Bills excluded is the case of invoices issued by the enterprise or receive, but not be tax authorities accepted due to violation of the regulations on the establishment and use of invoices. The common reasons leading to the bill being category includes errors in information on bills, no signature, the seal of the sale, fake bills, of unknown origin. So bill is kind of accounting how? Here are detailed instructions on the case of accounting invoice is accompanied by specific examples. Let's AccNet find out now!

1. Accounting invoice purchase is kind of like how?

Case 1: Invoice not qualified to deduct input VAT

|

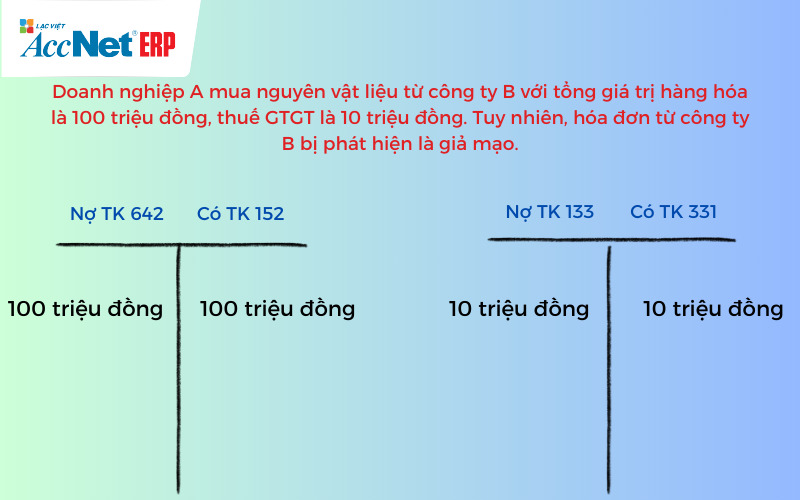

Company A purchases raw material from company B with the total value of goods is 100 million, VAT is 10 million. However, the bill from company B is detected as fake. When that business is A must accounted for as follows:

Adjusting entry:

- Debt TK 642 (Cost management business): 100 million.

- Have TK 133 (Tax VAT is deducted): 10 million.

Read more:

Case 2: accounting invoices eliminated after payment how?

|

Business C purchase equipment from suppliers of D with value 50 million, was paid in full. Then, the tax bill detection is not valid.

Adjusting entry:

- Debt TK 138 (other receivables): 50 million.

- Have TK 642 (Cost management business): 50 million.

2. Accounting bill of sale is kind of like how?

Case 1: accounting for the bill of sale is not valid

|

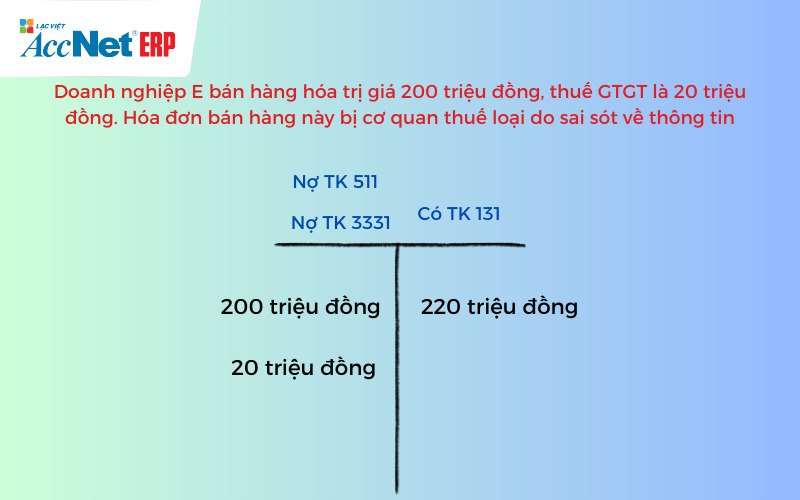

E-business to sell goods worth $ 200 million, VAT is 20 million. Bill of sale this is the tax type due to errors of information

Adjusting entry:

- Debt TK 511 (sales revenue, and provide services): 200 million.

- Have TK 3331 (VAT payable): 20 million.

Case 2: accounting invoices eliminated after the declared VAT like?

|

|

Business F has to declare VAT from a sales invoice worth $ 500 million, VAT 50 million

Adjusting entry:

- Debt TK 3331 (VAT payable): 50 million.

- Have TK 511 (sales revenue, and provide services): 500 million.

Read more:

3. Accounting invoice cost of office space, water and electricity excluded

|

Business G has recorded the cost of electricity, water year 5 is 10 million, VAT 1 million.

Adjusting entry:

- Debt TK 642 (Cost management business): 10 million.

- Have TK 133 (Tax VAT is deducted): 1 million.

4. Accounting, invoice, loan interest, and the financial cost is kind of like how?

|

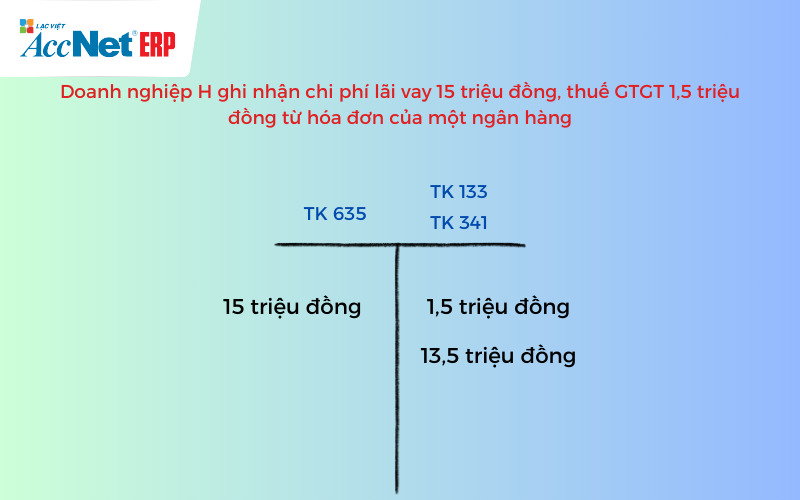

Business H recorded interest expense 15 million, VAT 1.5 million from the bill of a bank.

Adjusting entry:

- Debt TK 635 (financial Expenses): 15 million.

- Have TK 133 (Tax VAT is deducted): 1.5 million.

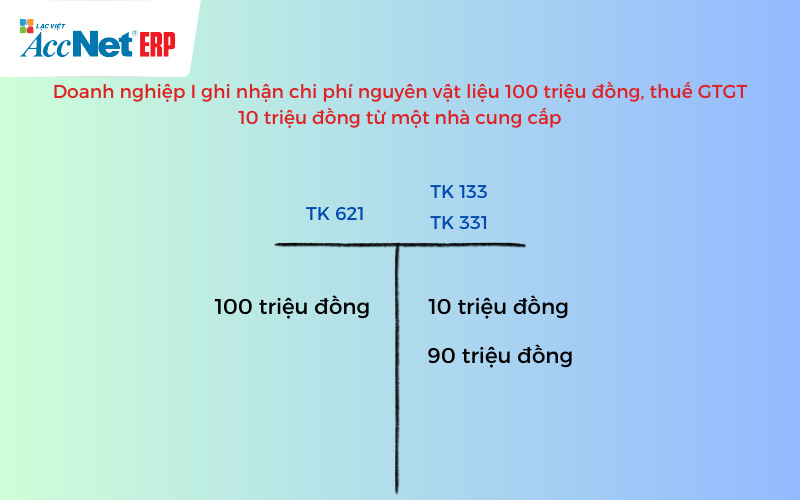

5. Accounting invoice cost of raw materials, tools and equipment types

|

Business I recorded the cost of raw materials 100 million, VAT 10 million from a supplier

Adjusting entry:

- Debt TK 621 (Cost of raw materials directly): 100 million.

- Have TK 133 (Tax VAT is deducted): 10 million.

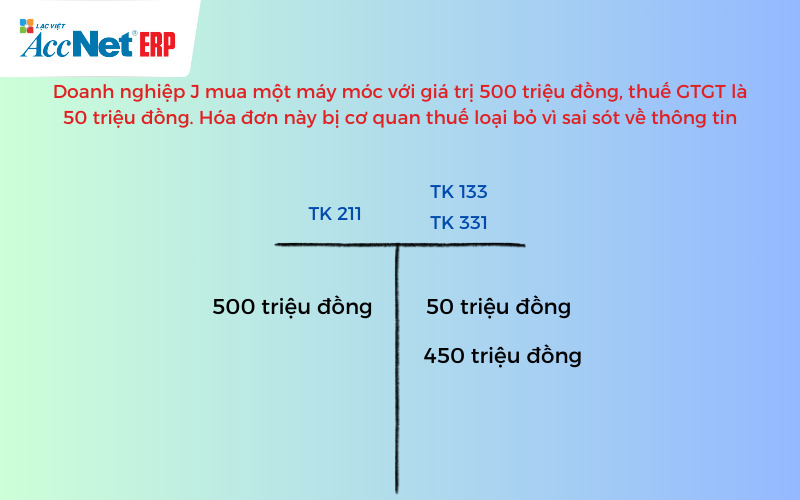

6. Accounting shopping bill property fixed device type

|

Business J buying a machine with value 500 million, VAT is 50 million. This bill is the tax removed because of flaws in the information provided.

Adjusting entry:

- Debt TK 211 (Assets, tangible fixed): 500 million

- Have TK 133 (Tax VAT is deducted): 50 million

Learn more:

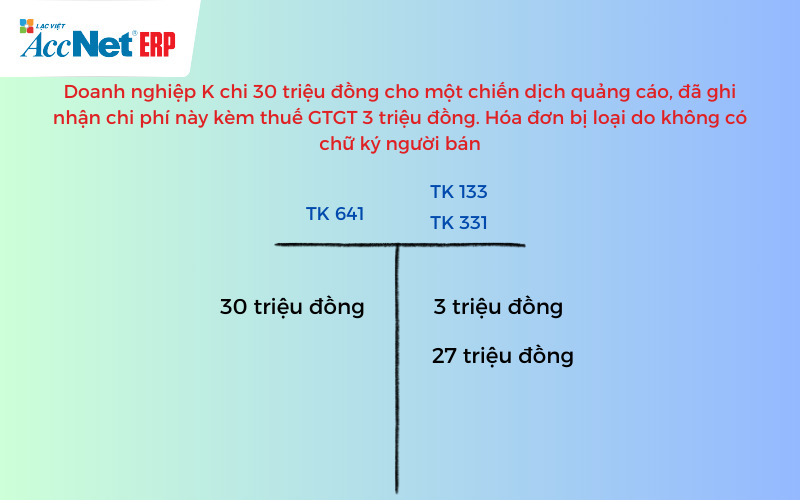

7. Accounting invoice cost of marketing, advertising is kind of like how?

|

Business K cost 30 million for an advertising campaign, has recorded this cost with VAT 3 million. Bill eliminated due to no signature the seller.

Adjusting entry:

- Debt TK 641 (Cost of sales): 30 million (reduced advertising costs)

- Have TK 133 (Tax VAT is deducted): 3 million

8. Xử lý hóa đơn bị loại chuẩn với AccNet eInvoice

Khi hóa đơn bị loại — tức là không được chấp nhận về mặt thuế — doanh nghiệp cần điều chỉnh lại sổ sách kế toán & hóa đơn một cách chính xác theo quy định. Theo hướng dẫn hiện hành, nếu hóa đơn đầu ra bị loại, kế toán phải xóa bỏ ghi nhận doanh thu và thuế GTGT đầu ra tương ứng; nếu hóa đơn đầu vào bị loại, phải điều chỉnh chi phí, công nợ và thuế GTGT đầu vào (nếu đã ghi nhận) cho phù hợp. Lúc này, AccNet eInvoice chính là công cụ hỗ trợ mạnh mẽ để xử lý các hóa đơn bị loại một cách nhanh, chuẩn và tự động:

- Hệ thống sẽ tự động phát hiện hóa đơn bị loại hoặc không hợp lệ, đưa vào trạng thái cần kiểm tra trước khi phát hành hoặc hạch toán.

- Khi phát hiện hóa đơn đã được ghi nhận trong sổ sách nhưng bị loại sau đó, AccNet eInvoice cho phép thực hiện điều chỉnh bút toán (giảm doanh thu/tăng chi phí, điều chỉnh thuế GTGT) theo nguyên tắc kế toán – thuế mà không làm mất bản gốc.

- Khi điều chỉnh hoặc lập hóa đơn thay thế, các module liên quan như bán hàng, tài chính, công nợ sẽ được cập nhật song song, đảm bảo số liệu nhất quán khắp hệ thống.

- Hệ thống cũng lưu lịch sử phiên bản hóa đơn — ban đầu, điều chỉnh, thay thế — để bạn dễ tra cứu, đối chiếu và giải trình nếu cơ quan thuế yêu cầu.

With AccNet eInvoice, việc xử lý hóa đơn bị loại không còn là gánh nặng nghiệp vụ thủ công mà trở thành quy trình minh bạch, tự động và đúng luật, giúp doanh nghiệp yên tâm quản lý thuế – kế toán hiệu quả hơn.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Cách ghi nhận và xử lý chứng từ giảm giá trong kế toán doanh nghiệp

Accounting properly when the invoice type is very important to avoid the risks as arrears of tax, penalty, administrative difficulties in the balance bookkeeping. The accounting accuracy also help businesses maintain transparency in financial reports, create favorable conditions for the tax inspection. Hope through this article, the business will understand bill is kind of accounting how? I wish you successful application!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: