The use of electronic invoices requires not only legal imperative, but also the solutions to improve the efficiency of accounting, optimize costs, increase transparency in the management of revenue – the cost for the business.

From date 01/07/2022, according to the provisions of circular 78/2021/TT-BTC, the Decree 123/2020/ND-CP, 100% of enterprises, economic organizations, households and individuals trading subject to use the bill to move to electronic invoice. This requires every business should master process guide sign up using electronic invoices to ensure regulatory compliance, at the same time effective integrated with the accounting system is deployed.

The article below AccNet will guide detailed step by step book, the noted legal matter, the practical benefits from the application of electronic invoices into accounting work. At the same time, the article also open accounting solutions – sync bills for businesses looking for the optimum in operating.

1. Any business need to register to use electronic invoice?

According to the provisions of Decree 123/2020/ND-CP, dated from the day 01/07/2022: all business, economic organization, business, individual business has incurred obligations tax must register to use electronic invoices.

Mandatory subjects applied electronic invoice

- Businesses of every type (LIMITED, private, joint venture...).

- Cooperative business units that have incurred commodity trading services.

- Personal business has revenue from $ 100 million/year and above.

- New business established.

Case be temporarily postponed or apply flexible

- Some remote areas no network infrastructure – is temporarily use paper bills under the proposed tax authorities.

- Micro business or not have enough technical conditions can be supported by software vendors bill electronic certified.

The importance of the registration of the right time

The registration of the right time, follow the right process will help your business:

- Avoid administrative penalties due to the delay (penalty from 4-20 million purchase behavior).

- Active integration with accounting software, avoid interrupting the current financial – accounting.

- Avail support policy book for free from the software vendors reputation.

Read more:

2. Registration guide use electronic invoices according to the process detailed

The guide book bill electronic properly will help businesses quickly put into operation the system of accounting – bills smoothly, legal, cost savings. Here is a detailed guide to circular 78/2021/TT-BTC, the actual deployment in the enterprise.

Stage 1. Preparation conditions before signing up

Before proceed to registration, businesses need to fully prepare:

- Digital signature (token) valid: To sign up, electronic invoice sent to the tax authorities, ensure the legality.

- Software electronic invoice standard Is Ministry of Finance announced on the list of providers eligible connection with the tax system.

- Login account tax system electronic (eTax): for registered business transactions electronically with the tax authorities.

Suggestions: Businesses can choose accounting solutions integrated electronic invoice to sync data, cost savings, more manageable instead of two software discrete.

Stage 2. The step registration guide use electronic invoices with tax authorities

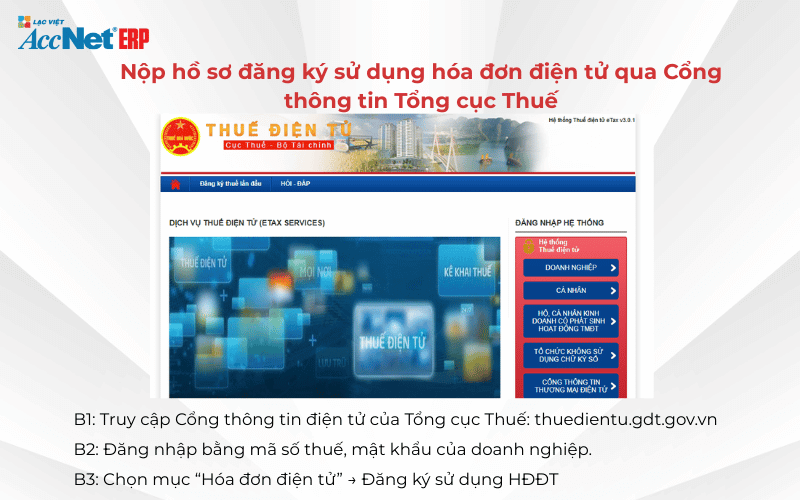

The entire registration process is done online via the system of the General department of Taxation:

Step 1: login system eTax

- Truy cập: https://thuedientu.gdt.gov.vn

- Sign in with business account was provided by the tax authority.

Step 2: Select the "book using electronic invoices"

- Click on the menu “Electronic invoices” → select “User registration”.

- Select the registration form: 01/ĐKT-HĐĐT (specified in annex IA – circular 78/2021/TT-BTC).

Step 3: Registration number, send the registration form

- Check the technical information: tax code, type the invoice registration form, code or no code, information software use.

- Register number and submit.

Step 4: Wait for the tax feedback

- The response time is usually within 1 working day.

- If the profile is valid, businesses receive notifications acceptable use of electronic invoices.

Stage 3. Processing time, how to handle situations rejected

- Processing time: As a rule, the tax authority will respond in 1-2 working days.

- Case rejected:

- False information in the registration form.

- No digital signature is valid.

- Not yet registered account electronic transactions tax.

When rejected, businesses need to review the entire record, sending back samples 01/ĐKT-HĐĐT after editing.

Stage 4. Connect software electronic invoice to the accounting system

Once approved, register using electronic invoices, businesses need to ensure software electronic invoice can:

- Create electronic invoicing standard XML format.

- Automatically send invoices to buyers, save to database.

- Sync invoice data with accounting software, serving a revenue – cost.

- Automatic VAT reports, revenue reports,...

Suggestions: Business should be the preferred solution electronic invoice has integrated accounting available as AccNet eInvoiceto help minimize data entry manually, sync data revenue – bills – bookkeeping – tax report in just one single platform.

PHẦN MỀM HÓA ĐƠN ĐIỆN TỬ ACCNET EINVOICE TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT AccNet eInvoice được thiết kế như một nền tảng quản lý hóa đơn điện tử toàn diện, tích hợp sâu vào hệ thống tài chính – kế toán – bán hàng của doanh nghiệp. Đây không chỉ là công cụ phát hành hóa đơn, mà còn là giải pháp giúp tối ưu toàn bộ quy trình vận hành liên quan đến hóa đơn điện tử. Với AccNet eInvoice, doanh nghiệp có thể:

TÍCH HỢP XUẤT HÓA ĐƠN TỪ MÁY POS - SÀN TMĐT (RA MẮT 2025) Một trong những điểm khác biệt nổi bật của nền tảng này là khả năng tích hợp xuất hóa đơn ngay từ máy POS tại cửa hàng bán lẻ và từ các sàn TMĐT lớn như Shopee, Lazada, Tiki… Cụ thể, với AccNet eInvoice: ✅ Số hóa hóa đơn – Tối ưu quản trị doanh nghiệp ✅ Tích hợp toàn diện cùng AccNet ERP ✅ Chi phí hợp lý – Lợi ích vượt trội ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET EINVOICE

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

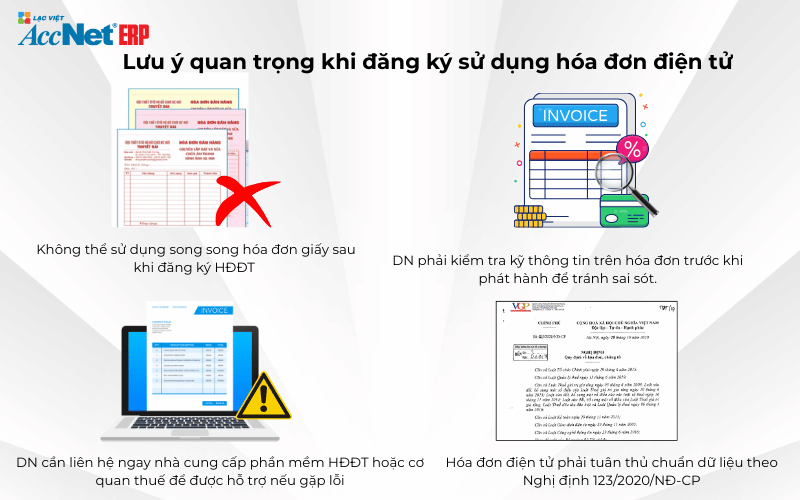

3. The important note when registering to use electronic invoice

In the process of user registration, businesses need to understand the following points to avoid mistakes, risks arising:

Choosing the right software provider standard

- Check out the list of units is the Total Tax administration recognized.

- Priority unit provides comprehensive solution (invoice + accounting).

- Ensure the software can connect directly with the system eTax, no need operation manually.

Storage and security bill electronic regulations

According to Article 13 of the Decree 123/2020/ND-CP:

- Electronic invoices should be stored a minimum of 10 years.

- Data must ensure the confidentiality – integrity – be retrieved when needed.

Suggestions: Business should choose software vendors have systems, cloud storage, backup periodically.

Check, periodic review system, electronic invoice

- Check tax code information, buyer, goods to avoid mistake.

- Limit the maximum setting wrong or duplicate invoices – avoid being sanctioned.

- Collated data accounting – bills – report tax monthly.

Procedure to change your registration information using electronic invoices

When software changes, contact information or type of bill:

- Business must follow the procedures for registration information change form 01/ĐKT-HĐĐT.

- Register number, send it back on the system eTax.

- Once accepted, will be used according to new information.

4. Comparison between self-deploy and use solution electronic invoice integration

Many businesses are wondering: should be done step by step guide to register to use electronic invoice, deploy discrete, or use software solution, integrating accounting – bill electronic right from the start? Here is the detailed comparison to businesses to easily take your pick match:

| Criteria | Self-deployment craft | Use the integrated solution |

| Deployment time | Long, due to handling each part | Hurry, only 1 – 3 days integrated sync |

| Initial cost | May be low, but the potential hidden costs (errors, violations, system integrators, private, retail, etc.) | Package software package, incentives, clear cost |

| The ability to synchronize | Invoice data, accountants generally discrete, easy-to-deviation of | Auto sync: invoice → recorded accounting right |

| Legal risks | Easy to errors in the storage, reporting, control | Minimize mistakes, correct GDT |

| Technical support | Dependent on each side supplied separately | Be fully supported by 1 only clue |

| Scalability | Difficult to expand as business, scale | Easy upgrade module suitable business development |

Case study practice: Business SME save 40% of the cost

Công ty TNHH TM&DV Tan Minh – expert distribution industrial electrical equipment: Ago, the department of accounting use accounting software left bill electronic platform to the other → numerous faults coincide code bill, slow aggregate revenue. After switching to software solutions, accounting integration electronic invoicing, in only 3 months:

- Save 40% of the cost of operating the accounting department.

- No longer mistakes invoice output.

- Data bills – bookkeeping – sync- easy to audit.

- Reduced up-time report tax from 3 days to 0.5 days.

Read more:

5. Frequently asked questions (FAQ)

Question 1. Register to use electronic invoice no charge?

→ No. The registered using the electronic invoice with the tax authority is free. However, businesses need to purchase software electronic invoice from service provider or use the software integrated accounting – bills are paid.

Question 2. Businesses can use a variety of electronic invoices not?

→ There. Businesses can sign up using parallel bills have the code, no code of the tax authority, depending on the needs, conditions.

Question 3. If you change the signature of then have to register it again?

→ Do not need to re-register model 01/ĐKT-HĐĐT, but need to update the software on the invoice, the system eTax to ensure invoice issued is still valid.

Question 4. Electronic invoicing can save now?

→ Business can save the bill at:

- Private servers of the enterprise (need to periodically backup).

- Hosting service, cloud computing from software vendors.

- Storage systems combined.

Note: Need to store a minimum of 10 years, to ensure data integrity.

Learn more: Quy trình quản lý và bảo quản chứng từ hóa đơn số từ nhà cung cấp

When the switch of boom, legal requirements, more and more closely, the guide sign up using electronic invoices not only obligations but also the strategy digitized accounting necessary for businesses to accelerate growth, optimize cost, financial transparency. The selection of software solutions electronic invoice accounting integration is the fastest way to help businesses:

- Deploy – standard GDT.

- Good control of revenues, expenses – reduce errors.

- Meet the requirements of audit – financial statements quickly and accurately.

- Save manpower, cost and time.

Experience free demo software electronic invoice AccNet eInvoice - integrated accounting standard circular 78, which confirm the connection system from the General department of Taxation.. Sign up demo here or contact your consultant to be supported to develop comprehensive!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

Headquarters: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

Hotline: 0901 555 063

Email: accnet@lacviet.com.vn

Website: https://accnet.vn/

Theme: