According to the Decree 123/2020/ND-CP, Circular 78/2021/TT-BTCbill electronic (HĐĐT) must be stored a minimum of 10 years to serve the inspection and collation. However, in the process of use, the business can meet case the invoice is lost due to a system error, technical error or other causes. So, when electronic invoice is lostbusinesses that need to handle such as how to ensure compliance with legal regulations?

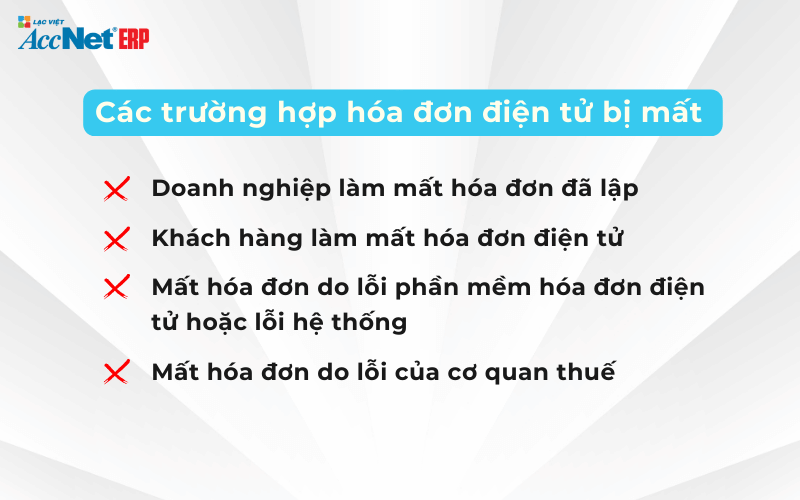

1. The case, the electronic invoice is lost

Bills, lost/deleted/lost can occur in the following cases:

- Business losing issued invoice: the Invoice has been set, send for customer, but lost data due to system failure, computer, lost file storage...

- The client losing the electronic invoice: the buyer has received the invoice but getting lost or not able to access my bills.

- Take the bill due to a software bug electronic invoice or system error: the Bill was released, but lost due to a software bug, error or malfunction server of the service provider of electronic invoice.

- Take bill due to the fault of the tax authorities: In some rare cases, the electronic invoice has been issued code from the tax authority but is error in the system storage of the directorate General of Tax.

Read more:

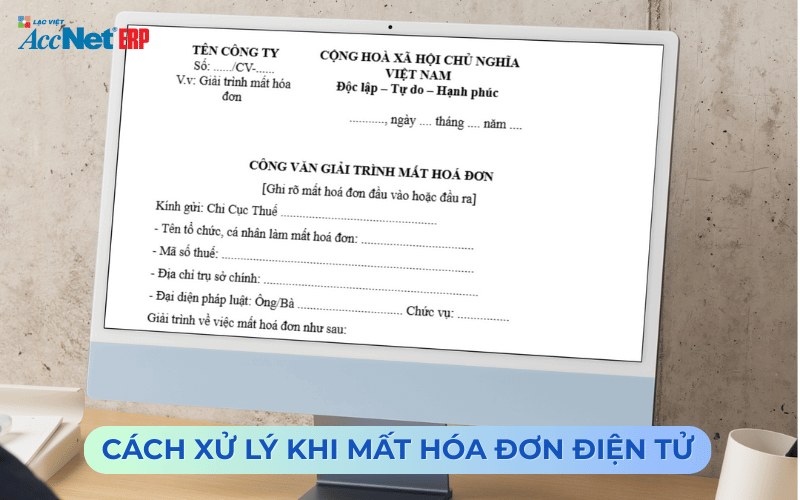

2. How to handle the loss electronic invoice

Business case losing bill electronic establishment

- Business need test data in software electronic invoice, email or backup system (if any).

- If not found, the business must contact the service provider electronic invoice to restore data.

- If not recoverable, businesses need to set up text notifications missing electronic invoice sent to the tax administration within 02 working days from when discovered electronic invoice is lost.

- If the invoice sent to the customer, businesses can suggest customer to send back an invoice has been received.

Case the client losing the electronic invoice

- Customers need to send a written request to reissue an invoice for the seller (the business issuing invoice).

- Enterprise reset electronic invoice from the system store, send back to the client. This invoice must have the same number, date, content as the original invoice.

- Invoice level was not reported to the tax authority, without prejudice to the obligations tax declaration of the business.

Case, the electronic invoice is lost due to software error or system error

- Business need immediately contact the supplier software electronic invoice to the test, restore the data.

- If you can't restore, businesses need to notify the tax authorities, perform the steps reissue the invoice according to the instructions.

Case, the electronic invoice is lost due to the fault of the tax authority

- If the business has released the bill electronic code of the tax authority but is data loss on the tax system, it should send the written request to check the data bill.

- Entrepreneurs can access your receipt from your email client or from your system supplier invoices electronically.

Read more:

3. Preventive measures bill online lost data

- Backup recurring bills: Business should store electronic invoice on many different systems (internal computer, email, hard drive, mobile service, cloud storage such as Google Drive, OneDrive).

- Invoice management science: Set the storage rules, access subdivisions, reasonable to limit the risk of losing your invoice due to the fault of humans.

- Always update data with tax authorities: When the invoice is lost, notice of right to tax authorities to avoid being sanctioned.

- Use software electronic invoice credits: Choose a provider software electronic invoice has good security system, support recover data when trouble

To avoid risk of lost data, electronic invoice business should use specialized software such as AccNet eInvoice – the solution helps to automatically save the invoice standard XML, sync data with tax authorities, lookup safe even if the device is having problems.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT

AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

- Tạo và phát hành hóa đơn chỉ trong chưa đầy 30 giây, đảm bảo tốc độ và tính chính xác cao.

- Ký số trực tiếp ngay trên phần mềm, loại bỏ nhu cầu chuyển đổi file qua các công cụ trung gian, tiết kiệm đáng kể thời gian và chi phí.

- Tự động hóa toàn bộ quy trình từ nhập liệu, gửi email cho khách hàng đến lưu trữ hóa đơn, giúp giảm thiểu thao tác thủ công và hạn chế tối đa rủi ro sai sót.

- Kết nối liền mạch với hệ thống kế toán, bán hàng và ngân hàng điện tử, tạo nên một dòng chảy dữ liệu xuyên suốt trong toàn bộ hoạt động tài chính.

- Đồng bộ dữ liệu theo thời gian thực, mang lại sự minh bạch, chính xác và hỗ trợ ban lãnh đạo đưa ra quyết định kịp thời.

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025)

Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice:

- Xuất hóa đơn trực tiếp từ máy POS: Khi khách hàng thanh toán tại điểm bán hàng, hóa đơn điện tử được sinh ra ngay lập tức trên thiết bị POS, giúp giảm thiểu tối đa thao tác thủ công cũng như thời gian trì hoãn — toàn bộ giao dịch đều được ghi nhận & xử lý nhanh chóng, chuẩn xác.

- Tích hợp với sàn thương mại điện tử: Doanh nghiệp có thể kết nối dữ liệu đơn hàng từ các sàn TMĐT phổ biến, đồng bộ thông tin bán hàng, rồi phát hành hóa đơn tự động từ hệ thống AccNet. Việc này giúp tránh sai sót, tiết kiệm thời gian so với xuất hóa đơn thủ công từ file excel hay nhập dữ liệu tay.

- Đồng bộ hóa – lưu trữ & quản lý một cách liền mạch: Các hóa đơn phát sinh từ POS hoặc các sàn TMĐT được tích hợp vào hệ thống kế toán – lưu trữ hóa đơn đầu ra đầy đủ, cho phép tra cứu nhanh chóng, hỗ trợ trình tự kê khai thuế, đối soát doanh thu theo từng kênh.

- Tối ưu quy trình, giảm sai sót: Với tự động nhập liệu, ký số trên phần mềm, gửi hóa đơn cho khách hàng qua email hoặc các kênh số, doanh nghiệp giảm thiểu hầu hết các bước thừa, tránh được lỗi nhập tay hoặc mất dữ liệu.

✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp

- Discount 80–90% chi phí in ấn, chuyển phát, lưu kho

- Rút ngắn 70% thời gian xử lý, tăng hiệu suất kế toán

- Hóa đơn phát hành – tiền về nhanh hơn, cải thiện dòng tiền

- Hạn chế tối đa sai sót nghiệp vụ, minh bạch hóa dữ liệu

- Nâng cao trải nghiệm khách hàng nhờ tra cứu & thanh toán tiện lợi

✅ Tích hợp toàn diện cùng AccNet ERP

- Tự động hạch toán doanh thu ngay khi phát hành hóa đơn

- Phiếu thu/chi lập tức khi có biến động ngân hàng

- Updated công nợ & số dư real-time

- Hóa đơn gắn kết chứng từ gốc & báo cáo tài chính – đối chiếu nhanh, báo cáo chuẩn

✅ Chi phí hợp lý – Lợi ích vượt trội

- Gói cơ bản chỉ từ vài trăm nghìn đồng

- Phù hợp cả doanh nghiệp nhỏ lẫn tập đoàn lớn

- Đầu tư một lần – tận dụng lâu dài, dễ dàng mở rộng theo nhu cầu

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Learn more: Hướng dẫn khởi tạo hóa đơn điện tử cho giao dịch thương mại số

Electronic invoice is lost is incident can happen, but can handle quickly if the business comply with regulations. When the invoice is lost, businesses need to check the data, contact the software vendor, immediately notify the tax authorities for assistance. The storage bills carefully, make periodic backup is the most effective way to prevent the risk of losing bill in the future.

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: