Account accounting is the tool to perform the accounting of the business reflects the level of income and expenditure in the production process business, rely on it to perform liable to pay tax to the state. So the system of accounting accounts extremely important that any accountant would also need to grasp. In this article, AccNet will provide to you account system accounting circular 200 the most detailed.

1. Account system according to circular 200, what is?

Account system according to circular 200 is the system account is issued under circular no. 200/2014/TT-BTC effective from 01/01/2015 to replace the account in Decision 15/2006/QD-BTC.

To accomplish the accounting profession, then tables accounts accounting circular 200 this is extremely important, especially for big businesses today. See the next section for detailed reference tables accounts accounting offline.

Read more:

2. System tables accounts accounting according to the circular, 200 details

| THE SYSTEM ACCOUNT, BUSINESS ACCOUNTING CIRCULAR 200 | ||

| (Issued under circular no. 200/2014/TT-BTC dated 22/12/2014 of the Ministry of finance) | ||

| NUMBER TK | ACCOUNT NAME | |

| Level 1 | Level 2 | Category - Asset account |

| 111 | Cash | |

| 1111 | Money Vietnam | |

| 1112 | Foreign currency | |

| 1113 | Gold currency | |

| 112 | Bank deposits | |

| 1121 | Money Vietnam | |

| 1122 | Foreign currency | |

| 1123 | Gold currency | |

| 113 | Money transfer | |

| 1131 | Money Vietnam | |

| 1132 | Foreign currency | |

| 121 | Trading securities | |

| 1211 | Stock | |

| 1212 | Bonds | |

| 1218 | Securities and other financial instruments | |

| 128 | Investments held-to-maturity date | |

| 1281 | Term deposits | |

| 1282 | Bonds | |

| 1283 | Loans | |

| 1288 | Other investments held to maturity | |

| 131 | Receivable of clients | |

| 133 | VAT deductible | |

| 1331 | VAT is deducted of goods and services | |

| 1332 | VAT is deducted of fixed assets | |

| 136 | Receivable internal | |

| 1361 | Capital business in subdivisions | |

| 1362 | To collect about the exchange rate differences | |

| 1363 | To collect about the borrowing costs eligible for capitalization | |

| 1368 | Receivable other internal | |

| 138 | Other receivables | |

| 1381 | Lack of assets awaiting disposal | |

| 1385 | Receivable on shares | |

| 1388 | Other receivables | |

| 141 | Advance | |

| 151 | Goods in transit | |

| 152 | Material, materials | |

| 153 | Tools | |

| 1531 | Tools | |

| 1532 | Packaging rotated | |

| 1533 | Furniture for rent | |

| 1534 | Equipment and spare parts | |

| 154 | The cost of production, unfinished business | |

| 155 | Finished products | |

| 1551 | Finished products warehouse | |

| 1557 | Finished products real estate | |

| 156 | Goods | |

| 1561 | The purchase price of goods | |

| 1562 | Cost of purchasing goods | |

| 1567 | Merchandise real estate | |

| 157 | Goods on consignment | |

| 158 | Goods in bonded warehouses | |

| 161 | Genus career | |

| 1611 | Genus career year ago | |

| 1612 | Genus career this year | |

| 171 | Transactions of buying and selling bonds | |

| 211 | Fixed assets tangible | |

| 2111 | Buildings, architecture | |

| 2112 | Machinery and equipment | |

| 2113 | Means of transport, transmission | |

| 2114 | Equipment and tools management | |

| 2115 | Perennials, cattle work and for products | |

| 2118 | Fixed assets other | |

| 212 | Fixed assets finance lease | |

| 2121 | Fixed assets tangible financial leasing. | |

| 2122 | Fixed assets intangible finance lease. | |

| 213 | Fixed assets intangible | |

| 2131 | Land use rights | |

| 2132 | Right released | |

| 2133 | Copyright, patent | |

| 2134 | Trademarks, trade names | |

| 2135 | Software program | |

| 2136 | License and license | |

| 2138 | Fixed assets other intangible | |

| 214 | Wear and tear of fixed assets | |

| 2141 | Wear and tear of fixed assets tangible | |

| 2142 | Wear and tear of fixed assets finance lease | |

| 2143 | Wear and tear of fixed assets invisible | |

| 2147 | Wear real estate investment | |

| 217 | Real estate investment | |

| 221 | Investment in subsidiaries | |

| 222 | Investment in joint venture, link | |

| 228 | Other investment | |

| 2281 | Investment capital contribution to other units | |

| 2288 | Other investment | |

| 229 | The loss reserve assets | |

| 2291 | Provision for diminution in value of trading securities | |

| 2292 | Reserve losses investing in other units | |

| 2293 | The room must be uncollectible | |

| 2294 | Provision for diminution in value of inventory | |

| 241 | Construction in progress | |

| 2411 | Shopping tangible fixed assets | |

| 2412 | Basic construction | |

| 2413 | Major repairs of fixed assets | |

| 242 | Prepaid expenses | |

| 243 | Assets deferred income tax | |

| 244 | Pledge, mortgage, deposit, sign a bet | |

| Level 1 | Level 2 | Category - accounts payable |

| 331 | To be paid to seller | |

| 333 | Taxes and other payables to The state budget | |

| 3331 | Value added tax payable | |

| 33311 | Output VAT | |

| 33312 | VAT on imported goods | |

| 3332 | Excise tax | |

| 3333 | Import | |

| 3334 | Corporate income tax | |

| 3335 | Personal income tax | |

| 3336 | Tax resources | |

| 3337 | Land tax, land rent | |

| 3338 | Environmental protection tax and other taxes | |

| 33381 | Environmental protection tax | |

| 33382 | Other taxes | |

| 3339 | Fees and accounts payable other | |

| 334 | Payables to employees | |

| 3341 | Pay employees | |

| 3348 | Pay other workers | |

| 335 | The cost to pay | |

| 336 | Pay internal | |

| 3361 | Pay internal business capital | |

| 3362 | Internal payable on exchange rate differences | |

| 3363 | Internal payable on the borrowing costs eligible for capitalization | |

| 3368 | Pay other internal | |

| 337 | Payment-in-progress plan construction contracts | |

| 338 | Pay, payable other | |

| 3381 | Surplus assets pending | |

| 3382 | Union funds | |

| 3383 | Social insurance | |

| 3384 | Health insurance | |

| 3385 | Payable on shares of the | |

| 3386 | Unemployment insurance | |

| 3387 | Unrealized revenue | |

| 3388 | Pay, payable other | |

| 341 | Loan and debt finance lease | |

| 3411 | The account borrowers | |

| 3412 | Debt finance lease | |

| 343 | Bonds issued | |

| 3431 | Bonds often | |

| 34311 | Denomination | |

| 34312 | Bond discount | |

| 34313 | Additional bonds | |

| 3432 | Convertible bonds | |

| 344 | Get escrow, sign on | |

| 347 | Deferred income tax pay | |

| 352 | Redundancy pay | |

| 3521 | Preventive product warranty goods | |

| 3522 | Backup warranty construction | |

| 3523 | Preventive restructuring business | |

| 3524 | Payable other | |

| 353 | Bonus and welfare fund | |

| 3531 | Bonus | |

| 3532 | Welfare fund | |

| 3533 | Welfare fund was formed in fixed assets | |

| 3534 | Prize fund management company executive | |

| 356 | Development fund of science and technology | |

| 3561 | Development fund of science and technology | |

| 3562 | Development fund of science and technology has formed fixed assets | |

| 357 | The price stabilization fund | |

| Level 1 | Level 2 | Type - account equity |

| 411 | Capital investment of the owner | |

| 4111 | Capital contributed by the owner | |

| 41111 | Common stock have voting rights | |

| 41112 | Preferred stock | |

| 4112 | Capital surplus | |

| 4113 | Conversion option bonds | |

| 4118 | Other capital | |

| 412 | Difference revaluation of assets | |

| 413 | Variances exchange rate | |

| 4131 | Exchange rate differences due to the revaluation of the item monetary assets and liabilities denominated in foreign currency | |

| 4132 | Variances exchange rate in the period before operation | |

| 414 | Investment and development fund | |

| 417 | Funds assist in arranging business | |

| 418 | The fund other equity | |

| 419 | Stock fund | |

| 421 | Profit after tax has not distributed | |

| 4211 | Profit after tax undistributed years ago | |

| 4212 | Profit after tax has not distributed this year | |

| 441 | Capital investment in basic construction | |

| 461 | Source of funding career | |

| 4611 | Source of funding career year ago | |

| 4612 | Source of funding career this year | |

| 466 | Source of funding has formed fixed assets | |

| Level 1 | Level 2 | Type - revenue accounts |

| 511 | Sales and service provider | |

| 5111 | Revenue sale of goods | |

| 5112 | Sales of the finished product | |

| 5113 | Revenue to provide services | |

| 5114 | Revenue grants, subsidies | |

| 5117 | Revenue business real estate investing | |

| 5118 | Other sales | |

| 515 | Revenue financing activities | |

| 521 | The sales deductions | |

| 5211 | Trade discount | |

| 5212 | Sales returns | |

| 5213 | Discount sales | |

| Level 1 | Level 2 | Type - expense account BUSINESS |

| 611 | Purchasing | |

| 6111 | Purchase of raw materials, materials | |

| 6112 | Buy goods | |

| 621 | The material cost, direct material | |

| 622 | Costs directly | |

| 623 | Cost of used construction machine | |

| 6231 | Cost | |

| 6232 | The cost of raw materials | |

| 6233 | The tooling cost production | |

| 6234 | Depreciation construction machines | |

| 6237 | Cost of services purchased in addition | |

| 6238 | Cash expenses other | |

| 627 | The cost of production in common | |

| 6271 | Cost of workshop staff | |

| 6272 | The cost of raw materials | |

| 6273 | The tooling cost production | |

| 6274 | Depreciation of fixed assets | |

| 6277 | Cost of services purchased in addition | |

| 6278 | Cash expenses other | |

| 631 | Production cost | |

| 632 | Cost of goods sold | |

| 635 | Financial expenses | |

| 641 | Cost of sales | |

| 6411 | Staff costs | |

| 6412 | The cost of raw materials, packaging | |

| 6413 | Cost utensils | |

| 6414 | Depreciation of fixed assets | |

| 6415 | Warranty costs | |

| 6417 | Cost of services purchased in addition | |

| 6418 | Cash expenses other | |

| 642 | Cost management business | |

| 6421 | Employee expense management | |

| 6422 | The cost of materials management | |

| 6423 | The cost of office supplies | |

| 6424 | Depreciation of fixed assets | |

| 6425 | Taxes, fees and charges | |

| 6426 | Cost contingency | |

| 6427 | Cost of services purchased in addition | |

| 6428 | Cash expenses other | |

| Level 1 | Level 2 | - Type of account other income |

| 711 | Other income | |

| Level 1 | Level 2 | Type - expense account, other |

| 811 | Other expenses | |

| 821 | Cost of corporate income tax | |

| 8211 | The cost of corporate INCOME tax current | |

| 8212 | Costs deferred INCOME tax | |

| Level 1 | Level 2 | Type - specified account & SUMMARY |

| 911 | Define business results | |

DOWNLOAD SYSTEM TABLES ACCOUNTS ACCOUNTING CIRCULAR 200 AT THIS

- Download Excel File

- Download PDF File

3. Apply to account accounting circular 200

System tables accounts accounting circular 200 issued applicable for all businesses are in business activities on the field, economic sectors differently.

With the application object is the big business can use the system without notification to the tax authority.

Read more:

In the case of small and medium enterprises can still use the tables accounts accounting circular 200 this. However, if you're using tables accounts accounting circular 133 and want to transition to circular 200, required to inform the tax agency specific this conversion.

4. Chuyển từ hệ thống tài khoản theo Thông tư 200 sang quản lý kế toán tinh gọn bằng AccNet ERP

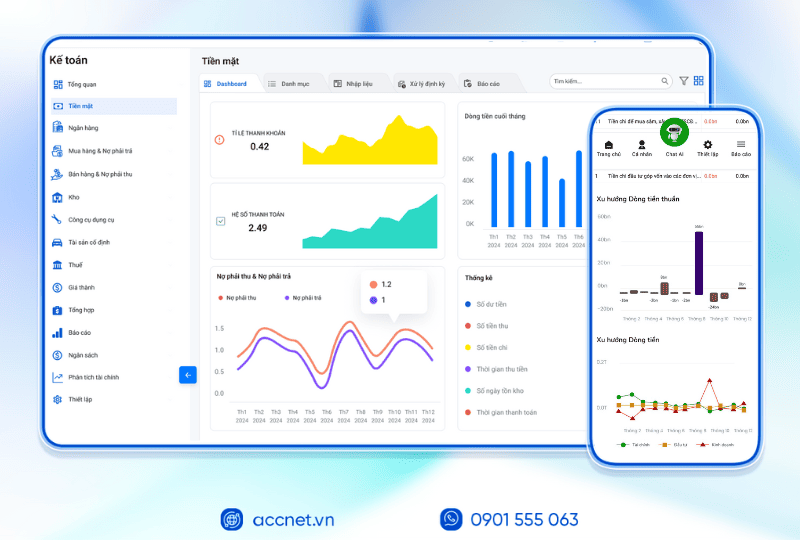

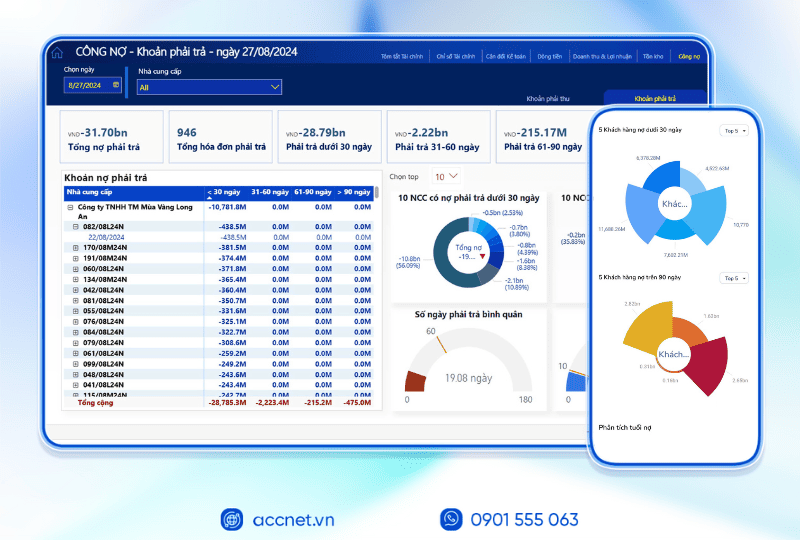

Việc hiểu và áp dụng đúng account system accounting circular 200 là bước nền tảng quan trọng để đảm bảo tính minh bạch, chính xác trong hạch toán tài chính. Bảng tài khoản này giúp doanh nghiệp phân loại rõ ràng các khoản tiền mặt, tài sản, chi phí, doanh thu… và phản ánh đúng các nghiệp vụ kinh tế phát sinh.

Tuy nhiên, khi khối lượng giao dịch ngày càng nhiều và phức tạp, quản lý bằng Excel hoặc ghi chép truyền thống dễ dẫn đến sai sót, thiếu đồng bộ và khó theo dõi kịp thời. Đó là lúc AccNet ERP trở thành giải pháp tất-cả-trong-một để biến hệ thống tài khoản Thông tư 200 trở nên trực quan, tự động và dễ vận hành.

Learn more:

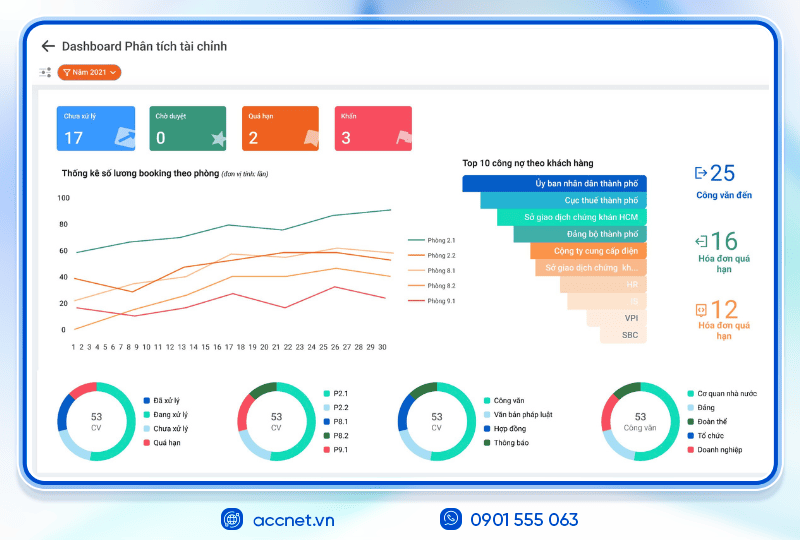

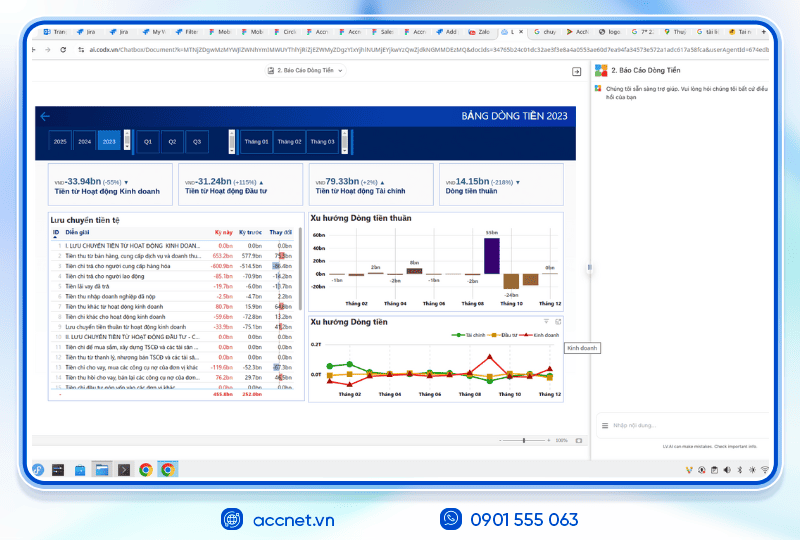

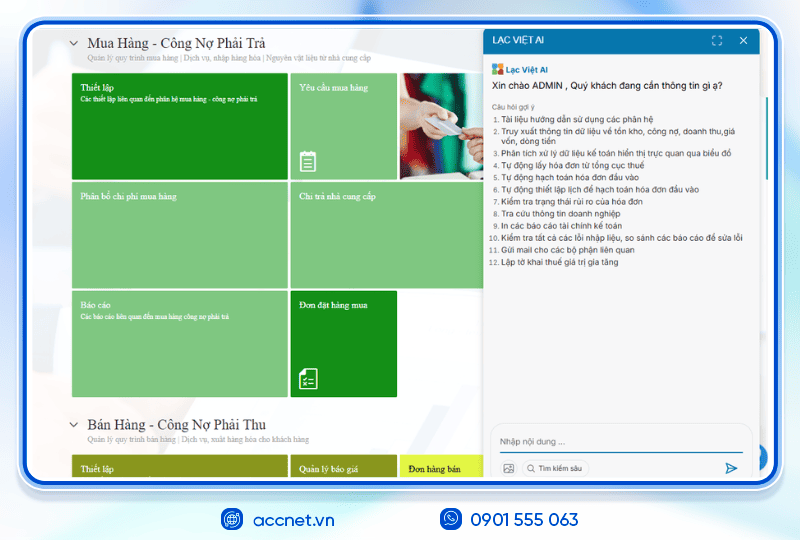

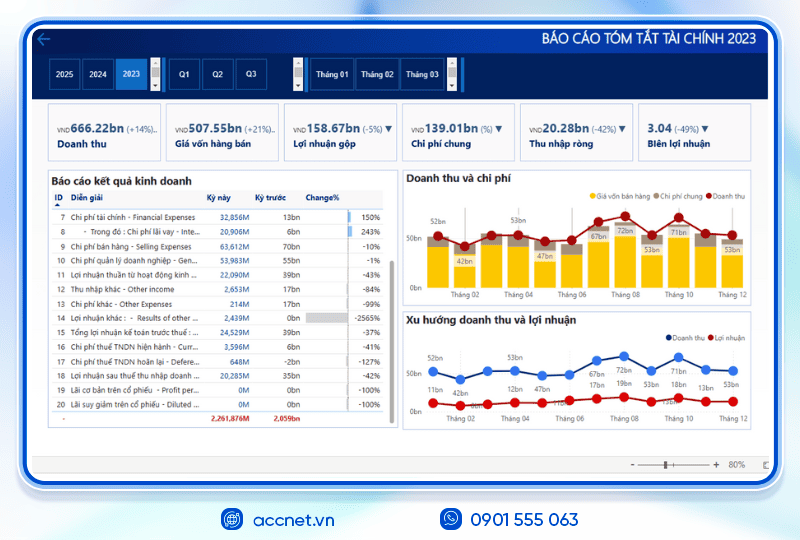

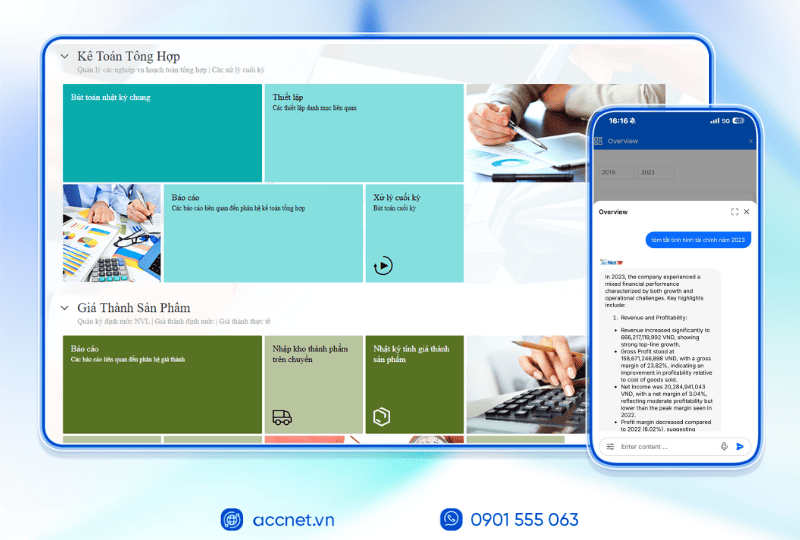

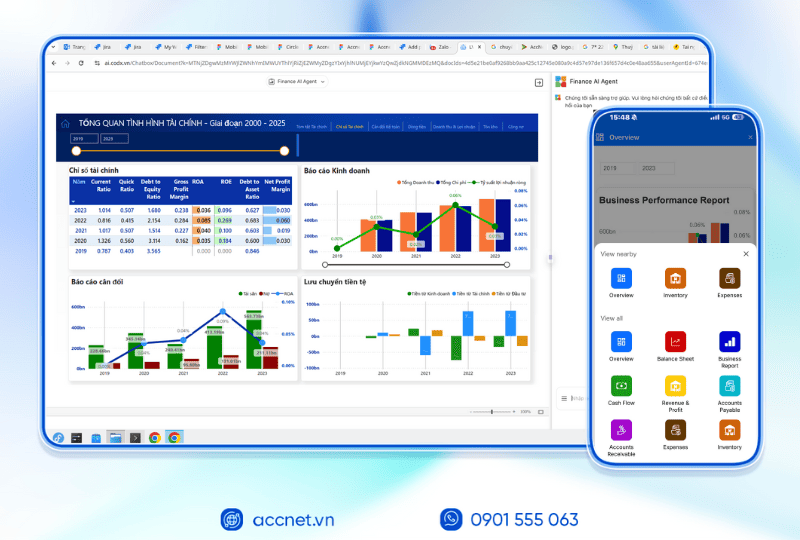

Với AccNet ERP, doanh nghiệp có thể:

- Tự động hóa hạch toán theo Thông tư 200: các giao dịch phát sinh được ghi nhận vào đúng tài khoản tương ứng, không cần nhập tay.

- Đồng bộ dữ liệu liên module: từ bán hàng, mua hàng, kho, công nợ… đều liên kết chặt chẽ để tránh số liệu rời rạc.

- Báo cáo linh hoạt & trực quan: hơn 100 mẫu báo cáo tài chính sẵn sàng, hỗ trợ truy xuất số liệu nhanh, dễ so sánh số liệu kế hoạch – thực tế.

- Tích hợp trợ lý AI tài chính – kế toán: hỗ trợ dự báo dòng tiền, cảnh báo rủi ro, giúp ra quyết định nhanh chóng.

Khi áp dụng AccNet ERP, doanh nghiệp không chỉ tuân thủ đầy đủ Thông tư 200 mà còn nâng cao hiệu quả quản lý, giảm tối đa sai sót thủ công, đồng thời tối ưu hóa mọi hoạt động tài chính – kế toán trong một nền tảng thống nhất.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Hướng dẫn tổ chức sổ sách và quản lý nghiệp vụ kế toán định kỳ

Thus, detailed information about the table account system accounting circular 200 was AccNet cung cấp đầy đủ và chính xác nhất trong bài viết. Lưu ý rằng đây là bảng tài khoản kế toán được sử dụng nhiều nhất hiện nay, do đó các kế toán viên cần phải nắm được chi tiết nhất nhé. Hy vọng những thông tin trên đem lại nhiều kiến thức hữu ích và giúp các doanh nghiệp thực hiện các nghiệp vụ kế toán nhanh chóng dễ dàng hơn.

CONTACT INFORMATION:

- THE COMPANY SHARES INFORMATION, LAC VIET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063 | (+84.28) 3842 3333

- 📧 Email: info@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: