In the process of issuing the invoice, the wrong name of goods is one of the flaws common. Although only a small bug, but if not timely adjust this mistake can cause severe effects. This article AccNet will help the business understand the adjustment name goods including: concept, legal regulations and the specific situation.

1. Bill adjustable name what is commodity?

Bill adjusted the name of goods is a type of bill is set when errors are detected related to the name of goods and services on the original invoice was issued.

Errors about the name of goods may include:

- Write the name wrong goods, but the correct code number.

- Record the wrong description of goods/services provided.

- Wrong combination of goods name, unit number.

Illustrative example: On invoice "Dell Computer Inspiron" but the fact must be "Dell Computer Latitude".

Read more:

2. Legal grounds of the adjustment name goods

2.1. Latest regulations from circular 78/2021/TT-BTC and Decree 123/2020/ND-CP

Follow Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP:

- Electronic invoices must accurately reflect the information such as the name of goods, quantity, unit price, amount.

- In case there are errors, enterprises need to invoicing adjust/replace to modify information.

- Business't be canceled invoices issued if already delivered to the customer.

2.2. Specific instructions from the General administration of Tax on the adjusted name goods for bill

Tax authorities have given the specific principles for the adjustment name of goods:

- The adjustment applies only when errors do not affect the tax code, payment amount, tax rate.

- The adjustment must be made through the program, bill has the confirmation between the buyer and the seller.

2.3. The irregularities commonly encountered when non-compliance

If not, adjust the name of goods for bill regulations, the business may encounter:

- Xử phạt hành chính: Theo Nghị định 125/2020/NĐ-CP, mức phạt có thể lên đến 5 - 10 triệu đồng nếu hóa đơn sai sót không được điều chỉnh kịp thời.

- Denied tax-deductible VAT: errors on invoices affect the validity of the voucher, which leads to the risk of losing your right to a tax deduction.

2.4. The latest data on the invoice adjustment name goods

According to the report of the directorate General of Tax year 2023:

- More than 35% of businesses experiencing errors related to the bill, which recorded the wrong name goods accounted for 20%.

- Not timely correction of errors made 10% business administrative fine in the past year.

3. Detailed instructions how to set up the adjustment name goods

3.1. Prepare necessary documents

To set the adjustment, businesses need to prepare:

- The original bill: A bill has flaws about the name of goods.

- Minutes of the invoice correction: Has a signature confirmation of both the buyer and seller.

- Software electronic invoice: The invoice adjusted quickly, properly regulated.

Read more:

3.2. The steps invoicing adjust the name of goods

Step 1: make a record adjusted invoice. Content the minutes should indicate errors, adjustment, confirmation signature of both parties.

Step 2: Set the adjustment on software electronic invoice

- Select the function "invoice adjustment".

- Specify: Type of invoice adjustments. Content errors, adjust: “tune name goods from A to the B”. Note't be changed other information such as the amount, the tax rate.

Step 3: Send invoices adjust the name of goods with the custom client to collate, store.

3.3. Important note when invoicing adjustable

- Date of invoice adjustments must be after the release date original invoice, prior to the time the tax declaration.

- Content on invoices need to specify a "tune name goods," not to overwrite the original invoice.

- Minutes of adjustment, the adjustment must be stored for reference when the tax authority request.

4. When to set/adjust the name of goods for bill?

Business only billed adjust the name of goods when:

- Errors related only to the name of goods or description of goods/services.

- Other information such as tax code, quantity, unit price, amount, tax rates are accurate.

- The two sides of sale agreed, confirming flaws through the program.

Learn more:

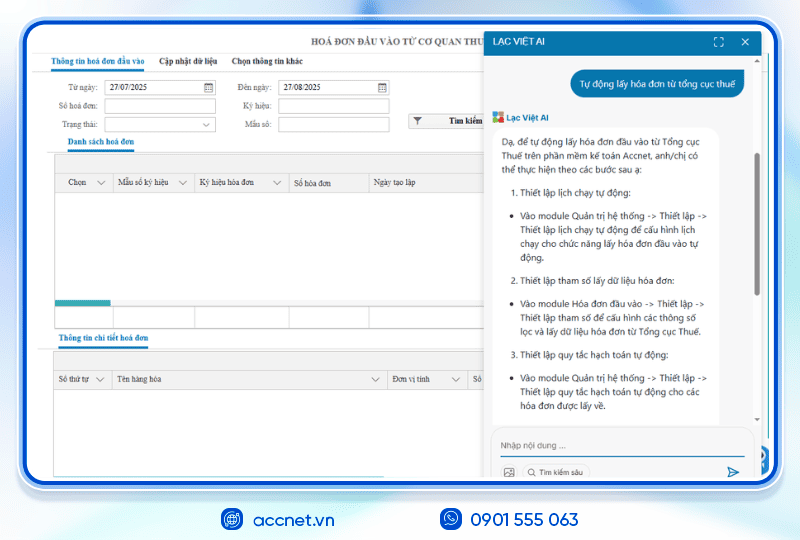

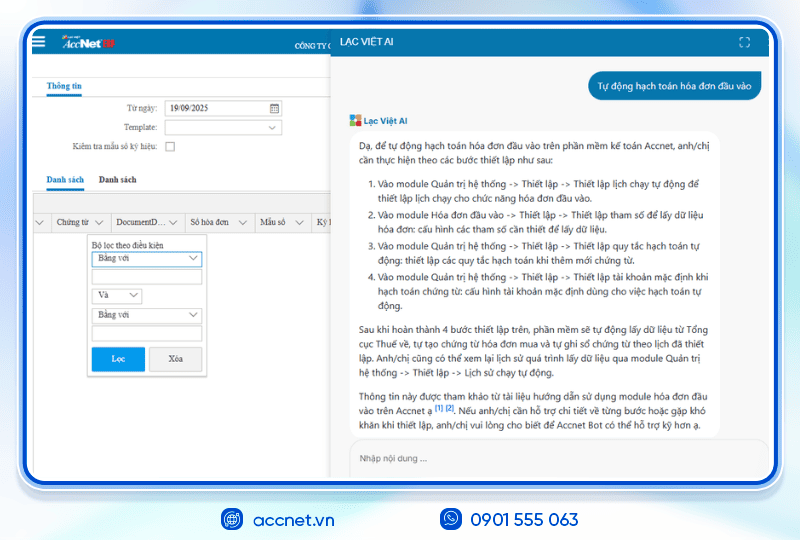

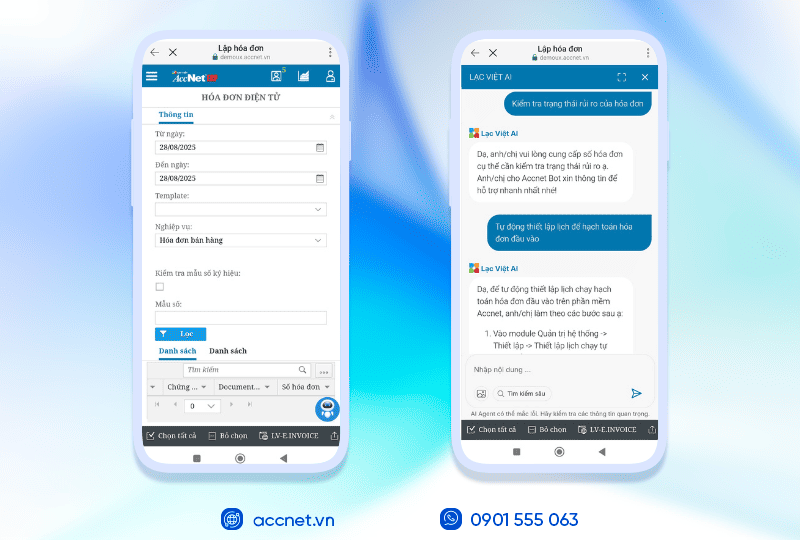

5. Solution process optimization tuning name goods for bill

Phần mềm AccNet eInvoice không chỉ đáp ứng đầy đủ quy định của Thông tư 78/2021/TT-BTC và Nghị định 123/2020/NĐ-CP mà còn giúp doanh nghiệp:

- Automatically detect errors when the invoice.

- Integrated invoicing feature adjustable sent to the customer quickly.

- Minimize the risk of penalties thanks to the high accuracy.

- Reduce 50% of the time invoice processing errors.

- Cost savings papers and records storage.

According to the survey from the General administration of the Tax year 2023:

- 85% of businesses use software electronic invoice has significantly minimize errors in the information on the invoice.

- In it, the enterprise application software automatically adjust the bill reported 70% reduction in processing time, 30% of the cost of personnel.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Refer to: Phương pháp quản lý chứng từ giảm giá bán hàng cho doanh nghiệp

Hóa đơn điều chỉnh tên hàng hóa tuy là vấn đề phổ biến nhưng có thể được khắc phục hiệu quả nếu doanh nghiệp nắm rõ quy định, áp dụng quy trình khoa học. Hãy trải nghiệm ngay giải pháp hóa đơn điện tử AccNet eInvoice. Đăng ký ngay để nhận tư vấn miễn phí phần mềm!

CONTACT INFORMATION:- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: