In business, revenue is the vital factor. Revenue higher business as there are many opportunities to develop and expand the scale. How to revenue growth sustainable? The answer lies in the accounting department sales details. So accounting what is merchandising? Today, inviting you along Accnet tìm hiểu về khái niệm/nhiệm vụ/thách thức/quy trình/hạch toán của KTBH - an arm invaluable help decision to the success or failure of the business in this article!

1. Accounting what is merchandising?

1.1. Definition

Accounting sales (KTBH) là bộ phận chịu trách nhiệm quản lý/ghi chép các nghiệp vụ liên quan đến bán hàng, nguồn tiền trong khâu bán hàng. Kế toán trong bán hàng tập trung giải quyết các công việc sau:

- Export bill of sale.

- Recorded in accounting books, cost of sales, general sales,...

- Reported according to the other requirements of the business.

1.2. Vai trò của kế toán bán hàng

KTBH là bộ phận để các nhà quản lý đưa ra những quyết định kinh doanh chính xác với những vai trò quan trọng như:

- Provides detailed information about sales, financial situation, support construction management business strategy.

- Report details the disparity between production, sales, to propose necessary adjustments.

- Record, analyze the cost of sales to propose solutions to optimize costs.

- Reporting inventory quantity, value, helps control inventory.

- Ensure compliance with safety regulations, consumer protection, protecting the rights of clients in sales activity.

Read more:

- Giải pháp ghi nhận doanh thu và theo dõi tồn kho theo thời gian thực

- Professional accounting sales và cách định khoản chuẩn theo từng trường hợp

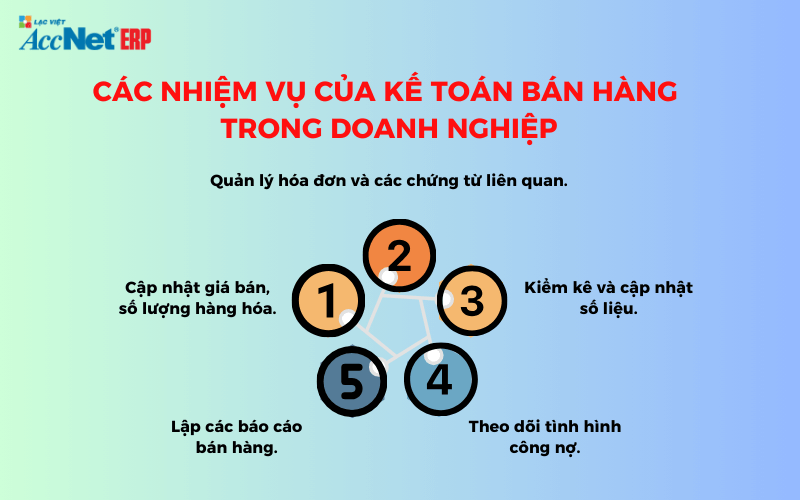

1.3. Các nhiệm vụ chính trong kế toán bán hàng

The task of accounting for revenues in the enterprise to ensure the effective and transparent financial management, sales. Here are some of the main tasks of the accounting details of the sale:

- Cập nhật giá bán, số lượng hàng hóa

Accounting details, sales responsible for the update selling price, the number of goods and products new to the accounting software. When there is a change in the selling price, the accountant should promptly notify the relevant department.

- Quản lý hóa đơn, chứng từ liên quan đến nghiệp vụ bán hàng

Business casual encounter in accounting revenue là việc quản lý hóa đơn đầu vào, đầu ra của doanh nghiệp để đảm bảo tính chính xác, đầy đủ của thông tin hóa đơn

- Xuất hóa đơn bán hàng

- Cập nhật & theo dõi doanh số bán hàng hằng ngày

- Nhập số liệu mua bán hàng

- Calculate the trade discount or rebate payments to customers (if available)..

- Nhiệm vụ kế toán bán hàng là kiểm kê, cập nhật số liệu hàng hóa trong kho

Kế toán doanh thu phối hợp với kế toán kho, thủ kho để kiểm kê hàng hóa tồn kho, xác định chính xác số lượng hàng hóa thực tế tồn kho của doanh nghiệp như sau:

- Collate the number of inventory realistic with the amount of inventory to detect, timely processing of errors on the number of goods inventory.

- Update the quantity inventory with reality to help accounting details, track sales, manage your inventory the most accurate.

- Reporting metrics for sale – purchase of the day to analyze the business situation of enterprises.

- Công việc kế toán bán hàng là theo dõi tình hình công nợ bán hàng

Combined with accounting for revenues, liabilities accounting to statistics on public debt, debt collection, money management restaurant overall, comprehensive.

- Actively Participate in planning the recovery of the debt to urge customers timely payment.

- Money management debtors, track details of each customer, the shipment, the amount of money, cheap debt, the time limit, the situation repayment of the guests to take measures timely processing.

- Kế toán lập các báo cáo số liệu bán hàng

Report the sale catalogue out, including the items were sold out, including the item name, quantity sold, price, revenue,...

- Report receivables, including customer name, amount owed, payment term,...

- Report on the use of financial bills, such as the number of bills were used, the number of bills remaining inventory,...

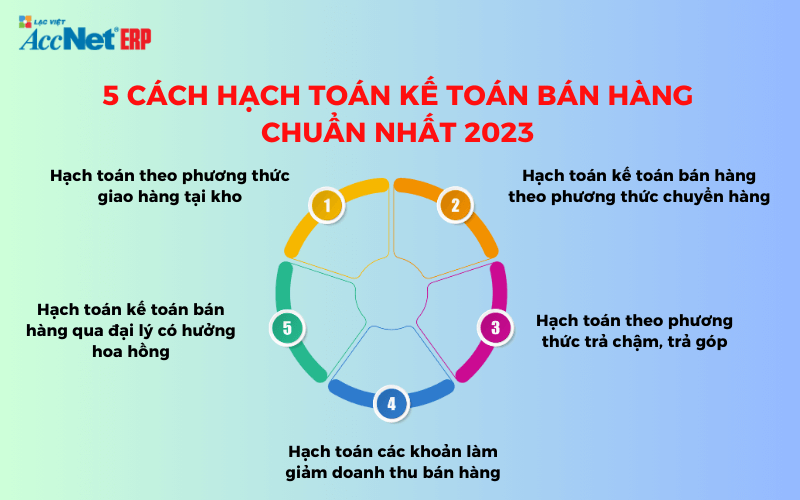

2. Cách hạch toán kế toán bán hàng chuẩn nhất

Please read the description overview of the steps accounting details sales today:

- Delivery method at the warehouse.

- The method of shipping.

- Installment payments.

- The method of reduction of sales revenue.

- Method of sales through dealers have roses.

2.1. Hạch toán theo phương thức giao hàng tại kho

+ Determine the cost price of products have consumed:

- Debt accounts 632: cost of goods sold for the record amount of money needed to pay for the price of capital goods.

- Have an account 155, 1561: Value finished products and goods for sale to record the cost of production of the product was consumed.

+ Recorded sales revenue:

- Debt accounts, 111, 112, 131: the Total price paid to record the total value of payments from customers.

- Have an account 511: sales revenue is price without VAT to revenue recognition from the sale.

- Have an account 3331: VAT payable output to acknowledge the amount of VAT payable to the tax authorities.

2.2. Hạch toán kế toán bán hàng theo phương thức chuyển hàng

+ Reflects the price of capital goods sent for sale:

- Debt accounts 632: cost of goods sold to the recorded value of the goods has been delivered (price of capital).

- Have an account 157: Goods sent for sale to reduce the value of the goods in the ledger.

+ Reflect revenue:

- Debt accounts, 111, 112, 131: the Total price paid to record the total value of payment from the buyer.

- Have an account 511: sales revenue is price without VAT to revenue recognition from the sale.

- Have an account 3331: VAT payable output to acknowledge the amount of VAT payable to the tax authorities.

2.3. Hạch toán kế toán bán hàng theo phương thức trả chậm, trả góp

+ Determine the price of stock of finished products, goods have consumed:

- TK 632: cost of goods sold, used to reflect the value of products, goods and services have consumed in the states.

- TK 155, 1561: Value finished products, goods for sale, used to reflect the value of products and commodities were sold in the states.

+ Reflect revenue sales pay now:

- TK 111 - Cash: this account is used to reflect the existing situation, volatility of cash in the funds of the enterprise.

- TK 112 - bank deposits: this account is used to reflect the existing situation fluctuations of bank deposits of the business.

- TK 511 - sales service provider: this account is used to reflect sales revenue, providing services actually incurred in the period, including sales of goods and sales offers service, sales, installments, deferred...

- TK 3387 - unrealized revenue: this account is used to reflect sales installment sales deferred, has not obtained the money in the states, which are allocated gradually according to the collection period.

- TK 3331 - VAT payable: this account is used to reflect the amount of VAT payable to The state under the provisions of the current legislation.

+ When the money is collected sales (principal + interest), or collecting money sales next:

- Debt TK 111, 112 is reflected proceeds from the customer for the amount of principal and interest installments, deferred.

- Have TK 131 is a reflection of the amount receivable by customer with respect to the principal amount of, interest on installment or deferred rest.

+ The transferred interest deferred sales with a buyer payment:

- Debt TK 3387 is to reflect the interest on installment or deferred allocation in the states.

- Have TK 515 is reflected revenue from financial activities.

2.4. Hạch toán kế toán các khoản làm giảm doanh thu bán hàng

(*) Arising discount, trade discount sales:

When there is trade discount or reduction in the price of sale:

- Debt accounts 521 (5211, 5213): Remember price is not VAT.

- Debt account 3331: reduced VAT.

- Have the account 111, 112, 131...: Remember the price paid.

The move reduced turnover in the accounting sales:

- Debt accounts 511: sales revenue, service provider.

- Have an account 5211, 5213: Reduced revenue.

(*) Note on accounting payment discount when sales:

+ In case of not paying the purchase money, enjoy discount payment:

- Debt account 111, 112: the amount obtained.

- Debt accounts 635: Number of discount customers enjoy.

- Have an account 131: the ratio Of debt to income customers.

+ If the customer has paid in advance, enjoy the discount:

- Debt accounts 635: Number of discount customers enjoy.

- Have an account 111, 112: the discount you are entitled to.

(*) Accountant sales returns:

+ Every bounce has identified as consumption:

- Debt accounts, 155, 156: Finished goods is returned.

- Have an account 157: Goods in transit.

+ Every bounce was defined as consumption:

Upon receipt of the goods sold, income stock:

- Debt accounts, 155, 156: Finished goods is returned.

- Have an account 632: cost of goods sold.

Reflecting the turnover of sales returns:

- Debt accounts 521 (5212): sales returns (sale price hasn VAT).

- Debt account 3331: reduced VAT of every bounce.

- Have the account 111, 112, 131...: Remember the price paid.

+ Costs incurred related to be accounted for in cost of sales:

- Debt accounts 641: Cost of sales.

- Debt accounts 133: VAT deductible.

- Have the account 111, 112, 131: Record the price paid.

+ End move up revenue:

- Debt accounts 511: sales revenue, service provider.

- Have an account 5212: Reduced revenue.

2.5. Hạch toán kế toán bán hàng qua đại lý có hưởng hoa hồng

(*) Accountant in the delivery unit agent:

+ When stock products send agents:

- When stock products send agents unit, debit account 157 (consignment sale), there are accounts, 155, 156 to reduce the product value in the ledger.

+ When the goods were sold by dealer:

- Debt accounts, 111, 112, 131... to record the value of the payment from the agent.

- Have an account 511 to reflect revenue sales service provider.

- Have an account 3331 to record the amount of VAT payable.

- Debt accounts 632 (cost of goods sold), which account 157 (Goods sent for sale) to reflect the cost price of goods sold.

+ Reflect the amount of commission payable to agents:

- When paying commissions to agents, accountants, debit account, 641 (Cost of sales), debt accounts 133 (Tax VAT is deducted), along with the account 111, 112, 131... to record the value of the payment.

(*) Accountant in receiver unit agent, the price is right commission:

+ When receiving goods sold by dealer

- Upon receipt of goods sold from dealer accounting sales debit the account 111, 112, 131... to reflect the value of the payment to the agent.

+ Periodically, when determining the revenue commission:

- Periodically, when determining the revenue commissions from sales agents, accountants, debit account, 331 (to be paid To seller), no account 511 to reflect revenue sales service provider. If yes, record the VAT account 3331.

+ When to pay sales agent for delivery:

- When paying sales agents, accountants, debit account, 331 (to be paid To seller), have the account 111, 112 to reflect the value of the payment.

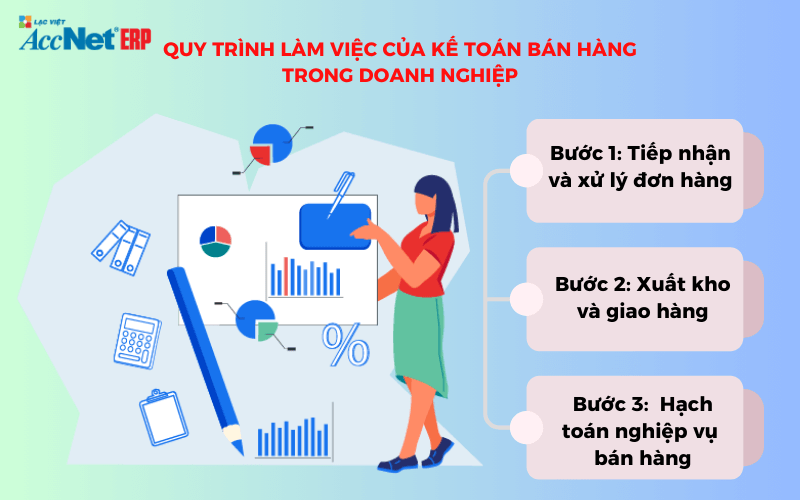

3. Process sales accounting in business

Process work in accounting, revenue is process chain professional, specifically includes the following steps:

Step 1: receiving/processing of orders/contracts

- Accounting details sales receipt of orders or contracts from sales staff or sales office.

- For the amount of inventory is not enough to meet demand, accounting report back to staff sales consultant or cancel orders.

- If inventory full, the accounting establishment request, cumshot, inventory, invoice, then transferred to the warehouse for shipment.

Step 2: Export warehouse and delivery process

- The stock goods based on the votes required stock from accounting sales.

- Detailed accounting, sales invoicing, vouchers related, then transfer them to the clerk for delivery to the customer.

Step 3: accounting, business sales

- Detailed accounting sales accounting sales professional into window aggregate, window related details.

- For the business service provider, after the client pay or accept payment, accounting, invoicing, accounting, business economics arising from services provided.

4. Các thách thức thường gặp trong KTBH

4.1. Sai sót trong việc ghi nhận doanh thu - công nợ

Kế toán bán hàng yêu cầu sự chính xác cao trong ghi nhận dữ liệu. Tuy nhiên, nhiều doanh nghiệp gặp phải sai sót do:

- Sai số phát sinh khi dữ liệu được ghi nhận bằng tay.

- Nhầm lẫn hóa đơn hoặc mã sản phẩm, ghi nhận không đúng doanh thu/công nợ.

- Không đối chiếu kịp thời giữa đơn hàng, hóa đơn, thanh toán.

Hậu quả: Gây ảnh hưởng đến báo cáo tài chính, làm giảm uy tín doanh nghiệp. Phát sinh các tranh chấp với khách hàng/đối tác.

Cách khắc phục: Sử dụng phần mềm kế toán tự động để hạn chế lỗi nhập liệu. Xây dựng quy trình kiểm tra chéo dữ liệu giữa các bộ phận như bán hàng, kế toán, kho.

4.2. Quản lý chiết khấu/giảm giá

Chiết khấu, các chương trình giảm giá là công cụ quan trọng để thúc đẩy doanh thu, nhưng việc quản lý không đúng có thể dẫn đến:

- Gây thất thoát doanh thu, ảnh hưởng đến lợi nhuận.

- Thiếu minh bạch trong ghi nhận, sai sót khi tính toán doanh thu thực tế.

Giải pháp: Áp dụng các chính sách chiết khấu rõ ràng, được tích hợp tự động vào hệ thống quản lý bán hàng. Đào tạo nhân viên về cách áp dụng, ghi nhận chiết khấu chính xác.

5. Những công cụ và phần mềm hỗ trợ kế toán bán hàng

Theo một báo cáo của Gartner, doanh nghiệp sử dụng phần mềm kế toán tự động tăng 35% năng suất, giảm 20% chi phí vận hành liên quan đến kế toán.

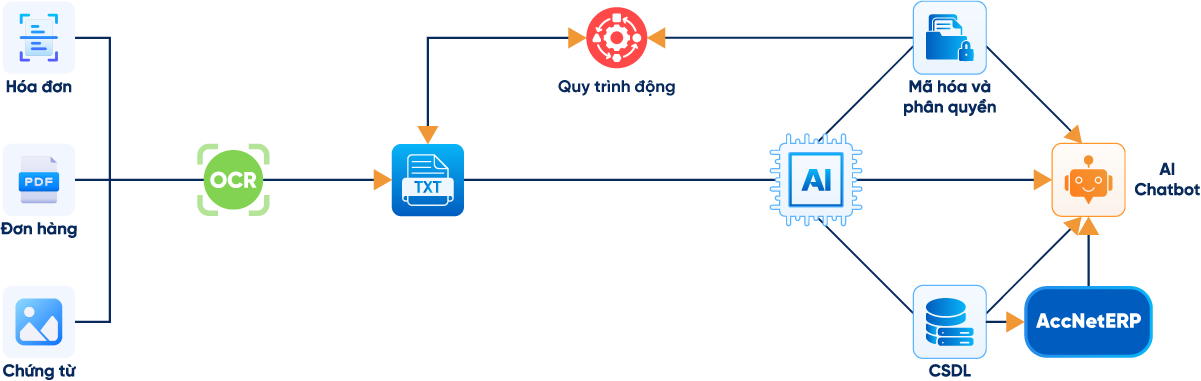

Việc sử dụng phần mềm kế toán mang lại nhiều lợi ích vượt trội so với các phương pháp truyền thống. Một trong những phần mềm được sử dụng nhiều nhất chính là Phần mềm Accnet ERP:

- Tự động hóa quy trình ghi nhận doanh thu, quản lý công nợ, lập báo cáo.

- Tích hợp các tính năng kiểm soát chiết khấu, chương trình khuyến mãi.

- Hỗ trợ phân tích dữ liệu theo thời gian thực, giúp doanh nghiệp đưa ra các quyết định nhanh chóng.

PHẦN MỀM KẾ TOÁN ACCNET ERP TÍCH HỢP “TRỢ LÝ TÀI CHÍNH AI” With 7 phân hệ lõi tích hợp từ kế toán, bán hàng, mua hàng, sản xuất, kho vận, nhân sự đến phân phối, phần mềm quản lý doanh nghiệp AccNet ERP tạo nên một hệ sinh thái quản trị tài chính – điều hành khép kín, đồng bộ thông tin xuyên suốt: TÍCH HỢP TRỢ LÝ TÀI CHÍNH KẾ TOÁN AI - RA MẮT 2025 AccNet ERP là một nền tảng công nghệ mở, tích hợp các giải pháp tiên tiến như: DOANH NGHIỆP ĐƯỢC GÌ KHI TRIỂN KHAI ACCNET ERP? ✅ Quản lý tài chính chủ động – Không còn “bơi trong số liệu rời rạc” ✅ Hiệu quả rõ rệt khi ứng dụng trợ lý tài chính AI ĐĂNG KÝ NHẬN DEMO NGAY Vui lòng điền các thông tin vào form chúng tôi sẽ liên hệ lại với bạn trong 24h làm việc. KHÁCH HÀNG TIÊU BIỂU ĐÃ VÀ ĐANG TRIỂN KHAI ACCNET ERP

✅ Demo miễn phí full tính năng ✅ Báo giá cá nhân hóa theo quy mô doanh nghiệp ✅ Tư vấn 1:1 cùng chuyên gia có nhiều kinh nghiệm

Vietnam believe that mastering the knowledge about sales accounting what is skills will help you become a detailed accounting sales professionals to meet the job requirements. Wish you success!

CONTACT INFORMATION:

- ACCOUNTING SOLUTIONS COMPREHENSIVE ACCNET

- 🏢 Head office: 23 Nguyen Thi huynh, Ward 8, Phu Nhuan District, ho chi minh CITY.CITY

- ☎️ Hotline: 0901 555 063

- 📧 Email: accnet@lacviet.com.vn

- 🌐 Website: https://accnet.vn/

Theme: