Việc nắm vững the pen the moving end of the period không chỉ là yêu cầu bắt buộc về mặt kế toán mà còn là yếu tố then chốt để đảm bảo dữ liệu tài chính minh bạch, chính xác, tự động hóa trong phần mềm ERP.

Đối với các doanh nghiệp đang thi công hoặc triển khai giải pháp phần mềm kế toán ERP, bút toán kết chuyển cuối kỳ chính là bước “khóa sổ” toàn hệ thống – giúp phản ánh đúng thực trạng hoạt động, xác định lãi/lỗ, làm cơ sở ra quyết định chiến lược. Việc hiểu rõ quy trình này không chỉ giúp doanh nghiệp tránh sai sót khi lập báo cáo tài chính mà còn tối ưu năng suất kế toán, đặc biệt khi sử dụng phần mềm như AccNet ERP.

1. Khái niệm, mục tiêu của các bút toán kết chuyển cuối kỳ

Bút toán kết chuyển cuối kỳ là các nghiệp vụ được thực hiện vào thời điểm kết thúc kỳ kế toán (tháng, quý hoặc năm) nhằm chuyển toàn bộ số dư từ các tài khoản doanh thu, chi phí, xác định kết quả kinh doanh. Đây là giai đoạn cực kỳ quan trọng vì mọi dữ liệu kế toán được tổng hợp, kiểm tra, khóa sổ để chuẩn bị cho việc lập báo cáo tài chính.

Mục tiêu chính của bút toán kết chuyển cuối kỳ:

- Xác định kết quả kinh doanh (lãi/lỗ): Kế toán chuyển toàn bộ số dư của các tài khoản doanh thu, chi phí (từ loại 5 đến loại 8) sang Tài khoản 911 – Xác định kết quả kinh doanh. Việc này giúp doanh nghiệp biết được kỳ kế toán đang lãi hay lỗ, từ đó đưa ra định hướng quản trị tài chính phù hợp.

- Làm cơ sở tính thuế: Sau khi xác định kết quả kinh doanh, doanh nghiệp tính toán thuế thu nhập doanh nghiệp (TNDN) phải nộp cho Nhà nước. Đây là cơ sở để đảm bảo nghĩa vụ thuế được thực hiện chính xác, kịp thời.

- Đảm bảo tính minh bạch, tuân thủ pháp luật: Các bút toán kết chuyển phải tuân thủ theo quy định của Thông tư 200/2014/TT-BTC hoặc Thông tư 133/2016/TT-BTC tùy mô hình doanh nghiệp. Khi hoàn tất, tổng số phát sinh bên Nợ, bên Có của các tài khoản từ loại 5 đến loại 9 phải bằng nhau, đảm bảo không có số dư cuối kỳ.

Read more:

2. Các nhóm bút toán kết chuyển theo kỳ

Tùy vào thời điểm, phạm vi thực hiện, các bút toán kết chuyển cuối kỳ được chia thành ba nhóm chính:

- Bút toán định kỳ (tháng/quý)

- Bút toán đầu năm tài chính

- Bút toán xác định chi phí hợp lý để tính thuế TNDN

Việc phân nhóm này giúp kế toán chủ động kiểm soát thời điểm thực hiện, đảm bảo toàn bộ dữ liệu được phản ánh đúng kỳ kế toán.

Các bút toán định kỳ (Theo Tháng/Quý)

Tùy chu kỳ kế toán, doanh nghiệp cần thực hiện các nghiệp vụ kết chuyển sau:

| Thời gian | Các bút toán cần thực hiện | Nguồn tham chiếu |

| Hàng tháng | - Hạch toán tiền lương, các khoản trích theo lương - Hạch toán giá vốn hàng bán (nếu áp dụng phương pháp bình quân cuối kỳ) - Phân bổ chi phí trả trước (TK 242) - Trích khấu hao tài sản cố định (TSCĐ) - Hạch toán lãi tiền gửi ngân hàng - Kết chuyển thuế GTGT (nếu kê khai theo tháng) | Theo Thông tư 200 hoặc 133 |

| Hàng quý | - Kết chuyển thuế GTGT (nếu kê khai theo quý) - Nộp thuế TNCN (nếu kê khai theo quý) - Ghi nhận thuế TNDN tạm tính (nếu có phát sinh) | Báo cáo thuế định kỳ |

Việc duy trì các bút toán kết chuyển cuối kỳ định kỳ giúp hệ thống kế toán ERP luôn cập nhật số liệu chính xác, đồng thời hỗ trợ nhà quản lý theo dõi chi phí, doanh thu theo thời gian thực.

Các bút toán đầu năm tài chính

Bước sang năm tài chính mới, doanh nghiệp cần thực hiện một số bút toán chuyển tiếp để đảm bảo sự liền mạch của dữ liệu kế toán giữa hai kỳ:

| Accounting | Định khoản | Lưu ý thực hiện |

| Kết chuyển lãi năm trước (TK 4212 dư Có) | Nợ TK 4212 / Có TK 4211 | Chuyển lợi nhuận sau thuế chưa phân phối sang năm trước. |

| Kết chuyển lỗ năm trước (TK 4212 dư Nợ) | Nợ TK 4211 / Có TK 4212 | Ghi nhận lỗ chưa phân phối sang năm trước. |

| Hạch toán lệ phí môn bài | Khi ghi nhận: Nợ TK 6425 / Có TK 3339 Khi nộp tiền: Nợ TK 3339 / Có TK 111, 112 | Chi phí được tính vào Chi phí quản lý doanh nghiệp (TK 642). |

| Hạch toán vốn góp thực nhận | Nợ TK 111, 112 / Có TK 4111 | Ghi nhận khi chủ sở hữu hoặc cổ đông góp thêm vốn. |

Việc thực hiện đầy đủ các nghiệp vụ này không chỉ đảm bảo dữ liệu chính xác trong kỳ kế toán mới, mà còn giúp phần mềm kế toán ERP tự động hóa các khoản kết chuyển, báo cáo tài chính, tránh bỏ sót hoặc nhầm lẫn trong quá trình kiểm toán.

3. Các bút toán kết chuyển cuối kỳ

Trong quá trình hoàn thiện báo cáo tài chính, các doanh nghiệp cần thực hiện nhiều bút toán kết chuyển cuối kỳ khác nhau. Đây là giai đoạn hệ thống ERP tổng hợp, điều chỉnh, xác định kết quả kinh doanh chính xác nhất trước khi khóa sổ.

Việc thực hiện đúng, đủ từng loại bút toán giúp doanh nghiệp đảm bảo số liệu phản ánh đúng thực tế hoạt động, đồng thời đáp ứng yêu cầu kiểm toán, cơ quan thuế.

Bút toán hạch toán chi phí định kỳ

Các chi phí định kỳ cần được hạch toán chính xác vào cuối tháng hoặc cuối quý để đảm bảo giá thành, lợi nhuận được phản ánh đúng kỳ kế toán. Dưới đây là một số nghiệp vụ tiêu biểu:

| Profession | Định khoản kế toán | Details |

| Hạch toán lãi tiền gửi ngân hàng (TGNH) | Nợ TK 112 / Có TK 515 | Áp dụng cho lãi tiền gửi không kỳ hạn, thường phát sinh ở các tài khoản thanh toán. |

| Trích khấu hao tài sản cố định (TSCĐ) | Nợ TK 154, 622, 627, 641, 642, 811 / Có TK 214 | Dựa trên bảng khấu hao TSCĐ hàng tháng, giúp phân bổ chi phí hợp lý. |

| Phân bổ chi phí trả trước (TK 242) | Nợ TK 154, 623, 627, 641, 642, 811 / Có TK 242 | Áp dụng với chi phí thuê, bảo hiểm, hoặc công cụ dụng cụ trả trước nhiều kỳ. |

| Kết chuyển giá vốn hàng bán | Nợ TK 632 / Có TK 156 | Dành cho doanh nghiệp áp dụng phương pháp bình quân cuối kỳ khi tính giá vốn. |

Việc ghi nhận đúng, kịp thời các nghiệp vụ này giúp phần mềm ERP tự động cập nhật vào sổ cái, hỗ trợ doanh nghiệp theo dõi chi phí theo từng bộ phận, sản phẩm hay dự án – từ đó phân tích hiệu quả kinh doanh chi tiết.

Read more:

Kết chuyển thuế GTGT (Phương pháp khấu trừ)

Đây là một phần không thể thiếu trong các bút toán kết chuyển cuối kỳ, giúp doanh nghiệp xác định số thuế giá trị gia tăng (GTGT) phải nộp hoặc còn được khấu trừ kỳ sau.

| Accounting | Định khoản kế toán | Explain |

| Kết chuyển thuế GTGT | Nợ TK 3331 / Có TK 133 | Thực hiện bù trừ giữa thuế GTGT đầu vào, đầu ra, lấy số nhỏ hơn của hai tài khoản. |

| Nộp thuế GTGT | Nợ TK 3331 / Có TK 111, 112 | Áp dụng khi TK 3331 có số dư Có (tức doanh nghiệp phải nộp thuế). |

Tự động hóa quy trình này trong ERP giúp kế toán tiết kiệm thời gian đối chiếu, đồng thời tránh sai lệch trong kê khai thuế điện tử – một vấn đề thường gặp ở doanh nghiệp vừa, nhỏ khi ghi sổ thủ công.

Kết chuyển doanh thu, các khoản giảm trừ

Doanh thu là chỉ số cốt lõi của mọi doanh nghiệp, nhưng để phản ánh đúng doanh thu thuần, kế toán cần kết chuyển cả các khoản giảm trừ, doanh thu tài chính, thu nhập khác.

| Profession | Định khoản kế toán | Lưu ý thực hiện |

| Kết chuyển các khoản giảm trừ doanh thu (chiết khấu thương mại, giảm giá hàng bán, hàng bán bị trả lại) | Nợ TK 511 / Có TK 521 | Chỉ áp dụng theo Thông tư 200. Theo TT 133, các khoản này đã phản ánh trực tiếp bên Nợ TK 511. |

| Kết chuyển doanh thu thuần | Nợ TK 511 / Có TK 911 | Phản ánh doanh thu bán hàng, cung cấp dịch vụ trong kỳ. |

| Kết chuyển doanh thu hoạt động tài chính | Nợ TK 515 / Có TK 911 | Áp dụng cho các khoản lãi tiền gửi, lãi chênh lệch tỷ giá, cổ tức nhận được,… |

| Kết chuyển thu nhập khác | Nợ TK 711 / Có TK 911 | Ghi nhận các khoản thu nhập ngoài hoạt động sản xuất kinh doanh chính. |

Tại giai đoạn này, doanh nghiệp nên đảm bảo mọi doanh thu đã được xác nhận đủ điều kiện ghi nhận (chuyển giao quyền sở hữu, hoàn thành nghĩa vụ cung cấp dịch vụ), tránh tình trạng doanh thu ảo hoặc sai kỳ kế toán.

Kết chuyển chi phí

Để xác định kết quả kinh doanh thực tế, doanh nghiệp cần chuyển toàn bộ chi phí phát sinh trong kỳ về TK 911 – Xác định kết quả kinh doanh.

| Profession | Định khoản kế toán | Tài khoản chi phí (Có TK) |

| Kết chuyển giá vốn | Debt TK 911 | TK 632 |

| Kết chuyển chi phí tài chính | Debt TK 911 | TK 635 |

| Kết chuyển chi phí bán hàng | Debt TK 911 | TK 641 (TT 200) hoặc TK 6421 (TT 133) |

| Kết chuyển chi phí quản lý doanh nghiệp | Debt TK 911 | TK 642 (TT 200) hoặc TK 6422 (TT 133) |

| Kết chuyển chi phí khác | Debt TK 911 | TK 811 |

Thực hiện đúng các bút toán kết chuyển cuối kỳ giúp hệ thống ERP hiển thị bảng kết quả hoạt động kinh doanh tự động, hỗ trợ ban lãnh đạo theo dõi tình hình lợi nhuận thực tế, ra quyết định đầu tư – cắt giảm chi phí kịp thời.

4. Chi tiết hạch toán tiền lương, các khoản trích theo lương

Tiền lương, các khoản trích theo lương là chi phí lớn, phát sinh thường xuyên, cần được hạch toán định kỳ để không ảnh hưởng đến lợi nhuận cuối kỳ. Việc này đặc biệt quan trọng trong các hệ thống ERP có phân tích nhân sự – chi phí lao động theo phòng ban, dự án hoặc trung tâm chi phí.

Tính tiền lương phải trả

Khi xác định lương nhân viên hàng tháng, kế toán thực hiện:

Nợ TK 154, 241, 622, 627, 641, 642… / Có TK 334 → Phản ánh tổng số tiền lương phải trả cho người lao động trong kỳ.

Trích bảo hiểm, kinh phí công đoàn

| Content | Tỷ lệ phổ biến | Định khoản kế toán | Notes |

| BHXH (do DN đóng) | 17.5% – 18% | Có TK 3383 | Tính vào chi phí doanh nghiệp. |

| BHYT (do DN đóng) | 3% | Có TK 3384 | - |

| BHTN (do DN đóng) | 1% | Có TK 3386 (TT 200) / 3385 (TT 133) | - |

| Kinh phí công đoàn (KPCĐ) | 2% | Có TK 3382 | - |

| BHXH (trừ vào lương NLĐ) | 8% | Nợ TK 334 / Có TK 3383 | Phần người lao động chịu. |

| BHYT (trừ vào lương NLĐ) | 1.5% | Nợ TK 334 / Có TK 3384 | - |

| BHTN (trừ vào lương NLĐ) | 1% | Nợ TK 334 / Có TK 3386 hoặc 3385 | - |

ERP sẽ tự động tính toán các khoản trích nộp này dựa trên công thức, chính sách lương được cấu hình, giúp giảm rủi ro sai sót khi lập bảng lương thủ công.

Learn more:

Tính thuế TNCN, thanh toán lương

| Profession | Định khoản kế toán | Explain |

| Tính thuế TNCN phải nộp | Nợ TK 334 / Có TK 3335 | Trích thuế TNCN từ lương nhân viên. |

| Thanh toán tiền lương | Nợ TK 334 / Có TK 111, 112 | Chi trả thực tế sau khi trừ bảo hiểm, thuế. |

| Nộp tiền bảo hiểm, KPCĐ | Nợ các TK 3383, 3384, 3386 (hoặc 3385), 3382 / Có TK 111, 112 | Thực hiện chuyển khoản hoặc nộp tiền mặt. |

| Nộp tiền thuế TNCN | Nợ TK 3335 / Có TK 111, 112 | Ghi nhận khi doanh nghiệp hoàn thành nghĩa vụ thuế. |

Nhờ khả năng tự động hạch toán, kết chuyển, phần mềm kế toán ERP giúp doanh nghiệp không chỉ tiết kiệm thời gian xử lý bảng lương mà còn đảm bảo tuân thủ quy định về bảo hiểm, thuế thu nhập cá nhân, thuế doanh nghiệp.

5. Hạch toán, kết chuyển thuế thu nhập doanh nghiệp (TNDN)

Cuối kỳ kế toán, doanh nghiệp cần xác định nghĩa vụ thuế thu nhập doanh nghiệp phải nộp dựa trên kết quả hoạt động kinh doanh trong kỳ. Quá trình này bao gồm:

- Tính toán thuế TNDN phải nộp: Thuế TNDN được xác định dựa trên lợi nhuận kế toán trước thuế, sau khi điều chỉnh các khoản chênh lệch tạm thời, vĩnh viễn theo quy định thuế.

- Công thức: → Thuế TNDN phải nộp = Lợi nhuận tính thuế × Thuế suất thuế TNDN (thông thường 20%).

Bút toán hạch toán:

Nợ TK 8211 – Chi phí thuế TNDN hiện hànhCó TK 3334 – Thuế thu nhập doanh nghiệp

Sau đó, khi nộp thuế:

Debt TK 3334Have TK 111/112

Kết chuyển chi phí thuế TNDN: Cuối kỳ, kế toán kết chuyển chi phí thuế TNDN vào tài khoản xác định kết quả kinh doanh:

Debt TK 911Có TK 8211

6. Kết chuyển lãi/lỗ cuối năm

Khi đã hoàn tất việc kết chuyển doanh thu, chi phí, thuế TNDN, kế toán tiến hành xác định lãi hoặc lỗ trong kỳ.

- Nếu doanh thu > chi phí ⇒ Doanh nghiệp có lãi.

- Nếu doanh thu < chi phí ⇒ Doanh nghiệp bị lỗ.

Bút toán kết chuyển cuối năm:

Debt TK 911

Có TK 4211 – Lợi nhuận sau thuế chưa phân phối (trường hợp lãi)

hoặc:

Nợ TK 4211

Có TK 911 (trường hợp lỗ)

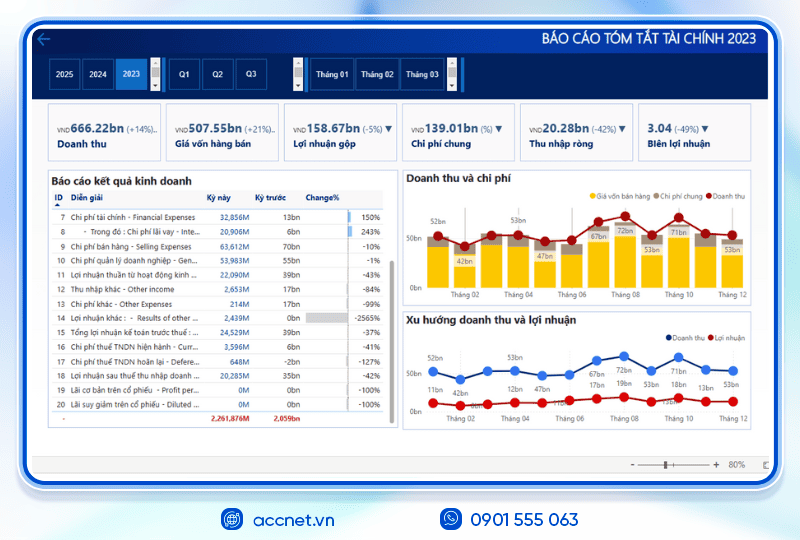

Sau khi xác định được kết quả, kế toán lập Báo cáo kết quả hoạt động kinh doanh, Báo cáo tài chính năm để trình bày toàn bộ tình hình lợi nhuận – chi phí của doanh nghiệp.

Refer to: Phương pháp kiểm soát và theo dõi các nguồn quỹ tài chính dự phòng

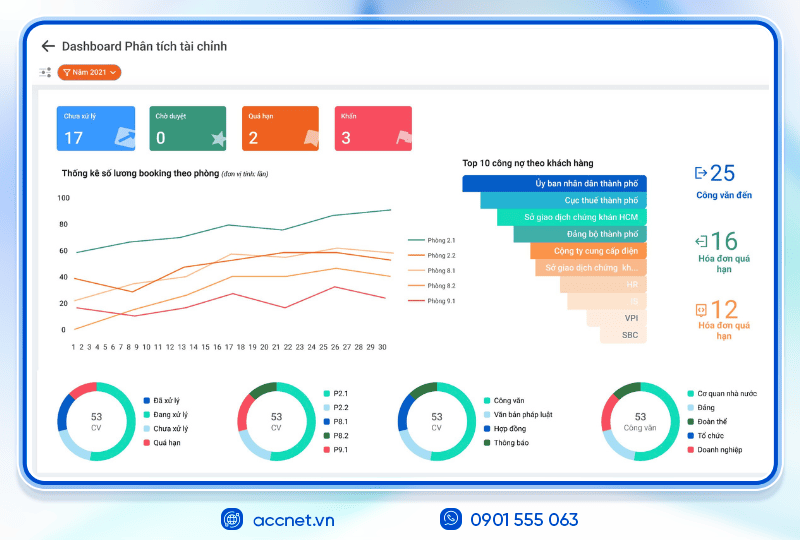

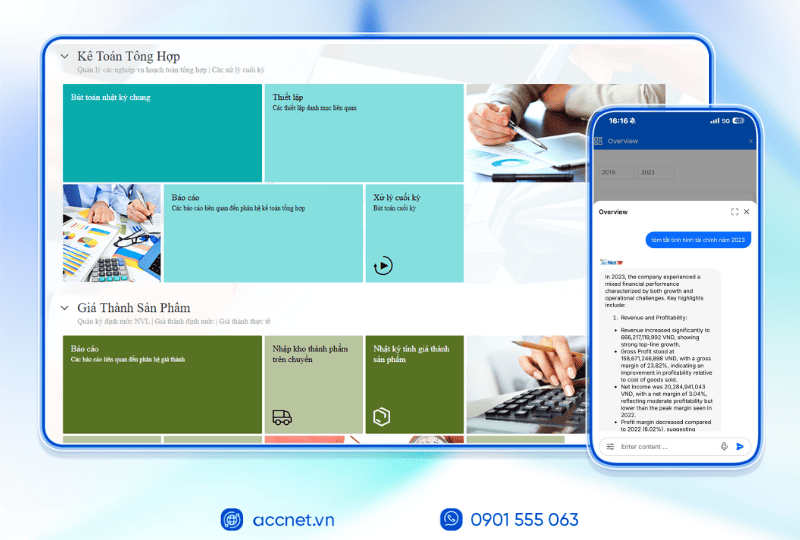

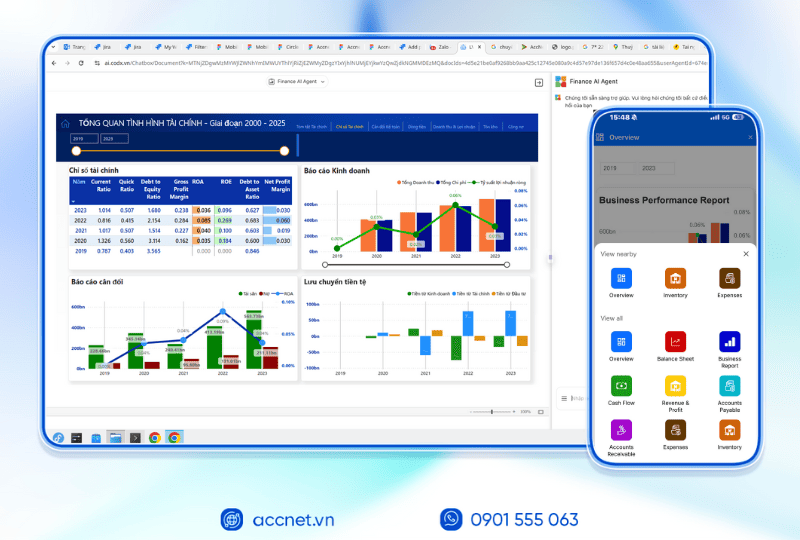

7. AccNet ERP – Giải pháp kế toán toàn diện cho doanh nghiệp Việt

AccNet ERP là phần mềm kế toán được phát triển bởi Lạc Việt, đáp ứng đầy đủ các nghiệp vụ hạch toán doanh nghiệp Việt Nam, đặc biệt tối ưu cho:

- Doanh nghiệp sản xuất, thương mại, dịch vụ có nhiều chi nhánh hoặc phòng ban.

- Doanh nghiệp cần tự động kết chuyển định kỳ, tích hợp báo cáo phân tích tài chính, tính năng cảnh báo sai lệch số liệu.

- Đội ngũ kế toán cần giảm khối lượng công việc cuối kỳ, đảm bảo báo cáo chính xác – kịp thời – minh bạch.

Tìm hiểu thêm giải pháp kế toán AccNet ERP tại Accnet.vn – Nơi doanh nghiệp của bạn được hỗ trợ triển khai, tư vấn chuyên sâu từ chuyên gia kế toán – tài chính hàng đầu.

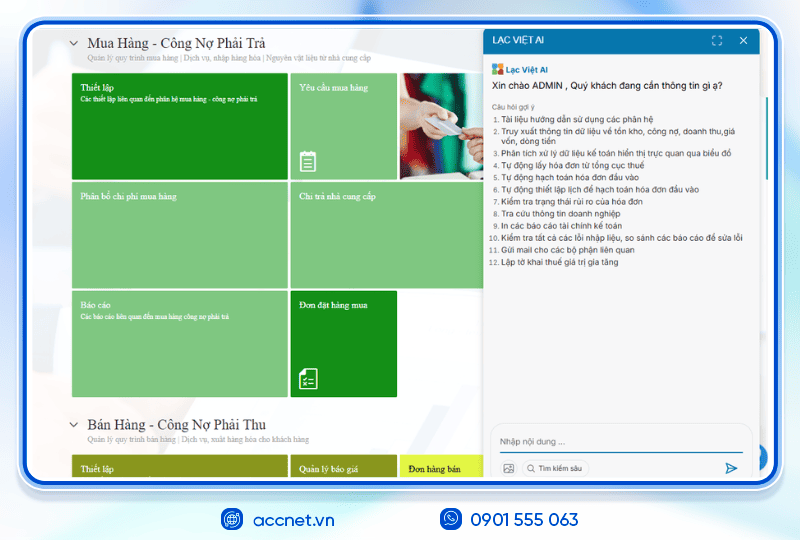

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI”

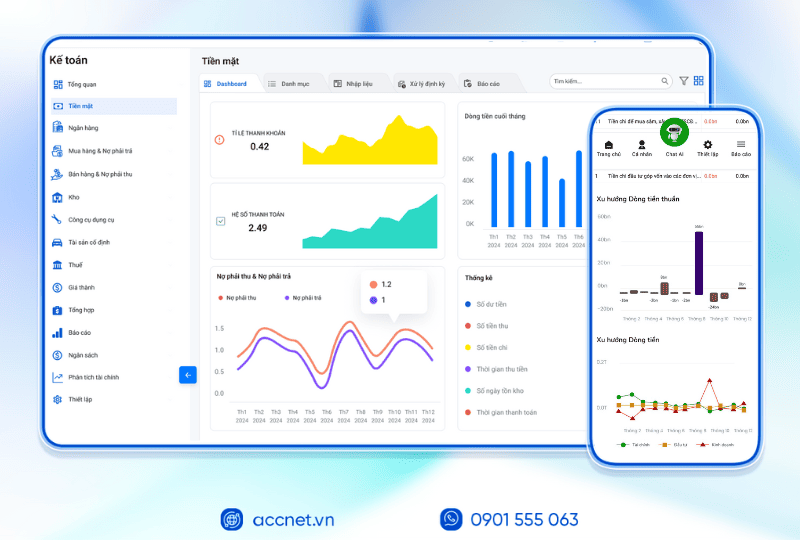

With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt:

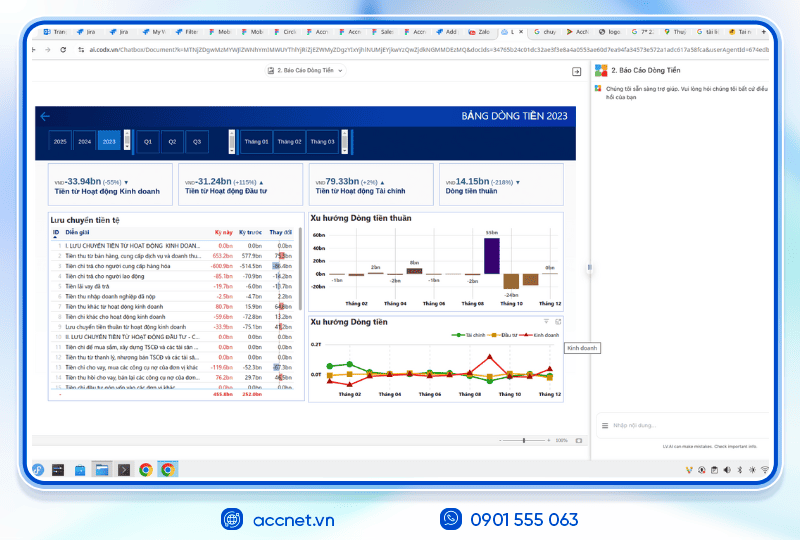

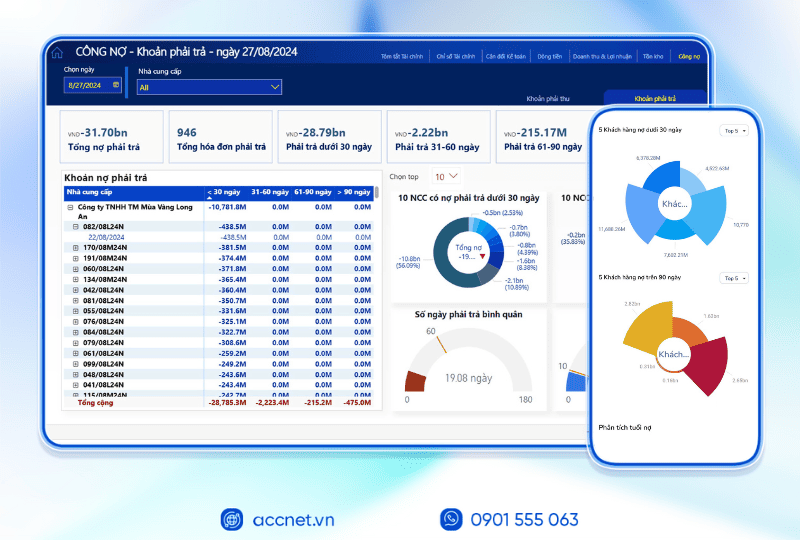

- Tài chính – Kế toán: Quản lý quỹ, ngân hàng, tài sản, giá thành, công nợ, sổ sách tổng hợp. Hơn 100 mẫu báo cáo quản trị tài chính được cập nhật tự động, đúng chuẩn kế toán Việt Nam.

- Sales: Theo dõi chu trình bán hàng, từ báo giá, hợp đồng đến hóa đơn, cảnh báo công nợ, hợp đồng đến hạn.

- Mua hàng – Nhà cung cấp: Phê duyệt đa cấp, tự động tạo phiếu nhập kho từ email, kiểm tra chất lượng đầu vào.

- Kho vận – Tồn kho: Đối chiếu kho thực tế và sổ sách kế toán, kiểm soát bằng QRCode, RFIF, kiểm soát cận date, tồn kho chậm luân chuyển, phân tích hiệu quả sử dụng vốn.

- Sản xuất: Giám sát nguyên vật liệu, tiến độ sản xuất theo ca/kế hoạch, phân tích năng suất từng công đoạn.

- Phân phối – Bán lẻ: Kết nối máy quét mã vạch, máy in hóa đơn, đồng bộ tồn kho tại từng điểm bán theo thời gian thực.

- Nhân sự – Tiền lương: Theo dõi hồ sơ, tính lương thưởng, đánh giá hiệu suất, lập kế hoạch ngân sách nhân sự.

TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025

AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như:

- Phân tích tài chính 24/7 trên cả desktop & mobile: Tư vấn tài chính dựa trên BI Financial Dashboard chứa số liệu thực tế chỉ trong vài phút.

- Dự báo xu hướng và rủi ro tài chính: Dự báo rủi ro, xu hướng về mọi chỉ số tài chính từ lịch sử dữ liệu. Đưa ra gợi ý, hỗ trợ ra quyết định.

- Tra cứu thông tin chỉ trong vài giây: Tìm nhanh tồn kho, công nợ, doanh thu, giá vốn, dòng tiền,… thông qua các cuộc trò chuyện

- Tự động nghiệp vụ hóa đơn/chứng từ: Nhập liệu hóa đơn, kiểm tra lỗi, thiết lập lịch hạch toán chứng từ, kết xuất file, gửi mail,...

DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP?

✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc”

- Automate 80% of the accounting profession standards, the Ministry of Finance

- AI support phân tích báo cáo tài chính - Financial Dashboard real-time

- Đồng bộ dữ liệu real-time, mở rộng phân hệ linh hoạt & vận hành đa nền tảng

- Tích hợp ngân hàng điện tử, hóa đơn điện tử, phần mềm khác…, kết nối với hệ thống kê khai thuế HTKK

✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI

- Giảm 20–30% chi phí vận hành nhờ kiểm soát ngân sách theo từng phòng ban

- Tăng 40% hiệu quả sử dụng dòng tiền, dòng tiền ra/vào được cập nhật theo thời gian thực

- Thu hồi công nợ đúng hạn >95%reduce losses and bad debts

- Cut 50% aggregate time & financial analysis

- Business tiết kiệm từ 500 triệu đến 1 tỷ đồng/nămincrease the efficient use of capital when deploying AccNet ERP

ĐĂNG KÝ NHẬN DEMO NGAY

Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc.

KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng

✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp

✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Quá trình hạch toán, kết chuyển doanh thu, chi phí, thuế the pen the moving end of the period là giai đoạn then chốt trong việc lập báo cáo tài chính cuối năm. Tuy nhiên, với doanh nghiệp có quy mô vừa, lớn, việc thực hiện thủ công dễ dẫn đến sai sót số liệu, trễ hạn báo cáo, hoặc khó kiểm soát dữ liệu kế toán liên phòng ban.

Đây chính là lý do phần mềm kế toán AccNet ERP ra đời – giúp doanh nghiệp tự động hóa toàn bộ quy trình hạch toán, kết chuyển cuối kỳ chỉ trong vài thao tác. Hệ thống cung cấp:

- Tự động định khoản, kết chuyển thuế, doanh thu, chi phí theo chuẩn Thông tư 200/133.

- Đồng bộ dữ liệu kế toán – kho – bán hàng – nhân sự, đảm bảo tính nhất quán, chính xác tuyệt đối.

- Hệ thống báo cáo tài chính, báo cáo kết quả kinh doanh, báo cáo thuế GTGT, TNDN được cập nhật theo thời gian thực, giúp nhà quản lý nắm bắt ngay tình hình lợi nhuận, chi phí.

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: