Các doanh nghiệp hiện đang thực hiện số hóa tài liệu, dữ liệu, chuyển dần hoàn toàn sang sử dụng hóa đơn điện tử (HĐĐT). Tuy nhiên, dù là hóa đơn giấy hay hóa đơn điện tử thì trong quá trình lập, xuất hóa đơn sẽ không tránh khỏi các trường hợp sai sót. Vậy đâu là cách handle electronic invoice write wrong đúng theo luật định? Cùng AccNet tìm hiểu chi tiết trong bài viết này.

1. How to handle bill electronic misspell circular 32/circular 78/Decree 123

Here are 7 adjusting the electronic invoice write wrong for each specific case:

1.1. HĐĐT chưa gửi cho người mua

When bill electronic has been established but there are flaws such as address, tax code (MTS), tax rate, name goods, wrong date or amount, however, the bill has not yet been sent to the client, accountant make cancellation invoice, issue a new invoice. Electronic invoice is cancelled, must be stored back to base when there is investigation from the tax authorities.

Way handle electronic invoice write wrong this base, according to the office of 3441/TCT-CS dated 29/8/2019 of the directorate general of tax on electronic invoices.

1.2. Hóa đơn đã gửi cho người mua chưa kê khai thuế

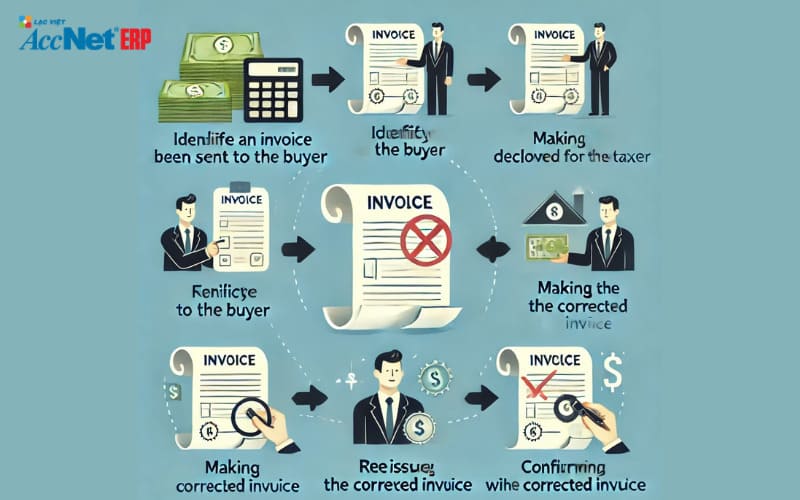

Invoice/send to the buyer but goods and services were delivered to customers but not yet tax declaration, then the processor when writing the wrong electronic invoice as follows:

- Step 1: Confirm the errors from the seller, the buyer agrees to cancel the invoice flaws.

- Step 2: sell-Side implementation of electronic invoices, send to the buyer. Note, on new bills need to confirm this is the alternative bill for old bill has flaws.

Read more:

1.3. HĐĐT được kê khai thuế đã gửi cho người mua

Goods/services sent to the buyer had the tax declaration will be made by the processor when writing the wrong electronic invoice as follows:

- Step 1: the Two sides set up a written agreement stating the flaws electronic signature of 2 sides.

- Step 2: the seller establishment the custom electronic invoice there are errors, specify the increase or decrease in the number of goods, the tax rate, the selling price for electronic invoicing errors earlier. Based on the minutes of this correction, the two sides will declare adjusted according to the applicable law.

1.4. Hóa đơn điện tử có mã của cơ quan thuế chưa gửi cho người mua

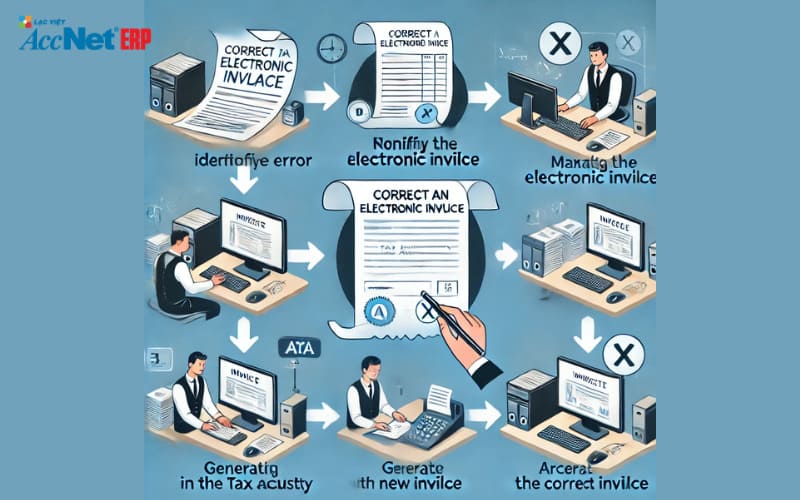

Electronic invoicing is the code of the tax authority, has not yet sent to the buyer be processed according to the following steps:

- Step 1: Use the template no. 04/SS-HDĐT in annex IA in the Decree 123 to inform the tax authorities cancel the electronic invoice is issued code has flaws.

- Step 2: Set up electronic bill new register number, send the tax agency to set new code, sent to the buyer.

1.5. Hóa đơn có mã của cơ quan thuế đã gửi cho người mua

Bills have errors in address, name, but not the wrong tax code is sent to the buyer made handle electronic invoice write wrong follow these steps:

- Step 1: The seller just notice about the mistake on without the need to issue a new invoice.

- Step 2: Use a template no. 04/SS-HDĐT in annex IA in the Decree 123 to inform about the flaws.

1.6. Hóa đơn điện tử không có mã của cơ quan thuế

Adjusting the electronic invoice write wrong for cases where the bill does not have the code of the tax authority as follows:

- Electronic invoices can only flaws about the name, the address, but tax code correct, the content remains true, then no need to reset the invoice. The seller need only inform the buyer about these errors.

- Case incorrect invoice, tax advance tax, goods not properly, then the seller needs to invoice adjusted for electronic invoices contain errors. On the bill adjustable specifies the “adjust for invoice model number ... symbol ... of ... days ... months ... years.” If the 2 parties have set up the deal before invoicing then need to set up the new agreement specifies the flaws.

Read more: Hướng dẫn xác thực hóa đơn điện tử bằng chữ ký số hợp lệ

1.7. Bill is the wrong information required under the provisions

Step 1: make a memorandum of agreement between the seller, buyer

- Specify the errors in buyer information/goods/services/quantity/unit price/amount/date/tax code/tax rate on record.

- Memorandum of agreement should be signed by both parties (seller and buyer).

Step 2: The seller informed adjust the invoice for the tax authority

- Use management system invoice electronic to send notifications adjustment.

- Notification content includes invoice information need to be adjusted, reasons adjusted.

Step 3: Set the adjustment to handle electronic invoice write wrong

- Bill adjusted just remember the information is false information properly adjusted. The information remains the same as the original invoice.

- Content invoice adjustments must specify the number of the original invoice/date of original invoice. Extra notes about the reasons for the adjustment.

2. Căn cứ quy định pháp lý khi xử lý hóa đơn điện tử viết sai

Before performing adjusting the electronic invoice write wrongbusiness or accounting student should know, understand the legal grounds made for each type of bill. Accordingly, depending on the type of invoice business use will apply the legal grounds different.

Currently there are two types of electronic invoice is used, the base handle specific as follows:

- Hóa đơn điện tử được ban hành theo thông tư 23/2021/TT-BTC: How to fix electronic invoice write wrong based on the 9 at the words, the dispatch instructions to handle different for each case, the specific flaws.

- Hóa đơn điện tử loại mới ban hành theo thông tư 78/2021/TT-BTC, Nghị định 123/2020/NĐ-CP: Căn cứ xử lý theo khoản 1 điều 7 theo circular 78 of electronic invoices, điều 19 theo Nghị định 123.

3. Note need to know when adjusting the electronic invoice write wrong

To ensure process handle electronic invoice write wrong done right, avoid meeting the other flaws to note the following issues:

- Set/border adjustment electronic invoice: the program should have enough signatures of the buyer and seller. Buyers have the electronic signature, then the minutes are set will sign electronically. If the buyer does not have electronic signature shall record set by paper directly.

- Need to have how to store electronic invoice be careful with the bill did get to give the tax authorities during the investigation.

- The adjustment is not recorded negative number (-)

Details of the case handle electronic invoice write wrong was AccNet presented in full in this article. Hope the information in the help for businesses, accountants done properly handle when you write the wrong electronic invoice if there are errors in the process of using electronic invoices, okay.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: