

- If necessary, store information, you click on the button "Download" to save the invoice as PDF

- Collate information bill on the system with the document you're holding.

3. Lợi ích của việc tra cứu hóa đơn trên Tổng cục Thuế

- Cách tra cứu hóa đơn trên Tổng cục Thuế sẽ xác minh hóa đơn hợp pháp, tránh rủi ro pháp lý: Hóa đơn không hợp lệ hoặc giả mạo có thể dẫn đến nhiều hậu quả nghiêm trọng cho doanh nghiệp, từ việc mất quyền lợi thuế đến các khoản phạt hành chính hoặc truy cứu trách nhiệm hình sự.

- Giảm sai sót trong kê khai, hạch toán thuế: Kê khai thuế giá trị gia tăng (VAT) và thuế thu nhập doanh nghiệp chính xác. Tránh hoàn thuế sai, tránh bị từ chối, yêu cầu nộp phạt.

- Tăng hiệu quả quản lý tài chính - kế toán: Tra cứu hóa đơn trực tuyến giúp kế toán viên tiết kiệm thời gian trong việc xác minh thông tin dòng tiền. Điều này đặc biệt quan trọng đối với các doanh nghiệp có khối lượng hóa đơn lớn.

- Minh bạch trong giao dịch: Khi hóa đơn được xác minh thông qua hệ thống Tổng cục Thuế, doanh nghiệp tự tin đối chiếu giao dịch, xây dựng niềm tin với đối tác, khách hàng.

4. Hướng dẫn xử lý rủi ro khi thực hiện cách tra cứu hóa đơn trên Tổng cục Thuế

4.1. Hóa đơn không tìm thấy trên hệ thống vì thông tin nhập sai, hóa đơn chưa được cập nhật, hóa đơn không hợp lệ. Cách xử lý như sau:

- Re-check the information entered.

- Try to lookup again at a later time.

- Contact with the seller or the tax authority if still not found.

4.2. Lỗi kỹ thuật khi thực hiện cách tra cứu hóa đơn trên Tổng cục Thuế, do kết nối internet yếu, sự cố hệ thống, trình duyệt web không tương thích. Cách xử lý:

- Ensure a stable internet connection.

- Try again later, if the system is maintenance.

- Update/change browser settings, clear the cache.

4.3. Thông tin hóa đơn không chính xác vì thông tin nhập không khớp, hóa đơn bị chỉnh sửa, hóa đơn giả mạo. Xử lý tình huống như sau:

- Collate the information on the original invoice.

- Contact the issuing receipts to verify.

- If necessary, contact the tax authorities for assistance.

5. Ứng dụng công nghệ trong tra cứu hóa đơn

Ngoài lựa chọn tra cứu HĐ trên Tổng cục Thuế bạn cũng có thể sử dụng software invoice management AccNet eInvoice để tra cứu. Thay vì chỉ đáp ứng mỗi chức năng tra cứu, phần mềm còn hỗ trợ doanh nghiệp kiểm soát, quản lý hóa đơn tự động, nhanh chóng, đảm bảo tính chính xác tuyệt đối. Trải nghiệm ngay để tối ưu hóa quy trình hóa đơn của bạn!

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

After reading this article, hopefully you have acquired the knowledge necessary to perform how to lookup bills on the General department of Taxation efficient. Mastering this process not only helps businesses to shorten the time to check in all circumstances and to report, in case the bill has flaws. Thank you for taking the time to read the article, wish you success in the lookup business invoice!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: