In the process managed/operated business, understanding the types of costs is the key element to ensure the effective and sustainable finance. One of the aspects vital but often overlooked is the cost indirectly. So indirect cost what is? Let's Accnet read the article below to clarify on the issue!

1. Indirect cost is what?

Indirect costs (costs not directly) are those costs not directly related to product/service specific business production/supply.

These are expenses not allocated directly to each unit of product/service specific. Instead, the cost is not directly often must be allocated based on the methods of calculation or by a percentage.

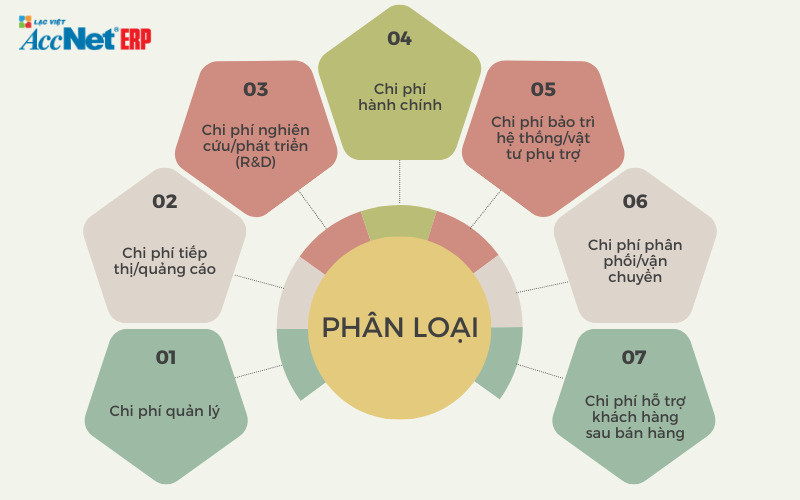

2. Types of indirect costs most popular today

Here are some of the costs not directly but businesses often encounter:

2.1. Cost management

- The account of salary, bonus, allowances for positions such as ceo, the senior management.

- Office rent, telephone, internet, water, materials office products.

- Organize meetings, conferences and seminars for leadership/staff management.

2.2. Indirect costs for marketing/advertising

This cost is related to the operations marketing/advertising products/services of the business:

- Advertising on tv, radio, newspapers, magazines, network sites.

- Organization of promotions, advertising campaigns to attract customers.

2.3. Indirect costs for research and development (R&D)

This cost includes expenditures for research/product development, new services or improvements to existing technology:

- Salary, bonus and allowance for scientists, engineers, research staff.

- Shopping research equipment, software, registration costs, maintain patent rights.

2.4. Administrative expenses

Administrative costs are the indirect costs to maintain the overall activities of the business, including:

- Rental protection outside the company, procurement of security equipment.

- Hire, reception services, office support, such as janitors, sanitation services.

2.5. Maintenance cost system supplies/auxiliary

This cost is the account system maintenance machinery and equipment, infrastructure of the enterprise:

- Maintenance and repair of machinery and equipment to ensure they are operational stability.

- Procurement of supplies, auxiliary such as oil, construction materials, office materials.

2.6. Indirect costs for delivery/shipping

Used to distribute/transport products of the business to the customer:

- Shipping products from warehouse to the customer, the cost of renting warehouse to store goods.

- Preservation of the product during transportation such as cargo insurance, the cost of protective packaging products.

2.7. Cost of customer support after the sale

The cost of this to support customers after they have bought the product/service of the business:

- Warranty and repair products when there is technical error.

- Provider of consulting services, customer support, after they buy the product.

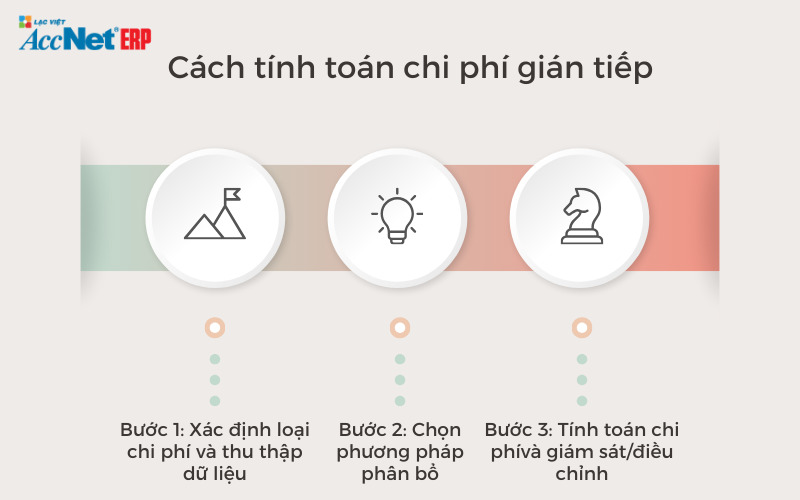

3. Guide how to calculate indirect cost effective

To calculate the cost not directly correct, you can apply the following steps:

Step 1: Determine the type of indirect cost and collect data

First you need to determine the type of expense not directly that the business faced. The types of expenses which may include:

- Cost of administration.

- The cost of marketing/advertising.

- The cost research/development.

- Shipping costs/delivery.

- Maintenance cost system supplies/backend.

- Cost of customer support after the sale.

Collect the source of information related to calculation of costs not directly include financial statements, management system, the existing cost of the business, the report business activities.

Step 2: Select the method for allocating indirect costs

There are many methods to allocate costs not directly, such as:

- Method percentage of sales: Allocation of costs not directly based on percentage revenue each product/service. For example, if the total cost does not directly is 20% of the total revenue, costs not directly of each product/service will be 20% of sales from that product.

- Method number of units: Allocation indirect costs based on the number of units of product produced or service provided. For example, the cost is not directly can be divided evenly for each product/service according to quantity.

- Standard method: Allocated based on the criteria/indicators to be determined first. These standards are the rules of business set out according to experience/historical data about the cost.

Step 3: Calculate indirect costs, and monitor/adjust

Calculate the cost not directly for each product/service on the allocation method selected.

If you apply the method percentage of sales, costs not directly is 20% of the total sales revenue of a product is 100 million, the cost is not directly for products that will be 20 million.

After the calculation, you need to monitor and evaluate the results to ensure fairness in the allocation of costs not directly, help you make the necessary adjustments over time.

4. The difference between direct costs and indirect costs

The comparison table below will help you understand more about the basic differences between direct costs and expenses not directly in business:

| Characteristics | Direct costs | Indirect costs |

| Definition | Be allocated directly to each unit of product/service specific | Not allocated directly to each unit of product/service |

| Related to | Directly related to product/service specific | Related to the overall operation of the business, not just specific for each product/service |

| Allocation indirect costs | Direct allocation based on product units | Allocated based on the calculation method or percentage |

| Management | Easy to manage because that is assigned to each unit of product | Requires calculation method is accurate to allocate the right level for the different activities of the business |

| Efficiency measurement | Easily measure the effectiveness | Difficult to measure the effectiveness depends on many different factors |

| Purpose of use | Calculate the product price, profit, direct | Calculate the total operational costs, business optimization costs overall |

5. Practical application of the cost not directly

Here are some practical application of understanding indirect costs:

- Budgeting, financial forecasting, helping businesses avoid the cost exceeds the budget or lack of financial resources.

- Calculate the price of products/services exactly to offer a price matching guarantee a profit competition in the market.

- The area has a high cost, find ways to optimize operations. If the cost of administration is too high, the business can review the organizational structure, work processes to minimize cost.

- Evaluate the effectiveness of the strategic business/marketing by comparing the costs not directly with the revenue/profit

6. Chuyển chi phí gián tiếp thành lợi thế cạnh tranh với AccNet ERP

Chi phí gián tiếp (hay còn gọi là overhead cost) như điện nước văn phòng, chi phí quản lý, quảng cáo, bảo trì, đều là những chi phí không gắn trực tiếp với từng sản phẩm hay dịch vụ cụ thể. Chúng dễ bị bỏ quên, gây lãng phí nếu không được kiểm soát chặt chẽ.

Vậy làm sao để thay vì là gánh nặng, những chi phí này trở thành nguồn lực giúp doanh nghiệp phát triển? Đó chính là lúc AccNet ERP – giải pháp quản trị doanh nghiệp toàn diện – trở thành trợ thủ đắc lực.

Khi AccNet ERP biến chi phí gián tiếp thành "phát hiện giá trị":

-

Từ dữ liệu rời rạc đến quản trị chi phí tập trung: Không còn tình trạng mỗi bộ phận tự quản lý chi phí hành chính, tiếp thị, bảo trì… AccNet ERP tập hợp mọi chi phí ở một nơi, cung cấp cái nhìn tổng hợp, dễ kiểm soát.

-

Phân bổ chi phí linh hoạt – chuẩn xác theo từng hoạt động: ERP hỗ trợ đa phương pháp phân bổ như theo doanh thu, theo số lượng, theo giờ sử dụng... giúp phân chia chi phí gián tiếp một cách chính xác theo từng mảng, tránh tình trạng "vơ đũa cả nắm".

-

Khai thác dữ liệu để tiết kiệm – không để đồng nào rơi phí: Khi đã bám sát chi phí – bạn có thể dễ dàng nhận ra bộ phận nào chi phí quá cao, từ đó đưa ra quyết định tinh gọn hoạt động hoặc tái cấu trúc (VD: thuê ngoài, tối ưu cơ sở vật chất…).

-

Audit trail đầy đủ – minh bạch từng đồng chi: Mỗi khoản chi tự động lưu lại: ai phê duyệt, khi nào, chi cho hoạt động gì… Tính minh bạch cao giúp kiểm toán dễ dàng hơn, nâng cao uy tín nội bộ.

-

Biến báo cáo thành sức mạnh chiến lược: AccNet ERP không chỉ cho xem "đã chi bao nhiêu", mà còn phân tích mức độ ảnh hưởng của chi phí gián tiếp đến lợi nhuận, dự báo ngân sách, đề xuất tối ưu ngay trên dashboard.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Article on business will understand indirect cost what is and the important role of it in business operations. The application of the method of calculating costs not directly justified will help business achieve the effect of financial expansion, growth opportunities in the business environment increasingly competitive today.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: