Hóa đơn điện tử có cần đóng dấu không luôn là câu hỏi của các doanh nghiệp kể từ khi hóa đơn điện tử được triển khai sử dụng. Có thể nói, thực hiện chuyển đổi hóa đơn điện tử là giải pháp tối ưu và mang lại nhiều lợi ích cho doanh nghiệp trong thời đại số. Tuy nhiên, trong quá trình thực hiện giao dịch các doanh nghiệp vẫn còn khá nhiều vướng mắc về các quy định. Để giải đáp vấn đề đó hãy cùng Phần mềm kế toán AccNet tìm hiểu ngay trong bài viết này nhé.

1. Hóa đơn điện tử có cần đóng dấu không?

Hóa đơn điện tử có cần đóng dấu không còn phụ thuộc vào tình trạng kinh doanh của từng doanh nghiệp. Nếu doanh nghiệp đủ điều kiện tự in hóa đơn thì không nhất thiết phải có con dấu. Trong một số trường hợp bên mua là đơn vị kế toán không có hồ sơ chứng minh việc cung cấp hàng hóa hoặc thỏa thuận giữa hai bên thì bắt buộc có chữ ký điện tử hoặc con dấu. Tuy nhiên cục thuế sẽ xem xét từng trường hợp cụ thể và điều kiện đáp ứng của doanh nghiệp mà có những hướng dẫn miễn tiêu thức chữ ký điện tử.

Theo thông tư 119/2014/ TT-BTC khoản 2 điều 5, tổ chức kinh doanh hàng hóa, dịch vụ có thể phát hành và sử dụng hóa đơn không nhất thiết có con dấu người bán và chữ ký người mua. Trong trường hợp: hóa đơn điện nước, viễn thông, ngân hàng đủ điều kiện tự in theo quy định của pháp luật

Read more:

Hóa đơn điện từ cần đóng dấu khi:

- Doanh nghiệp bán hàng đủ điều kiện tự in hóa đơn điện tử và thông báo phát hành hóa đơn thì không cần chữ ký. Và cũng không cần phải đóng dấu của bên bán hay chữ ký của bên mua.

- Business notices issued bills that have signed it mandatory electronic invoice must be signed.

- In case the buyer does not have to be an accounting unit, or is an accounting unit, the records and documents should prove to be the provision of goods and services such as contract, receipt, warehouse...then the seller to invoice electronically in accordance with the regulations and do not necessarily have the electronic signature of the buyer.

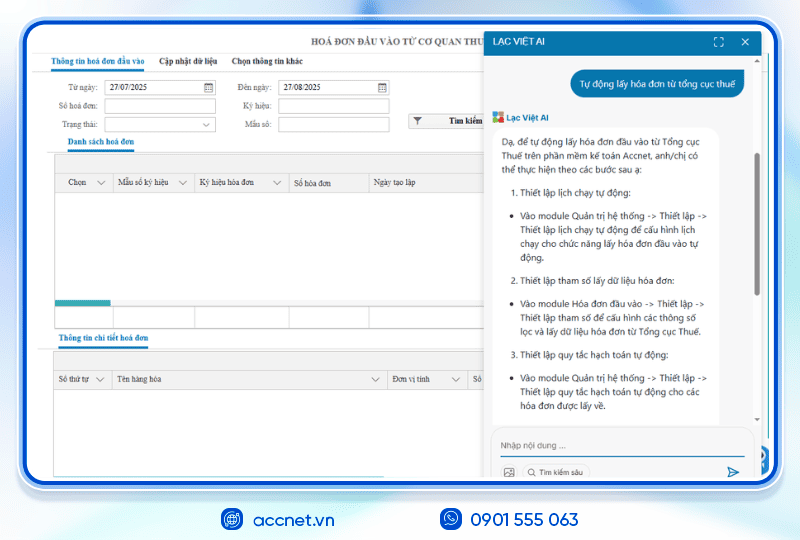

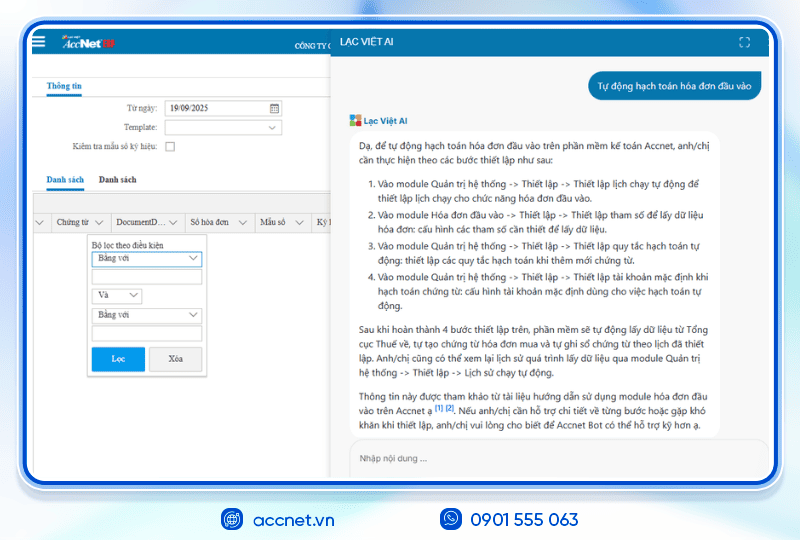

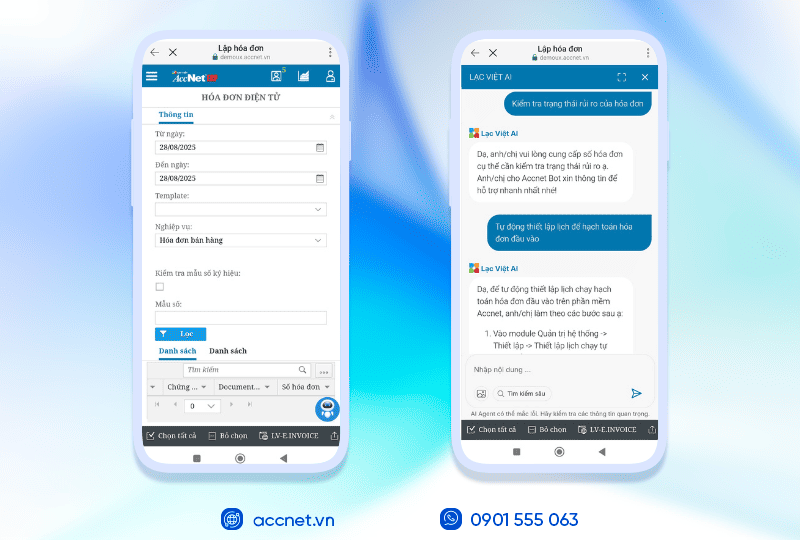

Phần mềm AccNet eInvoice tự động hóa toàn bộ quy trình phát hành hóa đơn điện tử mà không cần đóng dấu, đảm bảo tính pháp lý theo quy định hiện hành. Doanh nghiệp có thể yên tâm sử dụng AccNet eInvoice để phát hành hóa đơn nhanh chóng, chính xác mà vẫn tuân thủ đầy đủ các quy định pháp luật. Trải nghiệm ngay để tối ưu quy trình quản lý hóa đơn của bạn!

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

2. Các quy định khi đóng dấu hóa đơn điện tử cần nắm

Một hóa đơn điện tử đúng chuẩn theo quy định của pháp luật thì cần lưu ý những điều gì? Tham khảo dưới đây của AccNet để tránh những rắc rối không đáng có liên quan đến thủ tục hành chính.

- Nghị định số 04/2014/NĐ-CP tại Khoản 2 Điều 1 sửa đổi and bổ sung cho Khoản 5 Điều 5 Nghị định số 51/2010/NĐ-CP thì tổ chức kinh doanh có thể cùng lúc sử dụng nhiều hình thức hóa đơn khác nhau (Nhưng hóa đơn điện tử vẫn được nhà nước khuyến khích hơn hết).

- Thông tư số 32/2011/TT-BTC theo Khoản 1, Khoản 2 trong Điều 6 thì có quy định một trong những nội dung cần có của hóa đơn điện tử là chữ ký điện tử. Trong trường hợp không có đầy đủ nội dung bắt buộc thì thực hiện theo hướng dẫn riêng của Bộ Tài Chính.

- Thông tư 39/2014/TT-BTC theo khoản 3 điều 4 thì không nhất thiết có đầy đủ các nội dung bắt buộc. Trừ trường hợp người mua là đơn vị kế toán và người bán phải lập hóa đơn có đầy đủ các nội dung hướng theo quy định của pháp luật.

- For business organizations supermarket, commercial center, then self-printed invoices is established under the provisions of the law. 't necessarily have the information: tax code, address, signature of the buyer, the seal of the seller.

- Stamps tickets: For those stamps tickets have a face value of pre-printed, it does not necessarily have the signature, stamp seller, or any information about the tax code, signature, buyers,...

- For those Businesses that use large number of bills, the mortgage, the related issues of tax law, based on the particular business activity, sales methods, ways of invoicing and proposals of business, the tax department review and has written instructions bills do not necessarily have the stamp of the seller. Or a number of other cases will follow the instructions of BTC.

Read more: Hướng dẫn xử lý hóa đơn điện tử có sai sót về tên đơn vị mua hàng

Hy vọng bài viết này giúp Doanh nghiệp biết được rõ ràng câu trả lời về hóa đơn điện tử có cần đóng dấu không. Để biết thêm các thông tin chi tiết và nhân tin mới liên quan đến các vấn đề hóa đơn đừng ngần ngại liên hệ lại với AccNet theo thông tin sau:

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: