Liabilities accounting is one of the small array in the accounting profession. To better understand the role and tasks of accounting and public debt. The following article Accnet will help you have a better overview. Let's find out right now.

1. Public accounting what is debt?

Liabilities accounting is accounting operations management other liabilities or receivables of the Business. Done good business this will help business gain control over public debt, help the financial activities of the business becomes smooth.

1.1 Concept

Liabilities accounting (or Accounting liabilities) are parts assume the accounting work on the management of debts that a business must collect or pay. Business understanding and better control public debt will help the business operation becomes more smooth.

Therefore, liabilities accounting there are certain importance in every business.Help control debt situation to business can operate stable and long-term development.

1.2 Causes incurred liabilities

Cause arises public debt also comes from many causes. Which can list a few causes as follows:

- The mobilization and rotation of capital in business is not enough to conduct payment transactions for suppliers.

- The customer owes payment or late payment, do not have sufficient ability to pay for the business.

- The program promotes running sales by the customers receive the goods that has not require immediate payment

- The buyer a loan to prioritize paid for the unit to high interest rates and debt money low interest rates.

- Buyer payment after the commercial operation complete

Read more:

1.3 The type of public debt

Current liabilities are divided into 2 types is liabilities accounting receivable and accounts payable:

- For the debt to income: is the account to which the receivable of clients. By the time production of goods, products, for customers, but they are unpaid or only 1 part payment. Accounting public debt will track specific reference classification of each group and the customer subject to control.

- For public debt to pay: is the business account will be paid to the supplier. The value of goods, supplies, materials, and equipment used for production activities business. Received but not yet paid or just 1 part payment for suppliers.

2. Liabilities accounting perform the work?

The work of liabilities accounting is tracking analysis, and the urge to recover the debt. Besides staff make decisions about the account receivable and payable for leadership as:

- Calculate, record and have the feedback accurately promptly on the account filed

- The terms and classification vouchers according to each business arising

- Check stock from when performing the procedure revenue and expenditure

- Based on the form set receipt and expenditure to base pay

- Send coupon information to the revenue and expenditure for the relevant parts

- Tracking and monitoring the account of advance

- Carrying cash and print the report

- Reviewing and comparing with the cashier about conservation fund cash and conservation fund end date

- Established the form of VAT goods purchased on

- Establishment vote the submission of the budget, the bank

- Close up vouchers in numerical order, time, business arising

- Receive the warehouse, warehousing or a copy of the invoice to proceed with payment

- Collate public debt of the customer and company up the payment schedule

- Calculate the number of public debt incurred monthly and paper payment

- Reporting tracking debts of the business by subject

- Contributions, suggestions to the debt collection efficiency

3. The account related to accounting liabilities that businesses need to master

Below is the account related to tracking, applying for accounting tool for this.

3.1 receivables of customers

- Based on bill of sale

With Debt TK 131:

Have TK 5111: sales revenue

Have TK 5112: sales of finished products

Have TK 5113: revenue service

Have TK 3331: VAT sold

- Based on votes collect money

Debt TK 111: Cash increased

Have TK 131: receivables

- Based on the paper of banks

Debt TK 112

Have TK 131.

Debt TK 1388

Have TK 111,112.

3.2 account related to accounting accounts payable to suppliers

- Based on the invoice input

Debt identified need to pay for the supplier (NCC) will include VAT sides have TK 331 by profession arises.

Debt TK 152, 156

Debt TK 1331

Have TK 331

- When payment for NCC in cash. Accounting will be up payment receipt and transfer it to the cashier and payment receipt must be fully signed by the parties such as: the establishment of the treasurer and receiver. And then will proceed to transfer for accounting plan payment:

Debt TK 331: Details for the supplier.

Have TK 1111

- If making payment for NCC by bank transfer then accounting poultry credentials have complete information and the seal of the NCC, accompanied by a signature of the chief accountant. And conduct the payment, after payment done accounting will be done to save the voucher accounted in window bank every year.

Debt TK 331: supplier Details

Have TK 1121

|

Tham khảo thêm các phần mềm của Lạc Việt Accnet:

|

4. The accounting profession public debt today

4.1 The accounting profession receivables

This is a need to for business from customers. This account is considered a liquid assets because the business can use it as collateral high for the short-term loans.

And business of liabilities accounting is:

- Accounting of each account receivable in a clear detail, as well as the payment.

- Urge, made fast the recovery of debts and avoid current status is misappropriation of funds or bad debt

- Establishment vouchers and recorded the case of the payment by the exchange, clearing the debt or the debt of bad goods.

- On-site verification or a written confirmation with the bad debt or long.

4.2 The accounting profession to pay debt

Liabilities are the business account payment for the provider to serve active production business.

And business of public accounting liabilities need to perform:

- Updates, tracking and accounting specific clear but cases, the subjects have received money in advance and complete the handover

- Record of the debt to pay to easily track and made reduced the amount of debt upon arising early.

5. Business debt can't?

For people who do liabilities accounting will need to have a cold head, a hot heart and a positive attitude. And of course, it is accompanied by a number of skills such as:

- A good technical knowledge: this is the stepping stone to the accounting firm and successfully completed the task.

- Proficient profession:to help people do accounting mastery problem is easy to identify and track debts and smoothly.

- Skills microsoft office proficiency:use master spreadsheet tool Excel or other accounting software will help the processing of data quickly and more convenient.

- Analyze the ingenious flexible: the judgment and good analysis will help take the right decision, reasonable construction is the relationship sustainable.

|

Tìm hiểu thêm các bài viết cùng chủ đề:

|

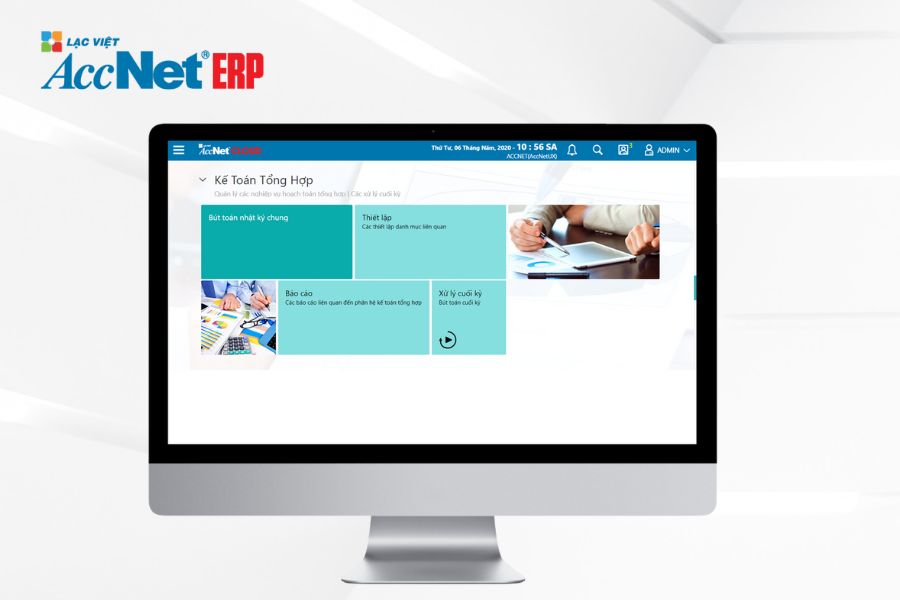

6. The solution helps businesses perform accounting liabilities easy precision

To build an accounting system and a team of professional personnel. This is probably the one thing shortcomings and difficulties with small and medium enterprises. By the obstacles of cost and office rent. Therefore Accnet would be an optimal tool to support business efficiency in the management and tracking of assets effectively. Besides, Accnet an ERP solution will auto is the research wing helps accountants solve 80% of the volume of the work:

- Automatic synthesis of data transfer revenue, set up tax returns, financial statements;

- Digitized each process, the union when the projector certification, books, detect and alert false immediately;

- Detailed tracking and automatic alerts overdue debt help debt management efficiency;

- The system meets full accounting profession according to the circular, the latest decision of the Ministry of Finance and the tax authority.

- Save time, cost and easy access anytime, anywhere;

Contact us to get support and advice

- The company shares Information, Lac Viet

- 23 Nguyen Thi Huynh, Ward 8, Phu Nhuan District, ho chi minh CITY. Ho Chi Minh

- Email: lacviet@lacviet.com.vn

- Phone:(+84.8) 3842.3333

Theme: